Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

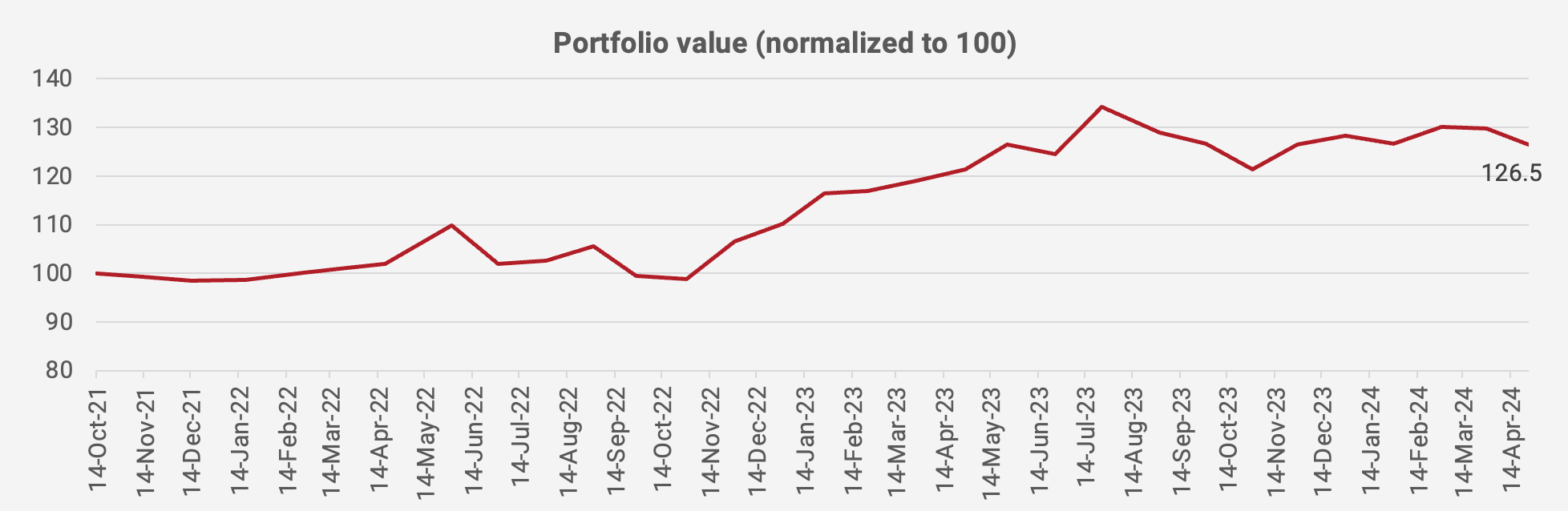

Tough month. Practically every single stock in the portfolio weakened. The primary driver was the strength of the US Dollar strengthened. The only stock that did well was CNOOC, which happens to earn its revenues in US Dollar. My portfolio lost -2.6% in April in US Dollar terms and is now +26.5% since inception in October 2021, equivalent to an IRR of +9.7%. To be clear, this is an actual portfolio that represents a majority of my personal savings.

One of the biggest losers was L’Occitane, whose share price dropped a bit before it was suspended. It’s now been two weeks and counting. My Hong Kong restaurant stocks declined further. Bloomberry Resorts dropped over 10% as well. I suspect that drop is related to the settlement of a lawsuit with former partner GGAM.

But as mentioned above, the real issue has been the strong US Dollar. Here is the DXY index, which measures the strength of the US Dollar against six other currencies:

Heres’ how my Asia-focused portfolio looks like, as of 25 April 2024: