Asia is catching up in vaccinations: Japan’s vaccination rate has overtaken that of the United States. South Korea is not far behind.

Thailand re-opening: Thailand is re-opening to foreign tourists. It will scrap quarantine requirements for all pilot areas this year

Macau casinos: The government plans to increase local ownership of Macau casinos. A new gaming law proposes for the sub-concession system to be removed. US casinos’ 2022 Macau concession renewals might be at risk.

Chinese anti-trust regulation: WeChat and AliPay are opening up their platforms to third-party links

Hong Kong tycoons: Early signs of a crackdown on Hong Kong tycoons, compelling them to contribute to Beijing’s Common Prosperity drive

Mainstream stock ideas: This table with 1-year returns for the favourite stocks on Finance Twitter shows that popular stocks tend to underperform

Company-specific reports

($ = behind a paywall)

I wrote a deep-dive on Indonesian dairy company Ultrajaya Milk (IDX: ULTJ — US$1.1 billion)

I wrote a post weighing the bull & bear cases for Ping An Insurance (SEHK: 2318 — US$81 billion) ($)

Punch Card Investor on e-commerce stock Sea Ltd (Part 1) (NYSE: SE — US$188 billion)

A quick note on Kazakhstan uranium miner KazAtomprom from the “searching 4 value” blog (LSE: KAP — US$10.2 billion). Also note this comment from the company’s Chief Commercial Officer.

Long-form writing

(estimated reading time) ($ = behind a paywall)

Bank analyst Daniel Tabbush on how Thai banks are likely to benefit from Thailand’s re-opening (2 mins)

Variant Perception: EM local currency debt underperforms in hiking regimes (1 min)

Harvard Business Review & Bain: Founder-led companies outperform the rest (5 mins)

John Authers: Executives using complex language produce lower returns (8 mins) ($)

Adam Tooze summarising the news flow on property developer China Evergrande (9 mins)

Anne Stevenson-Yang of J Capital weighs in on China Evergrande, discussing what a restructuring of the company might look like (7 mins)

Niall Ferguson: Will Xi move on Taiwan? History warns he might (13 mins)

Semi-Literate Substack: Mapping US chip company exposure to China (9 mins)

Podcasts and videos

(listening time) ($ = behind a paywall)

Howard Marks discussing market cycles (1:08 hours)

Ex-housing bear John Paulson interviewed by David Rubinstein (24 mins)

Mark Spitznagel is bearish (and selling a new book) (26 mins)

China-based tech analyst Dan Wang explains the tech crackdown (49 mins)

SCMP tech journalist John Artman discussing China’s tech regulation (1:05 hours)

Angelica Oung from the Taiwan-focused Taipology Substack on the Compounding Curiosity podcast (45 mins)

Asianometry: How Chinese state-owned Tsinghua Unigroup tried to roll up overseas semiconductor IP (15 mins)

Peter Zeihan: Why has the PRC not taken Taiwan? (5 mins)

Mike Green interviewing Louis Gave discussing Chinese politics on Real Vision TV (1:25 hours) ($)

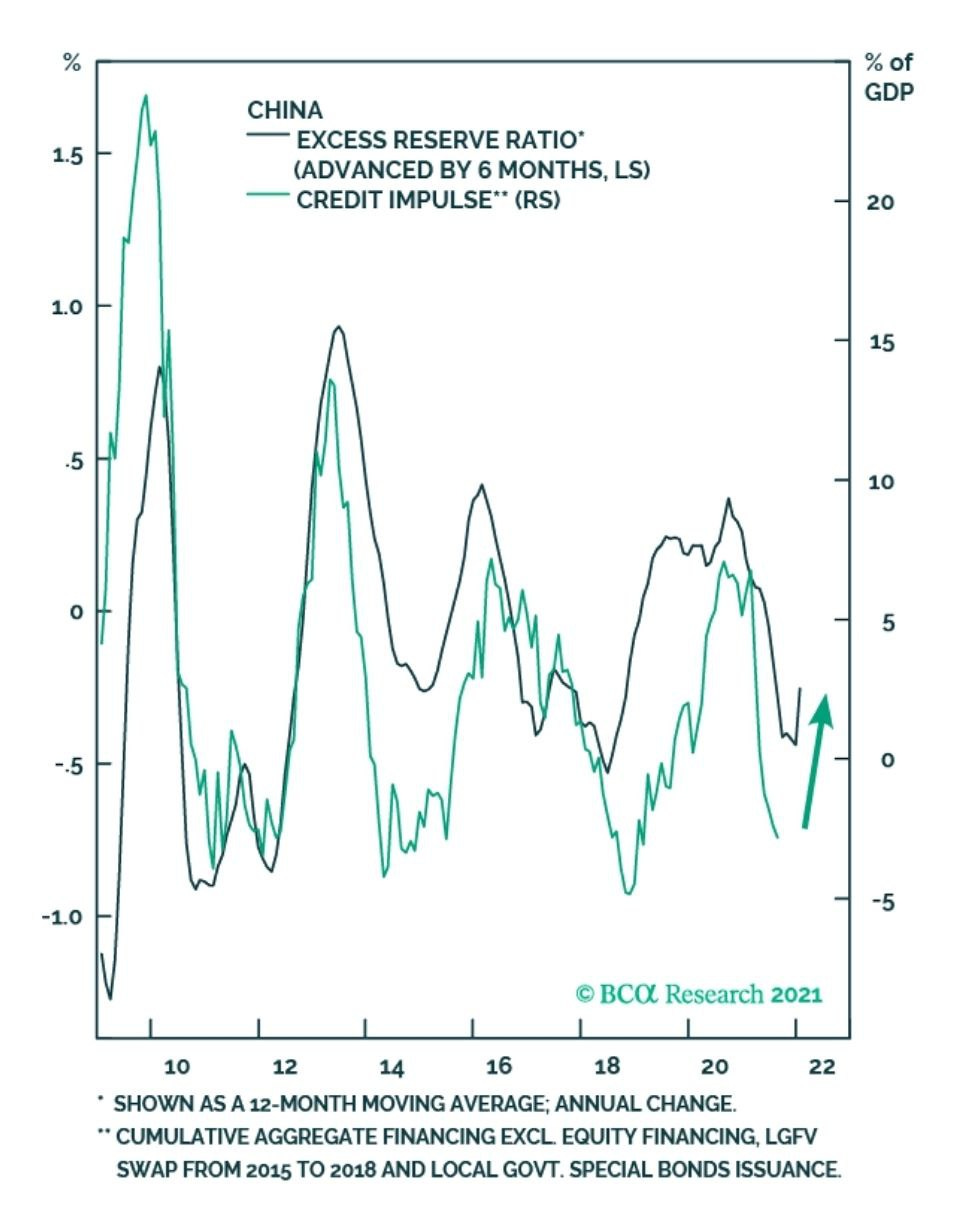

Chart of the week – China’s excess reserve ratio has started ticking up

Thanks for reading, and I wish you a great week ahead!

Sign up for over 20 deep-dive reports on Asian stocks per year and full disclosure of my personal portfolio.