Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Subaru at the time of publishing this article. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares

I discussed Subaru in 2022 back when the Japanese Yen had just started falling against the US Dollar.

Fast-forward to today, and the Japanese Yen is incredibly weak: at just 156 to the dollar. Subaru should in theory benefit from the current exchange rate as much of its revenues are from the United States. Subaru’s car sales has also recovered nicely from the COVID-19 pandemic. Yet its stock price continues to linger at a low level:

What’s going on? Well, in this post, I’ll discuss the reasons why investors continue to be cautious about Subaru. I’ll also provide an outlook for the company. And discuss Subaru’s 5.0x P/E in relation to that outlook.

Table of contents:

1. Quick recap

2. What’s happened since 2022?

2.1. Subaru’s 2023-2024 earnings reports

2.2. New vehicle releases

2.3. A shift in Subaru’s senior leadership

3. What's going to change for Subaru?

3.1. The company’s cautious 2025 guidance

3.2. Positive data from late 2024 onwards

3.3. Subaru’s new electrification plan

3.4. Greater capital returns

4. Valuation

5. Risks

6. Conclusion1. Quick recap

I wrote my first deep-dive on Japanese automaker Subaru Corporation (7270 JP - US$12 billion) in May 2022. Here’s a link to the deck I wrote at the time:

Back then, I made the following points:

Subaru’s brand name is incredibly strong, especially in the US mid-west. Their vehicles are known to be fuel-efficient, safe and reliable vehicles suitable for off-road driving. Subaru’s all-wheel drive and high ground clearance are key differentiating factors.

Subaru has its loyal fans. JD Power’s US auto brand loyalty study in 2021 also placed Subaru at the top (the latest survey: latest survey #2). Subaru also ranked as #1 in the American Customer Satisfaction Index for 2024. Finally, Consumer Reports ranked Subaru as the best overall auto brand in 2022, and it has retained this spot until today.

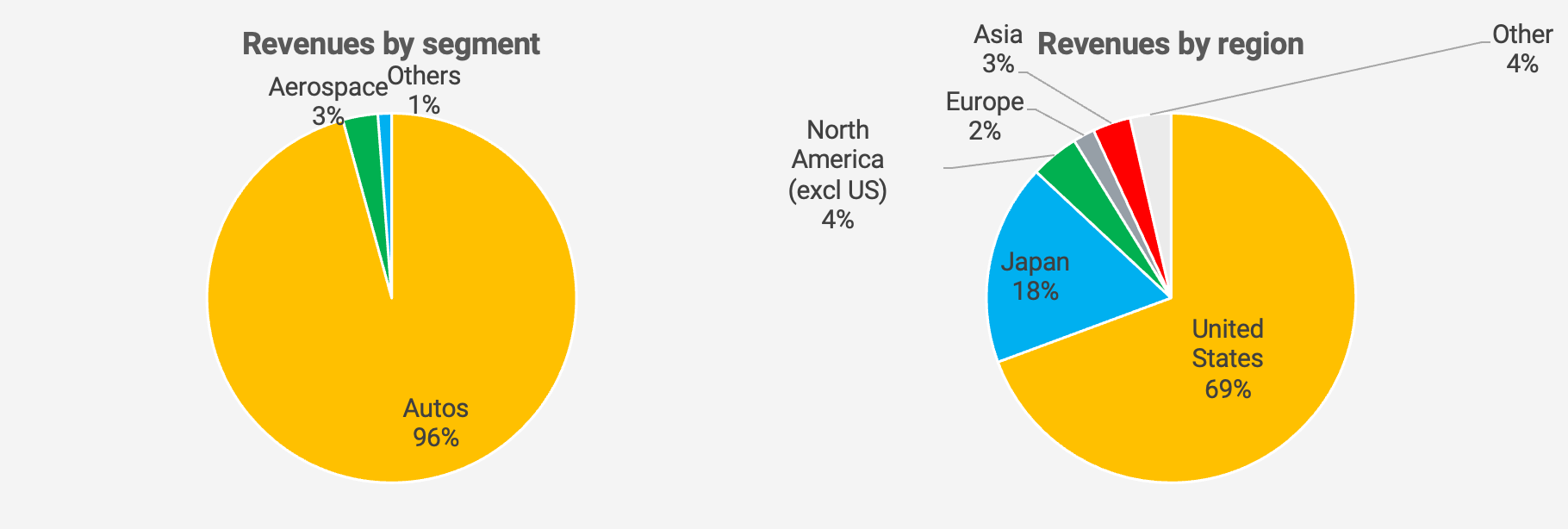

I argued that Subaru’s success from 2013 onwards was partly driven by the weakness in the Japanese yen. Subaru has some of its cost base in Japan, whereas its main revenues are in US Dollars. In other words, Subaru benefits from a weak Japanese Yen compared to the US Dollar.

Between 2016 and 2021, Subaru’s earnings per share dropped gradually. I attributed this drop to a sluggish US auto market, a low utilization rate at Subaru’s new Indian plant as well as production issues during COVID-19. Historically, Subaru had focused on just-in-time manufacturing, but that approach backfired when supply chains were disrupted from 2020 onwards. It made it challenging for Subaru to satisfy customer orders.

When writing the original report, the yen stood at 130 against the US Dollar. I believed that the yen would drop further. I predicted the weak exchange rate would improve Subaru’s competitiveness and boost its gross profit margin.

Meanwhile, the demand for Subaru’s vehicles remained strong. The number of Google search queries for the keyword “Subaru” had been flat since 2019, suggesting continued demand for the product. In addition, Subaru’s discounts remained the lowest in the industry, and the company’s backorders had reached a record high.

I believed that Subaru’s production issues would eventually ease. The shortage of semiconductor chips was already on the verge of easing, with Malaysian chip exports to the United States having started to accelerate from mid-2022 onwards.

With an assumption of a 23% gross profit margin and 1.1 million in sales volume by 2025 with 97% plant utilization, I expected Subaru to trade at 5.4x earnings, well below its 10x historical median.

The risks I foresaw were rising prices for raw materials and potential recalls, which have plagued the Japanese auto industry for years. But neither of these factors seemed particularly serious to me.

2. What’s happened since 2022?

2.1. Subaru’s 2023-2024 earnings reports

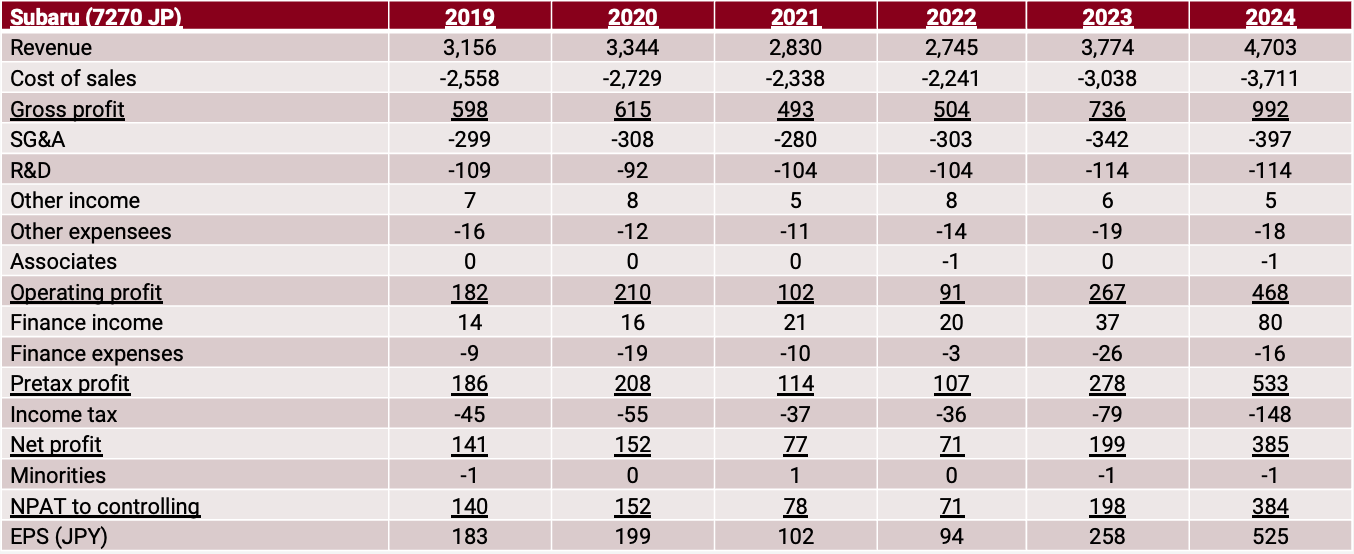

Since 2022, Subaru’s earnings have enjoyed a forceful recovery thanks to strong demand in the United States. Revenues grew almost 50% in yen terms from the 2019 level, many thanks to the weaker currency. Subaru’s earnings per share rose from JPY 183 in FY2019 to JPY 525 in FY2025 thanks to operating leverage.