Table of Contents

For Japan's retail investors, Yahoo Finance reigns supreme.

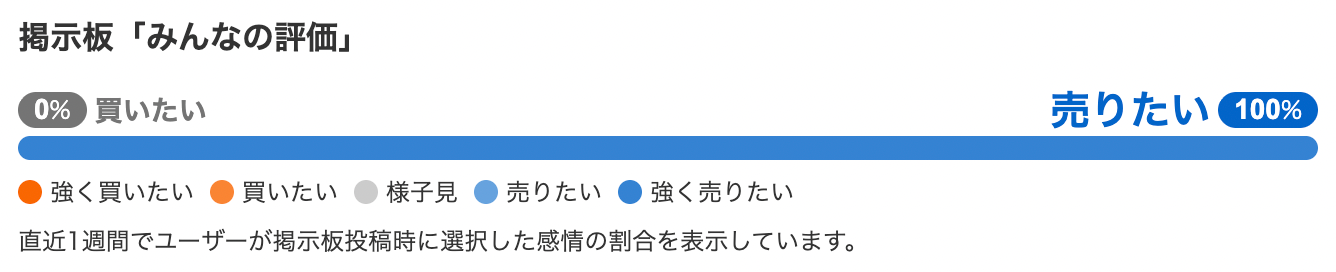

And if you check the message board for individual Japanese stocks such as Poper (5134 JP), you'll be presented with the following sentiment bar:

So what does this mean? Well, the heading says "Bulletin board: Everyone's view". The ranking measures bullish vs bearish sentiment among users of Yahoo Finance Japan's message board for that stock. And right now, 100% of users report that they "want to sell" their shares in Poper.

That begs the question: could investors use these Yahoo Finance rankings as short-term contrarian indicators?

Tsubouchi (2016) constructed a model using text from the Yahoo Finance Japan message board to predict short-term price movements. The model seemed to have worked well. Meanwhile, Tsukioka (2018) found that Yahoo Finance Japan pre-IPO message board sentiment led to higher subsequent returns but longer-term underperformance. In other words, sentiment does seem to serve as a contrarian indicator of future returns.

To conduct my own study, I'd need to examine the sentiment bar for each stock and then measure subsequent price movements. Unfortunately, the Wayback Machine doesn't have much historical data.

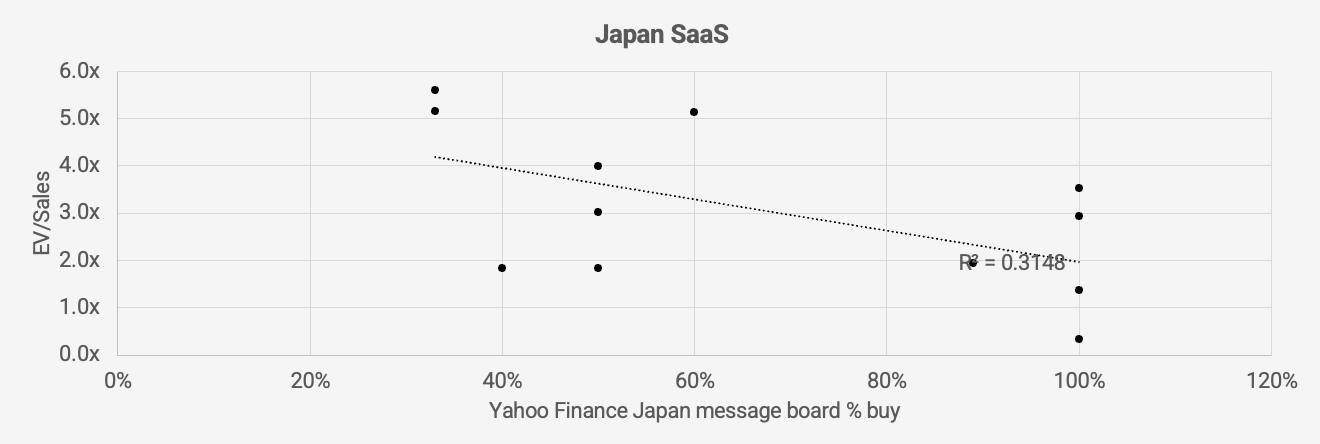

Instead, I took a cross-sectional approach, comparing the EV/Sales valuation multiple of Japanese SaaS stocks with the sentiment on today's Yahoo Finance Japan message board. Surprisingly, Japanese retail investors seem to like cheaper stocks more than expensive ones:

So while I haven't conducted a full-scale study yet and I don't have any evidence at hand, I'm convinced that the sentiment bar mentioned above has short-term predictive value. I personally turn cautious when the buy rating reaches 100% and more optimistic when it reaches zero.