Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

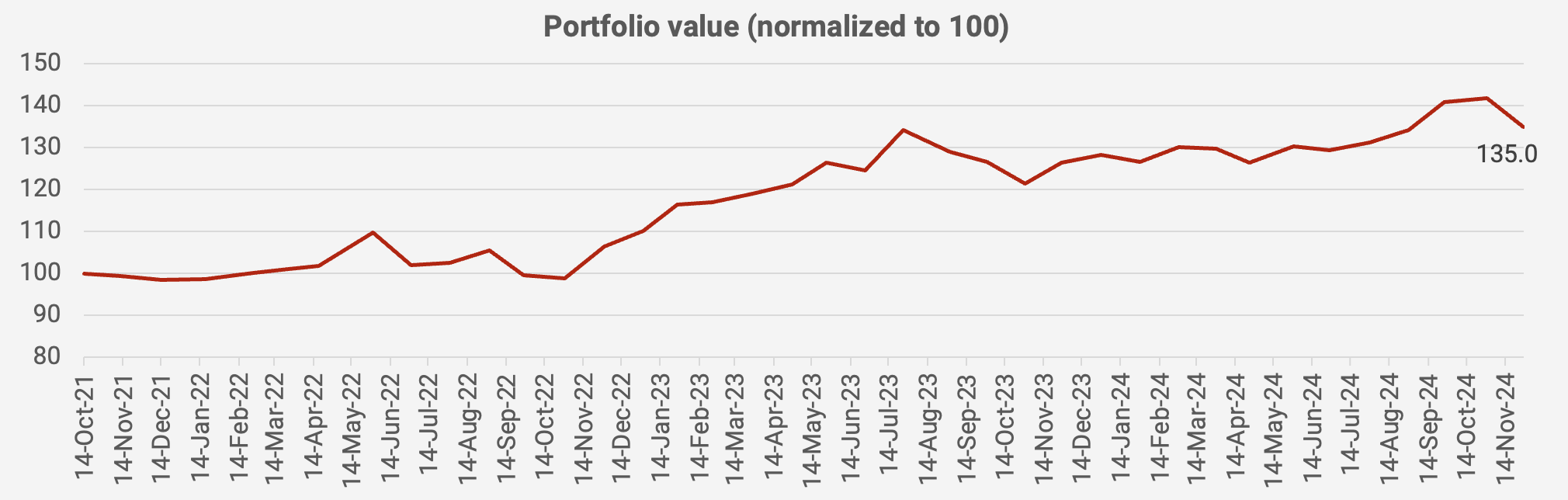

What a month. The portfolio dropped -4.8% in November. Probably the worst month that I can remember since starting to track it in October 2021. The value of the portfolio is now up +35.0% since October 2021, equivalent to a +10.1% compound annual growth rate:

It would be easy to blame macroeconomic factors such as the election of Donald Trump and renewed worries about US tariffs on Chinese goods. But there were also several idiosyncratic factors:

- New position Kaonavi dropped -27% in the past month after margins contracted due to their aggressive hiring of software developers

- Philippine casino operator Bloomberry Resorts saw weakness in its main casino in Entertainment City in Manila due to competition from online gambling and a lack of Chinese VIP customers

- Yakult dropped due to weaker-than-expected sales of the Yakult 1000 product now that the COVID-19 pandemic is over

Another negative factor for the portfolio and Asian equities is that the US Dollar remains strong. Or, as some might say: overvalued. For now, however, high interest rates continue to prop up the dollar. Once the dollar begins its weakening cycle, Asian equities should start outperforming again.

That said, I am not a China bull. The economy is looking weak, with falling property prices and a leadership that wants the state to control the economy. The country seems to be moving inwards politically.

However, there are plenty of opportunities in Hong Kong-listed companies whose fundamentals are moving in the right direction. For example, stocks such as Prada or Samsonite just happen to be listed in Hong Kong - they don’t have much exposure to China to begin with.

The median P/E for my portfolio is currently 11.4x. If you adjust for cycle-average margins, that number will come down closer to 10x. And many of them offer high-single-digit or double-digit dividend yields.

Here is what the latest portfolio looks like as of 28 November 2024: