Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

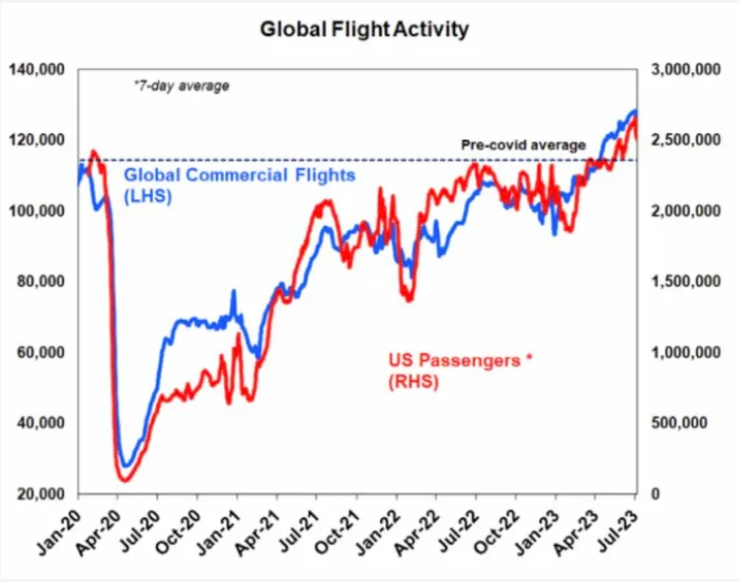

Last weekend, I came across this chart showing that global flight activity is already above pre-COVID levels:

I’ve also found myself travelling more in the past few months. I’m probably not the only one.

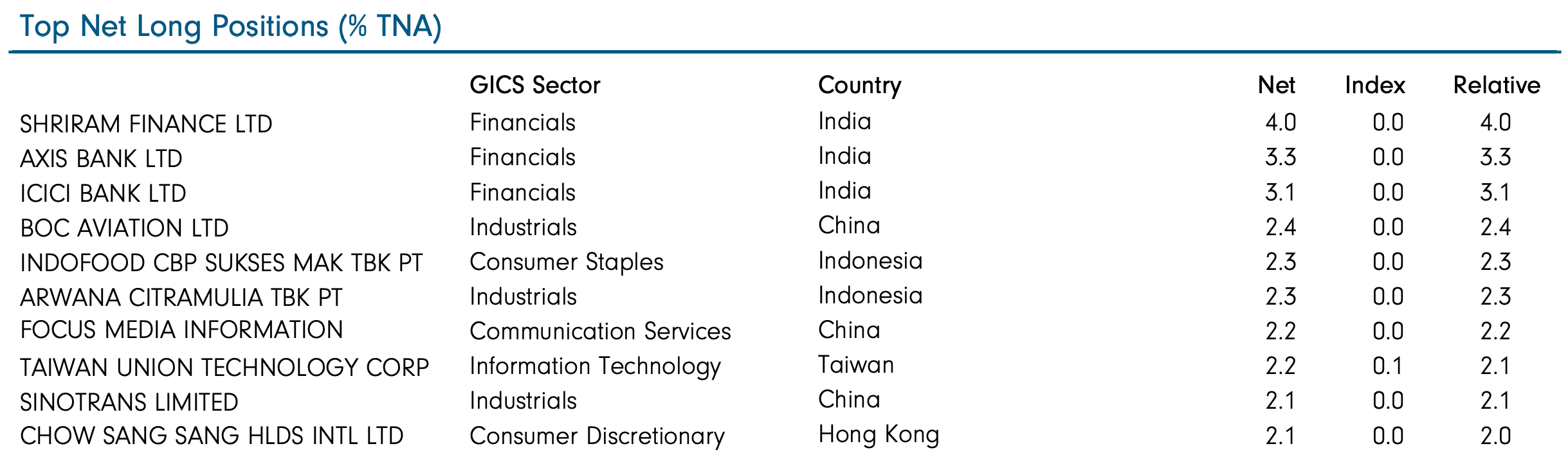

Meanwhile, the well-regarded Fidelity Asian Values Fund has taken a stake in BOC Aviation - an aircraft leasing company. What are they seeing that the market doesn’t?

I’ll try to figure out the answer in this post. Is travel demand now pushing lease rates and aircraft values higher? And who will be the main beneficiaries of this trend?

Table of contents

1. Travel demand is stronger than ever

2. Production remains capacity constrained

3. Supply & demand is getting tighter

4. CO2 ambitions increases demand

5. Investable universe of stocks

5.1. Aircraft manufacturers

5.2. Aircraft lessors

6. Conclusion1. Travel demand is stronger than ever

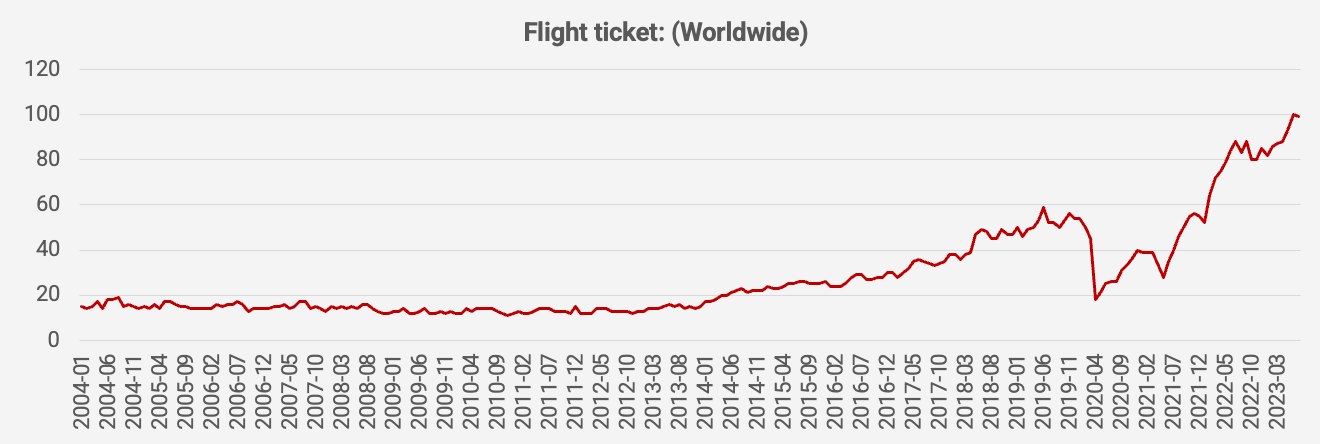

The number of Google search queries for “flight tickets” globally has gone ballistic:

Whether this is due to temporary revenge spending or a permanent shift in demand for travel is unclear. But people are certainly keen on travelling.