Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

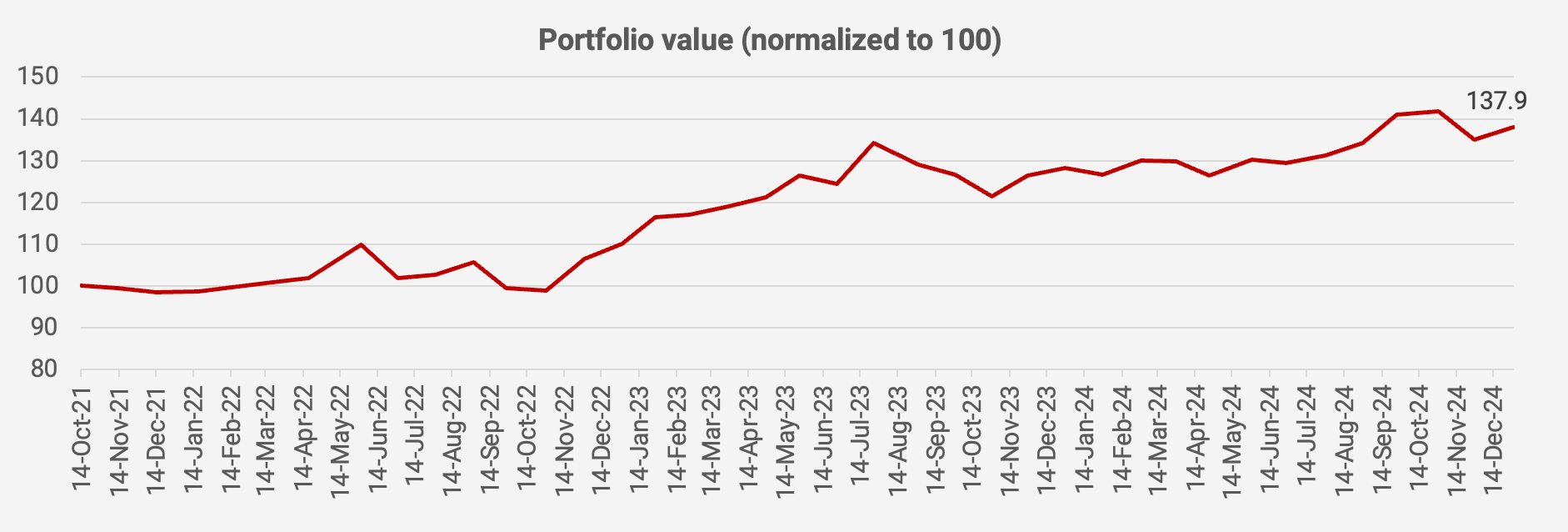

There has been a slight recovery in the past month, +2.2%, thanks to a rally in Hartalega and a rebound in Kaonavi. The value of the portfolio is now up +37.9% since October 2021, equivalent to a +10.5% compound annual growth rate:

The full-year 2024 performance was not impressive at just +7.5%, paling in comparison with the 20-60% returns demonstrated by many on Twitter.

My issue is that I’ve been stuck with companies like Multi Bintang that trade cheaply but are unlikely to rerate unless growth picks up.

I’ve been trying to shift into faster-growing companies such as Hartalega, Koshidaka, Ginebra San Miguel and Fairfax India. Even if the multiples don’t rerate I’m hoping that underlying growth will put a floor on the IRR of the portfolio.

I recently read Mano Sabnani’s book Money Secrets. He compounded his portfolio at 15.5% for almost three decades by investing in Singaporean small-caps. His strategy has been to keep 20% in cash in regular times and then invest in growth stocks during crises. Makes perfect sense to me.

Malaysian glove maker Hartalega was a growth stock purchased during a crisis, as was sportswear retailer MAP Aktif during COVID-19. Hopefully, I can find a few more such stocks.

In any case, here is what the latest portfolio looks like as of 31 December 2024: