On 31 December 2020, I wrote a short post called “Predictions for 2021”. Here is how those predictions panned out:

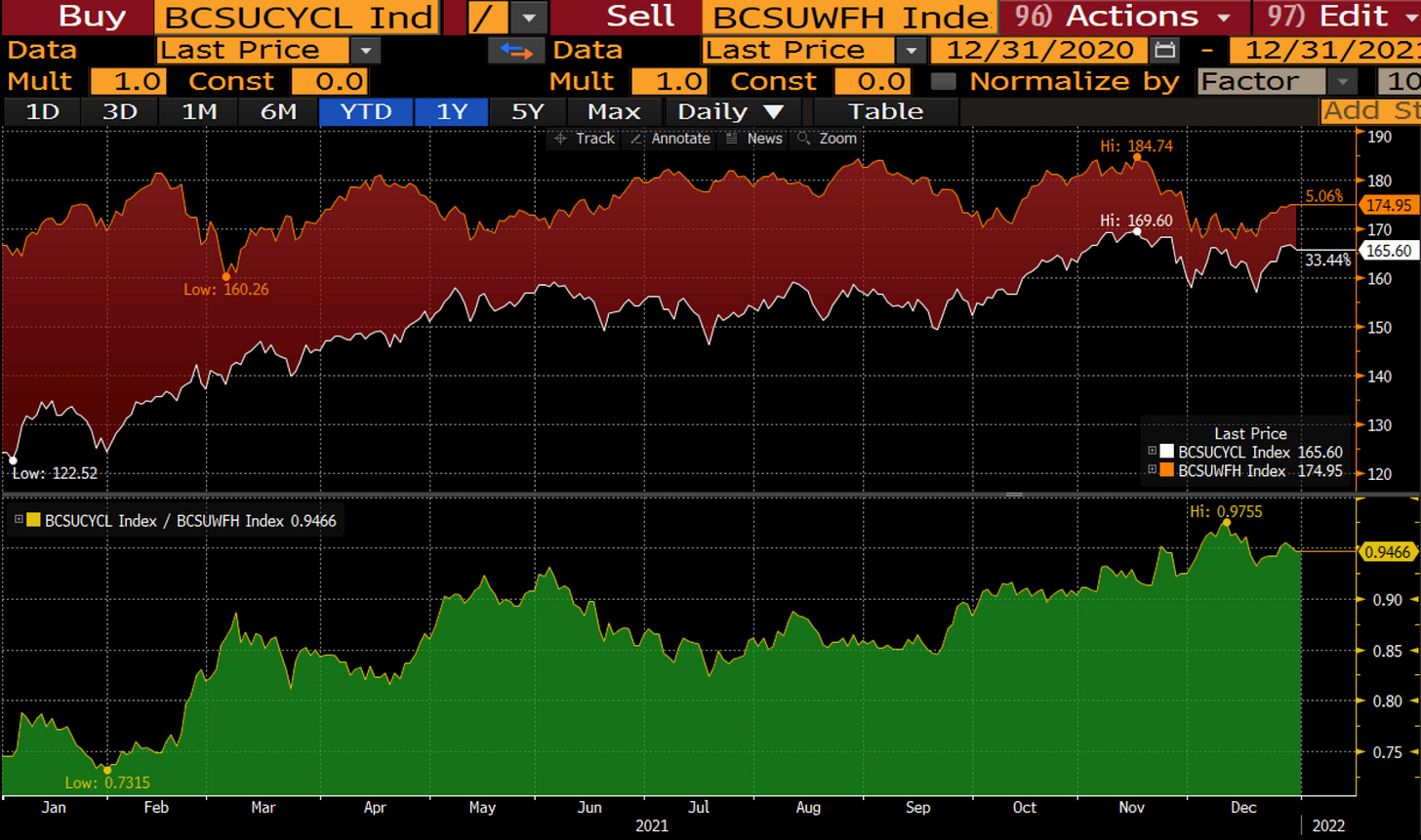

Old 2021 prediction #1 – Cyclicals will do better than “work-from-home” stocks

In the United States, cyclicals performed well in 2021. In Asia, the picture is mixed. Cyclical stocks in China performed poorly after weakening credit growth from late 2020 onwards and Delta variant outbreaks in many provinces. Most of the cyclical stocks that I track in Southeast Asia and Japan are more or less flat from the beginning of the year. However, they have outperformed work-from-home stocks such as Meituan, Alibaba, and Base Inc.

Old 2021 prediction #2 – Government bonds will suffer into a recovery

We did see government bond yields rise in 2021. The 10-year US Treasury bond yield rose from 0.91% to 1.51% (yields move inversely to prices). In Asia, long-term government bond yields rose for practically every country except China. China’s monetary and fiscal policies have been tight, while Delta variant outbreaks have led to frequent lockdowns. Nominal GDP growth suffered, and long-term government bond rates fell together with weaker economic growth.

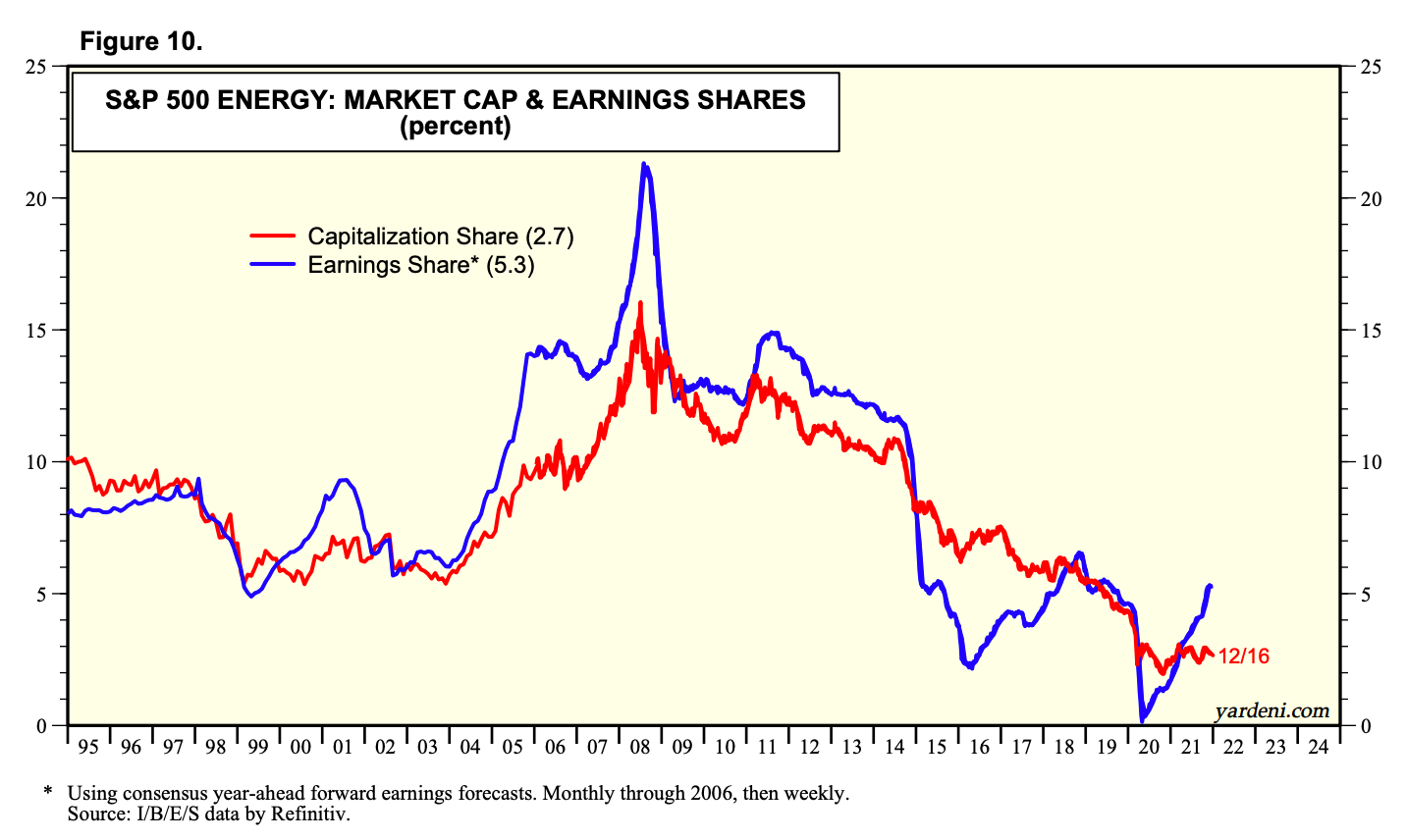

Old 2021 prediction #3 – We are witnessing the start of a new bull market in oil & gas stocks

US E&Ps had a great year in 2021, with the XLE ETF rising +46%. But oil services stocks as measured by the OIH ETF haven’t done nearly as well. Drilling remains muted as the Biden administration put a moratorium on new oil & gases leases on federal land. And oil majors have increasingly reinvested their capital into renewables rather than new oil & gas wells. The Brent crude oil spot prices rose from US$50/bbl at the beginning of the year to almost US$80/bbl. Measured as a proportion of the S&P 500 market cap, on the other hand, energy stocks have remained flat over the past year. In Asia, Japanese oil company Inpex did well, but CNOOC and PTT E&P ended the year more or less flat. Perhaps the oil & gas bull market is still in its infancy.

New predictions for 2022

And now that we’re facing a new year, here are some thoughts on what might be in store for 2022:

New 2022 prediction #1 – Omicron will lead to the end of the pandemic

Omicron is mild and highly transmissible. The effective transmission rate seems to be around 3.0 compared to 1.0 for the Delta variant. The case fatality rate for Omicron is just 0.19% vs Delta’s 1.59%. It may reach ~0.25% once the lag in deaths and disparities in reporting are taken into account. Omicron is now spreading so rapidly that most of the world ex-China might become infected by the end of February 2022. And Omicron is likely to lead to cross-immunity, causing it to replace Delta completely. Past COVID-19 victims such as restaurants, entertainment companies, hotels, travel companies, oil & gas companies and retailers are likely to recover with force. The only caveat is how governments will respond. Mainland China is my biggest worry, followed by Hong Kong and Singapore. Other Southeast Asian countries will probably let Omicron rip as they lack the capacity and willpower to fight it.

New 2022 prediction #2 – Carnage among the darlings of the COVID-19 bull market

Retail investors focus on momentum. If their portfolios end up with losses, they usually react by first doubling down and then panicking. I’m expecting this to play out in East Asian tech stocks, which have been the darlings of the COVID-19 bull market so far. The demand for consumer electronics, e-commerce, video games and other Internet-based services will likely drop after the pandemic. It's true that Chinese tech stocks have already corrected significantly. But in Korea, where trading volumes tripled into mid-2021, the “Seven Princesses" index remains over twice as high as before the pandemic. Taiwanese market darlings such as TSMC, Asustek and Mediatek look vulnerable too. In Vietnam, trading volumes have gone up 8x, and FPT more than doubled. When retail investors get involved in great numbers - it usually ends badly.

New 2022 prediction #3 – Emerging markets outperform after China eases from mid-2022 onwards

The Chinese Communist Party’s 2022 National Congress will be held in October or November. I believe that there is a good chance (50%+) that a new Chinese easing cycle will begin before this date. President Xi Jinping is seeking a third term. To neutralise opposition and to gain support among local government officials, credit needs to be flowing. Economic growth needs to recover. So it’s possible that a new Chinese easing cycle will begin by mid-2022. It would positively impact global ex-US growth and cause the US Dollar to weaken. Performance chasers disillusioned with concept stocks such as Tesla might then seek assets outside of the US to avoid underperforming, including in Asian emerging markets.

Happy New Year, and let’s hope for a prosperous 2022 for all of us!