Disclaimer: This article constitutes the author’s personal views only and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not recommendations to buy or sell stocks.

I have received several questions from readers on whether it’s the right time to buy Ping An Insurance (2318 HK / 601318 CH). Here is an attempt to answer that question.

Executive summary

Ping An is one of the leading life insurance companies in China

The company’s competitive advantage comes from its million-plus tied agents as well as strengths in technology and underwriting

The stock is down due to the company’s exposure to a weakening Chinese property market as well as fears about political risks

Ping An is now trading at a bargain level of around 6.0x P/E - very close to its SOE peers

While it’s difficult to judge Ping An’s real estate exposure and potential political risks, one should probably lean bullish at this point

Full write-up

Ping An Insurance started as a property & casualty insurer in Shenzhen, China, in 1988. The name Ping An means “peace and security”, suggesting that the company’s insurance products are safe.

The company was founded by Mingzhe Ma in Shenzhen in 1988 as a spin-off from state-owned enterprise China Merchants Group. It was the first Chinese financial group to adopt a shareholding structure.

It was first in several other respects: the first to receive foreign shareholders via Goldman Sachs and Morgan Stanley in 1994. The first Chinese insurer to have an international auditor. And the first to offer investment-linked policies.

Following the Communist revolution in 1949, China nationalised the domestic insurance industry and gradually shut it down. The government felt that there was no need for insurance when the government ultimately safeguards everybody’s lives. So by the 1980s, insurance companies such as Ping An had to build up expertise from scratch by bringing in experienced insurance executives from Taiwan and Hong Kong.

When Ping An listed on the Hong Kong Stock Exchange in 2004, it was the second-largest life insurance company in China and the third-largest in property & casualty. Ping An later listed on the Shanghai Stock Exchange as well.

Today, Ping An is a financial services conglomerate with operations in life insurance, pension, banking, securities and asset management.

Except for a recent slump, the stock has done well over time:

Driven by steadily rising premium volumes and earnings growth:

Ping An is unique in the way that it has approached technology. It regularly outspends its competitors on tech (it spends 1% of revenues on R&D) and is seen as an innovator in many respects.

A second differentiating factor is that Ping An has been proactive in seeking new distribution channels for its insurance business.

The diversified nature of the business has helped Ping An cross-sell its products to its different customer segments: across insurance, banking, asset management but also technology solutions such as auto (Autohome), healthcare (Ping An Healthcare and Technology), peer-to-peer lending (Lufax), real estate services (Haofang), etc.

In 2018, founder Mingzhe Ma announced that he would retire and be replaced by two co-CEOs:

Yonglin Xie: Has been with Ping An since 1994, working primarily for Ping An Bank. He also served as a special assistant to Mingzhe Ma for many years, making him a key ally to the founder.

Jessica Tan: Joined Ping An in 2013 and have previously served as COO. Before this, Jessica worked for McKinsey. While at McKinsey in Shanghai, she had done work for Ping An and apparently, Mingzhe Ma was so impressed that he reached out and offered her a job.

Today, Ping An is a large-scale company: US$163 billion in revenues, close to 200 million customers and 375,000 employees. Most of Ping An’s earnings come from life insurance. But it is also involved in property & casualty insurance (mostly auto insurance) and commercial banking via Ping An Bank.

The key segments are:

Life insurance: Long-term life & health insurance, primarily focused on protection products and savings contracts that provide better returns than what’s available through bank term deposits.

Property & casualty (P&C) insurance: Over 2/3 of China’s P&C is related to mandatory auto insurance, the rest being a mix of short-term medical policies, credit insurance, and property and agricultural insurance policies.

Banking / other: Ping An owns 50% of Ping An Bank (formed through the merger of three banks, the largest of which was Shenzhen Development Bank). It also operates a securities business, trust business, asset management and several major technology investments.

As observed from the company’s relative market shares, Ping An dominates in both life insurance (competitor: China Life) and P&C (competitor: PICC).

The key drivers of the business and the overall industry are:

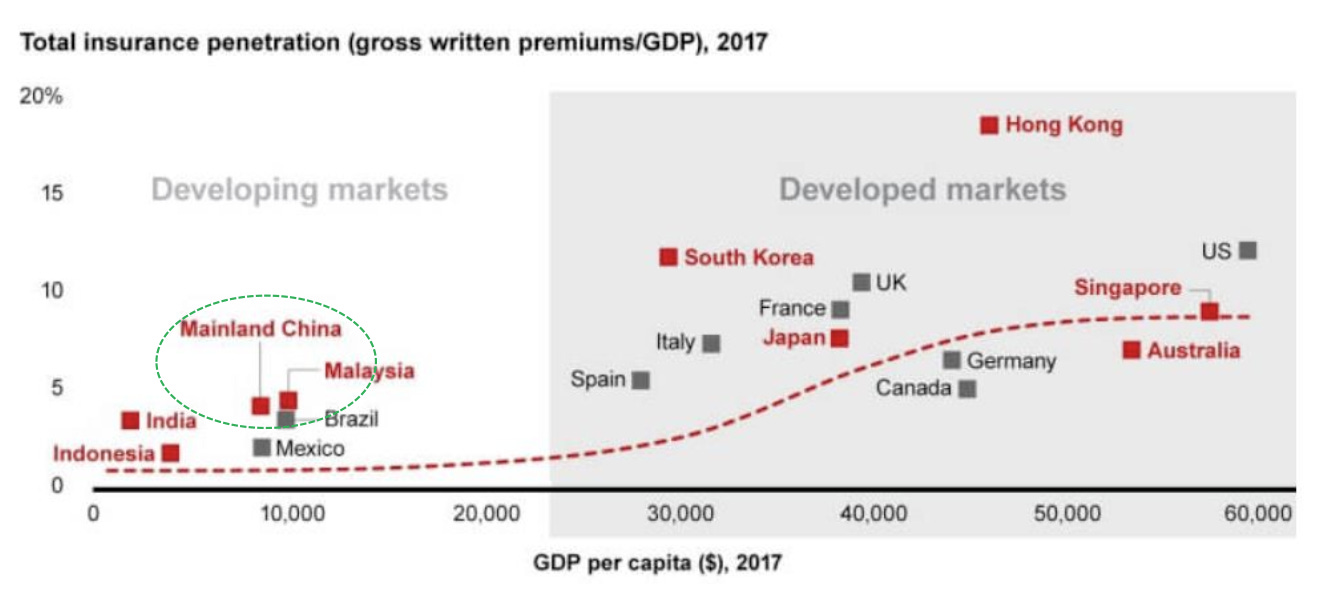

Country credit penetration: tends to follow an S-curve as incomes rise

The interest rate environment: higher interest rates enable insurers to earn a decent return on their investment portfolios

Underwriting: whether the company is pricing risks accurately

Capital allocation: whether the company is investing received premiums in a sensible fashion

Here are the main bullish and bearish arguments that I have been able to identify:

1. Low China premium penetration rate, especially in life

China’s insurance penetration rate has been rising gradually, thanks to higher incomes and greater sophistication in the financial planning of households.

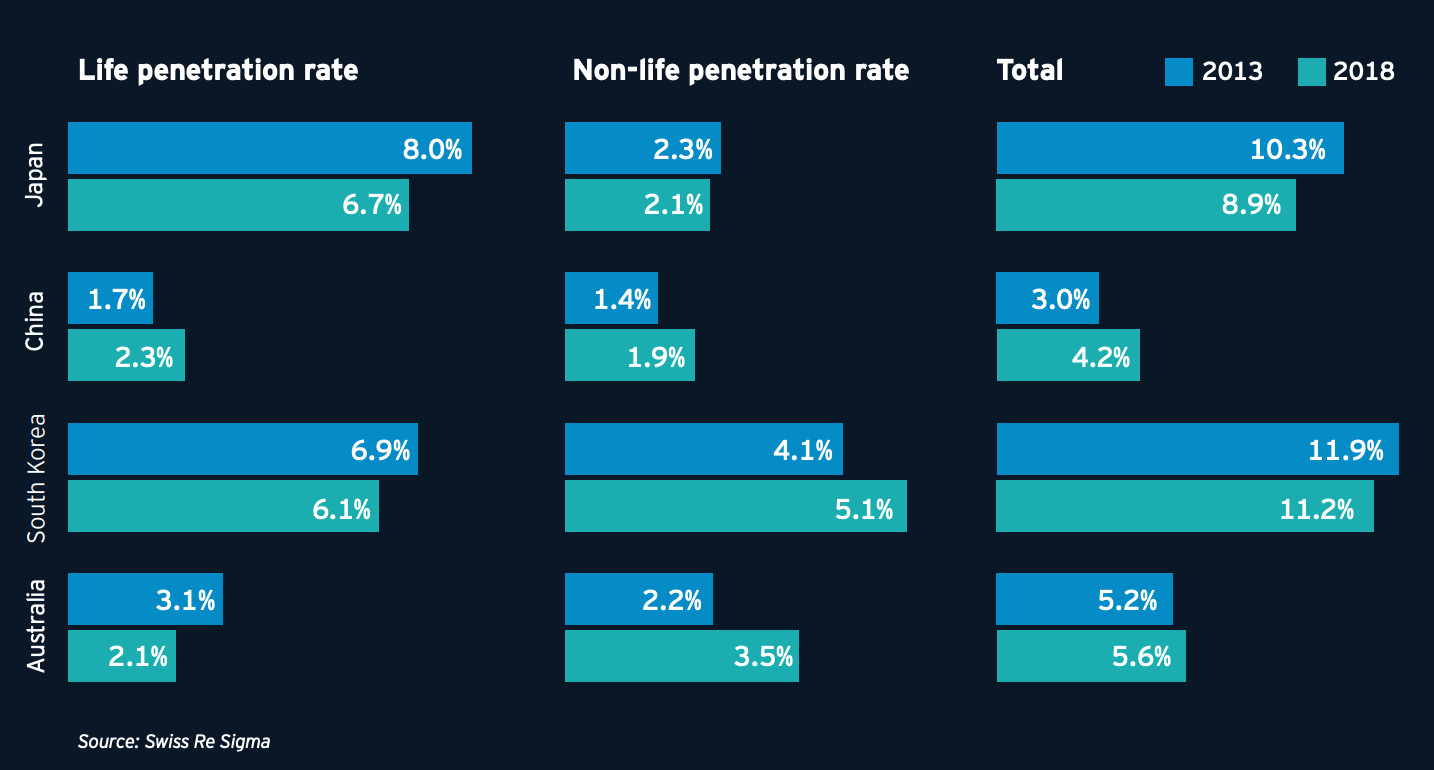

China’s life insurance penetration (gross written premium / GDP) remains low by international standards at around 2.3% as of 2018 compared to 6.1% in South Korea. In nonlife, the same numbers are 1.9% for China vs 5.1% for South Korea. The numbers are even higher for Japan.

Much of the differential can be ascribed to lower incomes in China. Compared to similar-income per capita countries such as Malaysia, the insurance penetration level is roughly equal. So you’re really making a bet on continued GDP growth, which in theory could lead to an S-curve effect of rapidly rising premium growth.

In Swiss Re’s worldwide insurance premium growth outlook, China stands out as the fastest-growing region in the world. Growth is expected to remain in the high single digits for non-life and double digits for life insurance.

Individuals in China tend to prefer investing in property as a way to save for their retirement. But insurance is becoming a more popular savings option, according to surveys conducted by China Reality Research:

2. Superior distribution

Ping An was the first non-SOE insurance company in China. As such, it had little distribution presence and had to find alternative ways to find customers.

It went early into telemarketing in the 2000s. It acquired a bank to get into bancassurance. And it also copied the old-fashioned sales agent model that had worked well outside of China but was new to the mainland.

Today, Ping An has a salesforce of 1.1 million agents - independent contractors who tend to be exclusive to Ping An (“tied agents”). Having access to this salesforce has been crucial to building up Ping An’s brand.

The reasons why Ping An’s salesforce have been so crucial for its success include:

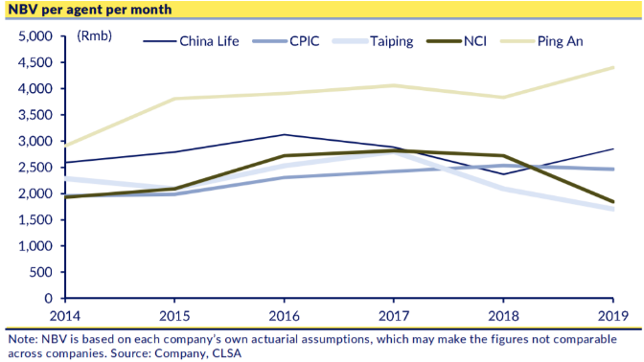

Opportunities for cross-selling: Ping An has a broad portfolio of products that agents can offer to their clients. That helps each agent earn high profits and attract the best agents in the industry. It also increases the client’s stickiness for Ping An. Ping An’s agents have by far the highest “value of new business” (NBV / VONB) per agent at around CNY 4,500 per month.

High-quality in-house training program: According to feedback provided to Bernstein, Ping An’s training program is among the best in the industry - rigorous and high-demanding.

Pruning of the sales force: Other than hiring the best agents and training them, Ping An is also ruthless in pushing out low-productivity agents to ensure that each agent contributes positively to the bottom line.

3. Continuous adoption of international best practices

The story of Ping An’s success has largely been about being early at adopting international best practices. As well as pushing for new innovative solutions to meet customer demands.

In the early years of Ping An, Mingzhe Ma recruited experienced industry executives from Taiwan and Hong Kong to set up the company. Ma also invited foreign companies such as HSBC, Morgan Stanley and Goldman Sachs to become shareholders. Ping An was also one of the first to build a sales agent force in China in the mid-2000s when other insurance companies instead relied on bank branches to distribute their products.

In recent years, Ping An has invested heavily in new technology solutions:

In 2011, the company built a peer-to-peer lending platform called Lufax, offering a marketplace for short-term investment products.

Ping An has also been at the forefront in adopting “insurtech” solutions, including selling insurance online. It acquired a large stake in Autohome, which the company is using to find leads for motor insurance. It also owns a stake in online-only insurance company Zhong’An Online P&C.

One of the most successful recent initiatives is the health service Ping An Good Doctor, which connects doctors with patients through an online video platform. The company has now has a market cap of US$8 billion.

4. Decent P&C underwriting metrics

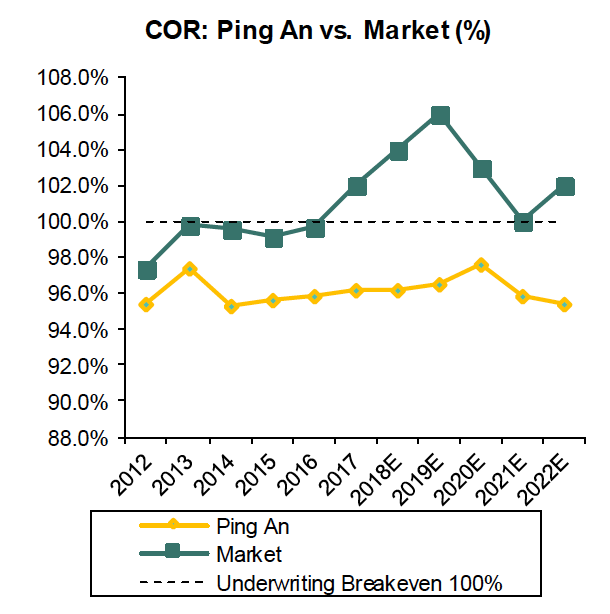

Within property & casualty, Ping An has historically far outperformed the market with an average 3 percentage point lower combined ratio each year. The underwriting advantage comes from a low loss ratio through superior underwriting. The expense ratio is more in line with that of the broader industry.

Ping An also leads the industry in terms of speed in claim assessment and settlement. In 2018, Ping An reported that 96% of day-time urban auto accidents requiring an on-site investigation were handled within five to 10 minutes - way faster than the industry-wide numbers.

1. Communist Party politics

Ping An’s founder Mingzhe Ma is a relentless entrepreneur. He has spent all his waking hours building up the company through the years, allegedly sleeping only 3-4 hours per day.

Still, one cannot help wonder whether Ping An has received support from the top Communist Party leadership.

According to Desmond Shum’s book Red Roulette, former premier Wen Jiabao acquired a large position in Ping An in 2002. He used his family and friends to purchase the shares for him. For example, thanks to her connection to Wen Jiabao, real estate developer Whitney Duan had enjoyed special access to low-priced land plots for many years. In return, Wen Jiabao received 30% stakes in the projects he developed. The profits from these projects were then invested in Ping An on Wen Jiabao’s behalf.

A 2012 New York Times exposé revealed that Wen Jiabao-linked entities owned US$2.2 billion worth of Ping An in 2007. And the value of that stake must have grown significantly since then. Besides Whitney Duan, Wen Jiabao had also enlisted his mother as a purchaser of COSCO’s Ping An shares. E-mails disclosed by Deutsche Bank mentioned that Wen Jiabao’s son Winston Wen had a major position in Ping An as well.

After Xi Jinping came to power in 2012, he has engaged in a crackdown on other factions within the party. While the 2013+ anti-corruption campaign was focused on party members and government officials, it appears that it has now been expanded to include private companies as well. As journalist Katsuji Nakazawa describes:

“The latest question session signals that President Xi Jinping is extending the tactics he used in his signature anti-corruption campaign to private companies…

That leadership team is now pressing private companies to get off the fence, show the flag and support Xi's political agenda, as it did to party members earlier in the anti-corruption campaign.”

What does this mean for Ping An? I’m not sure, but rumours are floating around that Ping An is in political trouble, most likely due to its connection to Wen Jiabao.

While it would be easy to connect Mingzhe Ma’s resignation to the avalanche of tech CEO resignations of the past year, I am not sure they are related. Mingzhe Ma announced his resignation in 2018, so it was a long time coming.

I do suspect, however, that Ping An has been forced to support unrelated state-owned or politically connected entities. For example, In early 2021, Ping An said it would acquire 51-70% of the Founder Group for CNY 37-50 billion. The Founder Group is a financial conglomerate that’s currently going through bankruptcy. Ping An argued that Founder Group has significant healthcare assets. But I can’t help wonder whether Ping An’s hand was forced by Beijing. The Founder Group bankruptcy seems like a hot mess.

In August this year, China’s banking regulator said it was probing Ping An for its investments in the property market. Ping An defended itself by saying that its real estate exposure (<5%) was lower than the regulatory cap. Earlier this year, CBIRC also ordered Ping An to halt the sale of alternative investment products.

I am not sure what this implies for Ping An’s future. Wen Jiabao certainly belongs to a competing faction. The state might well take over his shares. And I suspect that Ping An will engage in “national service” to a greater extent than in the past.

2. Difficult macro-economic conditions

Several macro factors have been headwinds for Ping An.

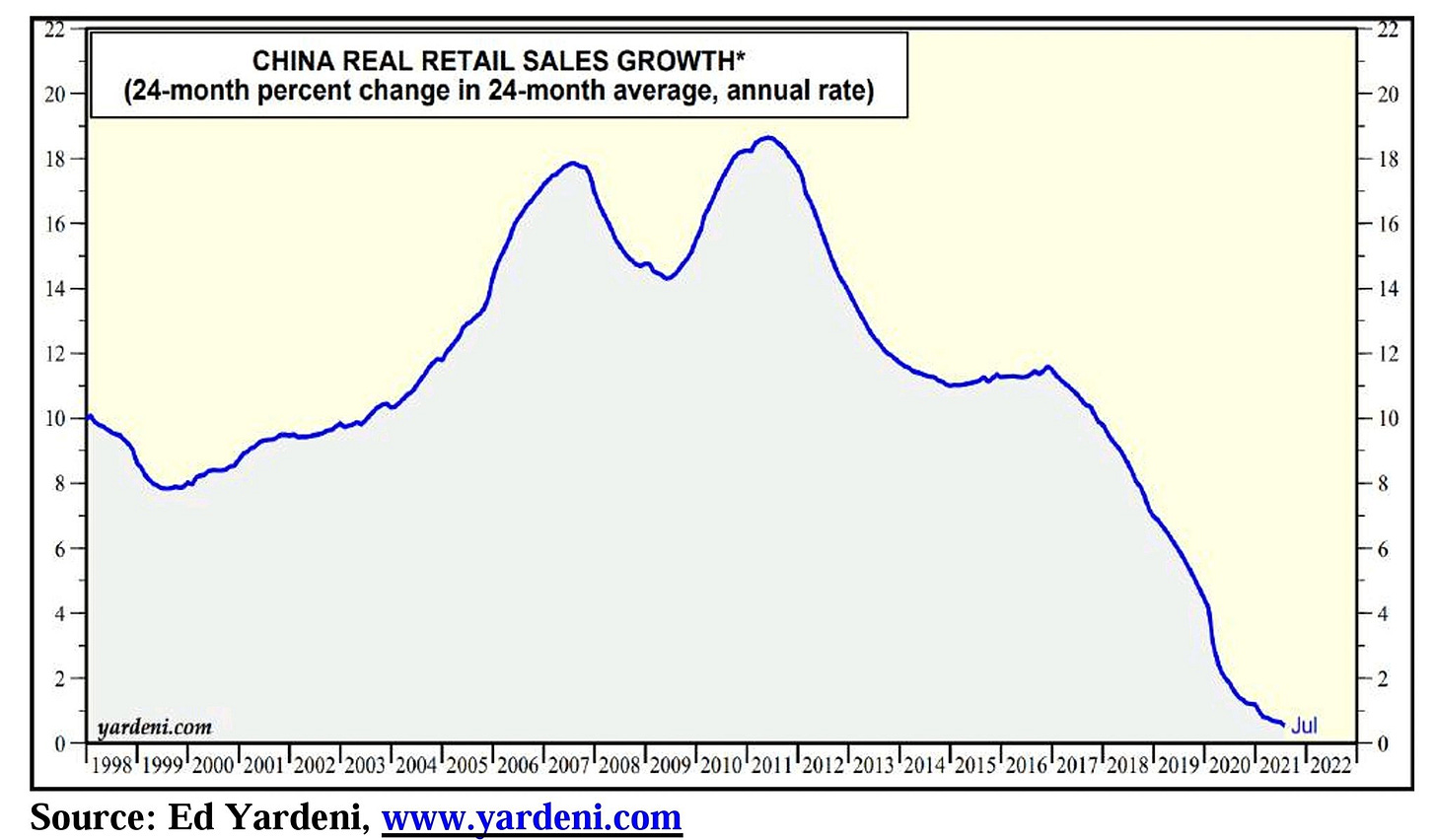

The Chinese economy has been slowing down over the past decade, as illustrated by China’s 2-year retail sales growth:

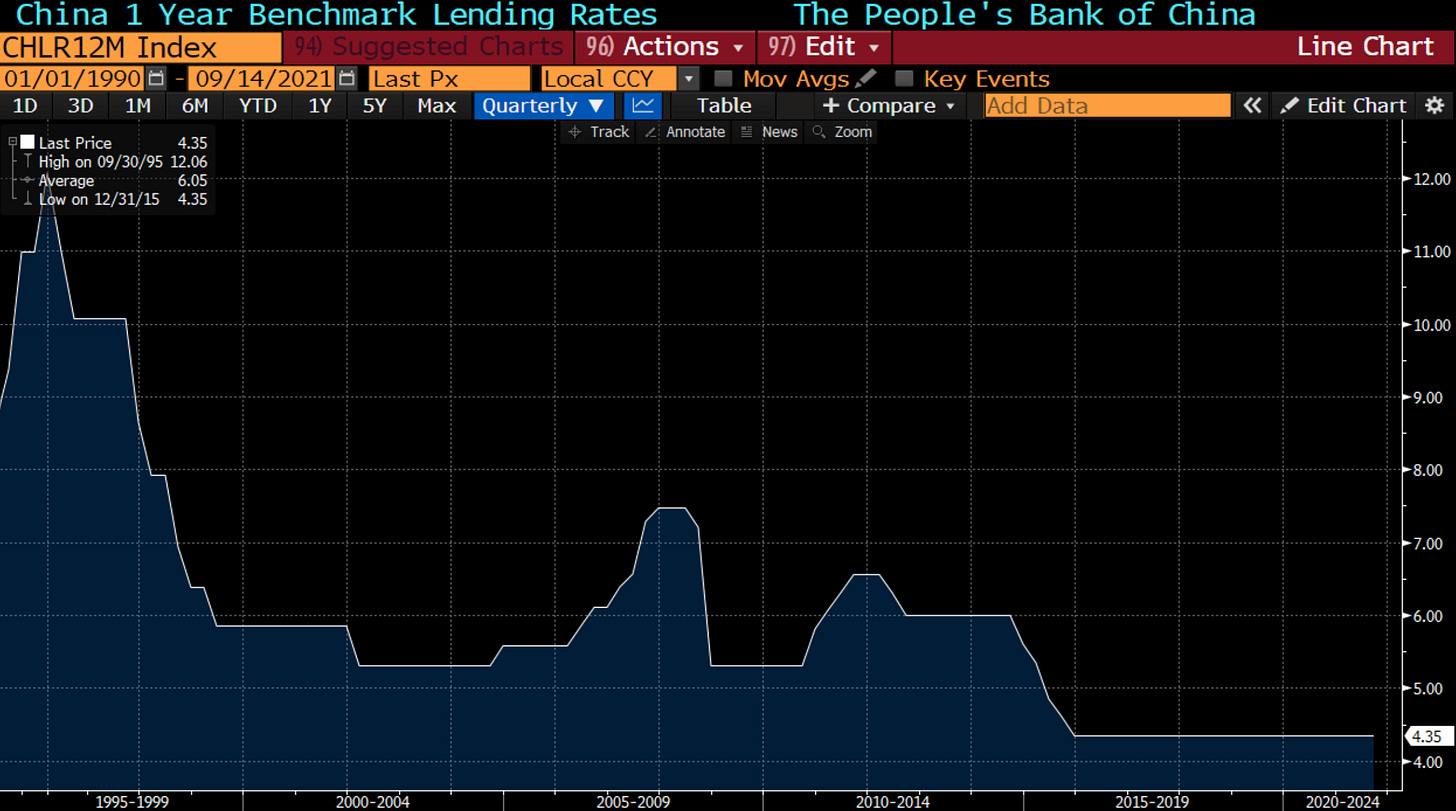

Deflationary pressures from a high debt burden (300%+ of GDP) put pressure on the PBOC to lower interest rates. The 1-year lending rate remains at 4.35% but could drop if the government sees a need to stimulate the economy.

Ping An suffers from an asset-liability mismatch, making it vulnerable to falling interest rates.

Life insurance contracts typically ensure a fixed pay-off at certain events such as mortalities, terminal illness or other triggers. Meanwhile, their investments tend to be short-term.

Ping An’s asset duration is six years, compared to 15-20 years on the liability side. The company doesn’t have a choice: there simply aren’t many long-term debt products available on the mainland. So it is forced to live with this asset-liability mismatch. It means that Ping An’s current portfolio of life insurance policies will drop in value if interest rates fall.

That said, China’s interest rate environment is still more favourable than those of many other countries such as Korea and Taiwan.

Ping An has a 5% exposure to real estate in its insurance investment portfolio. New home sales has started to weaken, and several property developers are facing bankruptcy. That is putting some pressure on the portfolio.

Ping An also has exposure to the property market via 50% owned subsidiary Ping An Bank. Several banks such as CMB and BEA have already started to report a rise in expected NPLs.

It’s also plausible that we will see mortality rates during the pandemic surprise on the upside, though I am not certain that deaths from COVID-19 will actually move the needle. According to The Economist, there were 7-13 million excess deaths worldwide in the first year of the pandemic - around 0.1% of the world population. But China has been relatively spared from COVID-19 related deaths so far, and it continues to engage in a zero-tolerance approach to the spread of SARS-Cov-2.

3. The pandemic has made real-life meetings difficult

Ping An’s 2020 new business value dropped 35% YoY with margins contracting as well. There was a recovery in the first half of 2021, but the Delta variant outbreak is likely leading to another setback.

The problems are two-fold:

Face-to-face meetings have been more difficult to organise due to fears of getting infected with COVID-19.

Selling long-term protection has been difficult due to weaker incomes during the downturn.

That said, the pandemic will ultimately pass. So the base case has to be that the value of new business will mean-revert over the medium-term.

4. An over-extended balance sheet?

Ping An’s fast growth has put some strain on the company’s balance sheet. Today, the company has the lowest solvency margin ratio of any Chinese insurer.

The amount of non-standard assets on Ping An’s balance sheet does not stand out. However, Ping An has a large exposure to so-called “wealth management products”. Competitor AIA has most of its investment portfolio in government bonds, corporate loans, equities and funds and almost no exposure to such non-standard assets.

It appears that a large proportion of Ping An’s “wealth management products” are invested in real estate, infrastructure or financial services. I imagine that a majority of these loans are to state-connected entities, especially within the infrastructure segment. Are these investments safe? I don’t think that’s necessarily the case. The state has the capacity to repay but not necessarily the willingness. As we have seen in the case of Tsinghua Unigroup, for example. And GITIC in 1999.

Ping An’s overall real estate exposure in the insurance investment portfolio is limited to about 5%. But it also has exposure via Ping An Bank (~10% of the total are developer loans) and through Ping An’s trust management business. Ping An Real Estate is said to have CNY 340 billion of assets under management. In a 2017 Institutional Investor article, Ping An was said to develop real estate across China. I am not sure exactly what arm of Ping An they were referring to.

Ping An’s 25% stake in China Fortune Land was carried on the books at close to the historical cost of CNY 18 billion. But Ping An announced that it had a total exposure of CNY 54 billion via an additional CNY 36 billion in debt. With total equity of CNY 988 billion (Ping An Bank fully consolidated), a write-down of around CNY 35 billion represents 3.5% of Ping An’s equity. Not a death blow but somewhat worrying.

The weakness in China’s property market is widespread. The most indebted developer of them all - China Evergrande - seems to be nearing bankruptcy. It does not look like Ping An has exposure to Evergrande through its investment portfolio. But Ping An Bank may well have related loan exposure. Note that Evergrande is based in Shenzhen, just like Ping An.

In 2010 Ping An acquired Shenzhen Development Bank - a company that has been plagued with a large portfolio of non-performing loans. It was later merged with two other banks into the now-50% owned subsidiary Ping An Bank.

While the loan book has been cleaned up since then, Ping An Bank remains poorly capitalised with a CET1 ratio of 9.5%. Ping An has tried to reduce the amount of wealth management products issued by the bank. Off-balance sheet wealth management products still represent 20% of total assets in mid-2020. These products might carry implicit guarantees.

Ping An Bank has also tried to reduce non-standard assets, trust exposure and guarantees to fintech subsidiary Lufax. It appears that Ping An provides guarantees for loans arranged via Lufax. It seems that consumers often use peer-to-peer lending platforms such as Lufax to finance down payments for home purchases.

It’s difficult to judge whether Ping An’s loan book is over-extended or not. Grant’s Interest Rate Observer noted in 2015 that Ping An Bank is among the most aggressive in using accounting games to hide non-performing loans. The breadth of Ping An Group’s conglomerate structure clearly makes it easy for it to shuffle bad loans between entities that may or may not be consolidated. That may well be the case.

A major bull case with Ping An is that China’s life insurance market is underpenetrated. Premium volumes to GDP are far lower than in developed Asian markets such as South Korea or Singapore. Ping An has strength across both life and P&C thanks to its million-plus tied agents and superior technology. Ping An has also been very successful in its underwriting, with P&C combined ratios far below industry averages.

The bear case is that the top leadership within the Communist Party may be cracking down on Ping An and potentially forcing it to engage in “national service”. In addition, short-term macro conditions are difficult, although those conditions could certainly improve following the pandemic. The balance sheet is somewhat of a question mark. There could be contingent liabilities from Lufax and Ping An Bank wealth management products and hidden exposure to property developers. Ping An’s solvency ratio is on the lower side.

Ping An’s historical P/B has been 2.3x compared to 1.2x today. The historical P/E has been 12.9x compared to 6.6x today. So the stock is certainly trading at much lower multiples than in the past.

Ping An’s international peers tend to trade at P/E 10x and P/B 0.9x. However, note that Chinese state-owned insurance companies trade close to P/E 5x and P/B 0.5x.

So far, there has been minimal insider buying, just 20,000 shares by director Zhang Wangjin in early September this year.

In August, Ping An announced it would repurchase 5-10 billion yuan worth of A-shares. The decision to repurchase A-shares makes sense in my view, given the minimal price difference between the company A- and H-shares:

The key question when it comes to Ping An is where the company’s ROE will end up.

Life: The life business has historically had an ROE of 35-40%, compared to low teens ROE for the major state-owned companies.

Non-life and Ping An Bank: These segments have ROEs closer to the cost of capital, especially the bank at 8-9% - at best.

If I’m right that Ping An will see its ROE compress over time, then earnings growth is likely to slow. But in any case, Ping An remains very inexpensive. If the ROE drops to 12%, Ping An’s multiple will end up at 4.9x by 2024.

Ping An already trades close to SOE multiples. Apply a P/E of 8x, and you’ll see an upside of +60% from the current share price.

So there is undoubtedly value in Ping An at this point, even if you assume weaker profitability in the years ahead.

I have personally not invested in Ping An yet. But that has more to do with my inability to dissect insurance company balance sheets rather than anything particular about Ping An. The risk-reward seems to skew positively at this point.

It might be a bit early to get involved. Rumours are flying around that Ping An is in political trouble. Several major Chinese property developers seem to be nearing bankruptcy. We won’t know the full impact on bank and insurance company balance sheets until such losses have been fully absorbed.

Further reading

Institutional Investor: Inside Ping An’s massive expansion (2017)

Insurance Journal: Interview with Jessica Tan (2019)

Wall Street Journal: China’s Insurance Giant Thinks It’s a Tech Company. Maybe It Is. ($)

What an impressive write-up. Thank you very much for all the work.

I'm really worried about the mismatching between assets and liability durations. I consider it a very big red flag, but it's a very interesting case to follow from time to time.

Joaquin

If blood was on the streets on banking and insurance. And a contagion was to take hold. What are your views on the sectors that one should concentrate on ?