Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

Table of contents

1. Portfolio update

2. Update on my key holdings

3. My plans going forwardPortfolio update

September was a weak month for the portfolio, which declined by -1.7%.

But some markets actually performed well. Chinese equities, in particular, have been on a bull run. There's been relentless buying of Hong Kong equities by Mainland Chinese investors through southbound flows. These investors tend to prefer technology companies, and I think that's why companies like Alibaba has done well.

The Chinese bull market has implications for Hong Kong, as IPOs and trading activity tend to have a significant impact on the local economy. I'm getting increasingly bullish on residential property prices in Hong Kong, especially in areas like Kowloon where newly arrived talent from Mainland China likes to live.

I also think that Fed Chair Jerome Powell is about to be replaced by someone more dovish. That would lead to lower US and Hong Kong interest rates, which should support Hong Kong's 3.75% residential cap rate. I haven't bought any Tai Cheung yet, but I'm considering it.

The news has been more mixed in Southeast Asia. In early September 2025, the Indonesian Rupiah depreciated against the US Dollar following the resignation of Finance Minister Sri Mulyani Indrawati. Investors now expect the budget deficit to increase beyond the current 3% maximum. I think investors are also concerned about the new Asset Forfeiture Bill, which would permit the seizure of assets involved in criminal activities. I fear that future "anti-corruption" campaigns will be used to consolidate power.

Equally puzzling were the late September social media rumors that the Philippine military was plotting to oust President Ferdinand "Bongbong" Marcos. The defense department denied the rumors, but no smoke without fire? We know that Duterte is working hard to regain power.

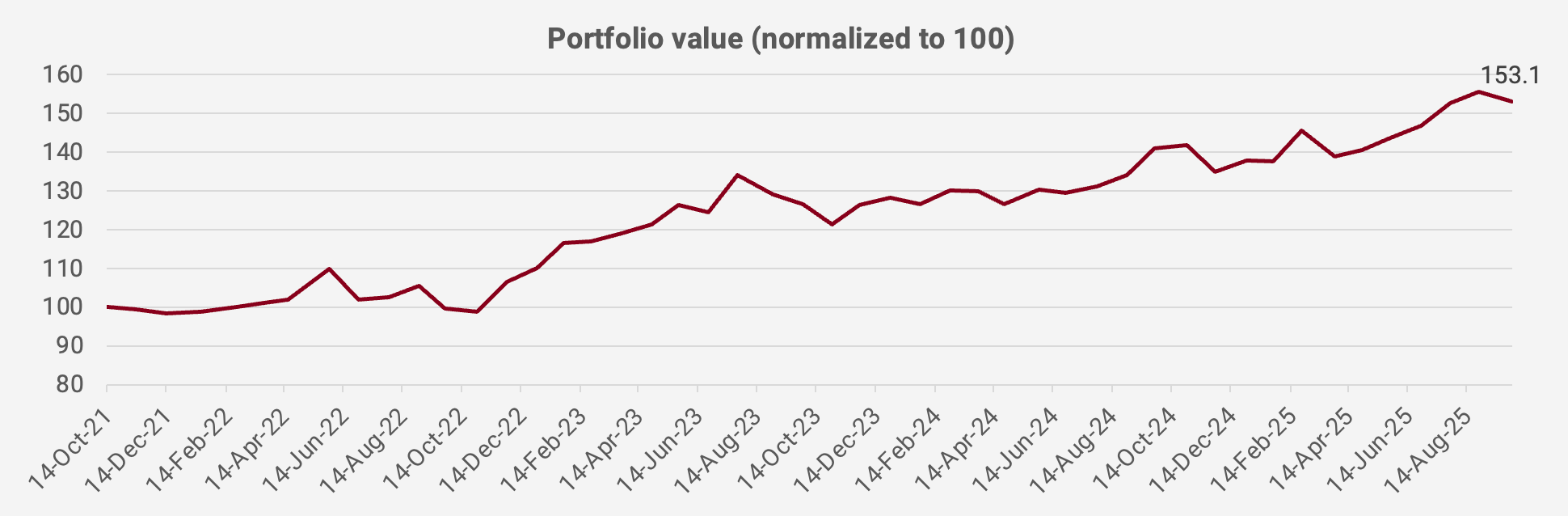

Here's a chart of the portfolio's value in US Dollar terms, with a decline of -1.7% month-on-month in September. Since the portfolio’s inception in October 2021, the value has increased by +53.1%, equivalent to a +11.3% compound annual growth rate:

The only stock that did well was Japanese Aircraft component supplier AeroEdge, thanks to enthusiasm about its new deal with Safran and the two upcoming "Project A" and "Project B".

On the negative side, you had beer producer Multi Bintang. The Rupiah fell, and the stock fell in local currency terms, too. I believe that this decline was related to macro.

There was also an 11% decline in the share price of Japanese secondhand goods trading platform Mercari. The CEO spoke to investors and guided for lower gross merchandise value growth in the fourth quarter of 2025. Though on the positive side, he's also guiding for a return to growth in the US. We should also expect a positive impact from the taxation of low-value imports after Japan's de minimis rules are revised in late 2026.

In any case, here’s the latest portfolio as of 29 September 2025: