Disclaimer: This article constitutes the author’s personal views only and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not recommendations to buy or sell stocks.

It’s been a while since my last reader Q&A, so now I continue down the list with a write-up on Sony Corporation (6758 JP).

Executive summary

Sony is in the early stage of the PlayStation 5 console cycle. The gaming console is likely to become a major success. In addition, several other growth drivers such as demand for camera image sensors and content for music and video streaming services are also positive for Sony’s near- to medium-term outlook.

The longer-term outlook for Sony’s music label and Hollywood studio can be questioned as streaming platforms disintermediate the two industries. You can also question some of Sony’s recent acquisitions, including its foray into the Japanese insurance market.

Nevertheless, the outlook for Sony’s earnings is excellent and I see an upside of +23% to a target price of JPY 13,920/share, assuming a 2024 EV/EBIT multiple of 15x.

Full write-up

Sony is a global consumer electronics giant with particular strengths in console gaming, televisions and image sensors.

It also owns movie production studios and record labels.

The stock is up roughly 10x since the bottom in 2013. Over the long run, the return CAGR has been more modest.

Sony’s revenues have been broadly flat over the past 16 years. The company’s operating margin has been rising steadily, however - especially since 2018. This margins expansion has been driven by the digitalisation of games for the Sony PlayStation console.

The company was founded as “Tokyo Telecommunications Engineering Corporation” right after World War II by senior engineer Masaru Ibuka and a young brash entrepreneur called Akio Morita. It later changed its name to “Sony” so that the company’s products would become more marketable overseas.

Some compare the relationship between Ibuka and Morita with the one between Steve Wozniak and Steve Jobs. Ibuka was a senior engineer and technically proficient. Akio Morita on the other hand was also a design and marketing genius.

One of Sony’s initial products was Japan’s first tape recorder, inspired by an American tape recorder Morita had seen used by US occupation forces in Japan.

Sony moved on to producing portable transistor radios, many for overseas markets. It became a major seller of televisions in the 1960s. In 1979, Akio Morita came up with the Sony Walkman, which became the first portable cassette player and enjoyed great success worldwide with over 400 million devices sold. A Sony camera was introduced in 1988.

In the 1980s, Sony entered into movie and record production via the acquisitions of CBS Records in 1988 and Columbia Pictures in 1989.

In the early 1990s, Akio Morita also oversaw the creation of the Sony PlayStation gaming console, which became another hit product.

CEO Howard Stringer helped Sony reinvigorate Sony’s movie business from 2005 onwards but let other parts of the business stagnate.

Since new CEO Kazuo Hirai took over in 2012, Sony has become a more focused and profitable company. It sold off its Vaio PC division in 2014. It sold its stake in the game developer Square Enix. In 2015, Sony purchased Toshiba’s image sensor business which has now become a cornerstone of the company. In 2017, it sold its lithium-ion battery business. It has now become a significantly stronger business.

Today, Sony’s key consumer electronics products include the PlayStation 5 gaming console, Sony BRAVIA television sets, Sony digital cameras and wireless headphones. But it also produces movies and music as well as image sensors for smartphones.

Sony’s largest segments include games & the Sony PlayStation network (close to 30%), followed by electronics (21%), financial services at 18%, image sensors at 11%, music at 10% and pictures at 8%.

Here are quick descriptions of each of the main segments:

Games: Sells PlayStation hardware game consoles, games and network services

Electronics: Televisions, speakers, cameras, medical equipment, etc.

Pictures: The fifth-largest Hollywood studio, with franchises such as Men in Black, Charlie’s Angels, Jumanji and Spider-man.

Music: Production and ownership of a music library that Sony gets royalties from, including from artists such as Queen, the Rolling Stones, Taylor Swift and Lady Gaga

Image sensors: The world’s largest image sensors (“CMOS”) manufacturer, with products that help smartphones capture photos

Financial services: Life and P&C insurance plus Internet banking via Sony Bank

Other: Disc manufacturing, recording media and storage media

When asked about the key drivers of the business, Sony’s management team mentions three: the PlayStation 5, content and image sensors.

I will now go through the main bullish and main bearish arguments for Sony and then wrap up with an earnings trajectory and how the stock is likely to be valued in case this scenario plays out as expected.

1. New CEO Kenichiro Yoshida is focused on the bottom-line

Sony’s previous CEO Kazuo Hirai initiated a process in 2012 where the focus was shifted from market share to profitability. His right-hand man Kenichiro Yoshida worked as CFO during this difficult period and helped bring financial discipline to the company after years of losses.

A number of these initiatives included:

A laser-focus on profitability

A reduction of costs (1/3 of staff were let go)

Exiting the loss-making battery manufacturing, camera module and PC segments

Reining in the company’s loss-making smartphone segment

Moving production to Southeast Asia, where labour costs are lower

Focusing on higher-margin premium TVs and exiting the mass-market TV segment

Yoshida has now become the CEO of the entire group and he continues the strategy that Hirai initiated. Jefferies analyst Atul Goyal described Yoshida the following way:

"Yoshida is very soft-spoken, but in person, you can see that he possesses a fierce intelligence and a clever political mind needed to navigate a large organization like Sony."

While innovation within Sony stagnated after Akio Morita passed away in 1999, Kenichiro Yoshida is now putting a greater emphasis on it. New projects include a robotic leg prosthesis, AI-assisted music composition software, 360-degree audio headphones, cameras that mimic the human eye and many other innovations. While it remains to be seen whether Sony can become innovative again, the chances are probably higher today than under 2005-2012 CEO Howard Stringer’s tenure.

2. Demand for Sony PlayStation 5 is off-the-charts

One of Sony’s flagship products is the PlayStation 5, a gaming console for serious gamers. The digital edition of the console has an MSRP of US$399. Games cost an additional US$60 each.

The PlayStation 5 launch in November 2020 was initially successful:

"PlayStation 5 achieved the highest launch month unit and dollar sales for a video game hardware platform in U.S. history. The records were previously held by the PlayStation 4, which debuted in November 2013."

On the day of the launch, customers lined up outside GameStop stores to get a hold of the console.

Reviews of the new console were generally positive. For example, Bloomberg said that:

“The most impressive thing about Sony Corp.’s PlayStation 5 isn’t the alien-like design or the powerful machinery inside. It’s the controller, which adds an entirely new dimension to the experience of playing video games.”

New search queries for both PlayStation 5 and Xbox Series X shot up to similar levels as Nintendo Switch before dropping to a level roughly half that of the Nintendo Switch.

Anecdotal evidence seems to suggest that PlayStation “owns” the console category in the minds of consumers. Many seem to think that PlayStation 5 is a better option than Microsoft Xbox’s new Series X console.

However, despite strong demand, supply chain issues for the PlayStation 5 has limited the opportunities for the consoles to reach consumers. The main problem seems to be a lack of semiconductor chips for the console. PlayStation 5 shipments reached 7.8 million in the first six months of release, surpassing the 7.6 million units that the PlayStation 4 shipped in the same time period. But the numbers would have been far higher were it not for said supply chain issues.

The price for the PlayStation 5 Digital Edition consoles on Amazon is currently US$830, compared to the MSRP of US$399. In other words, consumers are clamouring for new devices and the demand is nowhere near satiated yet.

Other than supply chain issues, many of the newly launched games for the PlayStation 5 are also available on the PlayStation 4. So consumers may not feel a need to upgrade right away. But it’s clear that PlayStation 5 will end up as the long-term winner. Expect strong sales numbers to continue.

3. Higher software and service penetration in gaming

Sony PlayStation Network currently has 46 million subscribers, a number that has been rising over the past eight years.

The PlayStation Plus service is an add-on subscription, providing subscribers early access to games and exclusive content. The PS Plus membership is also used to access online multiplayer capabilities on the PlayStation Network. The cost of PS Plus is currently US$60/year, which compares favourably to say Netflix and Amazon Prime. US$60 times 50 million implies another US$3 billion or JPY 330 billion in profits.

Meanwhile, the % of games sold online is now around 70%. That suggests that Sony will experience significantly higher mid-cycle margins during the PlayStation 5 console cycle than it did during that of PlayStation 4.

PlayStation 4 was released at the end of 2013, but the combined number of hardware units sold did not peak until 3 years later in 2016. The same pattern has been observed for Sony’s previous consoles PlayStation 1-3. So expect the ramp-up period for PlayStation 5 to be drawn out as well, not peaking until 2024-25.

Sony’s 2020 console sales were 14 million compared to 20 million at the 2016 peak. It would take a 50% rise in console hardware units sold to reach prior records.

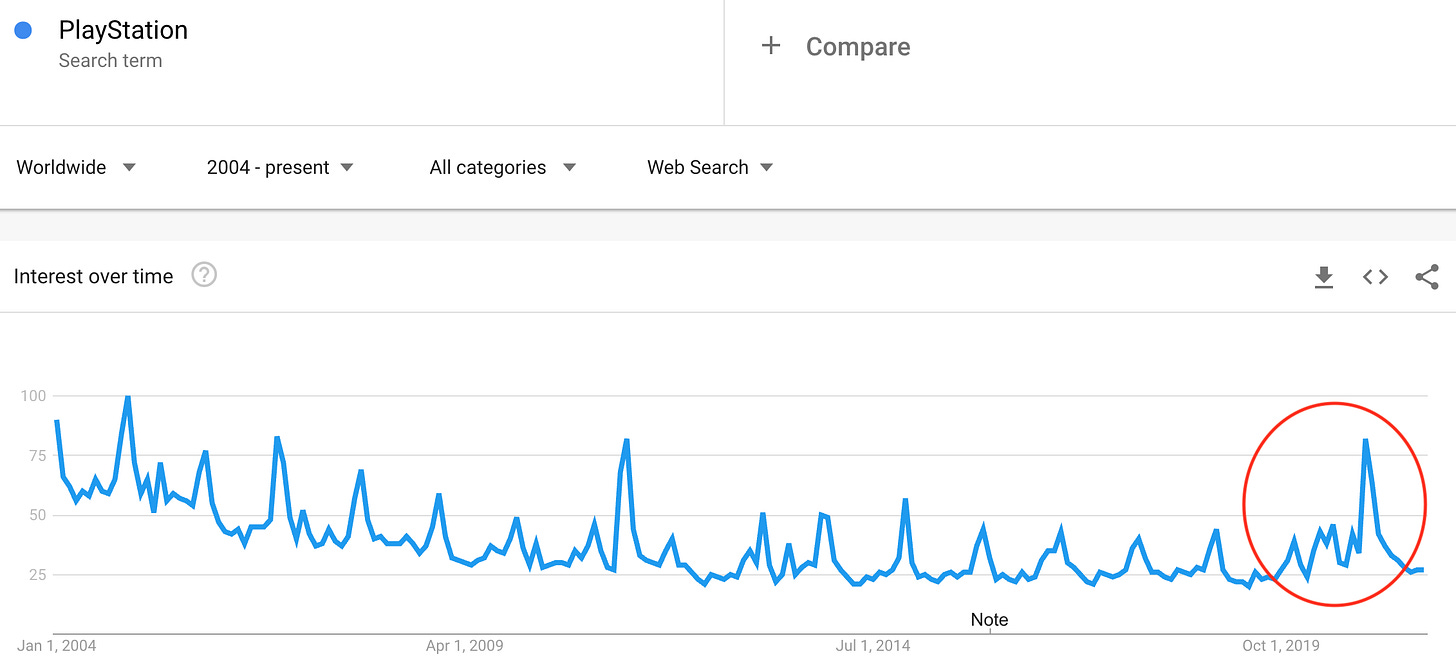

Will Sony’s PlayStation console hardware sales recover to its 2016 peak? I believe so, given the upwards movement in Google search query interest since the launch of PlayStation 5:

On the software side, the peak for PlayStation 4 came in 2018, after a full five years of ramp-up. Clearly, PlayStation 5 software sales are going to be a tailwind for years to come. That said, the 2020 numbers were artificially boosted by the pandemic by about 10-15%, due to the fact many consumers stayed at home.

Even though the number of games sold per year is not materially higher than in the past few cycles, note that the proportion of digital games is significantly higher today.

Here is how Sony’s gross profit benefitted from the shift from physical to digital games:

First-party physical: US$24 → First-party digital: US$39

Third-party physical: US$5 → Third-party digital: US$10

Given that 17% of games sold are first-party games, the transition to digital games brings in an extra US$7 in gross profit per game. This is equivalent to JPY 220 billion assuming 300 million games sold per year.

The positive effect on Sony’s gaming segment’s operating margin has been dramatically positive. This is a secular shift that will continue into the PS5 console cycle with mid-teens margins being the new normal.

4. New hit content from Sony’s game development pipeline

After many acquisitions throughout the years, Sony has amassed a portfolio of game development studios under the name of “Sony Interactive Entertainment” (SIE).

Key gaming franchises include:

Polyphony Digital’s Gran Turismo racing games

Naughty Dog’s “The Last of Us” and “Uncharted” series

Insomniac Games’ “Spider-Man”

Santa Monica Studio’s “God of War”

A number of new internally developed PlayStation games will be released in 2022:

Spider-Man: Miles Morales sold 4.1 million units in 2020 and is expected to continue to perform

The God of War sequel ranked as the most-wanted game award in the gaming industry's Golden Joystick Awards in 2020

Horizon Forbidden West’s predecessor Horizon Zero Dawn was one of the best-selling games for PS4 with over 10 million copies sold

Gran Turismo 7, belonging to one of Sony's highest-selling game franchises and exclusive to PS consoles, will be launched later in 2021

In addition, a number of third-party games are also in the pipeline:

The sequel of Square Enix's Final Fantasy was released in April 2021

Additional Electronic Arts' professional sports titles will be released following the success of Madden NFL

The latest gossip is that Rockstar North's highly anticipated Grand Theft Auto 6 will be released in 2025. When it is released, expect a significant bump in sales for the PlayStation 5.

5. Secular growth in image sensor demand

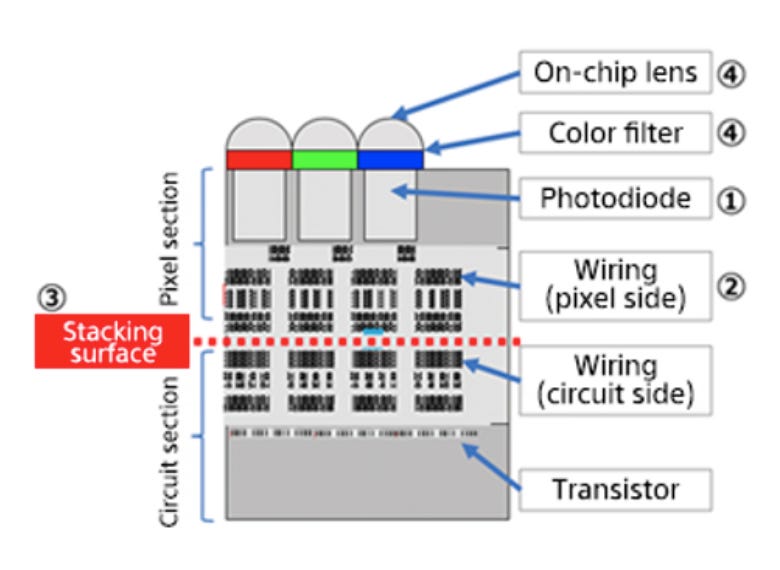

Image sensors in digital cameras convert “analogue” light into digital data that the devices can interpret. Sony’s image sensors are semiconductor chips using the “CMOS” technology (Complementary Metal Oxide Semiconductor). There are two parts of the image sensors: the “pixel section” where light is converted into data - the part where Sony excels. The other “circuit section” where pixel data is crunched is outsourced to third parties and then assembled together by Sony.

The key driver of the image sensor business is the growth in the number of cameras we use in our daily lives. Smartphones used to have one or two cameras - today they are more likely to have two or three. Sony has close to a 50% market share in smartphone camera image sensors and is the main supplier for Apple’s iPhone.

Advanced driver-assistance systems (ADAS) and autonomous driving might significantly increase the demand for cameras that interpret our surroundings. Tesla’s Model S has 8 image sensors and future vehicles are likely to have significantly more. Sony has a market share of 9% of the automotive CMOS market.

In the near term, Sony targets FY2022 operating profit of JPY 140 billion for its image sensor segment. This is despite the headwinds of Sony losing Huawei as its second-biggest image sensor customer. But expect growth to resume from FY2023 onwards.

6. Selling picks & shovels for the content creation industry

Sony sells cameras to both photographers as well as content creators. The number of YouTube channels is growing rapidly at over 20% per year. These content creators need professional equipment, and good cameras are a prerequisite to participate in the content creation game.

Sony’s camera franchise is unique in that it controls the market for mirrorless cameras, which have better auto-focus technology in videos. Such cameras are not pure commodities since each consumer typically purchases multiple lenses that are not compatible between the manufacturers.

While both Canon and Sony cameras are both popular among content creators, Sony leads in the mirrorless camera segment.

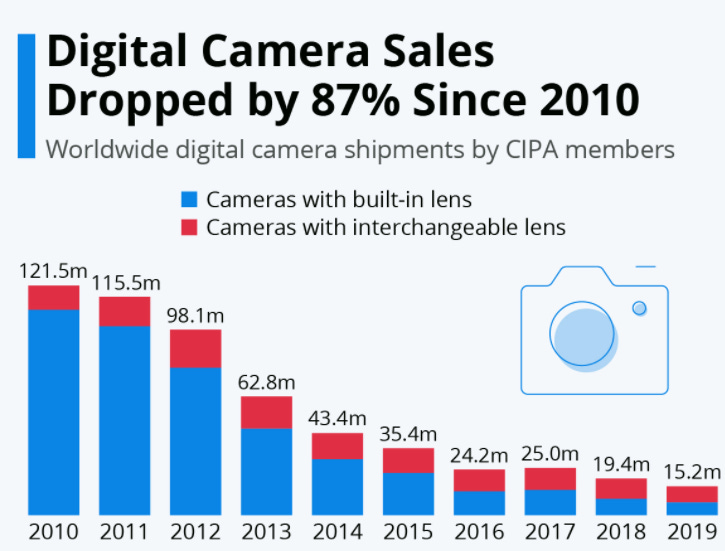

While the overall DSLR market has shrunk over the past few years, the market for mirrorless cameras is rising in the single digits.

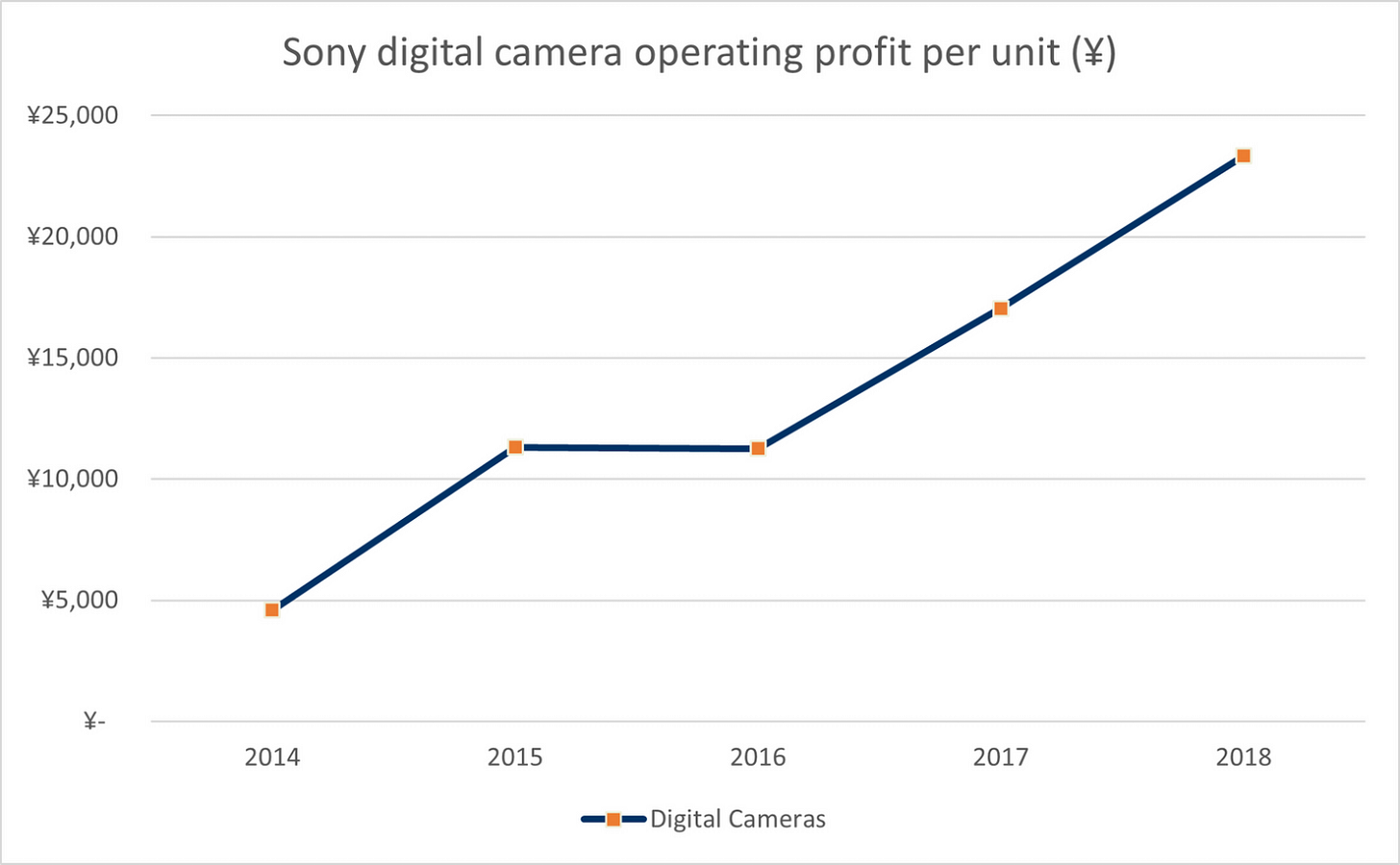

The content creation boom for YouTube, TikTok may explain Sony’s improved profitability of its digital camera segment:

1. Technology has disintermediated the need for record labels and movie studios

Digital service providers such as Spotify have partially disintermediated the music publishing and recording industry.

Music labels have traditionally helped artists record, promote and distribute music via physical media. Today, artists can publish their recorded music effortlessly via smaller distributors working with the likes of Spotify.

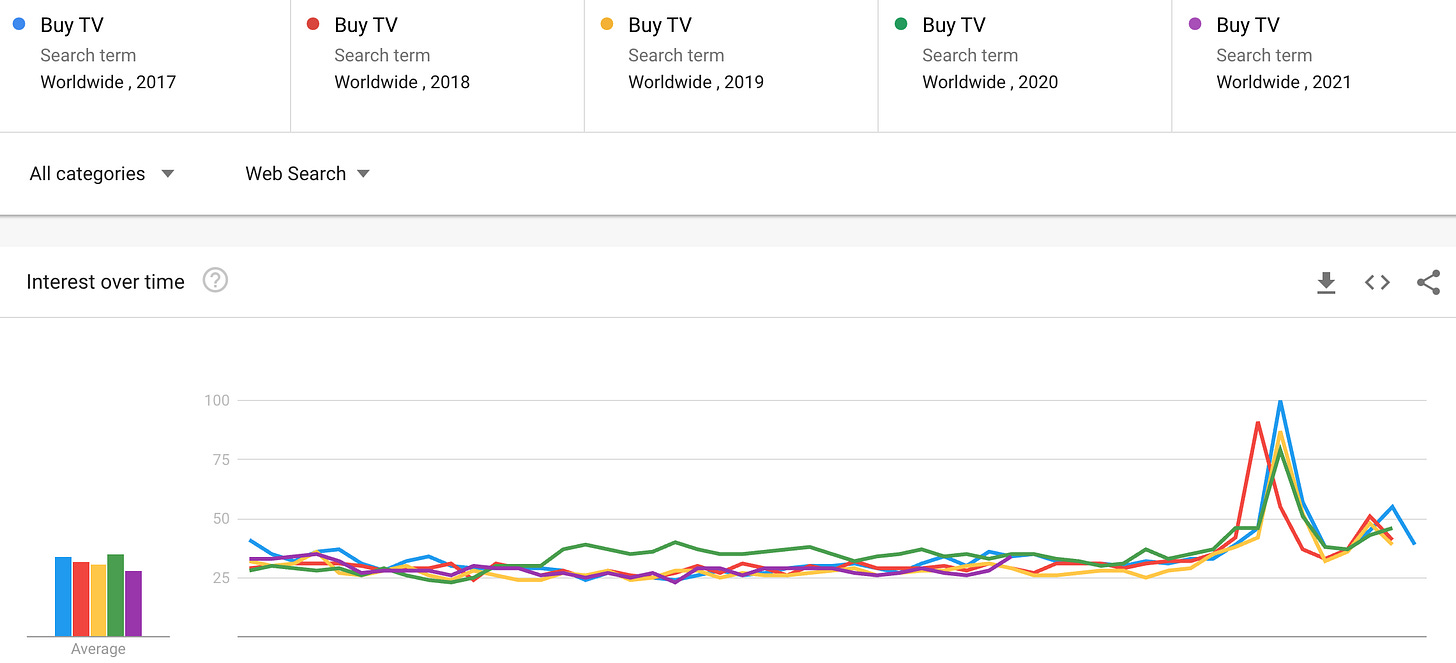

It’s clear that the major record companies are losing share of the % of music streams on Spotify and other digital service providers:

The gatekeepers of today are the digital service providers, whereas the major music labels have significantly less bargaining power.

That said, streaming services have helped grow the overall pie. So in the short-term, expect music labels to enjoy higher revenues and profits as well.

There’s a similar long-term challenge for Sony’s movie studio subsidiary “Sony Pictures”. By virtue of its size, Sony Pictures used to control distribution to both theatres and the networks. Today, the likes of Netflix and Disney control movie and TV series distribution. And with the number of options available to consumers on streaming platforms skyrocketing, Sony’s relative bargaining power has diminished.

Sony Pictures has itself avoided going direct-to-consumer. Whereas Paramount and Disney have started their own streaming services, Sony sells its movies to all of them.

The upside of Sony’s strategy of becoming a supplier to the industry is that a lack of ties to any platform helps it get the best prices for its movies and TV shows. The downside is losing out on subscription revenue. As you can probably tell, Sony is in effect betting on irrational spending in the streaming industry and therefore want to sell into it.

That’s fine in the short term. But over the long run, it is likely that Sony’s competitive advantage as a Hollywood movie producer will be diminished in this new era of streaming. Larger competitors such as Disney - which has consolidated the movie industry over the past few years and launched a streaming subscription service - is better positioned for the future.

To Sony’s credit, they have purchased the US anime-streaming service Crunchyroll. But this brand is associated with anime and may not be a good fit for Sony’s other non-anime content libraries.

In terms of financials, Sony’s music and pictures segments are actually doing fine. Prices for music and picture content has been bid up by the streaming platforms leading to higher profits for those companies who sit on libraries of content. It’s just a question of how long the party will last.

2. Korean / Chinese competition within electronics

The truth is that Korean brands have been doing inroads into Sony’s consumer electronics franchise for decades. Now, Chinese brands are increasingly posing a threat to both Korean and Japanese.

Sony’s consumer electronics revenue across televisions, smartphones, audio products has been weakening over time.

Many of these hardware products are near-commodities and there is no doubt that Chinese and Korean brands are both aggressive and willing to cut prices far below what Sony is willing to accept.

Within smartphones, key Chinese brands such as Huawei, Xiaomi, Oppo and Vivo are starting to dominate the market, together with Korea’s Samsung.

Within televisions, TCL’s Roku-enabled television sets have become popular in the low-end segment overseas. Among high-end OLED television sets, LG has now become the top-of-the-line choice of many consumers.

Japanese brands still dominate the camera segment. That said, DSLRs are arguably a dying market. Only the brands catering to content creators are doing well (including Sony, arguably).

3. A post-pandemic lull in demand for games / TVs

Alexa’s traffic rank for the website sony.com improved significantly during the pandemic and has then deteriorated since January 2021.

The demand for Sony’s console games and television sets most likely rose during the pandemic and is likely to weaken in a recovery scenario. Expect ~JPY 50 billion in lost operating profit television sales and a 10-15% drop in console game sales volumes as consumption patterns normalise following the pandemic.

On the other hand, PlayStation 5 has just been released and is leading a new console cycle. And the movie segment lost almost JPY 200 billion in revenues due to the closure of cinemas around the world. As the world recovers from COVID-19, expect such revenues to recover.

4. Sometimes questionable capital allocation

Sony’s shares outstanding has almost doubled since the 1990s, despite flat revenues. In 2015, the company raised JPY 350 billion in an equity raise, even though the company had a net cash position.

While the PlayStation business has now become a cash cow, Sony’s other businesses have previously kept the company’s ROE below 10%. They’ve had a strong brand name - they just were not able to monetise it.

It’s a mystery to me why Sony runs an insurance company. Not only that, it committed additional capital to it in 2020 when it acquired the remaining 35% of Sony Financial it did not already own. At the time, Yoshida argued that Sony Financial:

"Our financial business has a value chain that starts and ends within Japan… With heightening geopolitical risks, we thought it would be best to make this move. We also believe it will lead to long-term improvement of corporate value."

Insurance is a separate business with few synergies with Sony’s consumer electronics franchise. Citing geopolitical risks as a reason for the acquisition seems odd to me.

Acquiring EMI in 2018 at a total valuation of US$4.8 billion seems questionable to me as well, since the company only made US$160 million in operating profit the previous year. Perhaps demand for streaming of music will increase the value of EMI’s content library far in excess of the purchase price.

While Yoshida has done wonders in terms of monetising the PlayStation console, some of the company’s acquisitions seem odd to me. I would prefer if the company reinvested in organic growth opportunities that take advantage of Sony’s strong brand name.

The bull case for Sony is that the new CEO comes from a CFO background and has a laser-focus on the bottom line. The company is in the early stage of the PlayStation 5 console cycle, which is likely going to become the dominating console for years to come. The image sensor business continues to grow steadily driven by the demand for cameras in smartphones and potentially also vehicles.

The bear case is that Sony’s music label and Hollywood studio are losing out as technology disintermediate distribution of music and picture content. That said, even I acknowledge that Sony’s music and picture businesses are firing on all cylinders, with their content being bid up by increasingly popular streaming services. You can also question some of Sony’s recent acquisitions, including its bet on its insurance subsidiary.

Over the past 10 years, Sony has traded at a median P/E of 14.6x and a median EV/EBIT of 12.2x. That happens to be exactly where Sony is trading now as well.

But the peer group is trading at significantly higher multiples - closer to 20x EV/EBIT based on median peer group trading multiples adjusted for Sony’s relative segment contribution.

Here are a few comments on the earnings potential of each key segment:

Games: Game segment margins are likely to continue to go up thanks to higher PS Plus subscription penetration and greater digital sales, closer to 14%. While software sales will be somewhat hit by any end to the pandemic, PlayStation 5 ramp-up will outweigh that negative factor.

Electronics: DSLR and TV demand will weaken somewhat following the end of the pandemic, but smartphones losses are likely to narrow and content creator demand for mirrorless cameras will grow 20%+

Pictures: A recovery in theatre demand for movies plus a continued steady increase in the value of the library as the streaming wars continue short-term

Music: Streaming sales are pushing up the value of Sony’s content library. Live events are likely to recover post-COVID.

Image sensors: The image sensor business has been growing in the low-teens in quite a steady fashion, save for the loss of Huawei as a customer which will hurt FY2022. I predict +13% sales CAGR thereafter.

Finance: A decline in auto insurance loss rates could help profitability somewhat, but I expect zero growth in the segment.

With those assumptions, here is a rudimentary forecast of Sony’s future operating profit.

Applying an EV/EBIT of 15x yields a target price of JPY 13,920 with an upside of +23%.

It’s difficult to say what the right multiple should be - and whether Sony is ultimately undervalued. All I can say is that Sony’s tailwinds are highly positive with the PlayStation 5 ramping up over the next few years, image sensor demand keeping on growing and music label and picture revenues benefitting from streaming in the short-term as well.

In light of this backdrop, I expect Sony’s share price to continue to do well as the PlayStation 5 console cycle starts to become priced-in.

Further reading

Founders Podcast on Akio Morita and the founding of Sony ($)

Third Point Management: Sony activist campaign 2019

Drawbridge Research on Sony’s image sensor and camera businesses

Sleepwell Capital: introduction to the music publishing and recording industry

Thanks for reading!

Sign up for over 20 deep-dive reports on Asian stocks per year and full disclosure of my personal portfolio.

Terrific write up.. Sony seems to have a great future ahead and is a stock that has big potential.

Nice write-up. AAA games will retail at 69.99 for this new generation 9f consoles - a nice 16% increase over the 60 referenved in this article. Sony's decision to stay out of the streaming wars keeps me very long sony as Sonys current equity combined with its next 7-8 years of earnings will surpass sony's market cap. It will take Disney about 23 years of earnings to pull off that same feat of equity + earnings > current market cap (and that is when using disney recent peak earnings year of 2019.)

Very very long sony.