Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

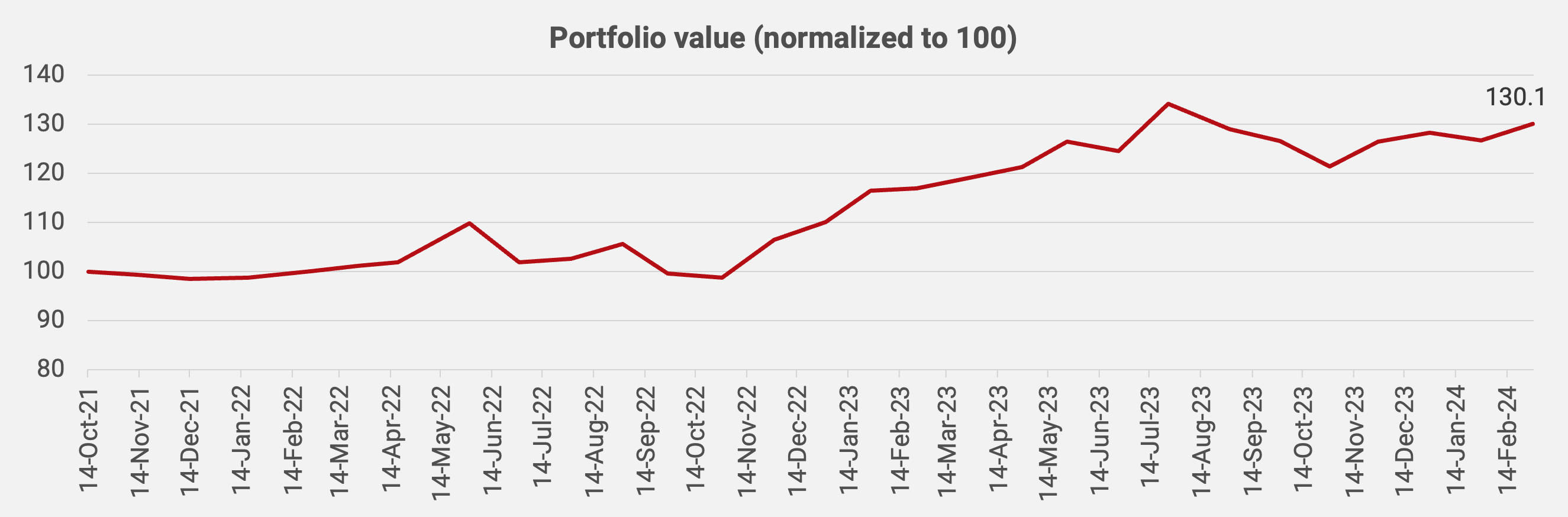

The portfolio had a nice rebound in February 2024, rising +2.7% month-on-month and +30.1% since inception in October 2021, equivalent to an IRR of +11.7%.

One explanatory factor was the jump in the share price of Hong Kong-listed cosmetics company L’Occitane after private equity firm Blackstone was rumored to place a bid for the company. Chinese oil & gas company CNOOC also moved higher for reasons I don’t fully understand.

Finally, Philippine equities have slowly moved higher in the past few months. A notable event is the recent reduction in stock transaction fees from 0.6% to 0.1%, causing investors to pay attention to the market again.

Here is what my current Asian portfolio looks like as of 29 February 2024: