Portfolio update August 2025

AeroEdge saves the portfolio. Estimated reading time: 26 minutes

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

Table of contents

1. Portfolio update

2. Update on my key holdings

3. My plans going forwardPortfolio update

Another leg up for the portfolio. My Japanese equities have performed strongly in the past few months. I want to think that it’s all because of my stock picking. But I think it’s more likely due to Japan’s current bull market. I read an article in Nikkei the other day about stocks that retail investors could buy for their NISA accounts. I get the sense that amateur investors are becoming increasingly involved. That’s probably bullish in the near term, and bearish in the longer term.

Meanwhile, my stocks in Southeast Asia continue to decline. Savvy investors tell me that stocks in Indonesia and Thailand are probably bottoming out. And in these markets, you can find solid blue-chip compounder stocks for 10-12x P/E. So it seems only rational that I should move my portfolio in that direction.

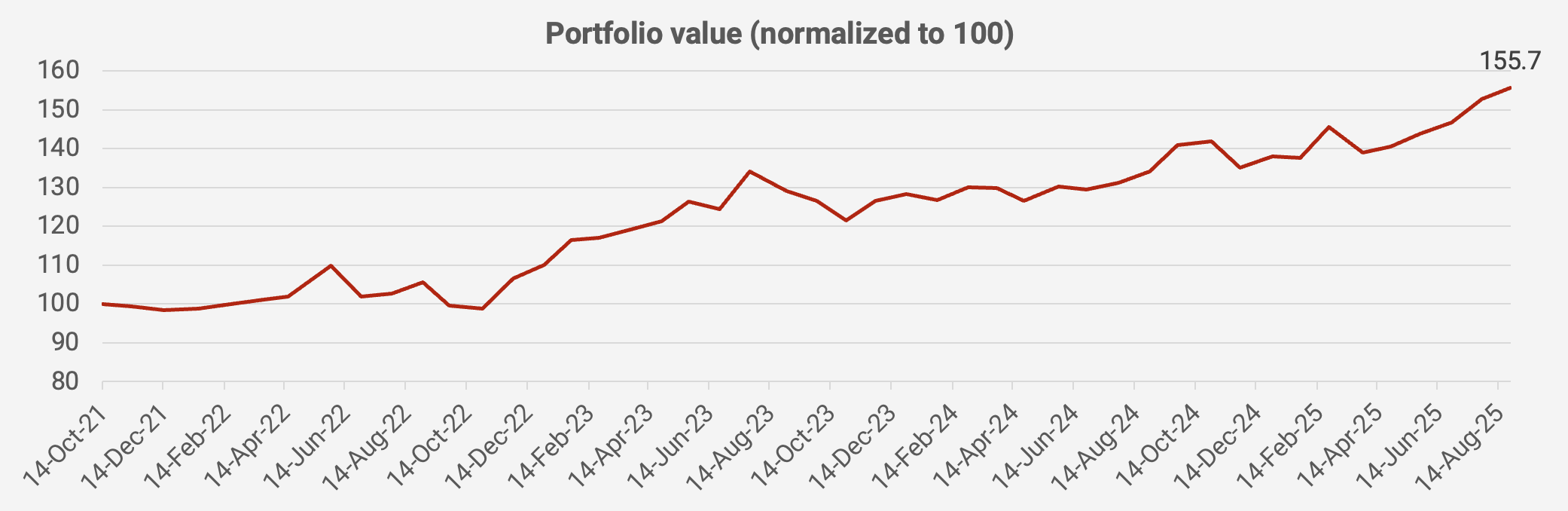

My portfolio rose by another +1.9% month-on-month in August. Since the portfolio’s inception in October 2021, the value has increased by +55.7%, now equivalent to a +12.1% compound annual growth rate:

Much of this month’s performance was due to the rally in Japanese aircraft component supplier AeroEdge. I got lucky: I had put on a large position just before the announcement that they would be taking materials manufacturing in-house (the titanium-aluminide alloy used in the LEAP engine’s low-pressure turbine blades). AeroEdge’s FY2026 guidance was upped to +36.9% year-on-year revenue growth and +28.3% year-on-year recurring profit growth.

On the negative side, Malaysian glove producer Hartalega’s share price continues to slide. I attribute this weakness to delayed orders amid US tariff hikes, as well as the unusual strength of the Malaysian Ringgit, and more recently, an unpaid tax notice from the Inland Revenue Board. There has been no insider buying in Hartalega yet, but the board is seeking approval for new share buybacks. The stock now trades at 1.0x book value. Before the COVID-19 pandemic, it had a return on equity of nearly 20%.

In any case, here’s the latest portfolio as of 26 August 2025:

Read next

Discover more from Asian Century Stocks

Deep reports for serious, Asia-focused investors.

By subscribing, I agree to Asian Century Stocks' Terms and Conditions, and acknowledge its Privacy Policy.