Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I hold a position in Tai Cheung at the time of publishing this article. To reiterate, this post and the presentation below are for informational and educational purposes only — not a recommendation to buy or sell shares.

A quick background

Tai Cheung (88 HK – US$272 million) is a small Hong Kong-listed property developer focusing on luxury homes.

I first wrote about the company in early 2024, when Hong Kong had just started recovering from the COVID-19 pandemic:

The company used to focus on construction. It was formed by a Mainland Chinese refugee called Edward TT Chan. He fled Guangzhou during the Second World War and ended up in Hong Kong. Working tirelessly for decades, by the 1970s, Tai Cheung had become one of the five largest Chinese-owned construction companies in Hong Kong.

Edward passed away in 1981. By that time, his son David Pun Chan had studied mathematics at MIT and then worked for Tai Cheung for a number of years. So he was well-placed to take over the business, despite being only 30 years old.

Marc Faber noted in his 1988 book The Great Money Illusion that David was a "bright and conservative CEO". And that remains the case.

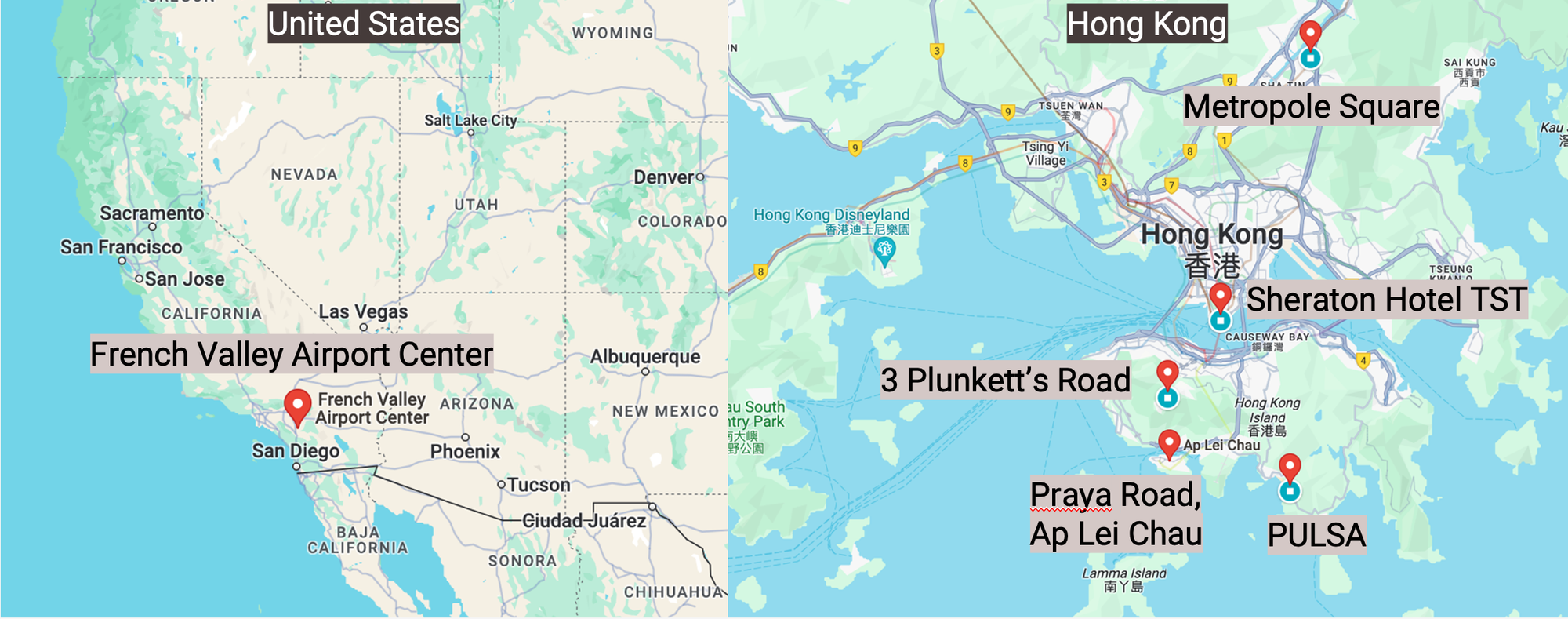

Since 1981, Tai Cheung has become more of a property developer than a construction company. It currently owns the following properties:

- A 35% stake in the Sheraton Hotel in Tsim Sha Tsui. It has a fantastic location overlooking the Victoria Harbour, as you can tell from the following pictures:

- Six connected houses at 3 Plunkett’s Road with about 4,000 sqft of living space. They're located near The Peak, overlooking Hong Kong Island. The driving distance to Central is about 12 minutes.

- Eight newly built villas at PULSA in Repulse Bay overlooking the ocean. These villas are newly built and have about 5,000-9,000 sqft of living space.

- A new luxury development on Ap Lei Chau on the Southern side of Hong Kong Island, called VELE. It's a condo tower with four-bedroom apartments in close proximity to the Lei Tung MTR station.

- It also owns strata-title properties in Metropole Square in Sha Tin

- As well as an industrial property in California called French Valley Airport Center, located between Los Angeles and San Diego.

Roughly 63% of Tai Cheung's gross asset value comes from luxury residential properties. The rest of the value is mostly from its 35% of Sheraton Tsim Sha Tsui.

Here's where the properties are located within the US and Hong Kong:

As you can tell, the residential properties are in amazing locations and are definitely targeted towards the higher end of the market.

That said, as you can tell from the share price, the last five years haven't been kind to the company:

The initial decline was due to a decline in tourist arrivals after the 2019 government protests in Hong Kong. After the protests broke out, Chinese tourism to Hong Kong plummeted. And in early 2020, the Hong Kong government shut down its borders entirely. After that, Sheraton's Revenue per Available Room (RevPAR) dropped precipitously.

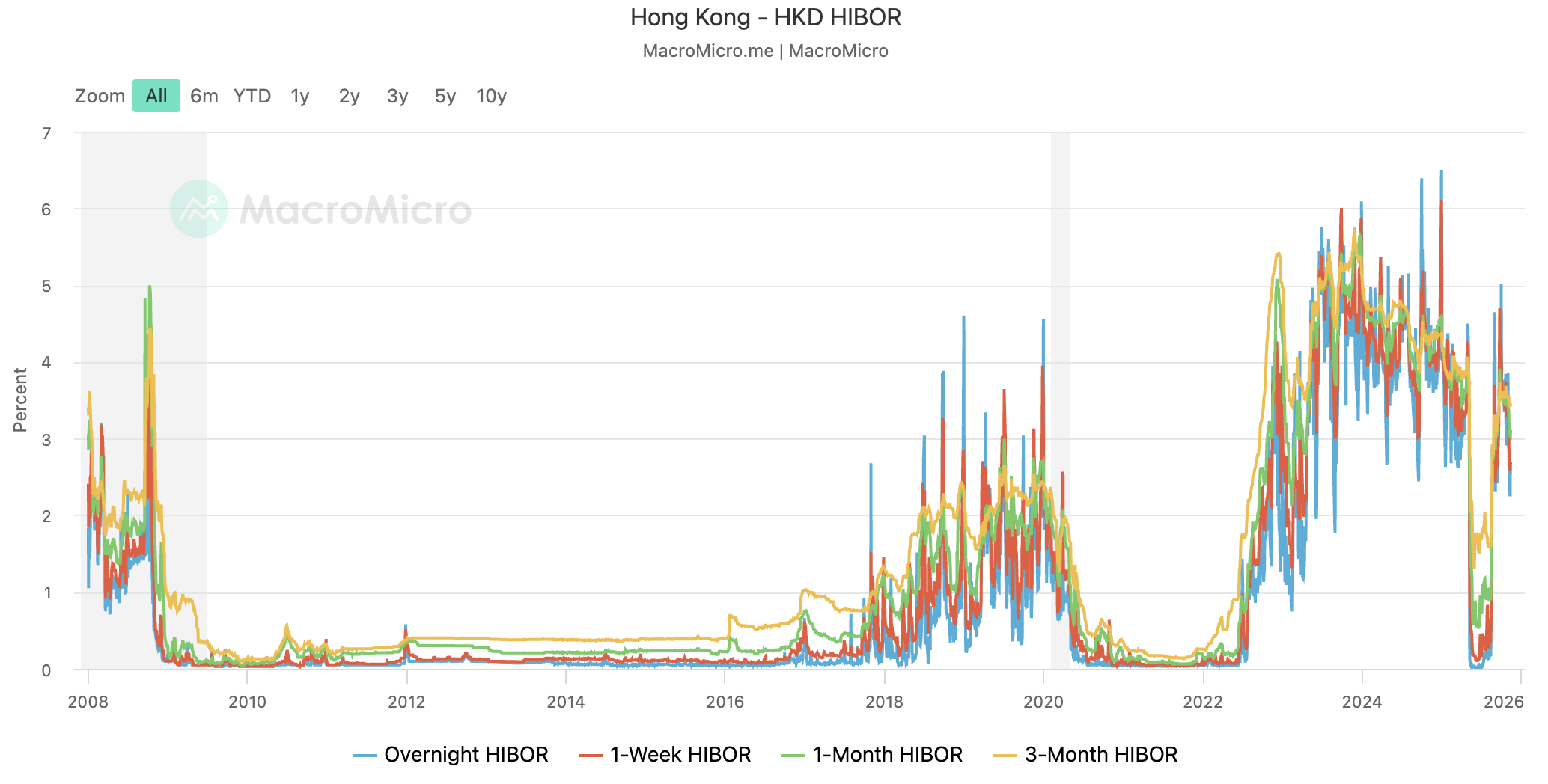

From 2022 onwards, Tai Cheung was further hurt by US interest hikes. Since the Hong Kong Dollar uses a currency board system, the Hong Kong Interbank Offered Rate (HIBOR) rose to a similar extent. And mortgage costs, therefore, came up as well. From 2022 to 2024, HIBOR rose from zero to over 5%:

Due to these higher borrowing costs, property prices finally started to decline. Investment buyers became cautious, knowing that they'd suffer from negative cash flows if they financed any purchase with debt.

By the time I wrote my deep dive in early 2024, I sensed that we were nearing the end of the COVID-19 pandemic. Hong Kong's borders had finallly opened up. Net migration had turned positive thanks to talent from Mainland China. I also felt that US interest rates were about to peak, and that borrowing costs would eventually come down.

Another positive tailwind was the October 2023 decision to cut the 30% additional stamp duties in half. I've always loved Hong Kong. I believe that eventually, Mainland Chinese would be tempted to buy properties in Hong Kong to enjoy the excellent education and healthcare systems, along with its ultra-low tax rates.

Update to my original post

In my view, the fundamentals have finally started to improve.