Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

Table of contents

1. Portfolio update

2. Update on my key holdings

3. My plans going forwardPortfolio update

Asian equities have been on a run recently. Singapore has rallied on the back of chatter about a new program designed to revive interest in local stocks. South Korean equities have also rallied, partly thanks to a July 2025 law that requires company directors to look after the interests of all shareholders, including minorities.

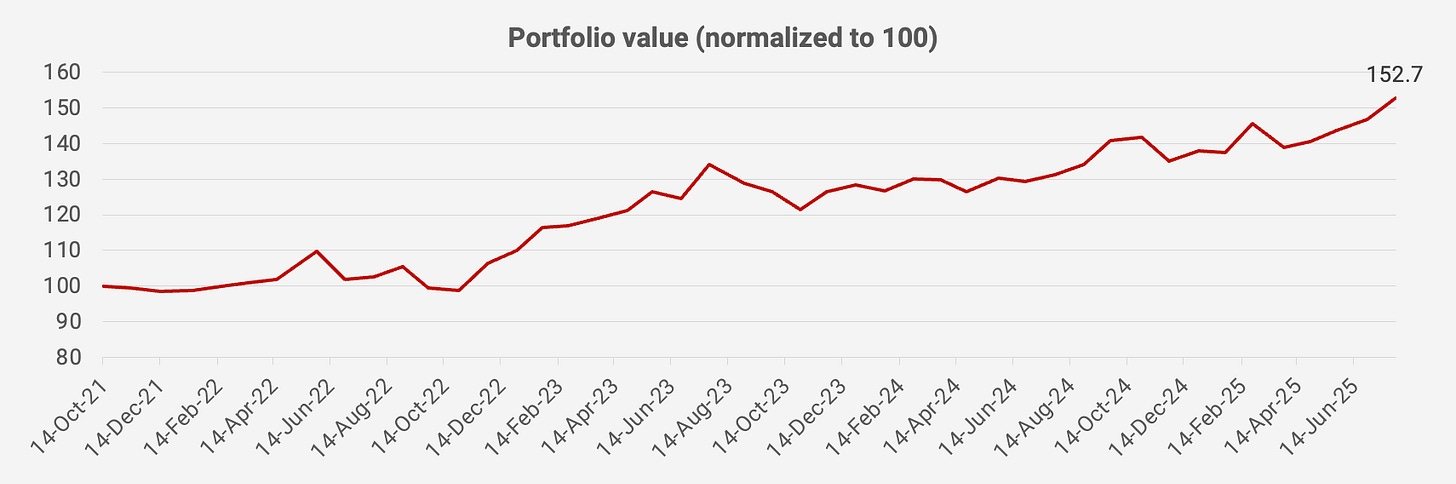

The broad market rally pushed up the value of the portfolio by another +4.1% month-on-month. Since the portfolio’s inception in October 2021, the value has increased by +52.7%, equivalent to an +11.8% compound annual growth rate:

When it comes to individual stocks, the share price of Japanese SaaS company Poper has come off by 25% from the peak. Roughly 1/3 of the free float has changed hands since the peak. Investors might be concerned about management’s guidance of a sequential decline in earnings due to “strategic investments”. But nothing significant has really changed, and last quarter's revenues grew at a whopping +45% rate on a year-on-year basis.

The border conflict between Thailand and Cambodia is getting worse. While there is a short-term truce right now, we’re finally seeing the risk of an outright war in Southeast Asia for the first time in many decades. I am not particularly worried about my single Thai holding Major Cineplex, however. It only has 4% of its screens in Cambodia, and I don’t expect the conflict to spread to Bangkok, Chiang Mai or other city centers within Thailand. And the Thai box office has been on fire since April, with Hollywood movie productions on track to finally recover from the COVID-19 pandemic.

Smaller holding Delfi has also rallied recently. While cocoa prices seem to be topping with better harvests in West Africa, the rally was not motivated by improving fundamentals. In fact, Delfi’s issues are more long-term in nature, with consumers unable to accept the higher prices that Delfi has begun to charge for its SilverQueen chocolate bars. Earnings are due on 8 August 2025.

In any case, here’s the latest portfolio as of 28 July 2025: