Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. We may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Bubble tea (珍珠奶茶), also known as “boba tea”, is a Taiwanese beverage. It blends tea — often mixed with milk or fruit flavours — with chewy tapioca pearls or other toppings (such as jelly, fruit popping boba, or pudding).

There’s been a massive rise in the popularity of bubble tea in the past few years. Just look at the chart of Google search queries for the key word “bubble tea”:

The big question is whether the product has staying power or whether the craze is nearing its end. This will have implications for Asia’s publicly listed bubble tea shop operators.

This post was written in collaboration with Diogo Perneta, who previously wrote about Chinese cemetery operator Anxian Yuan on Asian Century Stocks. If you have any questions for him, please ask them in the comment section below.

Table of contents:

1. A brief history of bubble tea

2. The bubble tea industry in 2024

3. The investable universe of stocks

3.1 Mainland China

3.2 Hong Kong

3.3 Taiwan

4. Valuation multiples

5. Conclusion1. A brief history of bubble tea

Bubble tea’s roots can be traced back to the 1600s. During their occupation of Taiwan between 1624 and 1662, the Dutch introduced the practice of adding milk and sugar to tea. While milk tea didn’t become an immediate trend, it laid the foundation for later innovations in tea preparation.

In the mid-20th century, Hong Kong-style milk tea gained popularity in Taiwan. However, the process of preparing such milk tea was intricate and therefore didn’t lend itself for standardization.

The product that we today know as “bubble tea” originated in Taiwan in the 1980s as a fusion of traditional tea culture and modern culinary creativity. The invention is often credited to Chun Shui Tang in Taichung, where a staff member added tapioca balls to iced tea. It’s also credit to Hanlin Tea Room in Tainan, where tapioca pearls inspired by local desserts were added to tea drinks.

Initially, the pearls were small and white, but the now-iconic black tapioca pearls emerged with the addition of brown sugar. The drink quickly gained popularity in Taiwan for its combination of chewy textures and sweet, refreshing flavors.

By the 1990s, bubble tea had spread across Asia and into the United States, propelled by immigrants from Taiwan. Over time, it evolved into a customizable beverage with diverse tea bases, toppings, and flavors.

The 2010s brought a global boom fueled by social media and Asian pop culture, cementing bubble tea as a worldwide phenomenon and a symbol of Taiwanese innovation.

2. The bubble tea industry in 2024

Most bubble tea is sold in specialized beverage shops. There are also ready-to-drink (RTD) bubble teas sold in supermarkets and convenience stores, but these do not contribute materially to industry turnover.

You can find bubble tea almost anywhere globally, especially in countries with large Taiwanese and Chinese communities. It’s particularly popular in Asia - the region where the key Taiwanese bubble tea brand initially expanded to.

According to CICC, Southeast Asia is now the fastest growing freshly made drinks market. They expect the market to grow at a 20% CAGR in the five years to 2028.

Looking into PRC’s beverage industry, there are two major types of beverage shops:

- Freshly-made coffee shops; and

- Freshly-made tea shops, where bubble tea is sold

In 2022, there were approximately 117,300 freshly made coffee shops in China, led by industry stalwart Luckin Coffee:

However, freshly-made tea is even more popular, with an estimated 407,000 shops as of mid-2022:

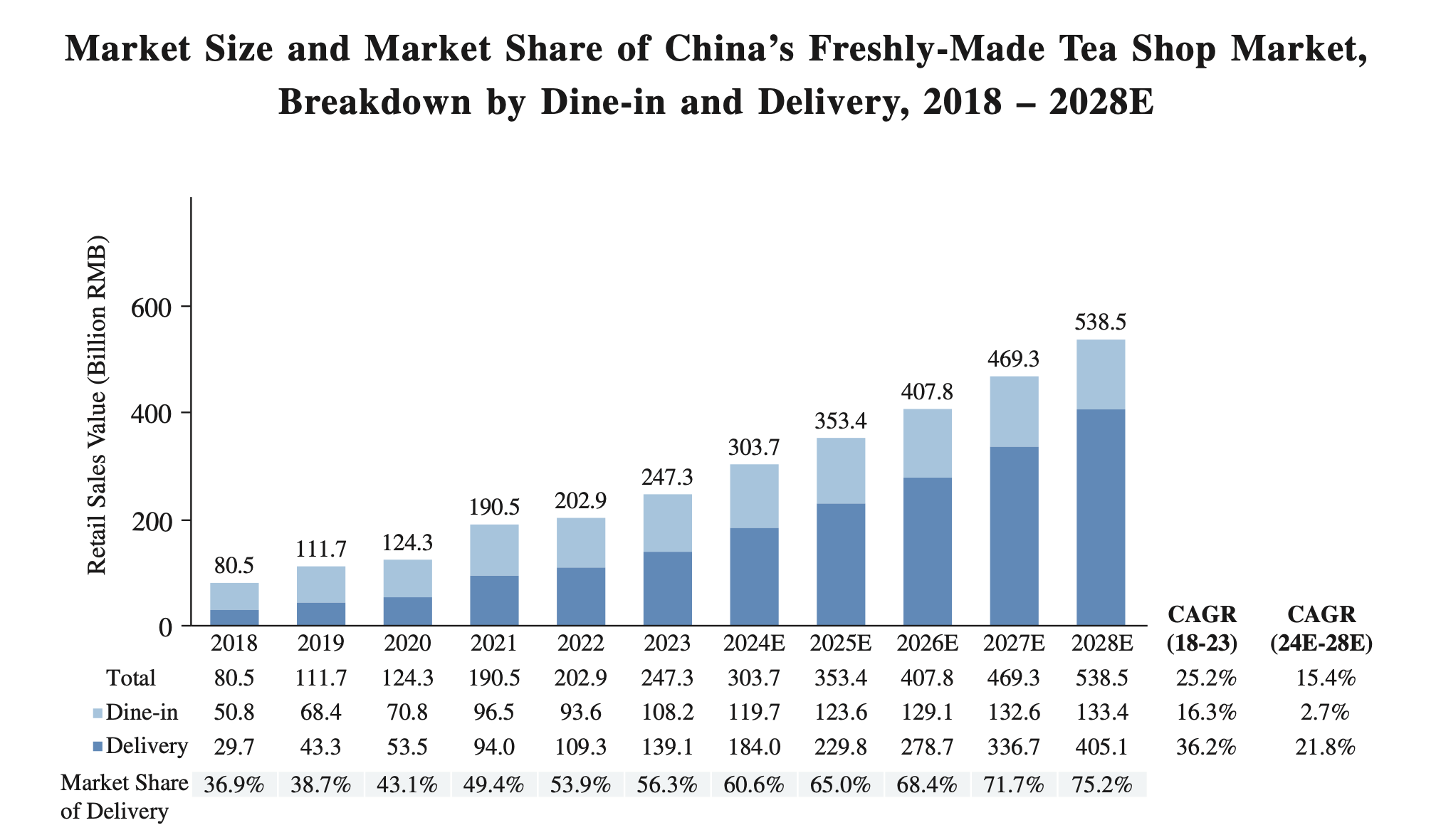

In sales numbers, the freshly-made tea segment made up roughly 64% of the CNY 380 billion beverage shop industry. And the tea sub-segment has apparently been growing at a 25% CAGR since 2018.

In 2020, the annual per capita consumption of freshly made tea in China was 6.2 cups. And when it comes to coffee, the annual consumption was only 1.7 cups. It’s not difficult to imagine that consumption going up over time.

The freshly-made tea market in PRC has shown robust growth across all city tiers. For example, third-tier city freshly made tea markets have experienced yearly growth of +34% in the past five years. And CICC expects the market to grow another +18% per year until 2028.

These numbers come from Frost & Sullivan, so they should be taken with a grain of salt. But it’s still clear that the industry has grown fast and that bubble tea has become far more popular than it was ten years ago.

Another factor behind the industry’s success has been the emergence of online food delivery platforms, enabled by the widespread adoption of mobile devices and shifting dining preferences. The delivery market now makes up 56% of industry revenues and is expected to reach 75% by 2028, again according to Frost & Sullivan numbers.

Based on selling price, freshly-made teas can be categorised into:

- Premium modern teahouses;

- Mid-end tea shops;

- Low-end tea shops

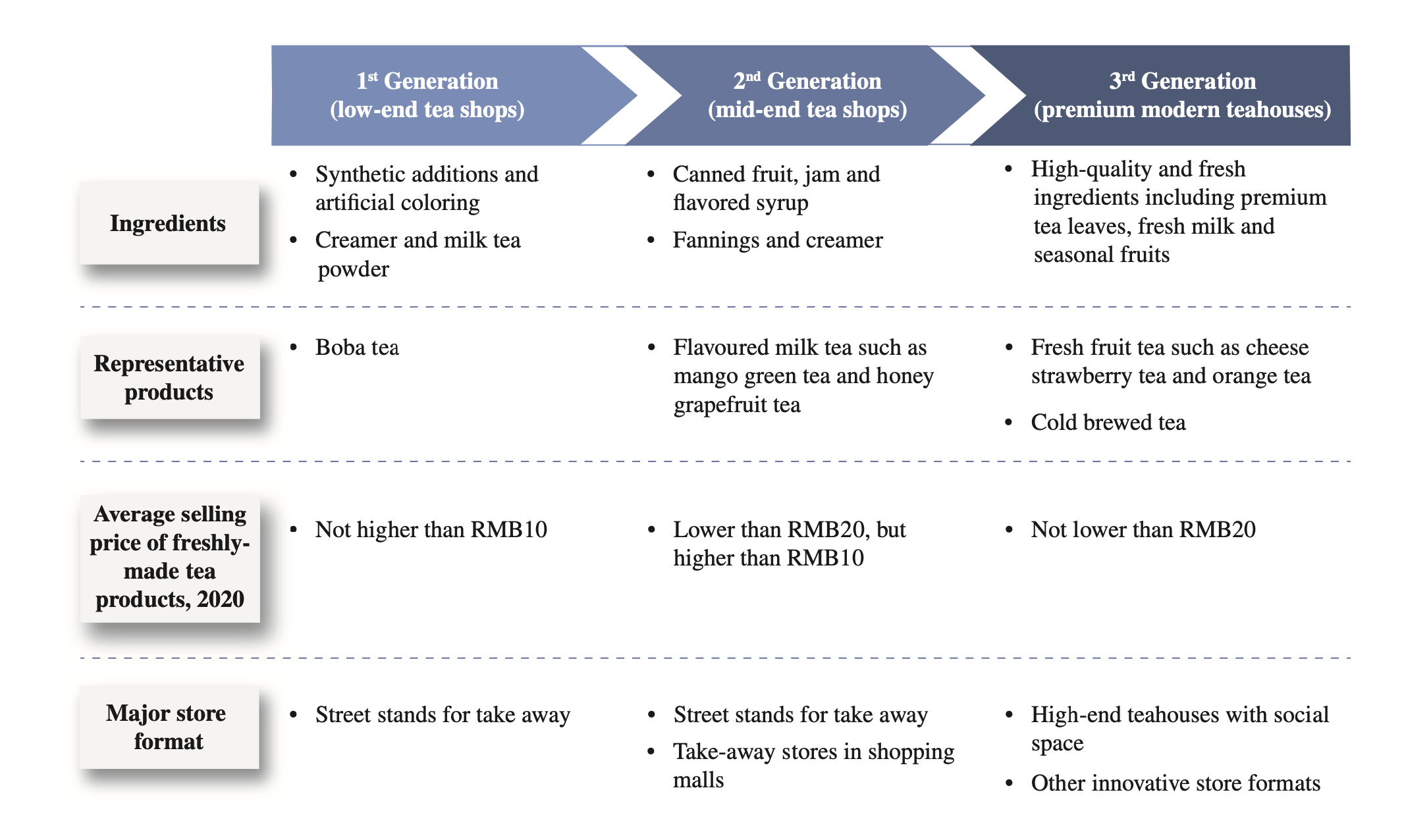

Low-end tea shops focus on affordability, using synthetic additives and milk tea powders to create simple drinks. They primarily operate as street stands for takeaway, with an average selling price not exceeding CNY 10 (US$1.4) in China.

Mid-end tea shops offer a step up in quality by incorporating ingredients like canned fruit and flavoured syrups to create drinks such as mango green tea and honey grapefruit tea. They are commonly found in shopping malls or as street stands, with prices ranging from CNY 10 to CNY 20 (US$1.4 to US$2.7).

Premium modern teahouses prioritize high-quality, fresh ingredients like premium tea leaves, fresh milk, and seasonal fruits. They serve innovative drinks such as cheese strawberry tea and cold-brewed tea in stylish social spaces, with prices starting at CNY 20 or higher (US$2.7 or higher).

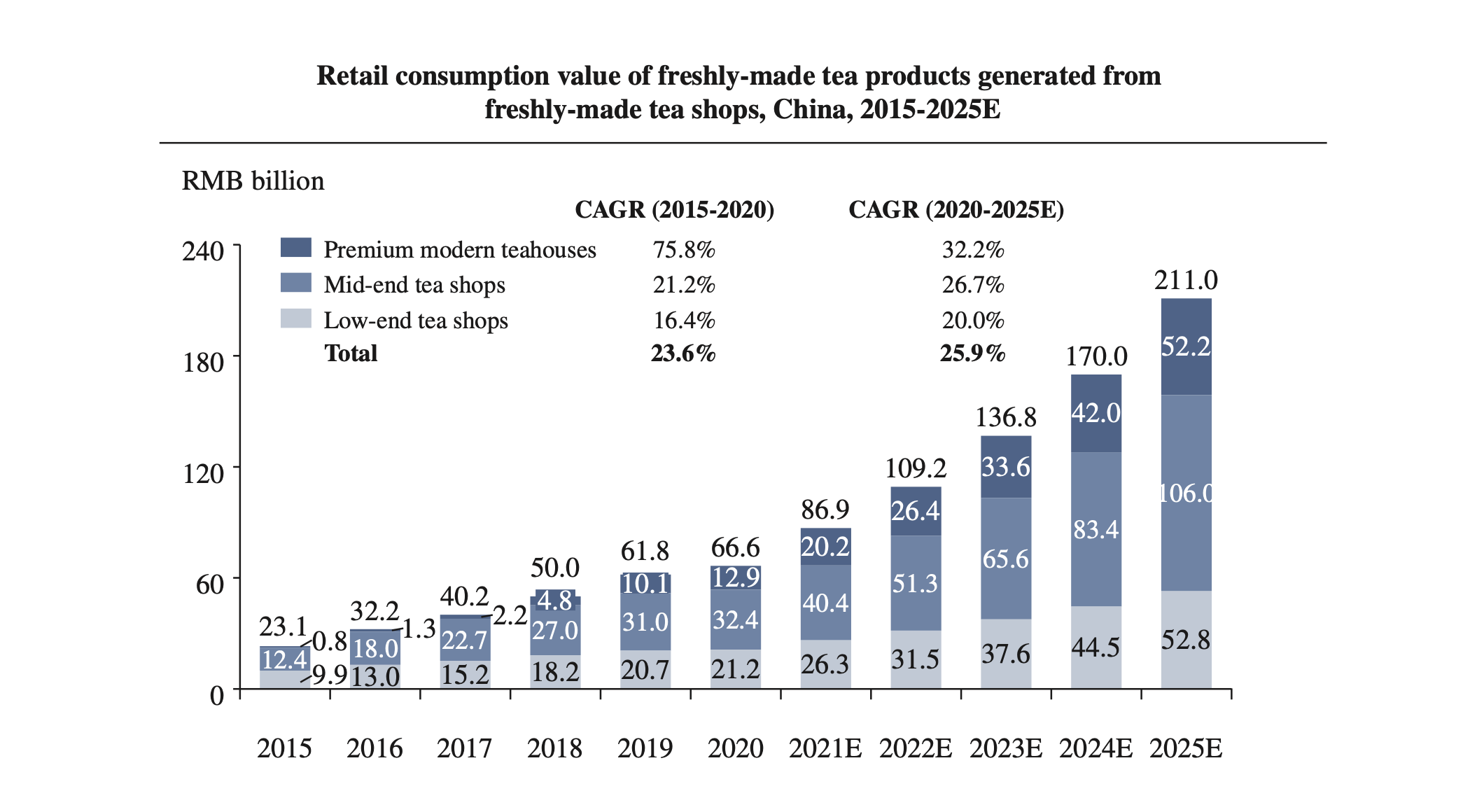

Premium modern teahouses, representing the third generation of tea shops, have experienced remarkable growth, outperforming other tea shop categories with an impressive CAGR of +76% from 2015 to 2020.

By 2020, mid-end tea shops dominated the market, accounting for 49% of total consumption, while low-end tea shops accounted for 32% and premium modern teahouses captured 19%.

The main point that CICC is trying to make with the above numbers is that premium modern teahouses are growing rapidly. Though be aware that inflation itself boosts the growth of a particular category defined as above a certain price level.

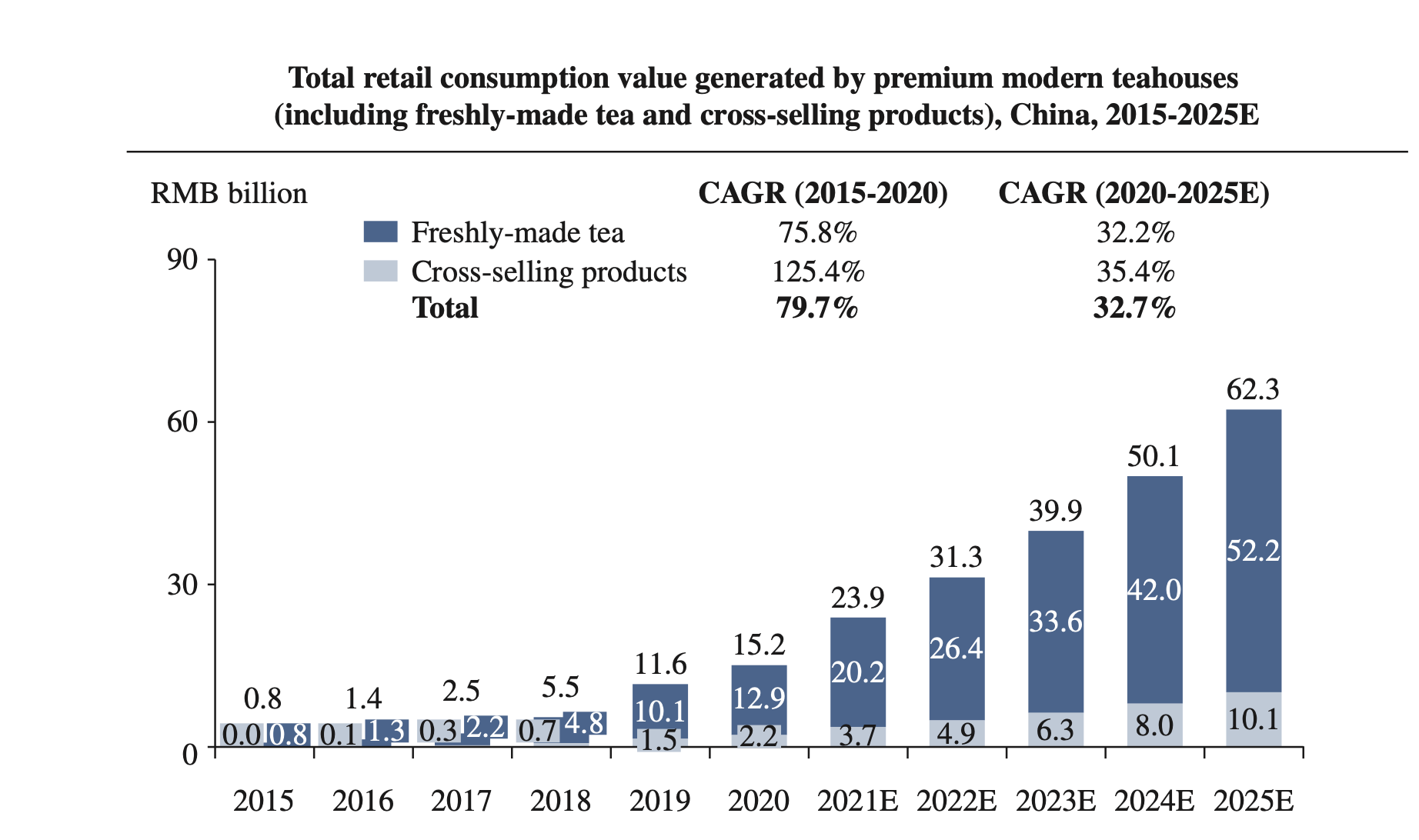

Cross-selling of products (baked goods, coffee, ready-to-drink tea beverages, and packaged snacks) is an opportunity that some premium tea shops are exploring. The sales of cross-sold products have been projected to grow even faster than the overall industry.

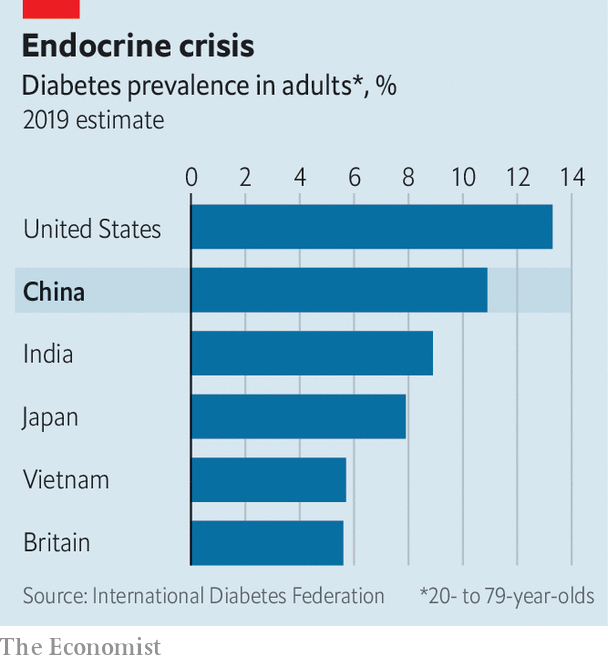

PRC has the world's largest diabetic population. So, the government is now recommending and following WHO guidelines to reduce sugar intake in diets. Sugar reduction is a key focus in government initiatives like the National Nutrition Plan (2017-2030), Health China Action (2019-2030), and Guidelines for Prevention and Treatment of Chronic Diseases in China (2017-2025).

This focus on healthy diets has become reflected in bubble tea consumption, too, with clients opting for less sugar in their drinks. It may even lead customers to avoid bubble tea altogether.

In 2024, the Chinese bubble tea industry started to suffer a downturn, with sluggish consumer demand and increasing competition within the industry, especially at the higher end. Chinese consumers have become price-sensitive.

More recently, videos like these have started to appear, highlighting mass closures of bubble tea shops across China.

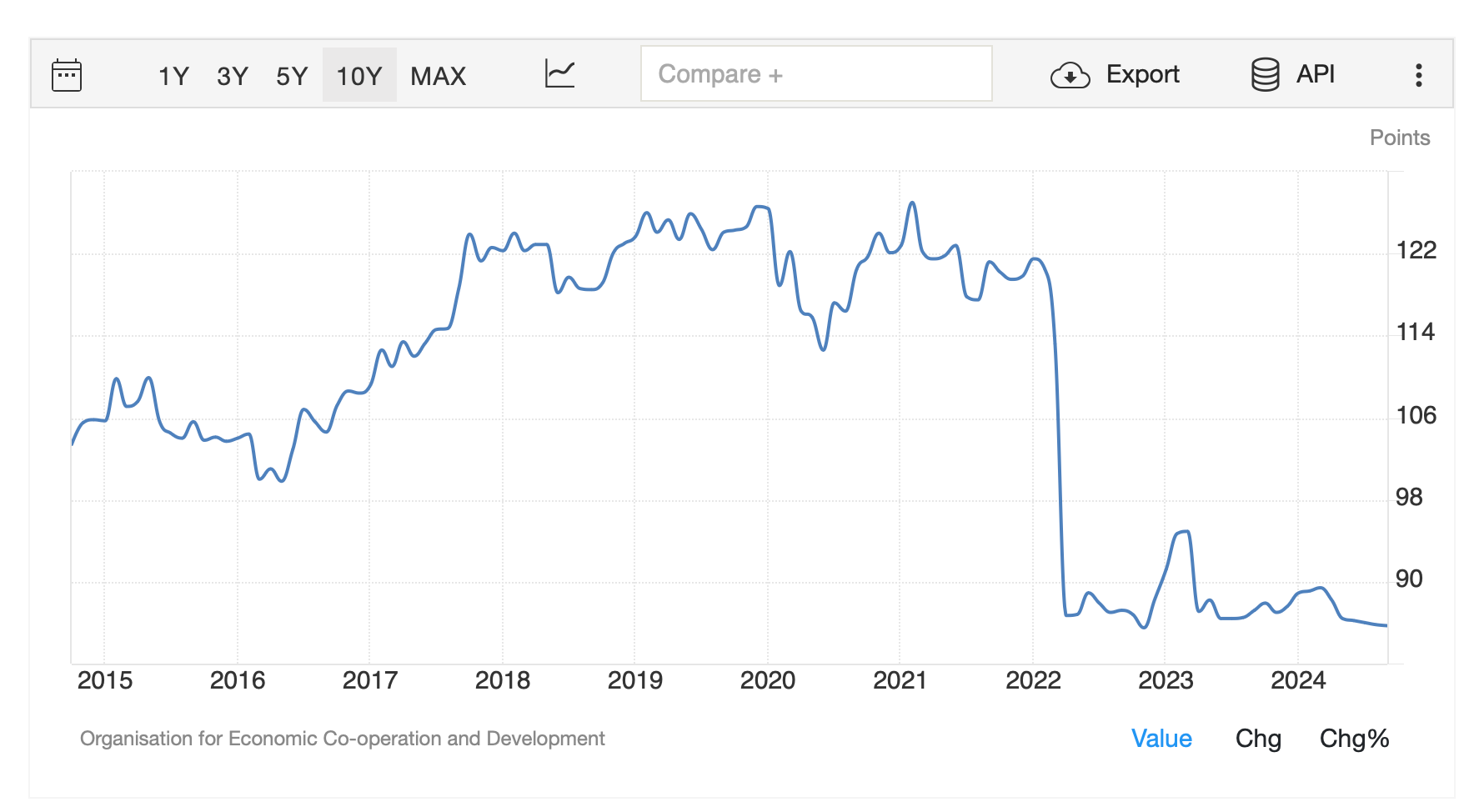

This weakness in Chinese consumption can also be measured through consumer confidence indices. According to McKinsey, consumer confidence is at an all-time low, though higher in China’s poorer cities.

Nayuki and ChaPanda, the only two publicly listed companies with their primary operations in Mainland China, reported revenue declines during this period and, consequently, pressure on their profitability.

You can also argue that increased competition, accompanied by a lack of product differentiation, has caused pressures on sales and margins. China’s top ten shopping areas host around 50 freshly-made tea shops within a 1km radius, while the top ten shopping malls average 10 tea shops each, reflecting a high concentration in prime retail locations. As product and service offerings become increasingly similar, price has emerged as a key factor for differentiation.

As a result, more and more lower-end and mid-range brands now offer fresh fruit tea products in their drinks. Such options were previously only available at more premium tea shops. They’ve achieved this by optimizing their fresh fruit supply chains and leveraging franchise models.

With fierce competition on their home soil, Chinese brands are now currently looking for expansion opportunities overseas:

“Amid surging tea chain growth in China, Shenzhen-based Heytea is seeking to build upon debuts in the UK, Australia, the US and South Korea made within the last 12 months while pursuing further international opportunities.” -World Coffee Portal

Chinese premium bubble tea player Nayuki is continuing to pursue an overseas expansion strategy, focusing first on Thailand:

“Steadily promoting the franchise business; continued overseas expansion, with the excellent performance of the flagship store in Thailand further boosting confidence.” - Nayuki- 1H2024 Results Presentation

ChaPanda is also expanding into other countries in the Asia-Pacific:

“We are advancing our overseas business as scheduled. As of 30 June 2024, we have opened four stores in South Korea, two in Thailand and one in Australia, respectively.” - ChaPanda- 1H2024 Results Presentation

Chinese bubble tea brands have set their sights on the US market to compete with already established Taiwanese and local brands. There has been an increased interest in Asian culture recently, partially thanks to the popularity of K-pop and Korean drama. In the words of Chinese business magazine Caixin:

“More and more bubble tea brands from the Chinese mainland have set their sights on the growing North American market to take advantage of changing consumer tastes and challenge the dominant Taiwanese brands there.” - Caixin Global

In 2023, the Taiwanese nonalcoholic beverage market grew +4% to a record high TW$57 billion (US$1.8 billion), driven by the demand for tea drinks.

The freshly made tea sub-sector registered TW$19 billion (US$582 million) in sales, representing an increase of +6% from a year earlier and accounting for 33 % of the nonalcoholic beverage market. So the Taiwanese freshly made tea industry is still growing.

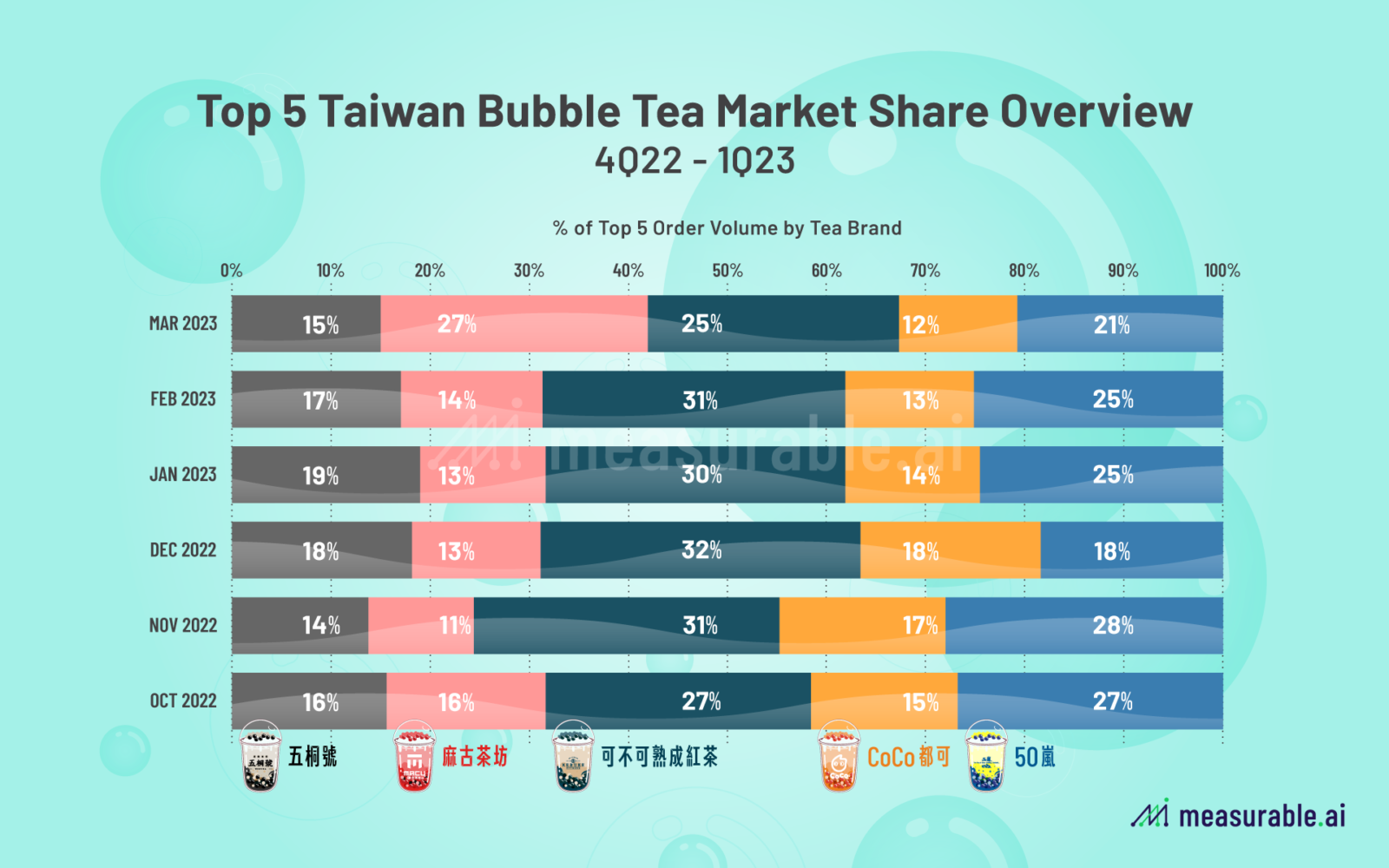

In the Taiwan bubble tea market, based on delivery data as of March 2023, local operator “Macu Tea” recorded the largest market share growth among the top five companies, solidifying its position as the leader with 27% of the market. “Kebuke” follows closely with a 25% share. The top five bubble tea brands collectively hold 45% of the market share, with the remaining 55% distributed among numerous smaller brands.

3. The investable universe of stocks

3.1 Mainland China

Nayuki (2150 HK - US$321 million) is premium teahouse operator in PRC. It has 1,894 stores, of which 1,597 self-operated and 297 franchised. So it relies mainly on the self-operated store model. As of June 2024, around 70% of the stores were in Tier 1 and New Tier 1 cities. Between 2021 and 2023, revenues increased at CAGR of +6%. The two founders Zhao Lin and Peng Xin own 59% of the company.

Nayuki's main competitor is HeyTea, which also uses self-operated store model. Nayuki stores boast a modern, premium design and specialize in offering a range of products focused on healthier options. They also offer baked goods.

After facing intense competition from mid-end tea shops that were penetrating the premium segment and higher-tier cities through franchisees with lower prices. Nayuki reacted and initiated a strategy to also expand via franchised stores in low-tier cities instead of relying solely on a self-owned model, which is more capital-light and enables quicker expansion.

However, they are carefully choosing franchisees for this expansion.

“When we open a franchise store, we want it to be exactly like our existing ones, delivering a high-quality experience to customers. We don't simply approve every franchisee who wants to join.” - CEO, Conference Call

Nayuki also embraces an internationalisation strategy to diversify its store portfolio. One of the markets that they are focusing on is Thailand.

“Both of our initial stores in Thailand are located in their top shopping malls. Our second store, which opened last week, is located in the atrium on the first floor of CentralWorld, Thailand's premier mall, where we have been allocated 200 square meters.” - Nayuki CEO- Conference Call 1H2024

For the first half of 2024, revenues declined slightly about -2%. And it returned to a net loss of RMB 438 million, after being profitable for first time in 2023. It has a cushion of RMB 2.6 billion in cash which should help if the company continues to bleed cash.

Management has focused on optimizing store costs, resulting in significant improvements in the cost structure. If the consumer market recovers, I believe they can achieve an operating profit of RMB 200 million within two years, equating to an EV/EBIT multiple of approximately 7.5x.

Chabaidao (2555 HK - US$2.0 billion) is mid-end tea shop operator. It runs stores under the ChaPanda brand name. In mid-2024, it had 8,385 stores, of which almost all (8,376) were franchised. They rely almost exclusively on franchising, focusing more on lower-tier cities. According to Frost & Sullivan, ChaPanda is ranked third in China’s freshly-made tea shop market in terms of retail sales value with a market share of 6.8%. Chapanda is ranked second in mid-end freshly-made tea shops in terms of gross merchandise value, with 15.6% market share. Wang Xiaokun and his spouse own 83% of the company. Revenues increased at a CAGR of +16% from 2021 to 2023, with an operating margin of 23%.

The Chabaidao stores are smaller and more efficient with less sitting space.

This bubble tea review blog ranked ChaPanda A-Tier bubble tea store, highlighting the tea flavour presence and taro balls.

“The tea was combined flawlessly with the other ingredients, resulting in a harmonious couple with the milk, rather than the milk-dominant drinks I’ve been having. The milk was high-quality, as I’ve come to expect. The taro balls were my favourite topping I’ve had so far in China.” - That Bubble Tea Blog

One of the main competitors in the mid-end tea beverage category, Guming (also known as Goodme), is preparing for an IPO in Hong Kong. Guming leads the mid-end category with a 17.7% market share in terms of gross merchandise value. Its store distribution is heavily concentrated in second-tier and lower-tier cities, with a notable focus on towns and townships. The total upfront investment for a Guming franchise is over RMB 330,000 (excluding rent), whereas ChaPanda requires a slightly lower upfront investment of RMB 280,000 (excluding rent).

Chapanda is also seeking to diversify its operations by expanding into Southeast Asia and its presence in Australia. They are introducing an independent, freshly brewed coffee brand called “Coffree.”. For example, Guming sells coffee in their stores, but this strategy has proven challenging due to the difficulty of changing an established brand image. Creating an independent brand is an easier strategy.

Over the past three years, ChaPanda has consistently maintained slightly higher operating and profit margins compared to Guming. However, this year, Guming's operating margin stands at 20.9%, surpassing ChaPanda's 19%.

For the first half of 2024, ChaPanda also experienced some demand weakness, with revenue decreasing by -10% and profits declining by -34%. It’s still profitable and currently trading at 16x P/E. If consumer spending recovers, it could end up with an earnings per share of HK$1, implying a P/E ratio of 10x.

3.2 Hong Kong

B&S International Holdings (1705 HK - US$18 million) - is a distribution and retail operator in Hong Kong’s food and beverages industry. Their biggest retail business is a franchisee operation of TenRen Tea, a freshly made tea brand from Taiwan. TenRen seems to be emphasizing traditional tea culture rather than innovation and customization.

B&S International hold the license to self-operate TenRen's 57 stores in Hong Kong. They also run other retail outlets such as Chef Hung, 1705, and Nam Kok.

TenRen's stores have been quite popular in Hong Kong for many years. However, when it comes to Google reviews, TenRen's ratings are lower compared to the emerging PRC brand HeyTea.

Competition has intensified in recent years with PRC bubble tea companies entering the Hong Kong market. Most recently, Mixue has opened stores in Hong Kong. Amid the current economic slowdown, Mixue's low-pricing strategy could pose a significant threat.

“Apparently, the pricing strategy by Mixue has already shaken the beverage market in China and overseas. Since its first Hong Kong stores opened last month in Mongkok, the business of Chinese lemon tea shops nearby are hit.” - Lacrucci

B&S International’s distribution business includes sourcing food and beverage products from overseas brand owners or their distributors, as well as over 100 brands, which are sold at retailers such as supermarkets, pharmacies, convenience stores, and department store chains in Hong Kong.

The company has a net cash position of around HK$25 million (16% of market cap), is trading at EV/EBIT of 4x and a dividend yield of 10%.

For the first half of 2024, Hong Kong's weak consumer market and outbound spending, especially in Shenzhen, impacted B&S International Holdings. As a result, revenues have declined by -5.1% year-on-year, with net profit decreasing by -40% year-on-year.

3.3 Taiwan

La Kaffa International (2732 TT - US$144 million) is a Taiwanese retail operator specializing in bubble tea stores. It owns the Chatime bubble tea franchise with 2,500 stores across over 50 countries. Chatime’s beverages include milk teas, fruit teas, smoothies and it also serves coffee.

Other than tea shops, La Kaffa also owns outlets selling traditional Taiwanese desserts (ChunSun and ZenQ) and bakery goods (Bake Code). And restaurants through its subsidiary Kingza International.

More recently, La Kaffa has entered the consumer goods sector with instant and refillable milk tea packs. And these are also sold online through the major e-commerce platforms. Growth at La Kaffa has been sluggish recently, and despite this, the stock still trades at a premium valuation of 20.3x P/E and 5.0% dividend yield.

Lian Fa International Dining Business (2756 TT - US$56 million) operates bubble tea stores under the Sharetea brand name. Its roughly 400 stores are positioned in the premium category and have sometimes been referred to as the “Louis Vuitton” of the bubble tea industry. The United States is Sharetea’s primary market with roughly 140 stores. But it also operates bubble tea shops in Canada, Dubai, Singapore and Taiwan. A few of its hero products include its Classic Pearl Milk Tea and its Okinawa Pearl Milk Tea.

Other store concepts run by Lian Fa include Kampung Hainanese Chicken Rice restaurants and MAMAK Stalls, which serve Malaysian food.

The company hasn’t grown much in the past few years, but the return on equity has been decent at 24% and the valuation is now a reasonable 13.6x with a 5.0% dividend yield.

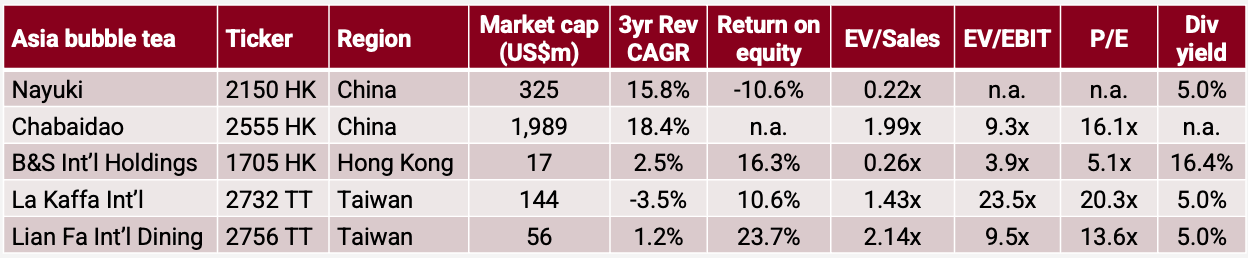

4. Valuation multiples

Judging from the number of Google Trends search queries, the popularity of ShareTea, Chatime and TenRen Tea seems to be falling since their peak in 2019. The data is not encouraging.

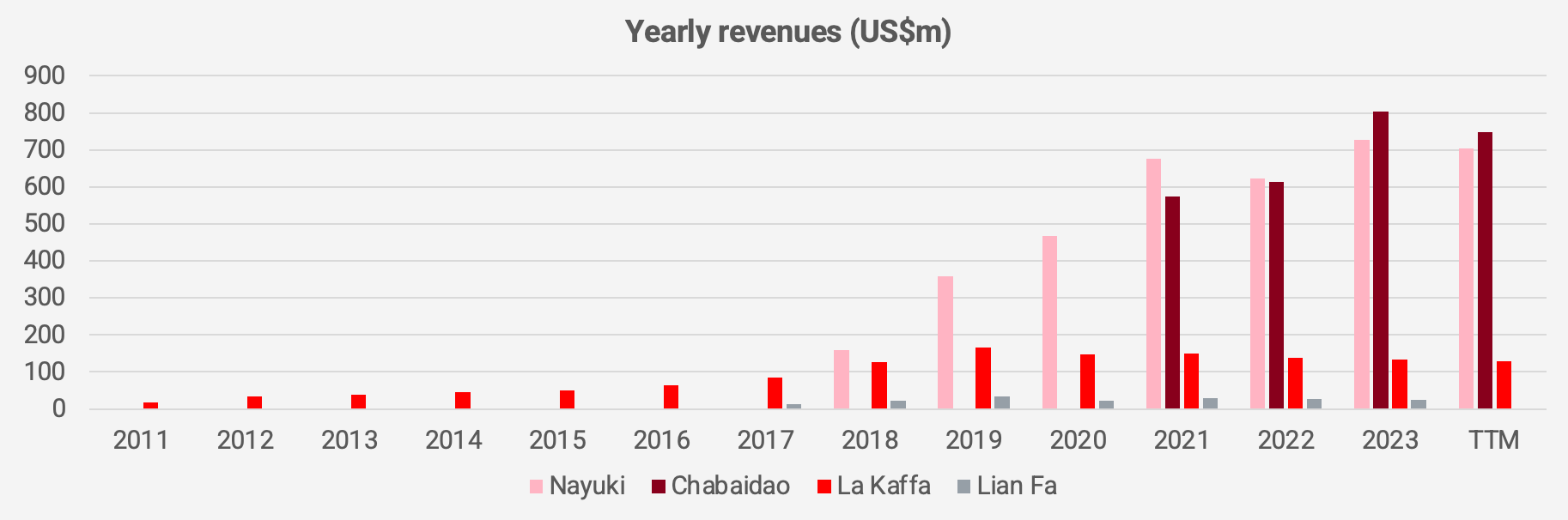

Reported revenues have also slowed recently. La Kaffa has shrunk its turnover since 2019, and Lian Fa isn’t growing either. Nayuki’s and Chabaidao’s revenue growth seems to be decelerating, too, after reports of intensifying competition in Mainland China.

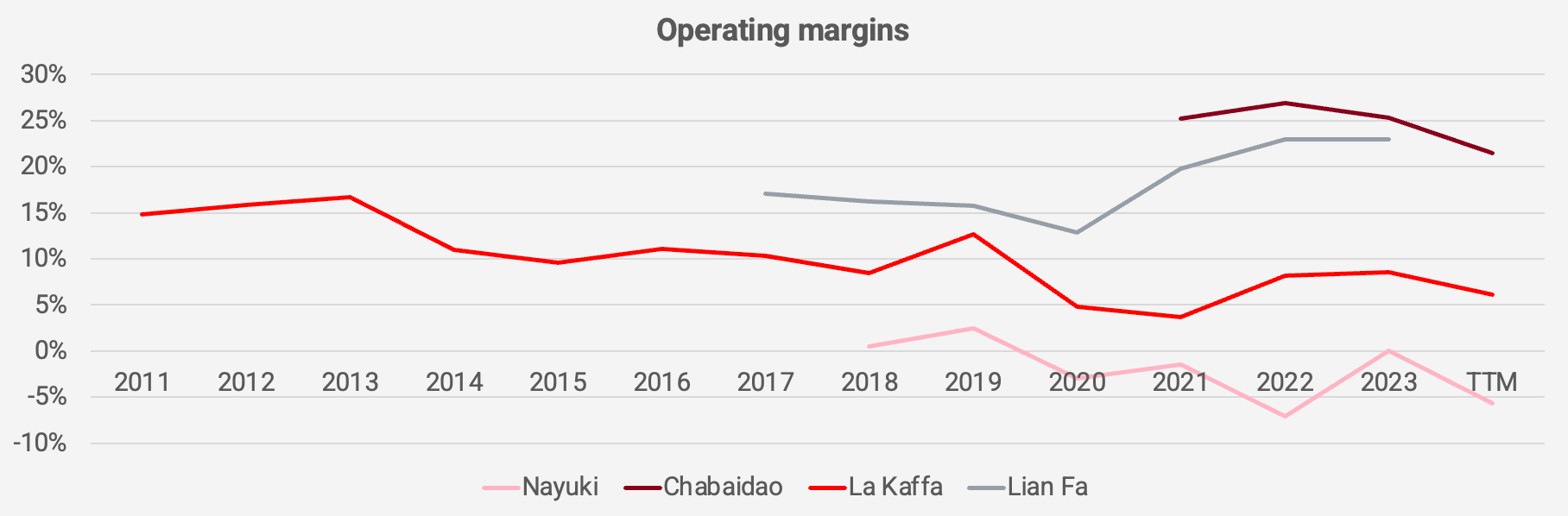

The operating margin profile suggests that Chabaidao is an outperformer. This is no doubt because of Chabaidao’s higher exposure to its franchisee operation. La Kaffa’s declining margins suggests increasing competition in the sector.

If Chabaidao’s franchisees are profitable and their operations sustainable, then the EV/EBIT does look unusually low at 9.3x. Such a low multiple is rare for companies with double-digit revenue growth. La Kaffa’s and Lian Fa’s multiples are high given that lack of growth. The stock with the lowest valuation multiples of all is B&S International Holdings, the Hong Kong-based distributor and TenRen Tea franchisee. It trades at a P/E of 5.1x, EV/EBIT of 3.9x a dividend yield of 16.4%.

5. Conclusion

In the PRC, consumer demand for freshly made tea beverages has visibly weakened due to the current economic backdrop with reduced consumer confidence and spending. Additionally, the IPOs of Mixue and Guming have been put on hold following regulatory decisions, likely influenced by the significant post-IPO share price declines of Nayuki and Chabaidao. However, this presents an excellent opportunity to research these companies more deeply.

Nayuki, in particular, stands out due to its focus on the premium segment, offering healthier options — a market with growing potential. Moreover, the inclusion of baked goods in their product lineup is also interesting. On the downside, it has yet to achieve full profitability. That remains a concern. Additionally, I was greatly surprised by Chabaidao. Customer reviews are better than I expect for mid-end stores. It’s a profitable business with a “lighter” business model and doesn’t trade at excessive valuation.

I also find Guming interesting, as the company is preparing for an IPO in 2025. Despite the industry's slowdown, Guming is outperforming its peers and continues to dominate the mid-end market segment.

The mid-end market could benefit from the ongoing economic weakness thanks to two separate factors: increased consumer confidence in lower-tier cities, where these businesses have a strong presence, and price-sensitive consumers seeking value-for-money options.

In Hong Kong, a weak consumer market and outbound spending are affecting the F&B industry. Despite that, B&S International Holdings has maintained a dominant bubble tea brand in Hong Kong over the past years. While its revenues and profits decreased this year, it trades at a low valuation multiple. A potential catalyst would be if Hong Kong's consumer spending recovers along with greater inbound tourism. The primary risk lies in fierce competition from PRC freshly-made tea brands entering the market with more appealing products.

The Taiwanese bubble tea shop operators La Kaffa and Lian Fa have not been able to grow their top-line revenues much in the past few years. And Google Trends suggests that their brands are becoming less popular. Between the two, Lian Fa has a greater return on equity, and its Sharetea stores enjoy strong customer reviews. The financials suggest strong execution on the part of Lian Fa’s management team.