Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in MAP Aktif at the time of publishing this article. To reiterate, this post and the presentation below are for informational and educational purposes only - not a recommendation to buy or sell shares.

Summary

- MAP Aktif is the sportswear subsidiary of Indonesian retail giant Mitra Adiperkasa.

- I wrote a deep dive on MAP Aktif in January 2022, during the depths of the COVID-19 pandemic. At the time, it was suffering from Indonesia’s large-scale social distancing restrictions. But I thought that it would eventually recover, continue growing its store count, and end up with a single-digit P/E ratio.

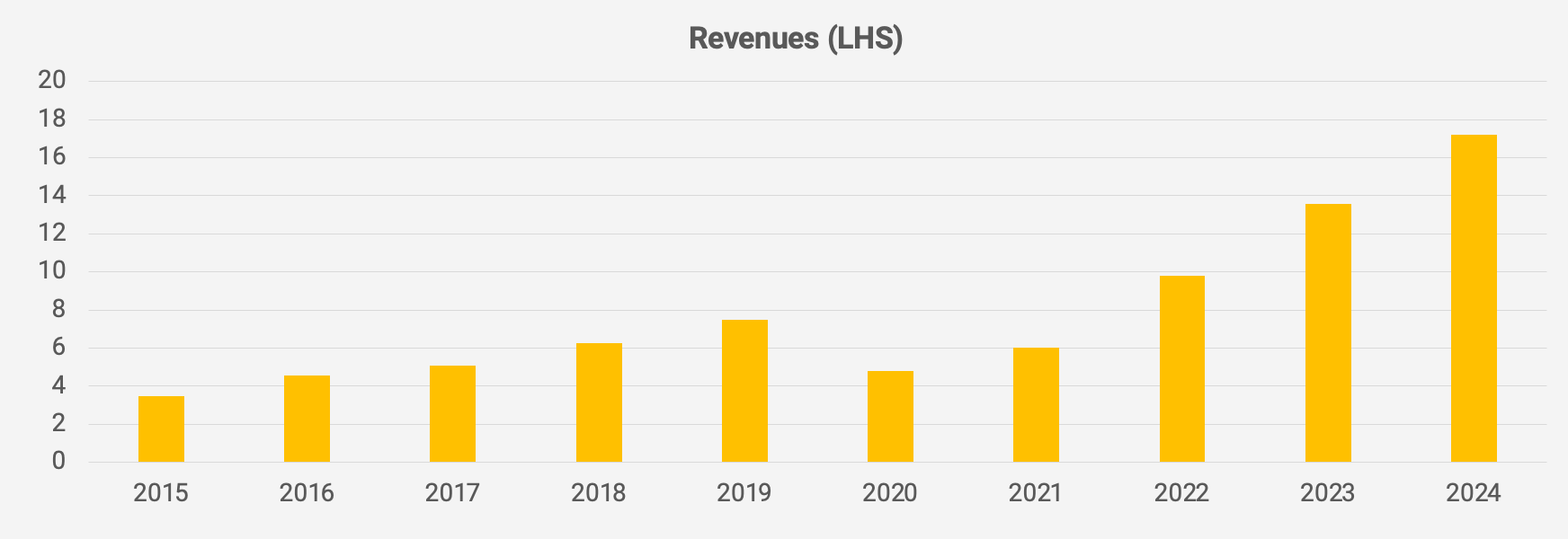

- The recovery was even more forceful than I had expected. Today, MAP Aktif’s revenues are more than twice what they were before the COVID-19 pandemic. The stock increased roughly fivefold before peaking in 2024.

- While MAP Aktif’s revenues continue to grow at a rate of close to 20% per year, there has been margin compression. I suspect MAP Aktif was overearning back in 2022-2023, as we had just emerged from the pandemic. The Indonesian macro environment is also challenging right now. There’s been greater competition from both JD Sports and Decathlon. And finally, MAP Aktif’s international expansion probably hasn’t been as profitable as that in Indonesia. All of these factors may have contributed to the decline in the gross profit margin from 48% to 46%.

- However, I believe MAP Aktif has performed admirably, regardless of these issues. First-quarter 2025 revenues grew by +17% year-on-year and net profit by +19%. Yet the stock price trades at a next-twelve-month P/E of just 11.8x.

- Assuming gross margins end up at 46%, opex/sales at 33% and top-line growth slows from 16% to 6%, I arrive at a 2030e forward P/E of 6.5x, well below the pre-COVID trading range of 15-20x.

Table of contents:

1. A quick background

2. The original thesis

3. MAP Aktif’s recovery

4. An updated valuation model

5. Conclusion1. A quick background

I first wrote about Indonesian sportswear company MAP Aktif (MAPA IJ — US$1.1 billion) back in January 2022. Here’s a link to the deep dive:

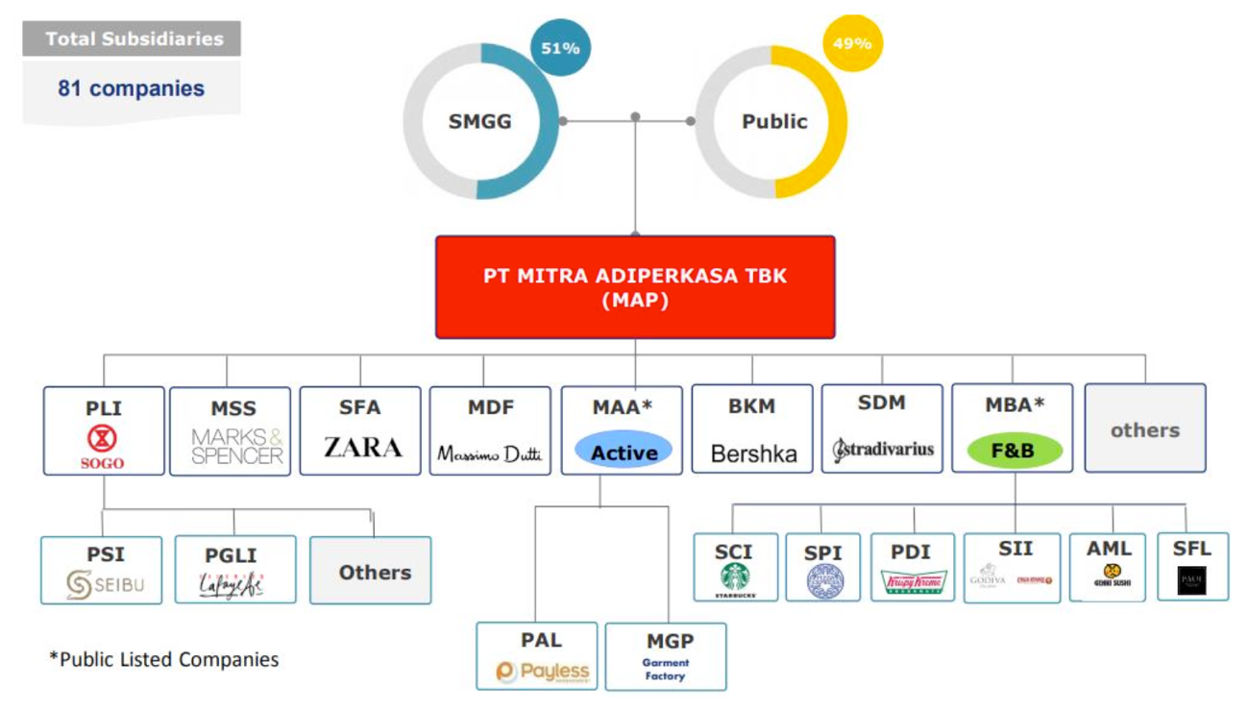

MAP Aktif is part of the broader Mitra Adiperkasa group (MAPI IJ — US$1.2 billion) — one of Indonesia’s largest retailers.

The story began in the early 1990s. Indonesian property developer Boyke Gozali had just built his high-profile shopping mall, “Plaza Indonesia,” and saw an opportunity to start a retail operation. In 1995, he established retailer Mitra Adiperkasa and hired Indian banker Virendra Prakash (“VP”) Sharma to manage it.

Mitra Adiperkasa’s first success was bringing Japan’s SOGO department store to Indonesia. And later on, he inked exclusive distribution deals with Starbucks, Zara, Marks & Spencer and Nike.

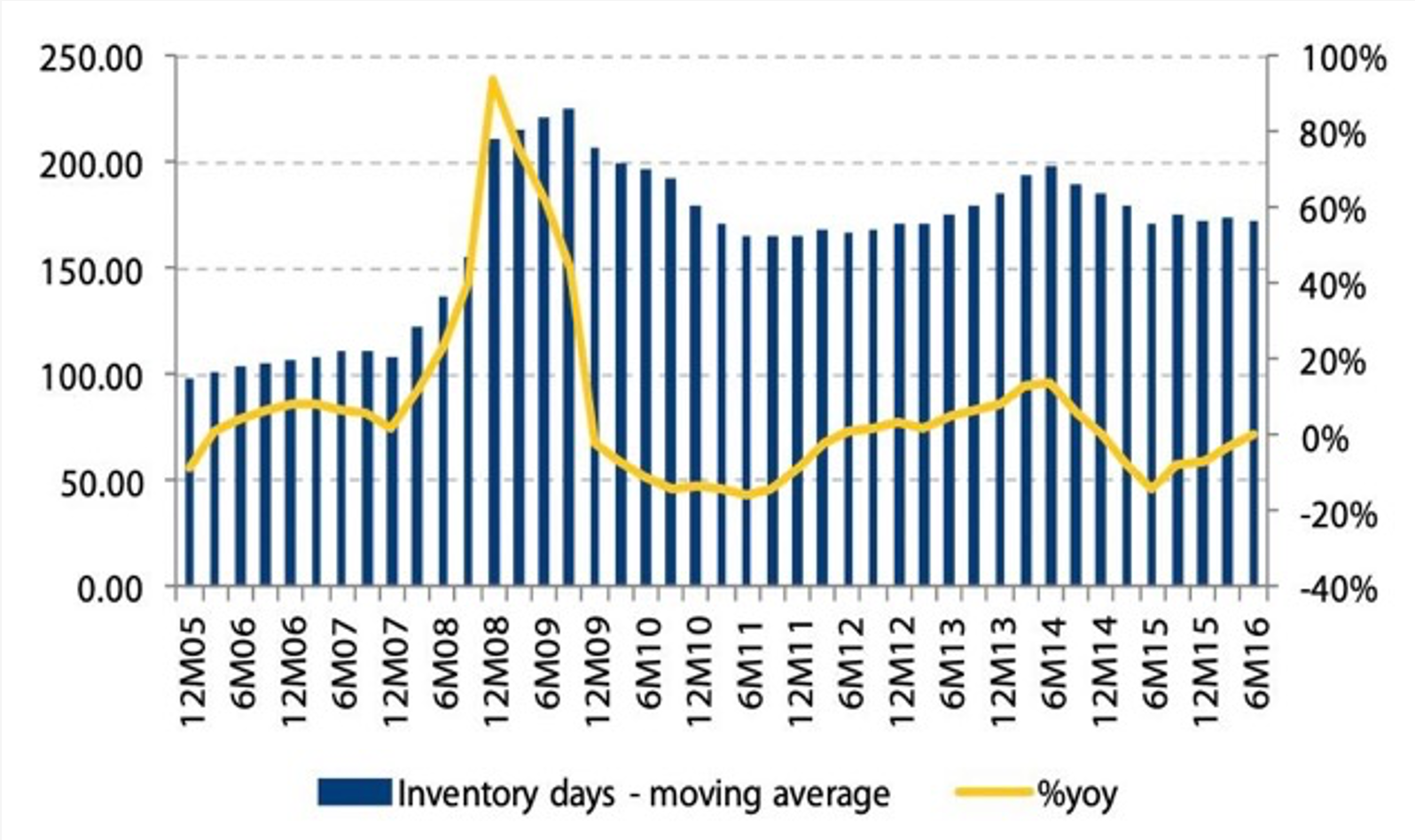

VP Sharma’s strength was securing great locations within Indonesia’s biggest shopping malls. He pushed the company to invest heavily in logistics to ensure that inventory levels were under control.

Indonesia’s retail sector benefits from protectionism. Foreign brands cannot easily operate their stores due to stringent regulations:

- Smaller stores with a floor area of less than 400 square meters must be 100% owned by local companies.

- Mid-sized stores between 400 and 2,000 square meters can only be 33-66% owned by foreign companies and require special licenses as well.

- Foreigners can indeed own larger stores above 2,000 square meters, but the availability of such stores within shopping malls is rare.

Therefore, foreign brands typically seek local partners, and ideally respectable ones such as Mitra Adiperkasa or Erajaya.

Mitra Adiperkasa was listed on what was then known as the Jakarta Stock Exchange in 2004. After the IPO, VP Sharma saw potential in the sportswear industry and decided to expand its store network within that niche, as well as sign distribution agreements with Nike, Reebok, and others.

During the 2008 financial crisis, Mitra Adiperkasa’s sportswear division ended up with excess inventory. It took years to digest, and the company had to employ heavy discounting to clear the inventory. Growth slowed, and Mitra’s brand partners were upset.

The problem had been a weak IT system and poor budgeting practices. While Mitra had an SAP system, it didn’t use it correctly across the organization.

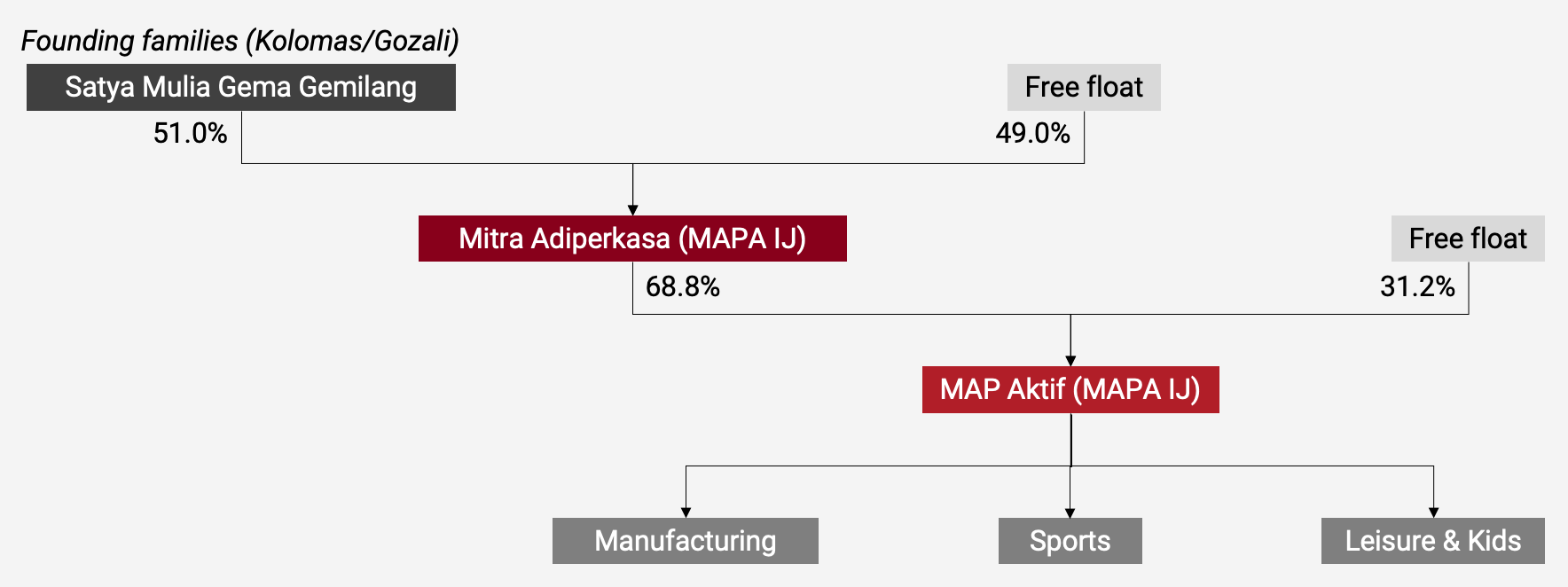

So in 2015, Mitra Adiperkasa brought in well-regarded private equity company CVC to help modernize its business practices. A new subsidiary, MAP Aktif, was carved out. This subsidiary then borrowed US$114 million from CVC through a loan that would ultimately result in a 30% equity stake in the event of an IPO.

CVC jumped into it and quickly helped the company modernize:

- Average store productivity improved by resizing stores and tailoring the product mix based on the store location

- Within the sportswear subsidiary, Mitra introduced private label products and obtained the licensing rights for Airwalk and Diadora, helping boost margins

- Mitra also outsourced logistics to third parties to save money and gain flexibility in its operations

- Parent Mitra Adiperkasa launched its first-ever loyalty program, “MAP Club”, improving customer loyalty and helping it understand its customers better

- Finally, CVC helped Mitra Adiperkasa launch an e-commerce site called MAPeMall, now rebranded as “MAP Club” and connected to the loyalty program

MAP Aktif eventually IPO’d on the Jakarta Stock Exchange in 2018, becoming a separately listed entity:

The IPO was a success. But after an initial run in the stock price, CVC sold down its 30% stake to just 7.5%. The market reacted negatively to the news. And then came COVID-19.

2. The original thesis

When I wrote my first in-depth analysis of MAP Aktif back in January 2020, the situation looked grim.

Indonesia had introduced large-scale social restrictions back in 2020, causing foot traffic to grind to a halt. MAP Aktif’s revenues dropped by 36% in a single year, and its profits evaporated. While the 2021 performance was better, Indonesia was still under lockdown.

But I felt that the underlying story was compelling. Indonesia had a sportswear retail selling space of only 1.3 square meters per 1,000 population. That compares favorably to China’s 10.1 and Singapore’s 11.5. So I felt that the company had a long runway of growth ahead of it.

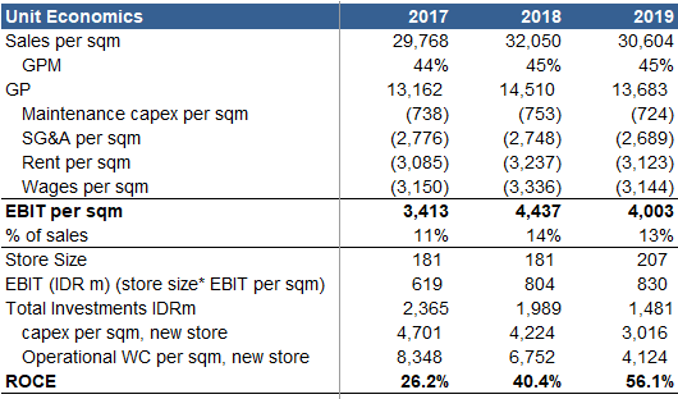

A Credit Suisse analysis of MAP Aktif’s store productivity confirmed strong unit economics. With a sales per square meter of IDR 31,000 and 13% operating margins, they calculated a return on capital employed of 56%, suggesting a payback period of less than 2 years:

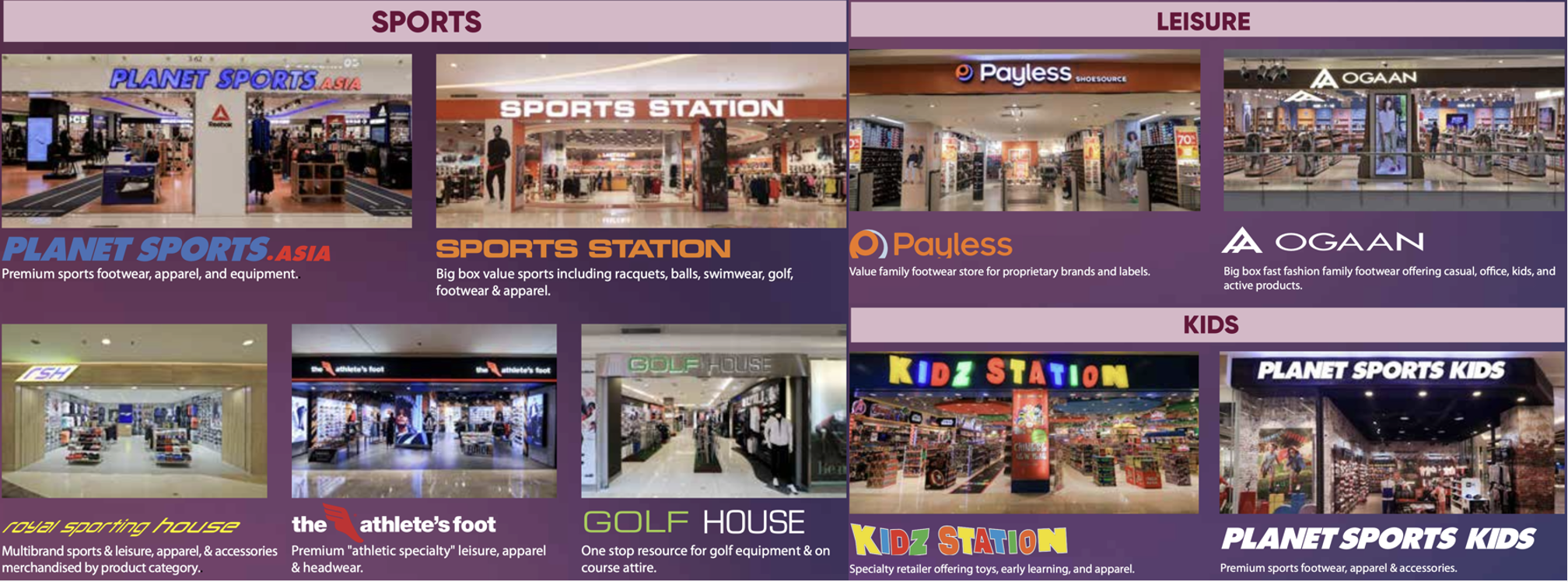

At the time, MAP Aktif had 1,121 stores across Indonesia. 70% of those were multi-brand stores such as the Sports Station, Planet Sports, Kidz Station and The Athlete’s Foot. The average reviews for these stores were 4.4 out of 5 on Google, so the customer feedback was positive, almost across the board.

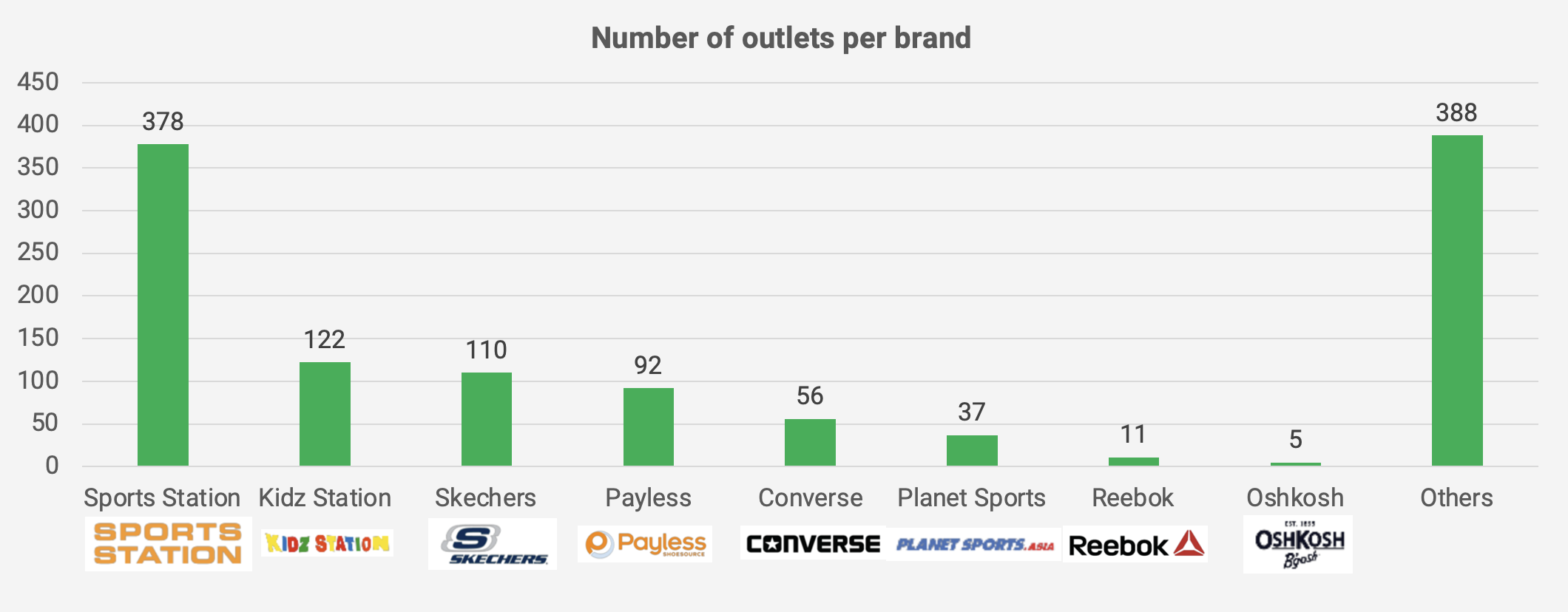

Out of these, “Sports Station” represented roughly 1/3 of the store count:

It was positioned as a mass-market brand, with prices significantly lower than at MAP Aktif’s other multi-brand store, “Planet Sports”.

More than 150 brands were sold in these stores, including Nike, Puma and Adidas. And roughly 40 of these were exclusive to MAP Aktif, meaning that no other retailer in Indonesia was allowed to carry them. The exclusive brand portfolio included Crocs, Ecco, New Balance, Taylor Made, Speedos, Reebok, Skechers, Oshkosh and Oakley.

Within MAP Aktif, the sportswear segment contributed to 83% of revenues. It also operated leisure shops for brands such as Birkenstock, Clarks, Onitsuka Tiger, and Dr Martens, with revenues from these shops contributing 9% of total revenues. Finally, it operated kids’ stores on behalf of brands such as Lego, Smiggle, and Crocs, contributing 8% of its revenues.

Before the COVID-19 pandemic, MAP Aktif had grown its store count by nearly 10% per year. By adding low-single-digit same-store sales, I felt that MAP Aktif could easily become a low-teens grower once Indonesia recovers from the COVID-19 pandemic.

MAP Aktif had also begun to expand overseas. Parent Mitra Adiperkasa had injected Planet Sports Philippines and its Thai business into MAP Aktif back in 2020. The company also had a presence in Vietnam. I saw particular upside in the Philippines, as the sportswear market there is almost as under-penetrated as in Indonesia.

I was also positive about MAP Aktif’s management team. Long-time Mitra Adiperkasa employee Michael Capper had helped MAP Aktif list on the Indonesia Stock Exchange, and then served as the CEO of the listed entity. I had a good impression of him, and liked that he had experience working for Reebok, Royal Sporting House and Dr Martens. He was also an avid runner, so I felt that he must empathize with MAP Aktif’s key customer base.

Assuming a recovery from the COVID-19 pandemic, I expected MAP Aktif to end up trading at a single-digit P/E, roughly half the pre-COVID average of 18x.

It wasn’t all rosy, however. I didn’t like the fact that MAP Aktif never paid out any dividends. I also saw a risk that e-commerce platforms such as Tokopedia and Shopee would erode MAP Aktif’s historical advantage as a necessary partner for foreign brands. Finally, there was a risk that French retailer Decathlon would eventually expand its business across Indonesia.

I usually don’t like investing in listed subsidiaries. The line between MAP Aktif and its parent, Mitra Adiperkasa, was fuzzy. They had a close relationship in terms of logistics, e-commerce and the loyalty program. I couldn’t rule out the risk of related party transactions at unfavorable terms.

Regardless of these risks, I still felt that MAP Aktif had a bright future ahead of it. COVID-19 wouldn’t last forever. With a strong balance sheet and support from its parent, I thought it would eventually emerge from the crisis even stronger than before.

3. MAP Aktif’s recovery

And indeed, that’s exactly what happened. After 2021, MAP Aktif staged a recovery that was far ahead of what I had expected. Its revenues are now more than double the pre-COVID level:

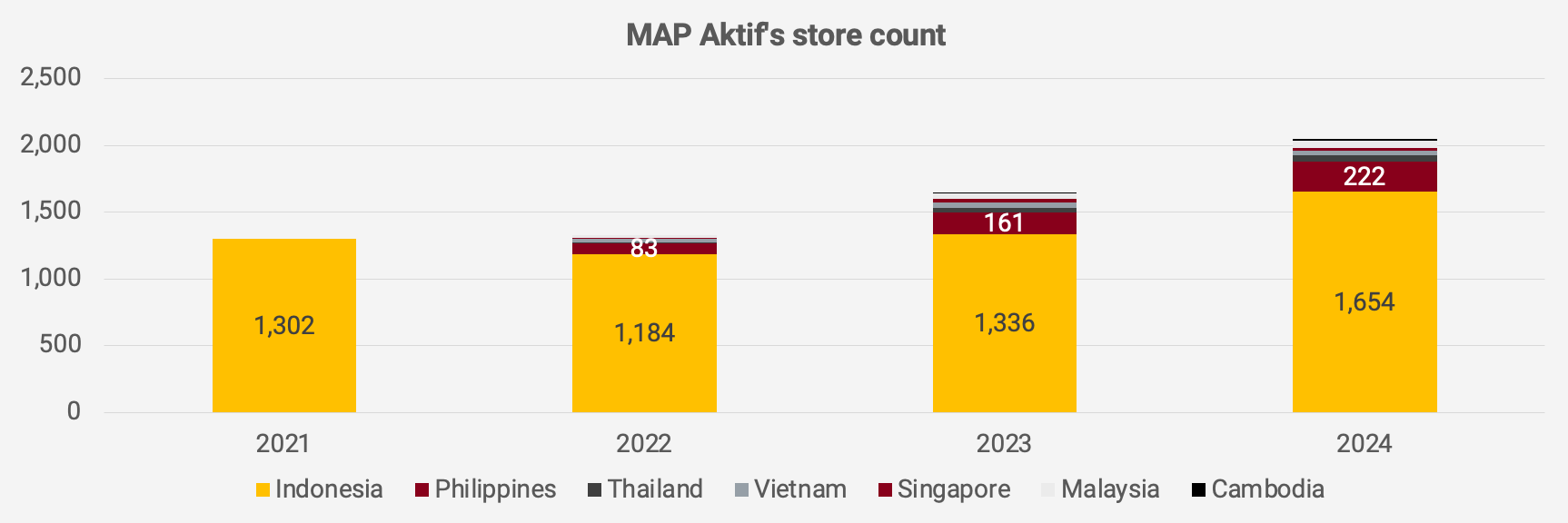

A rapid increase in the number of stores supported this explosive growth. Not just in Indonesia, but also in the Philippines and several other countries in the ASEAN region:

And the stock reacted strongly. From 2021 to 2024, the stock price quadrupled. However, the share price has subsequently declined by almost 40%: