Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

I spent the past few days in Manila, the capital of the Philippines.

Since Southeast Asia’s borders opened up in 2022, it’s become easier to travel across the region. Not only am I now able to better understand the companies in my coverage universe. I’m also able to pass on any insights to you.

So here is what I learnt from my short stay in Manila:

I travelled from my home base of Singapore to Manila’s Ninoy Aquino International Airport (NAIA). My first impression was that the airport had seen better days. In the context of modern Asian airports, NAIA offers no more than the bare minimum.

On the positive side, I learnt that the government is now trying to upgrade NAIA, with plans to double its capacity to 61 million passengers annually by 2028. Under the new government, infrastructure is being taken seriously again. The only question is whether airport services provider MacroAsia (MAC PM - US$147 million) - which I’ve written about in the past - will benefit from this upgrade.

Manila is a massive city. It’s home to 13 million people in an urban sprawl that takes hours to traverse. In fact, the city has grown so much that the original Manila is only one of 17 cities that make up the larger area known as “Metro Manila”.

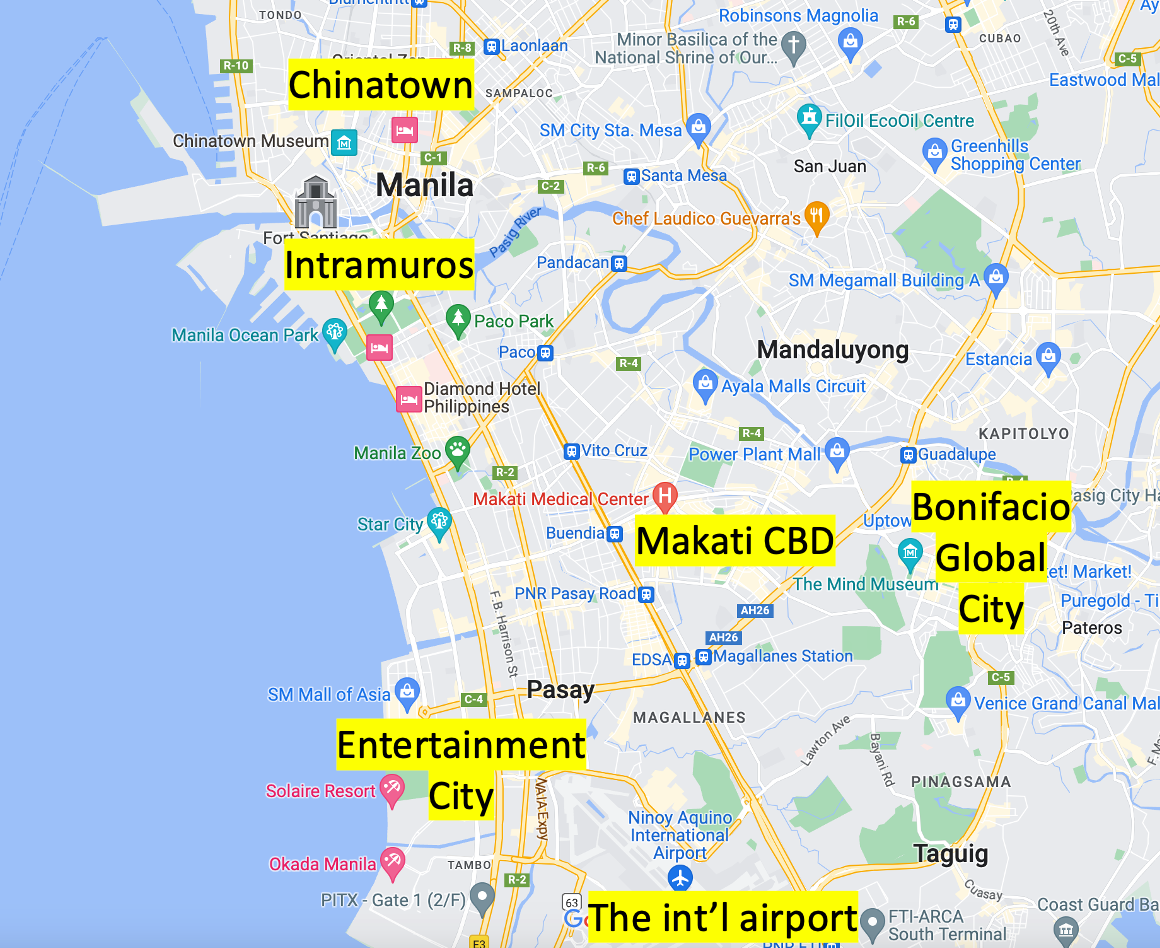

After exiting the airport, we drove to the Makati central business district (“CBD”). Once there, we visited the Ayala Museum, which provided the history of the Philippines from early settlement through colonialism and independence.

The Spanish influence is obvious. The Philippines was a Spanish colony from 1565 to 1898, leaving the country with a population of 80% catholic and a language peppered with words such as “pero” and “puede”. But American influence is also evident. During American rule, the literacy rate rose from just 2% to about 50%. While the Philippines adopted its religion from Spain, its education system was influenced by America.

Walking around in the Makati CBD, I learnt that much of the land we were walking on is owned by the Ayala Corporation (AC PM - US$7.0 billion) through its subsidiary Ayala Land (ALI PM - US$7.6 billion). The Ayala group has also developed a newer business district called Bonifacio Global City (“BGC”). While similar townships can be found in many Southeast Asian cities, these are extraordinary assets. It’s almost as if Manhattan was controlled by a single corporation.

We visited several of Ayala’s shopping malls. They were surprisingly pleasant. And packed with shoppers. The economy is clearly on fire after several years of pandemic restraint. While service staff still wear face masks to protect the guests from COVID-19, ordinary Filipinos have already ditched them.

In one of Ayala’s malls, we saw a machine with the words “GCash”, offering consumers the ability to deposit cash into a mobile wallet. Once the money reaches the wallet, it can be used to pay bills or for payment in most shops. You can think of it as a Filipino version of WeChat Pay. With 70 million users, GCash has become a phenomenon.

So who owns GCash? The Ayala Corporation, through its subsidiary Globe Telecom (GLO PM - US$5.1 billion).

What’s powerful about the GCash app is that half of the population remains unbanked. But with the app, it becomes easier to bring those individuals into the formal banking system. And lend out that capital to productive endeavours.

In Makati, we visited a modern Filipino restaurant. We tried a variety of dishes, from “kare-kare” (peanut stew) and “bangus” (fried milkfish). We later also tried “sisig” (chopped-up pig’s face) and “adobo“ (pork stew). All delicious, with a deep garlicky taste. If Chinese cuisine is characterised by soy sauce and Thai cuisine by chilli, then Filipino food best characterised by the word “garlic”.

We walked by several fast-food restaurants. The most famous might be the Philippine version of McDonald’s - Jollibee (JFC PM - US$5.2 billion). Serving a fare of fried chicken, rice and spaghetti, it’s popular among families. Former chef Anthony Bourdain was famously a fan of Jollibee. And owner Tony Tan Caktiong has a decent reputation in the industry.

In Bonifacio Global City, we visited the local pizza restaurant chain Shakey’s (PIZZA PM - US$291 million), which research provider Smartkarma has discussed in the past. The story is inspiring - a local pizza chain beating Pizza Hut at its own game. The restaurant environment was pleasant and inviting. Perfect for a family outing when parents want to treat their children to something special.

A few blocks away, we stopped by the hypermarket chain “S&R”, owned by grocery retailer Puregold (PGOLD PM - US$1.5 billion). Like America’s Costco, S&R is a membership club where you pay PHP 700 (US$13) per year for shopping there. The items were cheap by Western standards but only sold in bulk sizes. The way shoppers are rewarded with pizza and hot dogs after the checkout counters reminded me of IKEA, which employs a similar strategy. While owner Lucio Co is controversial, his Puregold grocery retail operation has been successful.

A short trip west of Makati, you’ll find the new “Entertainment City” - a stretch of casinos meant to rival China’s Macau. Sitting on flat reclaimed land, it’s a sprawling development that’s far from walkable. Manila’s Entertainment City felt like a big construction site to me.

I was impressed with the Solaire casino, owned by Enrique Razon’s Bloomberry Resorts’ (BLOOM PM - US$2.3 billion). The finishing of the building, the interior design, the artwork - everything was top-notch. In contrast, Universal Entertainment’s (6425 JP - US$1.5 billion) casino Okada Manila looked more run-down, at least from the outside. (Full disclosure: I own shares in Bloomberry Resorts.)

We also visited Manila’s old town and the city's northern parts. The poverty we saw was a stark contrast from the comfort of the Makati CBD.

The reality is that the Philippines remains a poor country. The bottom half of the population earned no more than US$250 per month. And a dozen families control large parts of the economy.

While East Asian countries like Japan, Korea and Taiwan managed to upgrade their economies by exporting manufactured goods, the Philippines never made such a transition. Instead, the Philippines’ largest exports remain its workers: domestic helpers, cover band artists, ship captains, etc.

It’s not hard to understand why. Filipinos are famously service-minded, friendly and hospitable. The Philippines may have one of the most service-oriented cultures in the world.

Unfortunately, services are difficult to export to other countries. While there’s been success in the BPO sector, manufacturing will be needed for a broad-based rise in family incomes. Or greater tourism once the infrastructure improves to at least Thai levels.

Several people I spoke to expressed disappointment about the election of new president Bongbong Marcos (“BBM”) in 2022. He is the son of Ferdinand Marcos, who allegedly stole billions of dollars from state coffers, while his wife Imelda amassed a luxury shoe collection of over 800 pairs. Which I’m sure was only the tip of the iceberg.

The big question on investors’ minds is whether the Philippines is returning to the old Marcos days of authoritarian rule, corruption and human rights abuses.

Worrying signs are starting to emerge. Nikkei reported that Bongbong Marcos’s cousin’s company RYM Business Management has started buying stakes in several important companies. And RYM has also injected capital into the Philippine Veterans Bank, which will enjoy financial firepower to acquire further assets. And there are also plans to set up a sovereign wealth fund, despite the nation’s persistent current account deficit.

And then there’s the risk of rising censorship. RYM Business Management has entered into a new joint venture with ailing broadcaster ABS-CBN (ABS PM - US$62 million) to provide "accurate and balanced news and information to the country". When the president's cousin sets up a major new TV channel, that’s not exactly a recipe for free and independent media.

In Southeast Asia, investors have become conditioned to ignore local politics. Savvy businessmen tend to cultivate relationships with whoever is in charge and do well across political transitions. But if martial law is imposed again - as under Ferdinand Marcos - all bets will be off.

But for now, the rule of law is still intact. And there are many other reasons to be positive. Bongbong Marcos’s government just approved 123 new infrastructure projects. And it’s now allowing full foreign ownership of infrastructure companies. To me, this suggests greater capital formation in the coming years and perhaps the start of a new credit cycle.

I also find it encouraging that the inflation rate is coming down. From 2022 onwards, the Bangko Sentral ng Pilipinas (BSP) has raised interest rates from 2% to 6.25% in just over a year to combat inflation. But now that the inflation problem is in the rearview mirror, I believe that the BSP will soon be able to lower rates and thereby stimulate the economy.

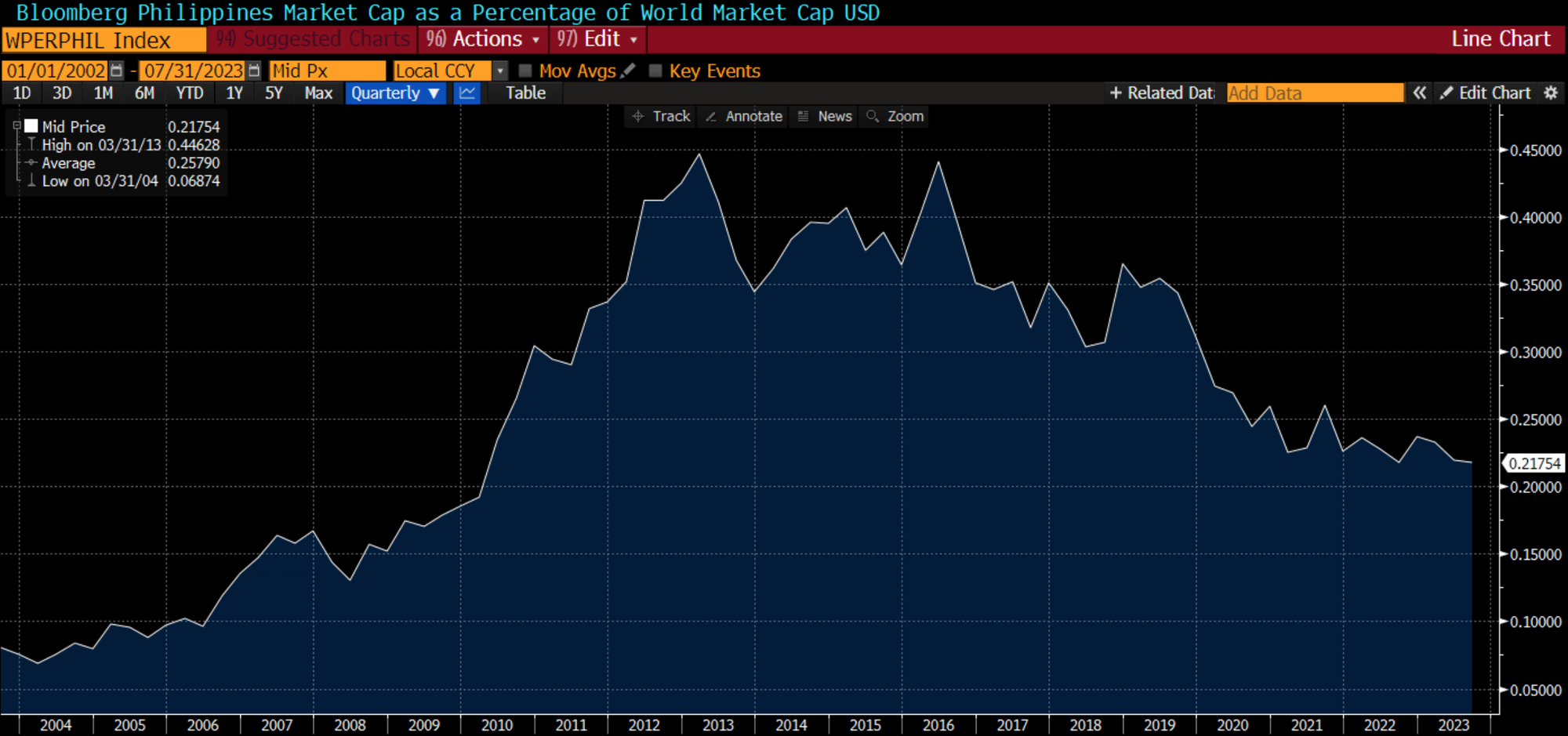

It’s also a fact that investors remain cautious about Philippine equities. The Price/Book ratio of the Philippine Stock Exchange Index (PSEi) is now close to its 2008 lows. And the total market cap of Philippine stocks as a percentage of the world market cap is also close to a 10-year low:

Conclusion

I went to Manila on a personal trip with no company meetings scheduled. But I came away more positive than before, given the rock-bottom valuations and a macroeconomic backdrop that’s likely to become more positive once interest rates come down to reasonable levels.

I’m becoming more careful of who I invest with. While the Ayalas, Razons and Gokongweis have decent reputations, other businessmen may not be as trustworthy.

And then there’s a question of politics. For now, Bongbong Marcos seems relatively hands-off. But whether he’ll eventually go down his father’s path - that remains to be seen.

If you would like to support me and get 20x high-quality deep-dives per year and other thematic reports like this, try out the Asian Century Stocks subscription service - all for the price of a few weekly cappuccinos.