Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I hold a position in Sony when publishing this article. Note that this is a disclosure and not a recommendation to buy or sell.

Summary

- I’ve written about Japanese entertainment conglomerate Sony in the past, most recently in 2022 when I did a deep-dive on the stock. You can find that report here.

- It’s a high-quality business. The PlayStation 5 console dominates its market, and Sony is strong across its record labels, Hollywood movie studios and image sensor segments. Sony’s consumer electronics products face competition, but management is dealing with this threat proactively.

- Since I last wrote about Sony, the stock price has gone sideways. Revenues have grown strongly, at least in yen terms, but there have been losses in the sales of PlayStation 5 hardware consoles due to their bulky nature and the strength of the US Dollar.

- Sony’s management team has just said that it expects the sales of its PlayStation 5 hardware consoles to peak. That’s fundamentally positive for earnings growth. We’ll now see the sales of high-margin software titles take over the mantle thanks to a much larger installed base of PlayStation 5 consoles than in the past.

- I also expect the market to be positively surprised by the success of Helldivers 2, which was primarily financed by Sony and released on 8 February this year.

Table of contents:

1. Quick recap

2. Update since my first write-up

2.1. Last few years financials

2.2. A management reshuffle

2.3. The weakening of the Japanese yen

2.4. New PlayStation Plus tiers

2.5. The fight for game exclusivity

2.6. The larger iPhone 15 image sensor

2.7. The Zee merger termination

2.8. Spin-off of financial services

3. What will change for Sony?

3.1. PlayStation 5 sales

3.2. New games in the pipeline

4. Valuation multiples

5. Conclusion1. Quick recap

I’ve written about Japanese entertainment conglomerate Sony two times in the past. The first time I was trying to answer a reader's question about Sony. My conclusion was that the Sony PlayStation 5 was early on in its console cycle and that earnings per share typically goes up through such cycles.

I then dug deeper with my June 2022 post on Sony (6758 JP - US$106 billion). You can find that full report here:

Here’s a summary of the report:

Sony is a Japanese entertainment conglomerate with six separate businesses:

Video games: Driven by the Playstation 5 video game console with its associated game app store. However, Sony also owns game developers and publishes games on behalf of others.

Music publishing: Sony has a huge library of recorded music and copyrights and is one of the three dominating companies globally, along with Warner Music and Universal Music. It grows in the high single digits, driven by demand from streaming platforms like Spotify.

Film production: Sony owns Columbia Pictures. It had some tough years in the 2010s but rebounded strongly after the 2017 hire of Anthony Vinciquerra, who has almost single-handedly turned it into one of the most successful Hollywood studios. It also benefits from the demand for online streaming services like Netflix.

Smartphone image sensors: Around 50% market share in the market for smartphone image sensors, which convert light into images through image processing chips. Sony is the sole supplier of image sensors to Apple’s iPhone product, showcasing its capabilities.

Consumer electronics: Sony also sells cameras, TVs, smartphones and other consumer electronics. This is a segment with high competition and stagnating demand as “software is eating the world”, in Marc Andreessen’s words.

Financial services: Sony runs Japan’s first-ever online-only bank and a life insurance business. It’s done well but will most likely be spun off at some point.

Sony’s music, film, and image sensor businesses had grown around the 10% mark. The consumer electronics business has faced losses for many years due to these issues, including competition from smartphones. My conclusion was the same as in my first post: the real driver of Sony’s earnings had been its video gaming business.

The PlayStation 5 was released in late 2020 and has held much promise. but in its first 1-2 years, it faced significant production issues due to shortages of semiconductor chips. When I wrote about Sony in 2022, I saw those chip shortages easing. I predicted that the sales of Sony’s PlayStation 5 consoles would potentially double. It also looked like PlayStation 5 was winning the console war against Microsoft’s Xbox X/S. And I thought it was early in its console cycle. With each console buyer typically buying 8-10 games each, I conjectured that we would see a spike in Sony’s earnings over the next few years.

Back in 2022, Sony’s former CFO, Kenichiro Yoshida, had just taken over as CEO after Kazuo Hirai. I felt positive about Yoshida because he was a numbers guy and led several reforms, including a system with detailed KPI for staff remuneration.

I forecasted a 2026e P/E of 11x, a decent discount to the global peer group’s 16x and Sony’s historical average P/E multiple of 16x.

The biggest risk, as I saw it, was that Microsoft would aggressively be courting users, lowering prices for games and game subscription services and making more of its games exclusive to Xbox. I also wondered whether some of the revenues from streaming services like Spotify and Netflix came from venture capital funding and whether such funding would disappear someday. However, the data suggested that most segments were doing well and that PlayStation 5 was winning the console war.

2. Update since my first write-up

Sony’s share price has been flat since 2022, with a drop in between, despite the weakening of the Japanese yen and a rallying Japanese stock market.

This surprised me, even though I’m aware that the starting valuation wasn’t necessarily low. Part of the enthusiasm for the PlayStation 5 was probably priced in. And what we saw after the COVID-19 pandemic was a decrease in user engagement as people played fewer games.

However, another factor weighed on Sony’s earnings, and I’ll discuss that in greater detail below.

2.1. Last few years financials

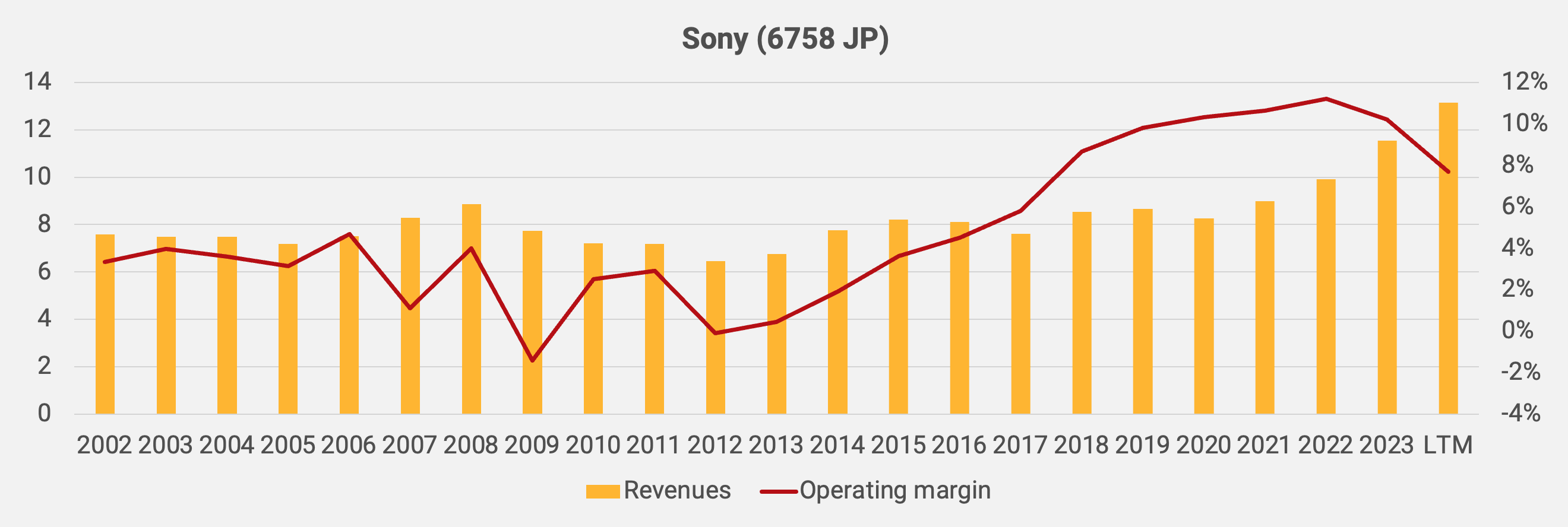

Let’s look at Sony’s financials. Since June 2022, revenues have grown strongly, but we’ve seen margin pressure, with the operating margin going from 11% to below 8% more recently:

On the revenue side, the main driver was the PlayStation 5 console's sales exceeding expectations. Revenues in the music and pictures segment were steady around the 10% per year mark. The weakening of the Japanese Yen from 2022 onwards also significantly benefited overall revenues.