Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

I just spent four days in Taipei — the capital of Taiwan, and its political and commercial center.

My trip was organized last-minute, and I didn’t have the chance to meet any companies this time around. But by meeting friends, I gained a better understanding of the macroeconomic climate, politics and the current opportunity. So I thought I’d share some of my takeaways with you.

For what it’s worth, the Taiwanese stock market performed strongly between 2022 and 2024. This year’s decline is primarily due to Donald Trump’s proposed tariffs on Taiwanese exports:

In any case, here are my thoughts from last week’s trip.

Table of contents

1. Lai Ching-te’s recall campaign

2. US tariffs are a clear negative

3. Annexation seems unlikely

4. The currency is undervalued

5. Housing has become expensive

6. The current watch list

7. Conclusion1. Lai Ching-te’s recall campaign

On Saturday, there was a large rally in Taipei under the banner of “Reject United Front, Defend Taiwan”. It’s been on everyone’s minds, including Substack writer Angelica Oung.

In essence, the rally was organized to support President Lai Ching-te’s recall campaign of KMT lawmakers suspected of collaborating with the CCP. The United Front refers to the CCP’s “United Front Work Department” influence operations.

Let me give you a backdrop. Current President Lai Ching-te is from the Democratic Progressive Party (DPP). But the Legislative Yuan (Taiwan’s parliament) is controlled by the opposition alliance, which includes the Kuomintang (KMT) and Taiwan’s People’s Party. The fact that the DPP does not control the legislature has led to an impasse and dirty methods to gain control.

The Chinese government used to be run by the KMT. When the communists took over Mainland China in 1949, the KMT and its supporters fled to Taiwan and moved the Republic of China's capital to Taipei.

KMT quickly introduced martial law in Taiwan under former military leader Chiang Kai-Shek, perhaps to combat communist interference. Martial law was then lifted in 1987 under his son Chiang Ching-kuo, and Taiwan has been a democracy ever since.

Since that time, KMT politicians have turned increasingly closer to their former enemy, the Chinese Communist Party (CCP). President Lai Ching-te’s DPP, on the other hand, wants Taiwan to remain independent from Mainland China, with no ambitions of ever returning to the mainland.

The CCP’s influence campaigns have intensified in recent years. The DPP is now accusing dozens of KMT lawmakers of working for the CCP and undermining national defense. A key sticking point is that the DPP is trying to increase Taiwan’s defense spending, in line with US demands. But the KMT is instead pushing for lower defense spending, leading to angst among some Taiwanese.

In Taiwan, lawmakers can be “recalled” if enough votes are gathered from the population. KMT lawmakers have been the primary targets of the current campaign, and 7 seem to have reached the second-stage threshold for recalling them from Taiwan’s parliament. If the lawmakers are pushed out in favor of DPP lawmakers, then the DPP could theoretically gain control of the legislature and get its budget approved.

KMT has responded by trying to introduce a law to shift national security powers away from the president and into the hands of the KMT alliance-controlled legislature.

Meanwhile, President Lai Ching-te is trying to tighten restrictions on trade with Mainland China. He’s also pushed to send home CCP activists operating on Taiwanese soil. He’s particularly worried about Beijing forcing Taiwanese companies to expand their investments in China, and what he claims to be organized intellectual property theft.

So Taiwanese politics are messy, not unlike South Korea. Taiwanese are well aware of the methods that the CCP uses to try to take control of the Taiwanese government. But whether Lai Ching-te will succeed in his quest to recall KMT lawmakers and achieve his political objectives remains unclear as of April 2025.

2. US tariffs are a clear negative

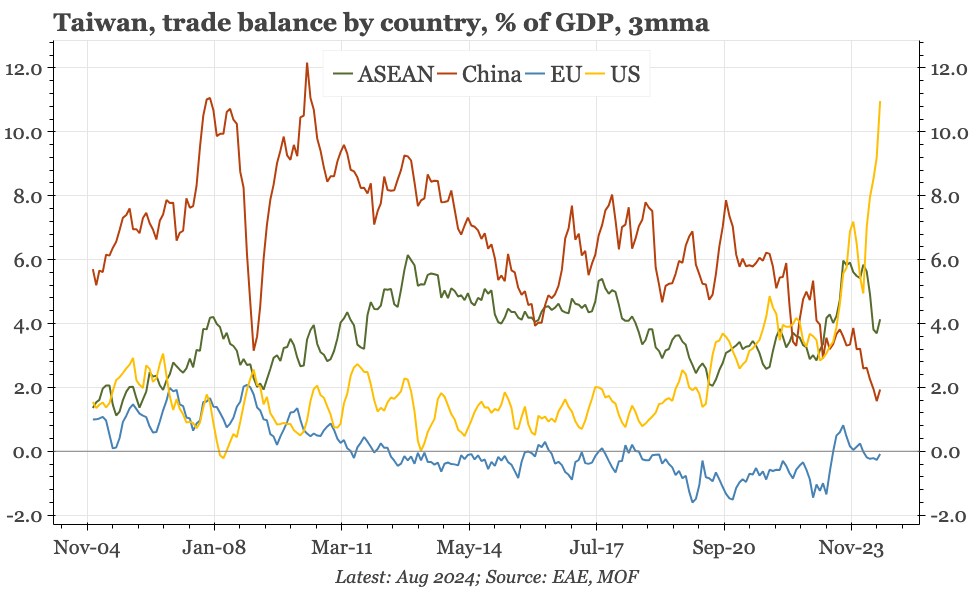

One of the key takeaways from the trip is that Taiwan will be at risk of US tariffs on Taiwanese goods. The economy was more or less built on the back of the demand for its goods and services in the United States.

Now that US President Donald Trump is threatening to raise tariffs on East Asia’s export-dependent nations, Taiwan is at risk weaker export demand. Trump has suggested a tariff of 32%. This rate will be implemented on Taiwanese goods exports in 90 days unless the Taiwanese government can find a deal that works for both sides.

Suffice it to say that US tariffs of 32% would be brutal for Taiwan’s export industry. Taiwan’s export/GDP ratio is almost 70%, an incredibly high number.

So what exactly are Donald Trump’s demands? One seems to be that voiced by Elbridge Colby — that Taiwan needs to increase its defense spending to 10% of GDP. Taiwan’s government debt/GDP is only 29%, so it certainly has the capacity to ramp up budget deficits. Taiwan’s foreign minister recently said:

“In response to President-elect Trump's call for Taiwan to demonstrate a stronger commitment to self-defense, we are of course ready to increase our defense budget”

But given the impasse in the Legislative Yuan, it seems unlikely that Lai Ching-te can meet that demand anytime soon.

Another one of Trump’s demands is a reduction in the bilateral trade deficit with Taiwan. The purchase of US defense equipment would certainly decrease the surplus. Buying US agricultural goods, such as pork, would also help, but would likely lead to a widespread backlash in Taiwan.

The proposed 32% tariff has been reduced to a 10% rate during an initial 90-day grace period. Taiwanese President Lai Ching-te has been well-behaved and not retaliated against Trump’s tariffs. So, in my view, the eventual tariff will probably end up closer to 10% than 32%.

In the near term, even a 10% tariff is likely to impact US demand for Taiwanese products, especially for lower-margin items such as textiles and simpler electronic components. So, expect weak macroeconomic data from April 2025 onwards.

3. Annexation seems unlikely

While the Taiwanese government is only spending 2.5% of its GDP on defense, it’s probably not at risk of an amphibious invasion.

As I’ve written in the past, it would be incredibly challenging to annexe the island. American military planners once concluded that a five-to-one superiority would be needed to secure a victory, given the dense cities and mountainous environment. And landing such forces on an island 160 kilometers away from Mainland China cannot be easy, either.

There would be significant risks for Xi Jinping on a personal level if a campaign fails. It could lead to a revolt against the CCP by the country’s own people. Xi’s hold on power could well vanish.

Some in Taiwan believe that the CCP will never be able to take control of the island. And they seem to be better informed than almost anybody. For example, after the spread of COVID-19, Taiwan was one of the first countries to close its borders, recognizing the problem earlier than the rest of the world. The same goes for cross-border influence.

The threat seems more political. I can see a future where the KMT regains power and agrees to specific demands raised by the CCP. A blockade coupled with an ultimatum could force the legislature to grant the CCP’s wishes, without any actual fighting on the ground. For example, we could well see a resurrection of the 2014 Cross-Strait Service Trade Agreement, which was set to allow partial CCP ownership of media outlets, greater economic linkages and an influx of Mainland Chinese to Taiwan.

The reality is that Taiwanese have been living with the threat for 75 years. The only difference now is that 1) the CCP has dramatically ramped up military spending, and 2) the United States has deserted its past ally, Ukraine. That has led some to question whether it would desert Taiwan in a time of crisis, too.

I came away from the trip thinking that I’ve probably overestimated the risk of a full-blown annexation of the island. Practically nobody in Taiwan is in favor of communist control. Taiwanese will certainly fight to avoid letting the island “becoming another Xinjiang”, in one person’s own words. I also believe that the Japanese are serious about intervening in any conflict, as it has a history with Taiwan being a former Japanese colony for 50 years. A slow takeover from the inside seems much more likely than an all-out war.

4. The currency is undervalued

Another takeaway from the trip is that the New Taiwan Dollar (NTD) feels undervalued at the current rate of 32.5 to the US Dollar. A high-quality meal at a casual dining restaurant costs perhaps US$8, compared to at least US$15 in Singapore.

A breakfast with egg pancake and soy milk costs US$1.5, far less than in Singapore, too.

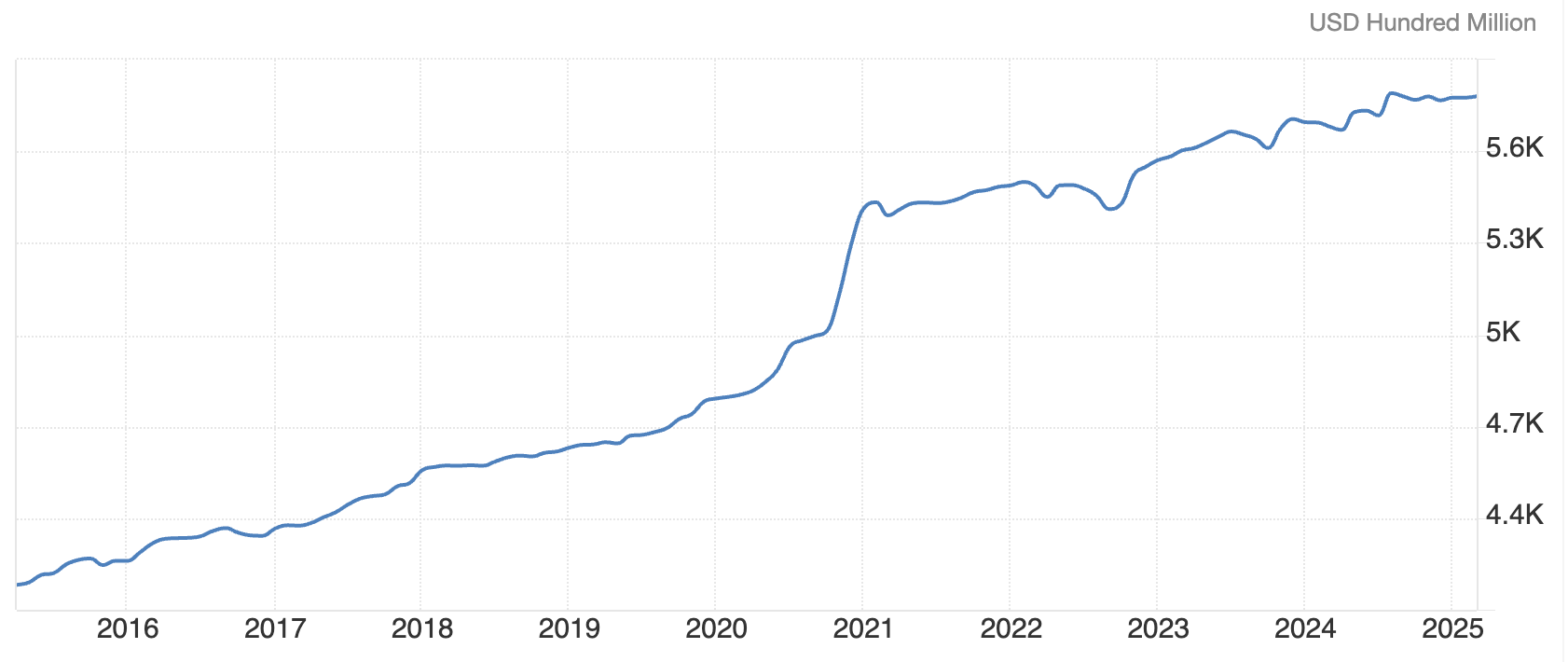

Donald Trump has criticized East Asian nations for keeping down the appreciation of their exchange rates. And Taiwan is certainly one of the countries that has actively manipulated its exchange rate to spur economic growth. Taiwan has a large current account surplus, so the Taiwanese currency should, in theory, be on an upward trajectory.

Taiwan’s manipulation of its exchange rate is evident from the fact that the government has accumulated foreign exchange (FX) reserves. It currently has FX reserves of US$578 billion, around 71% of GDP compared to just 18% in China.

But Taiwan also uses other methods to suppress its currency. It seems that its insurance companies have moved heavily into USD-linked assets in a search for yield. Taiwanese banks also have significant foreign currency exposures, partly due to their role in restricting capital inflows.

A few years ago, I was bewildered by the fact that Taiwan’s 10-year government bond yielded less than 0.5%. But then again, if its currency has the potential to eventually appreciate 50% against the US Dollar, who cares about the near-term yield?

From that perspective, I can see why locals have been willing to save in high-priced residential property or accept minuscule yields. They know that the currency trades significantly below its fair value.

5. Housing has become expensive

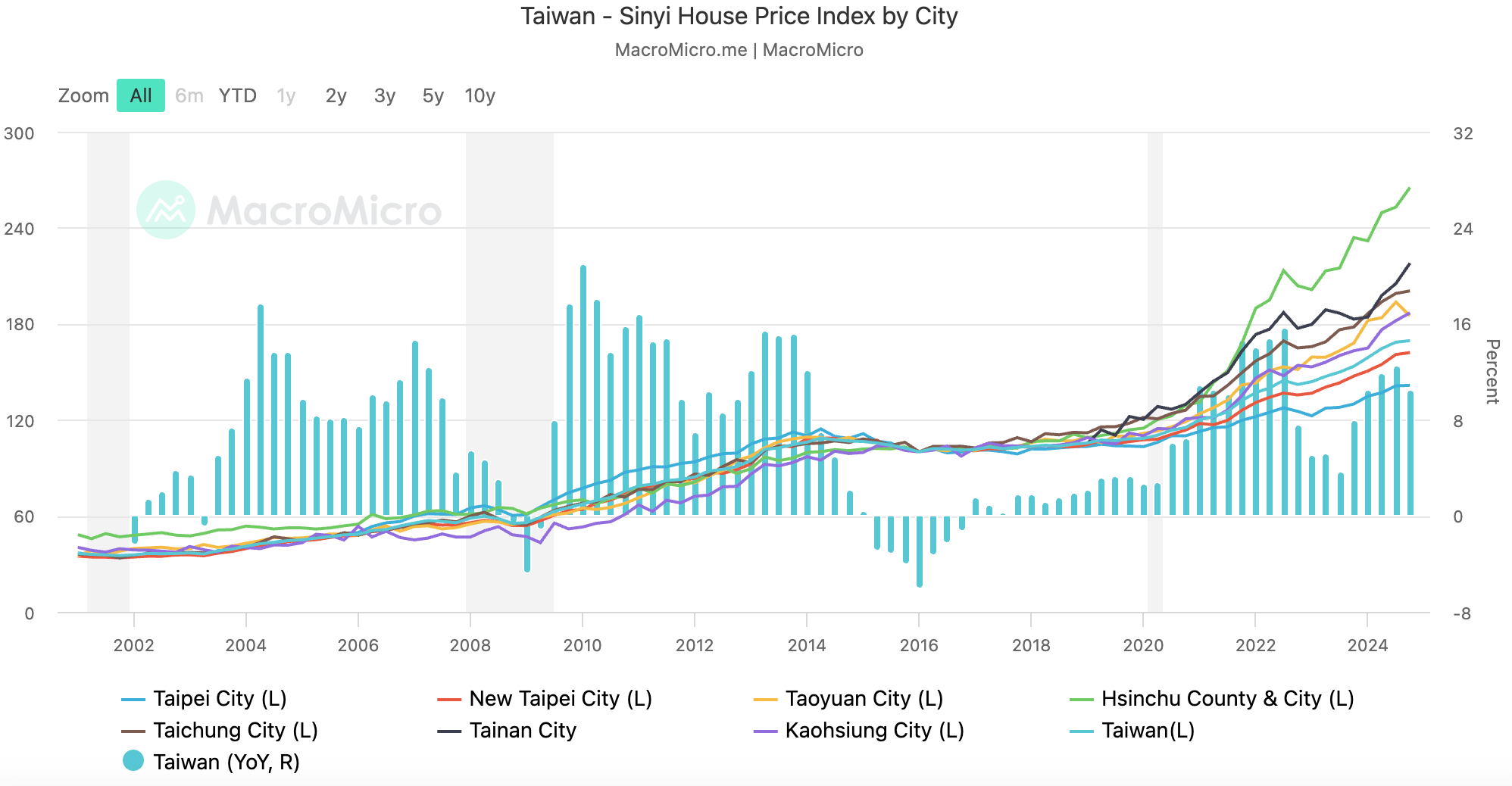

Much of the housing in central Taipei looks dilapidated. Apparently, 70% of the housing units are 30 years or older. The state of Taipei housing is hard to square with the fact that Taiwan’s PPP-adjusted GDP per capita is actually close to US standards. The living standards between the US and Taiwan don’t seem comparable at all, at least not in terms of housing.

One problem seems to be that redevelopment of any apartment block needs the approval of 100% of tenants. When apartments are owned by multiple children or grandchildren of the original owners, it becomes almost impossible to agree on redevelopment, even when it makes financial sense. So while owners may feel secure owning freehold property, the quality of that property might not be much to write home about.

It’s also a fact that Taipei’s residential property prices are incredibly high. According to this website, the price/income ratio is 33x, meaning that it takes 33 years of saving all income to be able to buy a property if you’re single. The gross rental yield in the city center is less than 2%. And prices continue to go up across both Taipei and nearby cities such as Taoyuan and Hsinchu:

One explanation is the influx of Hong Kong people to Taiwan since the national security law was introduced in 2020. Another explanation is that a great deal of wealth has been created from Taiwan’s trade with the United States, as it has skyrocketed in recent years. The average Taiwanese may not have benefitted much from TSMC’s success. But some individuals at the top have, and they may have ploughed their money into residential property.

Great for them. But not so great for the average Taiwanese looking to buy property. Perhaps that’s why Taiwan’s birth rate has dropped to just 0.9. Housing has become unobtainable, making some young Taiwanese postpone marriages and having children. It’s a pity, in my view.

6. The current watch list