Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- In this post, I've tasked the paid versions of ChatGPT, Gemini, Claude, and Grok to solve a series of equity research-related tasks.

- This post has been updated for the release of Gemini 3 and Claude Opus 4.5 in late November 2025.

- I've asked each of these generative AI tools to answer questions about Thai beverage company Carabao (CBG TB – US$1.2 billion). It produces an energy drink called Carabao Dang. Specifically, I asked them to provide me with information about the company's business model, supply chain, competitive advantages, recent news reports, valuation metrics and more.

- My conclusion is that ChatGPT and Gemini are neck-to-neck in most equity research tasks and that either of these is worth paying for. Gemini is faster and with the Gemini 3 model, now scores better than ChatGPT.

- As for Carabao, the tools helped me understand that it's taking market share from key competitor Osotspa. At 13x P/E, the valuation multiple is not particularly high, either. But it does have issues with related party transactions.

Introduction

I'm currently paying for four separate generative AI tools:

- ChatGPT Plus, which gives you access to the GPT-5 Thinking model

- Google Gemini, which gives you access to the Gemini 3 model

- Claude Pro, which gives you access to the Opus 4.5 model

- SuperGrok, which gives access to the Grok Expert model

In this post, I'll put them to the test. I have ten equity research-related questions I want to ask them. I'll then score their output on a scale from 1 to 10, before adding up all of their scores towards the end of the post.

The purpose is two-fold. I want to help you understand which service you should pay for. I also want to provide inspiration for how you can use these generative AI tools yourself.

The stock I will use for this experiment is the Thai energy drinks company Carabao (CBG TB – US$1.2 billion). Its stock price has slumped in the past few years, as you can tell from the following chart:

A few weeks ago, I noticed that there has been insider buying in the stock, with founder and CEO Sathien Sathientham buying shares for the first time in many years. Carabao now trades at 11x EV/EBIT - an all-time low.

Carabao's US peer Monster Beverage has performed beautifully over the past 25 years. So I wonder if Carabao could potentially repeat that success. Let's jump into it.

Business snapshot

First of all, let's start with a simple question: what does Carabao actually do? To answer that question, I feed the following prompt to each of the AI models:

"Explain in simple terms how Carabao makes money"

Here are the answers I got from each of the four generative AI models:

Here's the beginning of the answer from ChatGPT:

I think ChatGPT's answer is excellent. We learn that Carabao is a Thai beverage company focusing primarily on energy drinks, but also sports drinks and vitamin drinks. Furthermore, ChatGPT tells us that it's a vertically integrated operation and that it also sells to neighbouring countries like Cambodia and Vietnam. My only issue with ChatGPT's answer is that it doesn't mention that Carabao also sells beer on behalf of a related party.

Gemini 3's answer has improved significantly from the 2.5 model. It now goes through most of Carabao's product categories and correctly point out that the beer business belongs to a related party.

I still think the answer from Claude 4.5 is vague and that it doesn't tell me much about the product portfolio. The answer from Grok is similarly vague.

So in this first round, I think ChatGPT and Gemini 3 are tied on the first spot, each earning a score of 9. This is a step-up from Gemini 2.5's score of 5. While Claude has improved, the answer still leaves much to be desired.

Deep research report

Let's move on to a "Deep Research" request. This refers to ~20 page reports written by generative AI tools based on publicly available data.

The prompt I like to use is the following:

"Create a deep-dive investment research report on Carabao CGB TB.

Include:

• Company overview and business model

• Competitive advantages compared to its main competitors

• Discussion of historical financials and the drivers of key numbers

• Industry supply & demand and regulatory framework

• Discuss the current management team and its track record of creating value for shareholders

• Management's long-term plan and likely growth prospects

• Potential risks to earnings

• Valuation multiples compared to historical levels, the peer group and likely growth prospects

Please cite all sources and highlight areas of uncertainty or controversy."

Note that in Grok, the tool is called "Deep Search"; in Claude, it's called "Research"; and in ChatGPT and Gemini, it's simply called "Deep Research".

Here are the results of this prompt:

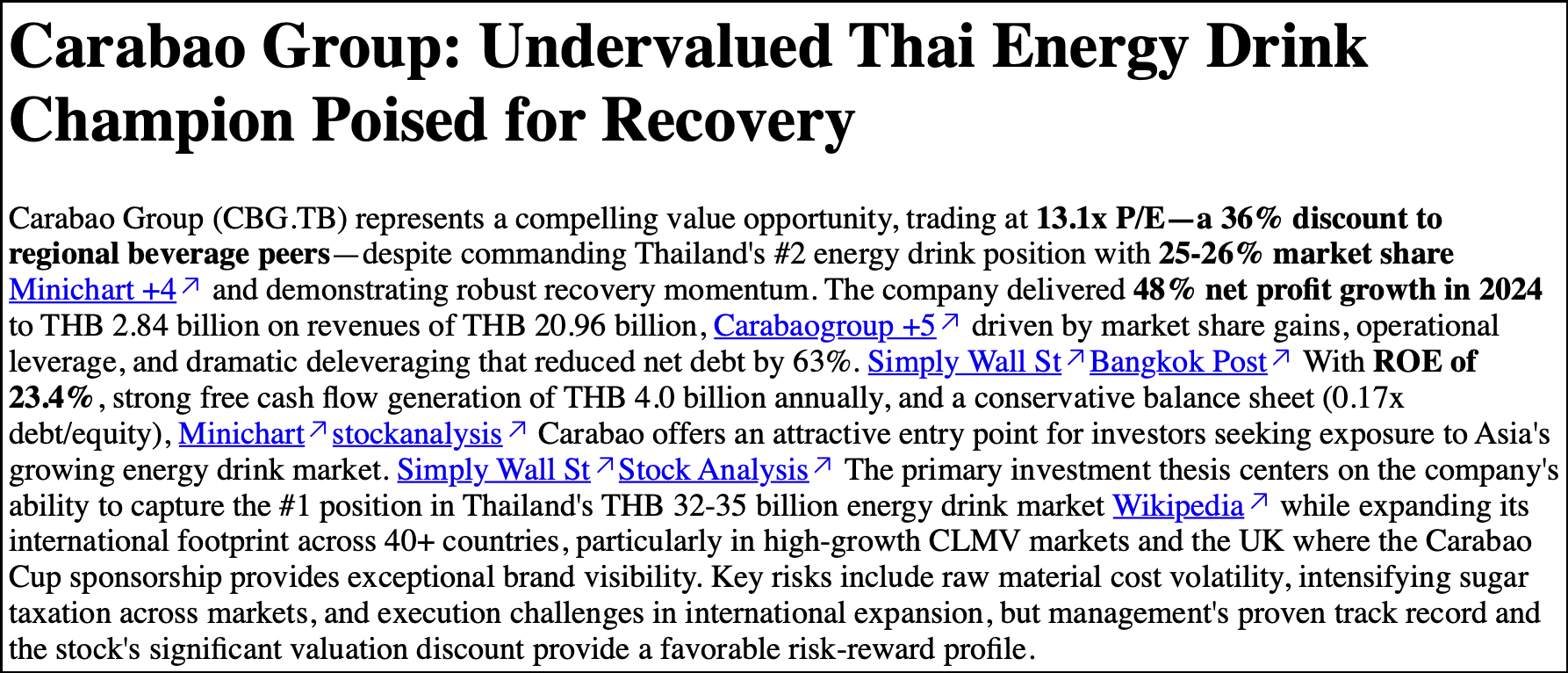

Grok was the fastest at generating these reports, followed by Gemini and Claude. ChatGPT took by far the longest but its report was also the longest at 25 pages.

The ChatGPT report was amazing, in my view. We learn that Carabao has done an incredible journey going from zero market share to 20-25% in less than 25 years, winning against incumbents such as Red Bull and Osotspa's M-150. It talks about how Carabao has been to undercut M-150 on price and how it's more popular among younger Thais. The report also talks about the issues facing Carabao, including the Thailand-Cambodia border conflict, cost inflation and a gradually higher sugar tax. However, I think the valuation numbers are wrong, as Carabao's P/E is closer to 13x than the quoted 17x.

The Deep Research report generated by Gemini 3 was shorter, but also excellent. It states that Carabao has two new factories ramping up in the next six months, in Cambodia and Myanmar, respectively. Gemini's attempt to provide an investment recommendation is detracts from the overall positive impression. I'd prefer it if Gemini just kept to the facts and nothing else. The Claude 4.5 report has improved significantly since the previous model. I like it just as much as that of Gemini. The Grok report is among the worst I've read – practically unreadable. ChatGPT wins again:

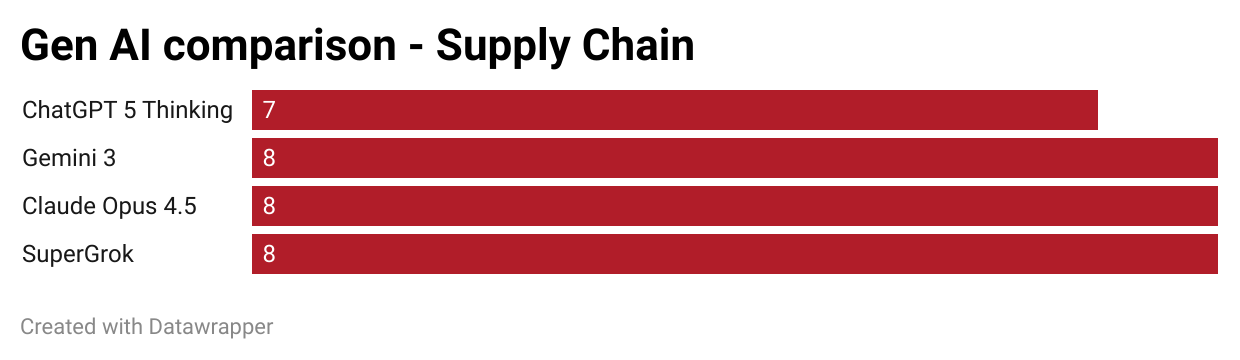

Supply chain analysis

To understand where Carabao sits in the energy drinks supply chain, I now ask these tools to help create a picture of the supply chain. Here's the prompt I use:

"Explain the supply chain that Carabao operates in when it comes to energy drinks products domestically and clarify where Carabao sits within it. I want the output to be a map from upstream inputs all the way to the end customer with all stakeholders accounted for. Make sure to capture the names of all the companies interacting with Carabao."

The answers from each of the tools:

The answers here were much better – strong across the board. We learn that Carabao is a vertically integrated operation producing the beverages itself, but also dealing with bottling and distribution in-house.

However, I note that only Grok points out that the Woody vitamin drink is produced under a JV format and that Carabao also distributes beer. Claude 4.5 misses that Carabao distributes beer and other beverages for related and third parties, though I love the way the answer is structured through clear tables. Gemini 3's answer is excellent and more to the point than ChatGPT's. So this was a close call with almost equal answers from the four models.

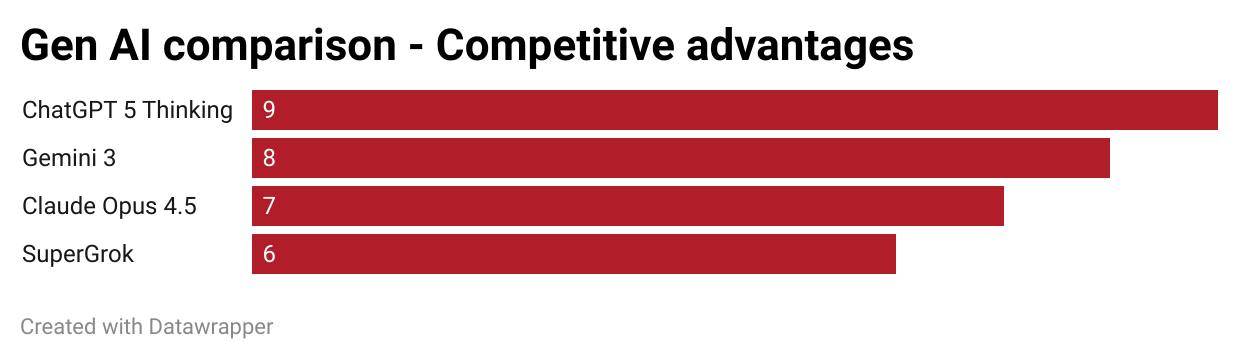

Competitive advantages

Next, I want to understand whether Carabao is a great business. Is the business defensible, and does it have pricing power? Here's the prompt I use to answer that question:

"I want to understand the strength of Carabao's products and business. How do the products compare with competitors' in terms of perceived value, branding, marketing etc? What are the competitive advantages that Carabao has that will protect it from competition in the future, so-called economic moats? And what is Carabao's bargaining power vs other stakeholders?"

And here are the answers I got from each of the tools:

It's clear that the Carabao brand is its key competitive advantage. It has a connection to the co-founder Aed Carabao's rock music and the sponsorship of the "Carabao Cup" English football league. It's also becoming clear that Carabao's distribution network is excellent, second only to Osotspa's.

ChatGPT's answer is amazing, in my view. It gives me the feeling of the positioning of Carabao Dang in the eye of the consumer, and what the brand means to them. It also points out that there isn't much product differentiation between Carabao Dang and Osotspa's competing energy drink M-150.

Gemini 3's answer has improved significantly from before, helping me understand the key differences between Carabao Dang and its competitors. Claude's answer has also improved a great deal, for example pointing out that Osotspa retook market share in 2025 thanks to its cheaper Yellow Cap variant. But overall, I'd say ChatGPT wins this one:

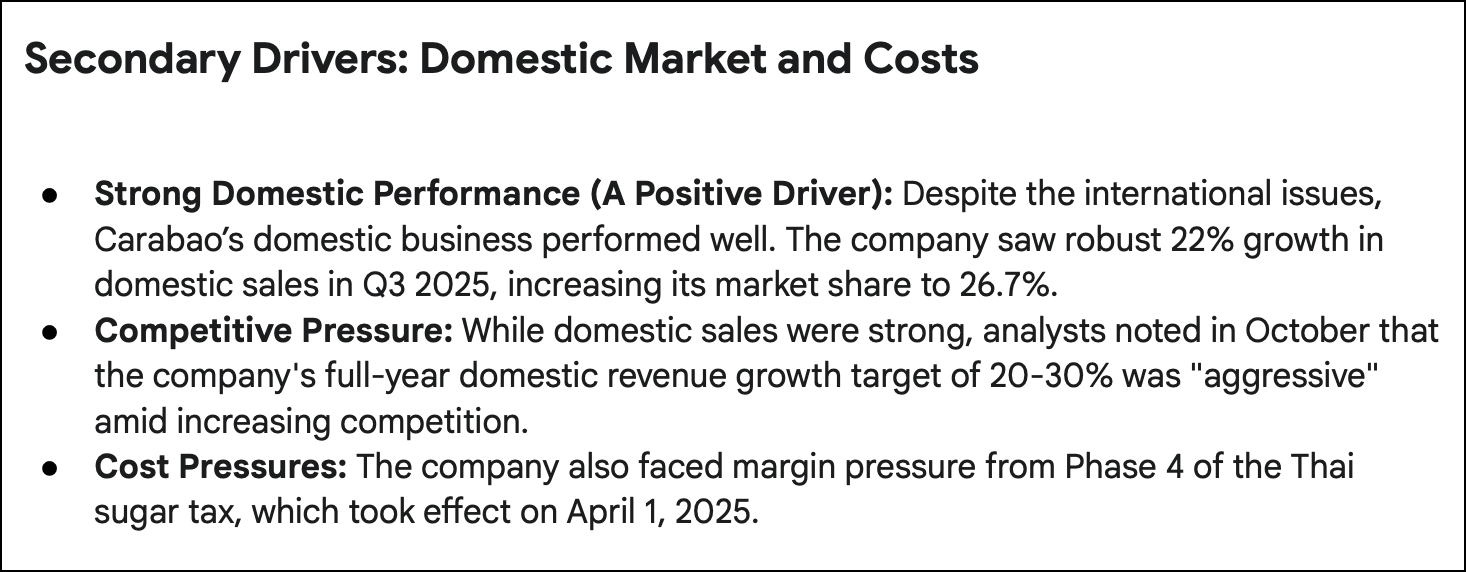

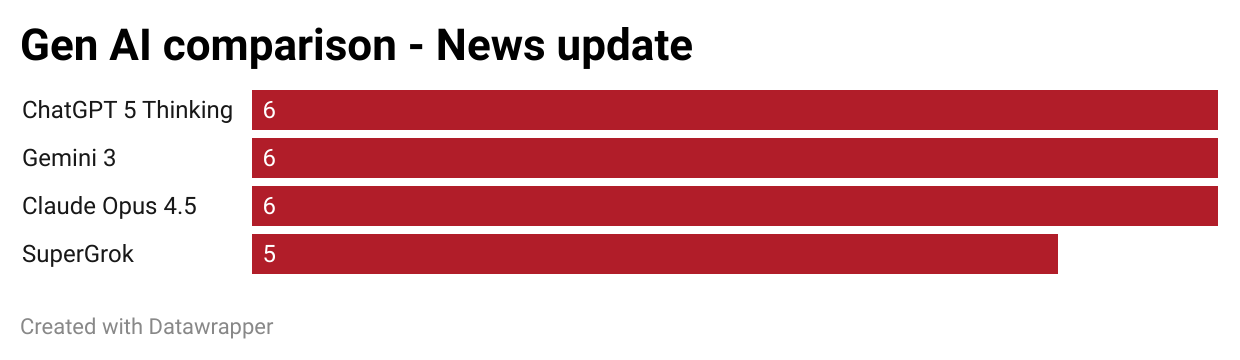

News update

In the next section, I'll review the news that has come out about Carabao in 2025, using the following prompt:

"I want to understand the primary drivers for Carabao's recent stock price performance. Find and summarize the key pieces of news that might have affected Carabao's business in 2025."

Here are the answers I got:

From these answers, I learn that Carabao has seen its Cambodian shipments grind to a halt due to the 2025 Thailand-Cambodia border conflict. But I also learnt that the energy drinks market is growing rapidly, with a lot of promotional activity.

ChatGPT's answers are long and extensive, but somehow missed the fact that Carabao signed a strategic partnership agreement with Tsingtao Brewery in September this year. I also think it underplayed the sugar tax rise on 1 April 2025. Gemini 3's answer was easy to read and provided a great summary, but also missed the Tsingtao Brewery agreement. Claude 4.5's answer was significantly better than the previous model's, and included information about the Tsingtao Brewery agreement as well as M-150's early 2025 market share gains. However, it did not contain any information about Carabao's Q2 and Q3 earnings. Grok's answer was in chronological order, a bit wordy and also missed several key facts, including that founder and CEO Sathien Sathientham bought shares in Carabao recently. In my view, neither model performed particularly well on this task:

Summarize earnings results

Next, I'll want to understand Carabao's first-half 2025 earnings result to get a sense of how well the company is performing. So I give each of the generative AI tools the following prompt:

"Analyze Carabao's latest earnings result and provide a snapshot of the key numbers, compare the revenues and earnings vs expectations, the key trends by product and geography, changes to the outlook and any key risks"

I then get the following answers:

We learn that 2Q2025 Carabao Dang energy drink sales rose +27% year-on-year in the first half, with gross margins staying high. Overseas sales dropped due to the Cambodia land border issue. Vietnam sales grew +38% year-on-year.

ChatGPT's answer was strong, though somewhat wordy. Gemini 3's was inexplicably worse than the previous model, though captured most of the important aspects, except the execution risks with ramping up its two new factories in Myanmar and Cambodia. Claude 4.5's summary was to the point and way better than before. Grok's answer was somewhere in between. I think Claude won this one.

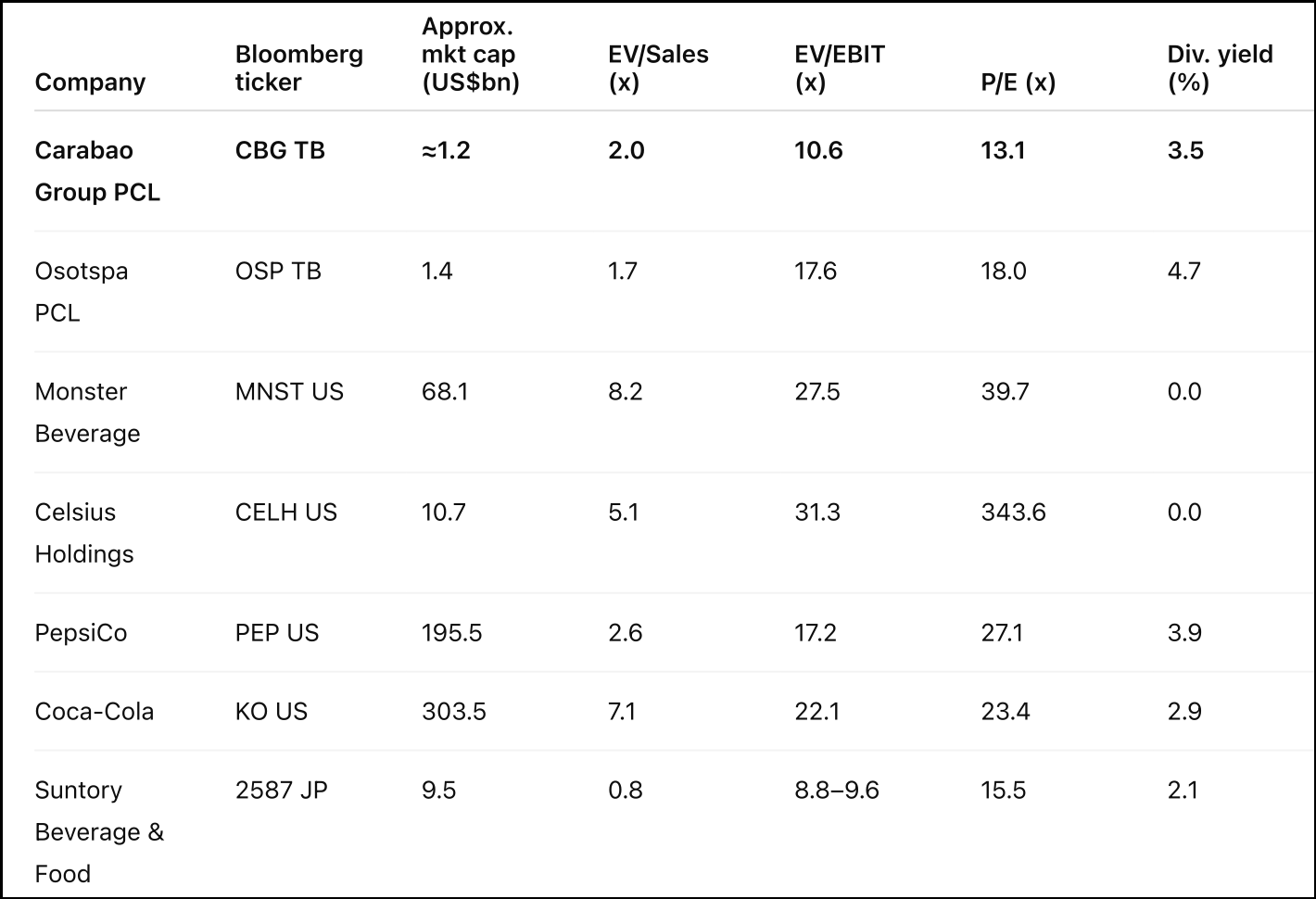

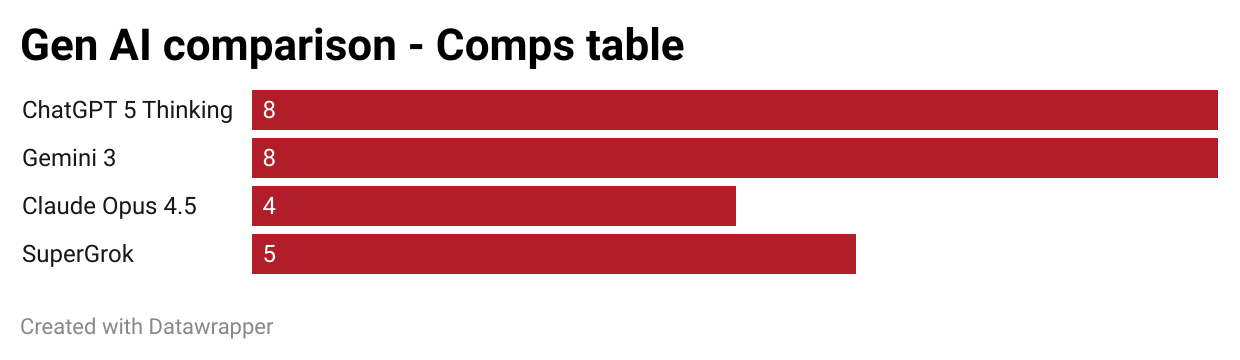

Comps table

Now let's compare the valuation multiples of Carabao with those of its global peers. Here's the prompt I use:

"Generative a comparables table with Carabao and its key global peers within the energy drinks industry. Include the Bloomberg ticker, USD market cap and the following valuation multiples: EV/Sales, EV/EBIT, P/E and dividend yield. Also include the 5-year average return on equity for each peer."

The answers:

Carabao's energy drink peers include Thailand's Osotspa, but also US peers Monster Beverage and Celsius Holdings. At 13x P/E and 11x EV/EBIT, it certainly trades at a large discount to most peers:

ChatGPT presented a great list of peers and also provided sources. However, it didn't include any ROE figures in the table. Gemini 3's answer is short but accurate and now includes Osotspa. Claude's and Grok's market cap numbers for Carabao were flat-out wrong but I appreciate that Grok included Eastroc Beverage. ChatGPT wins this one:

Challenging prediction

Next, I'll try to estimate Carabao's earnings for the next three years. This is a challenging task and will separate the wheat from the chaff. So I ask the models the following prompt:

"Estimate Carabao's earnings per share in the following three years from 2025 to 2027. Consider industry growth, market share gains, price increases, cost pressures, operating leverage, financing costs and share count dilution in your final earnings per share estimates."

Here are the answers I get:

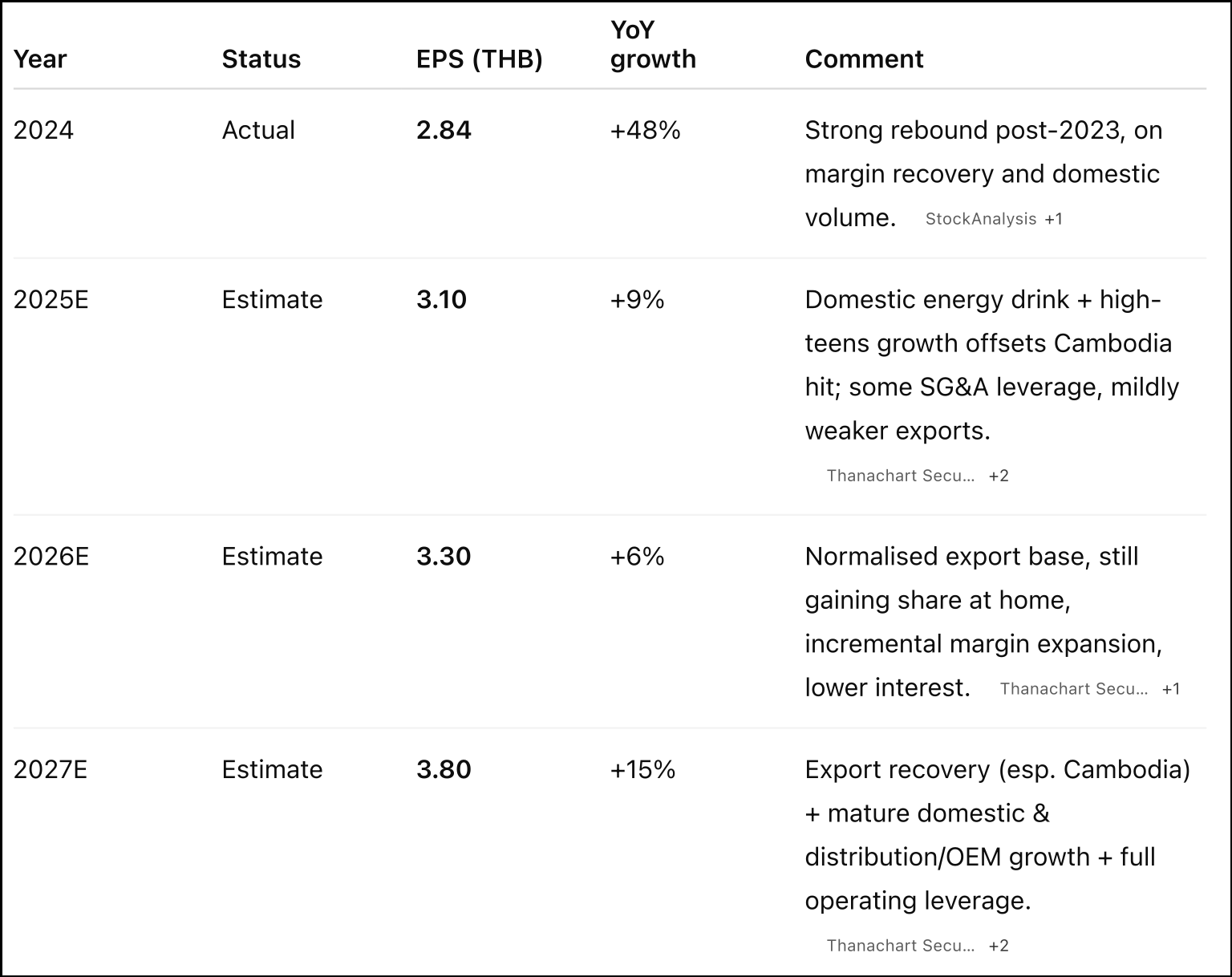

In my view, it's clear that Carabao's 2025 earnings will be hit by the Cambodia border issues, but that earnings will recover as the new factory ramps up through 2026:

ChatGPT correctly identifies the positive effect from the factory ramp-up in the next six months. Gemini 3's forecast now takes that factor into effect as well, though I think it might be underestimating the margin recovery story. I think Grok's forecast is unimpressive, assuming price increases despite the almost-fixed THB 10 price point and using global beverage sales growth as a guide. Claude 4.5's estimates are somewhat better but don't seem to consider the new factory in Cambodia. So ChatGPT wins this one, again:

Finding red flags

Next, I'll try to understand the accounting risks in Carabao's financial statements. Here's the prompt I used:

"You are a forensic equity analyst. Identify red flags and accounting risks in the attached financial statements and MD&A section of Carabao, including revenue recognition, segment reporting, leases, related parties, contingencies, stock-based comp, goodwill/intangibles across the income statement, balance sheet and cash flow statement."

The answers:

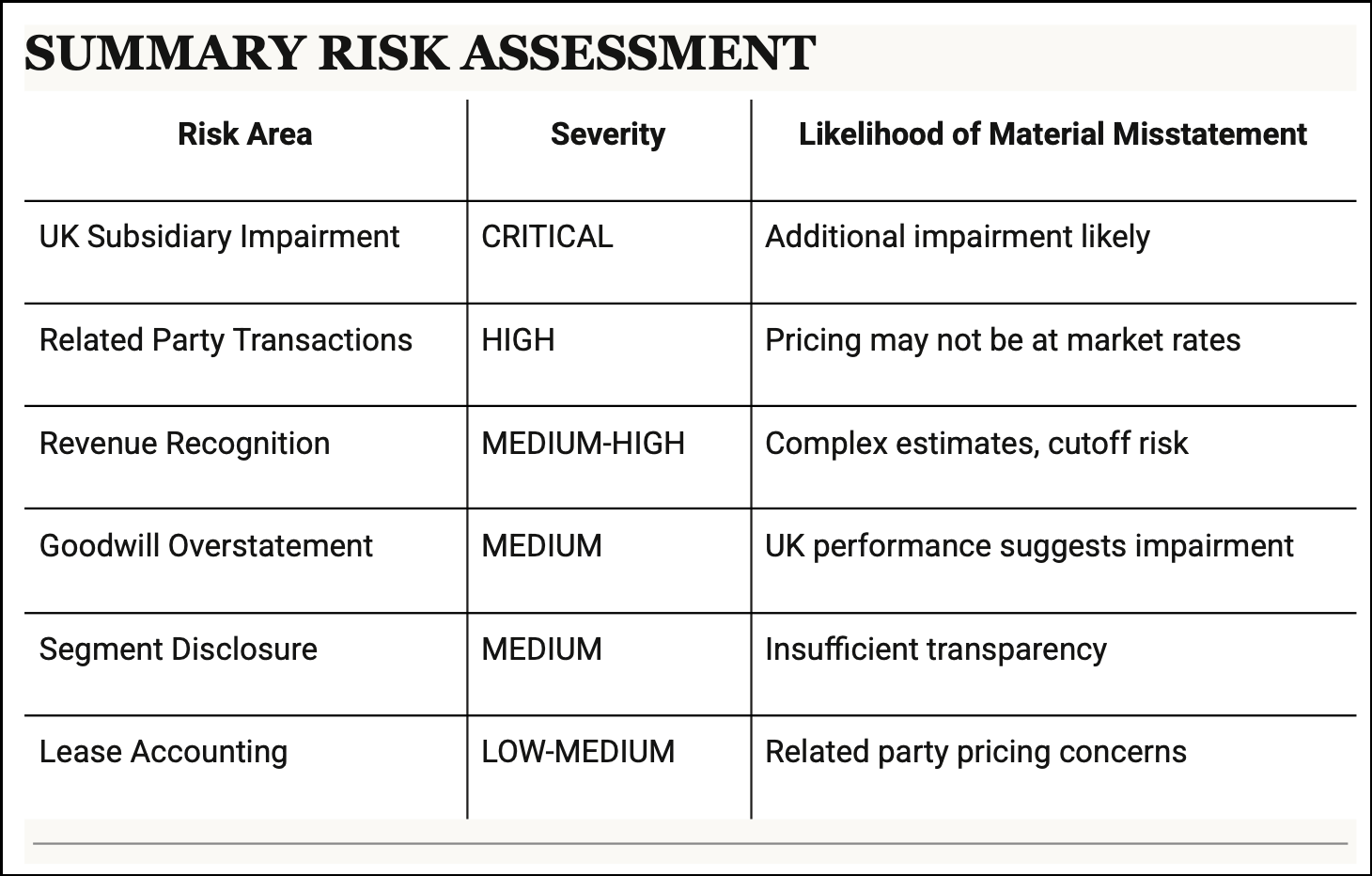

Claude's answer was amazing. It identified an impairment in Carabao Holdings Hong Kong, some goodwill, related party transactions including loans to related parties, a lack of geographic segment disclosure, and more. However, Claude 4.5 failed to load the answer, so I'm relying on the older model's output here.

Gemini 3's answer was great, adding that the cost of the Carabao Cup was 50% shared with a related party. Grok's answer was somewhere in between. ChatGPT only identified the low provisioning for discounts (worth mentioning?) and related party receivables, but nothing else. So this section is a tie between Gemini and Claude, in my view:

Q&A preparation

Finally, now that we've done all the background research, let's reach out to Carabao's management team and ask for a meeting with them. But which questions should we ask?

To get inspiration, I give each of the generative AI tools the following prompt:

"Create 15 precise questions for the CEO of Carabao about the company's long-term strategy, competitive advantages, capital allocation and risks that they see on the horizon. Order by information value."

And here are the questions they suggest:

Generally, I think the most important question is what's going to change in the future.

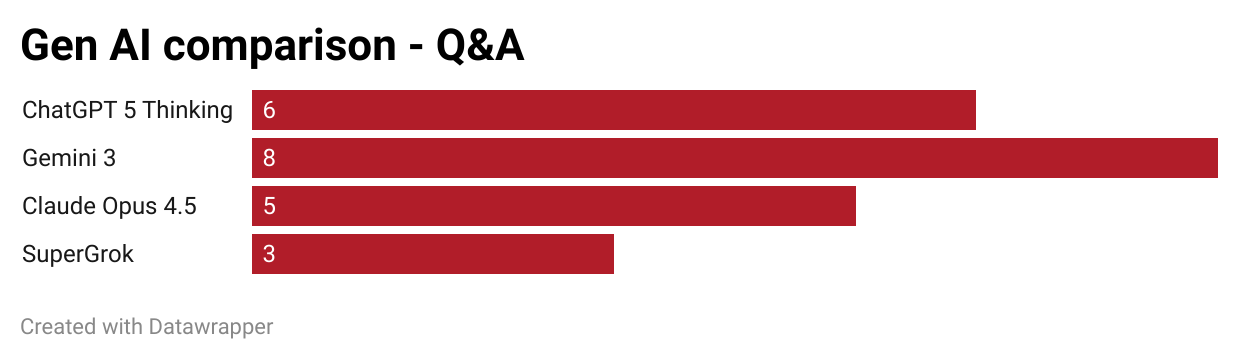

So for that reason, I think Gemini 3 performs the best. Its questions are specific and reveal how management thinks about strategy and capital allocation. Here's a highlight from Gemini's answer:

ChatGPT's answers are decent, too, touching on capital allocation and strategy. Grok's questions include a lot of fancy words but without much substance. Same with Claude 4.5, whose questions I continue to think lack nuance. So Gemini wins this round:

Conclusion

Before writing this post, I asked my Twitter followers which generative AI tool they prefer when it comes to equity research. Most preferred ChatGPT, followed by Gemini:

Reigning champion when it comes to equity research?

— Michael Fritzell (Asian Century Stocks) (@MikeFritzell) November 6, 2025

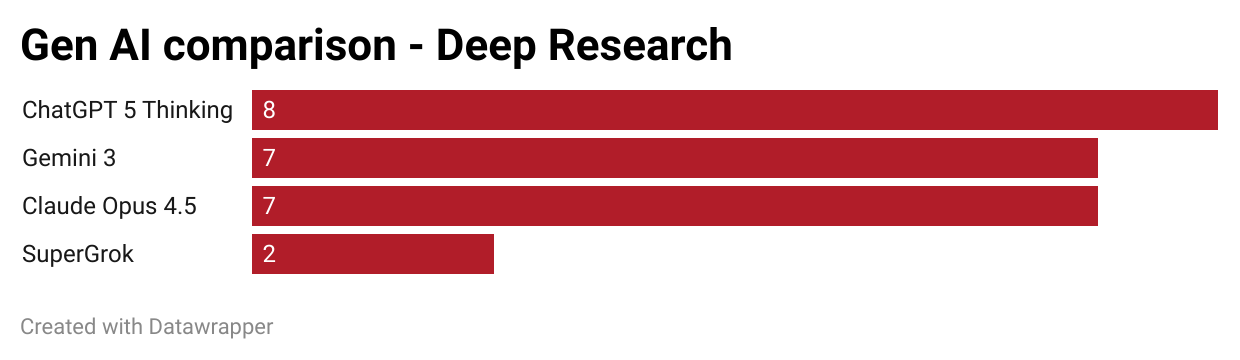

After running this experiment, I feel exactly the same way. Here's the final tally from my ranking of the generative AI models across each of the 10 categories:

So with Gemini 3, I think it's finally competitive against ChatGPT. Claude has improved, but is lacking in terms of data analysis and its nuance. SuperGrok remains far behind.

Here's my updated advice:

- With Gemini significantly faster than ChatGPT, and neck-and-neck on most tasks except Deep Research, I think you could argue that Gemini is a superior option to pay for. You'll get 20 Deep Research reports per day compared to only 25 reports per month for ChatGPT Plus. Gemini also gives you 2Tb of Google One storage, better functionality through the sister app NotebookLM and full integration with Gmail and Google Docs.

- I've been incredibly satisfied with ChatGPT's 5 Thinking model, so I'll probably continue using it. For no other reason that I've customized it, and that it already knows a lot about me as a person.

- Claude is said to be decent at writing text that sounds natural. If that's something that interests you, perhaps consider Claude as an option.

- The only reason to use pay for Grok, in my view, is to access and summarize posts from Twitter/X. But I'll think you'll get far paying for the lower-priced US$8/month tier, as it also gives you access to Grok.

And what did we learn about Carabao? It's an impressive company, run by an energetic entrepreneur with a long-term vision. It's continuously taking market share from Osotspa. And it's going to ramp up its exports through new factories in Cambodia and Myanmar. At ~13x P/E, the valuation is not particularly high. But be aware of the complex corporate structure with recurring related party transactions.