Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Table of contents

1. Background & current focus

2. "Minority Report"

3. Typical investor mistakes

4. The Research Alpha Fund

5. Currency risks

6. Nigeria

7. Argentina

8. Sri Lanka

9. Top stock

10. Contact details1. Hi Michael! Thanks for participating. Can you tell us briefly about your background, including your experience living in Asia since the 1980s?

Thanks so much for having me on!

My journey in Asia began in 1985 as a Yale-China exchange student at the Chinese University of Hong Kong. I was 20 years old, and it was my first real experience outside the US. The approach into Kai Tak airport—so close that we could see what people were eating in their apartments—made me realize how different the world outside my Washington, D.C. suburb could be. It was a life-changing experience for me and my fellow exchange students.

After finishing my undergraduate degree, I worked for Chase Manhattan in New York. My friends who stayed in Asia seemed to be doing well and having more fun, so I saved up $1,000, bought a one-way ticket for $400, and returned to Hong Kong with $600 and no credit card debt. It was the start of the first emerging market boom, and firms were looking for native English speakers to write company research. I hustled to get a job at Crosby Securities as a sell-side analyst.

My first assignment in 1989 was covering the Tiananmen protests. I thought I’d be out of work when China virtually closed after that. Luckily, the Indonesian stock market opened that summer, and I was sent to check out stocks in Jakarta.

From there, I helped Crosby enter markets opening to foreign investors: Pakistan, India, Sri Lanka, and China. To get up to speed on these, I tracked who owned what and mapped the connections between business families and the government. This turned into several longish reports, a lifelong passion, and now forms the basis of my investment methodology

2. Your blog “Minority Report” is one of my favorites of all time. Tell us what the blog is about? Which posts are you the most proud of, and which posts would you recommend us to read?

Thank you for your compliment!

I haven’t posted much since starting the fund, but much of my investment thinking – and other stuff - can be found there. As a sell-side analyst I got used to expressing my opinion, so I suppose I wanted to make some of my non-consensus views public. I also started it out of frustration with the repetitive, negative, and sensationalist tone typical of today’s financial press.

I recommend the post on corporate structure as the first stop for investors. It’s probably the most boring, but also the most important, IMHO. It describes why it’s important to look at the controlling shareholders’ entire holdings to determine the potential for them to take cash out of the company to the detriment of minority shareholders. Not many do this, but I think it’s vital to understand.

The second recommendation is a long-term comparison between two Indonesian business groups. Coming out of the 1997-2021 Asian financial crisis, one returned more than 200x, while the other group’s listcos were nearly flat. Researching and writing this greatly influenced the type of investing I do today. It highlights the importance of long-term thinking and choosing companies with a quality history and pedigree.

The most enjoyable post to write compares investing to music styles. Time permitting, I check out local music acts and clubs and visit vinyl and CD shops when I travel. Streaming makes discovering new music more accessible than ever, but nothing beats seeing a local act in their hometown or getting good recommendations from someone who knows the local scene.

3. What mistakes do you think inexperienced investors in emerging markets typically make? And what do the pros do better?

I think that both the pros and inexperienced investors make the same mistakes. Far too many treat them like a single, homogenous basket, when each country is unique. Some will break out larger markets like China, India, and Brazil, but very few look deeper and consider places like Indonesia and Turkey on their own merits. Treating each country on a standalone basis is a source of potential alpha, as few seem to be doing this.

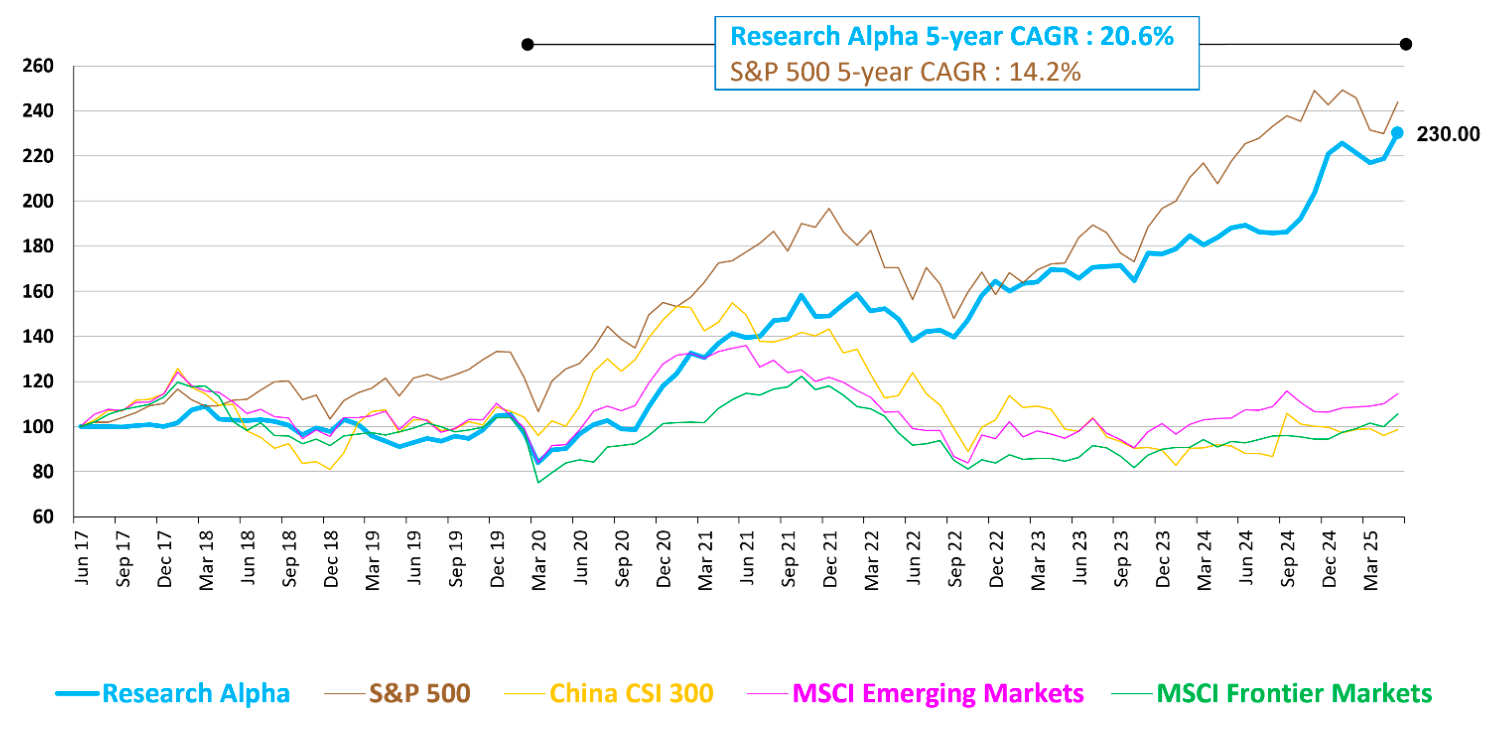

4. Can you tell us about your fund, “Research Alpha”, and the strategy you’ve employed to create a +130% return since its inception (despite a strong USD)? What is your “Trifecta Approach”?

Research Alpha is a long-only absolute return fund launched in 2017 at Fusion Wealth Management in Hong Kong. Our “Trifecta Approach” focuses on people, structure, and value. We look for companies controlled and managed by quality people, have corporate structures that align minority and majority shareholder interests, and buy at valuations that look like generational lows. Many times, these occur during a financial crisis. Our research focus on business groups allows us to quickly get up to speed on a new market to take advantage of these dislocations.

First is people. Management and quality owners are probably the most essential aspects of any business. Major decisions, particularly those regarding capital and resource allocation, are made by those at the top.

However, the people behind listed companies are not well-researched. The sell-side can’t do it as they don’t want to tick off corporate finance clients. And most of the buy side is just looking at the numbers, programming an algorithm, or hugging an index.

Few look critically at the controlling shareholders, which is another good source of alpha, hence our fund’s name, “Research Alpha.”

We ask ourselves questions such as: Are the controlling shareholders good or bad stewards of the company? Do they respect minority shareholder interests, and what’s their track record? Is the company their primary focus, or are they doing other things and not that focused on the listed company? Is their reputation good enough to attract and retain top talent?

Second is structure. We are very sensitive to the possibility of controlling shareholders extracting cash or something of value from listed companies to the detriment of minority investors. Like our deep dive into people, corporate structure is another thing few look at, but it is core to our investment philosophy and another source of ‘Research Alpha.’

Outside the US, listed companies are often majority-owned and controlled by large families, conglomerates, or business groups. It may be just one of their many assets, so their attention and resources could be focused elsewhere.

There’s also the strong possibility that the controlling family will transfer profits and cash from the listed company into their 100% owned and controlled entities. This is stealing from minority shareholders. It is easy to do and tough to prove. For instance, a listed candy company may buy packaging material from the controlling family’s wholly owned packaging company. By controlling both, the family can raise the packaging price to shift cash from the listed company, where they own, say, 30-50%, to their wholly owned entity.

Third is value. We like to buy at what appear to be generationally low prices. We do this by investing when and where there’s a financial crisis or significant devaluation. This mostly leads us to emerging and frontier markets simply because they’ve been out of favor since we started the fund, we have lots of experience researching and investing in them, and there are more of them.

MSCI says there are 23 developed markets. Our database tracks nearly 100 markets, so there are roughly three emerging or frontier markets for every developed one. And there are many markets that our database doesn’t include, such as Uzbekistan’s Republican Stock Exchange and several secondary boards, such as those in Nigeria, Egypt, and Pakistan.

We measure value using longer-term indicators such as CAPE or its dividend yield, price to sales, and EV/EBITDA equivalents. These are used for both the overall market and individual stocks and are very helpful during a financial crisis to help us determine long-term value when others see nothing but losses.

Another point is that, during a crisis, almost all stocks are good value. This allows us to concentrate on our quality metrics of people and value.

We then hold for a long time, reinvest our dividends, and let compounding do its magic.

5. How do you think about currency risk? How does FX exposure play into your investment decisions?

Invert, always invert.

We try to take advantage of currency volatility by buying after a big devaluation. It’s the significant currency depreciation combined with a meltdown in equity prices that typically makes us interested in a market.

At the end of the day, local prices, and by extension earnings and asset prices, tend to change in response to currency changes. Energy and technology are priced in USD and are so crucial to a modern economy that prices need to adjust to the USD rate at some point. If they don’t — usually due to bad policies — standards of living drop and politicians/leaders face pressure to make changes.

6. You’ve previously mentioned that Nigeria currently offers “the world’s best equity set-up”. How do you expect the future to play out for Nigerian equities?

While leaders like Milei in Argentina get more press, Nigeria’s reforms are just as significant.

Nigeria today reminds me of Indonesia after the Asian Financial Crisis: it’s also a big and diverse country, equities are very inexpensive, few investors are paying attention, but fundamental reforms are underway that should benefit the country long-term.

Since President Tinubu was inaugurated about two years ago, Nigeria has seen far-reaching reforms, including freeing the currency, ending petrol subsidies, and deregulating electricity generation and distribution. There are others but just these three are a developmental economist’s wet-dream.

More recently, leadership at the large state-owned petroleum company was replaced with directors who have relevant private sector experience. Like many state-owned oil companies, it’s rumored to be very corrupt and with new leadership, there’s a chance it can be improved.

There’s also the launch of the massive Dangote refinery, which should end the FX draining practice of exporting crude and importing refined products. It’s big enough to supply all West Africa so the country could start exporting refined products very soon. There’s a reason Aliko Dangote is the richest person in Africa, and I have no doubt that he’s an inspiration to younger Nigerians.

Listed companies and the market are reacting to the reforms. After several years of slowing and negative earnings, firms are regaining pricing power and income statements are starting to reflect this. Nigeria’s All Share index is up nearly 18% so far this year despite weak oil prices, Nigeria’s largest export.

Local and foreign investors are becoming more active. Foreigners accounted for 32% of turnover in the first four months of the year, nearly triple last year’s participation rate.

Finally, one can find very good value there with most companies trading below 10x earnings. Despite rising prices, most stocks are still 70-90% below their all-time USD highs. Our favorite NBFI (non-bank financial institution) is trading at some 3x earnings, has a 5% dividend yield, and is down nearly 70% from its 2008 USD high price.

Readers should bear in mind that we’ve been invested in Nigeria since the fund started and it’s been our biggest drag on performance. Thankfully we’re now starting to see the light with many of our shares doubling or more in the last 6-12 months. But doubling after 8 years is not a great return. This is a 9% gross CAGR which gets whittled down after all the fees and expenses are included.

7. I’m curious to hear your thoughts on Argentina. What reforms have Javier Milei undertaken and how has the economy responded to those reforms?

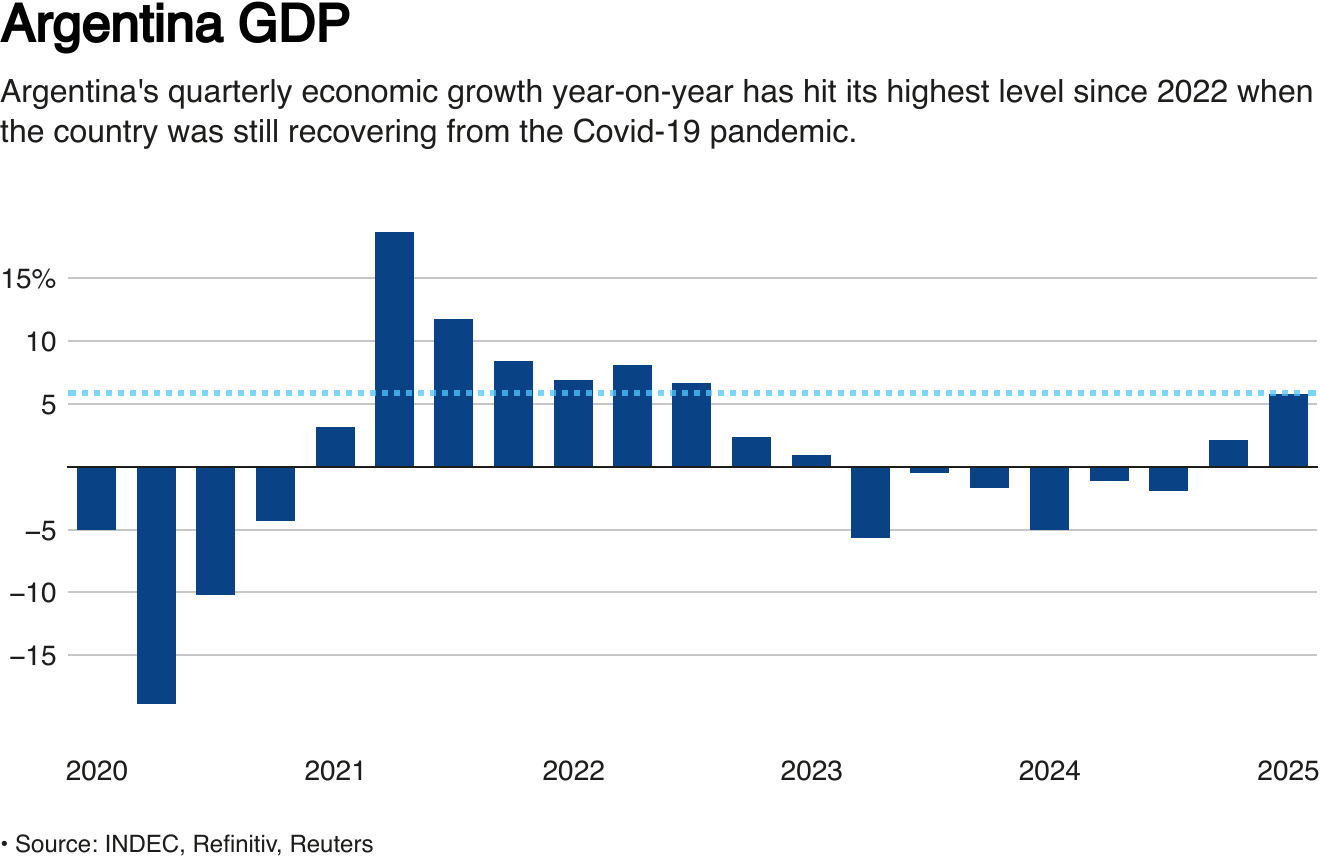

The reforms in Argentina have been dramatic and fast-paced. Since taking office in December 2023, the Milei administration has implemented sweeping reforms, including fiscal austerity, massive deregulation, privatization of state companies, and strict monetary policies to curb inflation.

As a result, Argentina recently posted its first fiscal surplus in over a decade, inflation has gone down from over 20% per month to 1.5%, and foreign reserves have increased. In April, after nearly six years, strict currency controls were lifted. The economy is expected to rebound to 5.5% growth this year and about 4.5% in 2026.

Milei’s approval rating, at around 45%, is the highest ever for an Argentine president at this stage in an election cycle, and his party is expected to perform well in October’s mid-term elections. This means that the current pro-business government may be in a position to solidify and strengthen the reforms.

We’ve been invested in Argentina since its last meltdown in 2019 and have done well, with our six-stock portfolio up about 6x.

8. Can you speak about the changes that are taking place in Sri Lanka, and what companies you think are well-placed to benefit from it?

Ironically, Sri Lankan equities were amongst the best performers in the last 12 months because of less change than most expected. They initially fell until just before the first post-Rajapaksa elections took place last September. The market was spooked because the leading candidate and eventual winner, Anura Kumara Dissanayake, has a far-left Marxist-Leninist-Communist background.

Better known by his initials, AKD campaigned on an anti-corruption platform and publicly acknowledged the vital role of private business and entrepreneurs, so he’s certainly not your typical communist.

It's the first genuinely new government since independence 76 years ago, and it looks like they’re sticking to their campaign promises. Feedback from a recent trip to Colombo was very positive. Several noted that petty corruption in Colombo is now rare. Officials are not asking for bribes to get things done, and police can’t be paid to look the other way for traffic violations. Businesspeople I met – even those who didn’t vote for him – believe he’s the best person for the job.

The positive vibes are backed by good economic news. Business confidence is at a 10-year high, last year’s 5% GDP growth was the highest in seven years, tourist numbers continue to increase, and, after five years, per capita income is back above USD4,000.

However, I’m not entirely impressed. The privatization program has been delayed or canceled, and the government still has a heavy hand in the economy. Energy prices are set monthly for the whole country, regional pricing on consumer products is restricted, and the government sets minimum hotel rates for foreigners which can be up to double what locals pay.

Despite these challenges, Sri Lankan equities are still good value with many quality companies trading at between 5-10 earnings.

9. Finally, if you had to put all your family wealth in a single stock in Asia Pacific and keep it for 10 years, which would it be and why?

That’s a tough one. Given the solid growth rates and changes in our markets I wouldn’t put all my eggs in one basket. Growth means change, and it's possible that things that look good today may not look so good in one or two years, much less than ten.

While Nigeria currently has better value than any Asian market, Sri Lanka and Pakistan both look attractive. Both have increased from what I think are crisis-level valuations but are still good value.

The rise of the consumer and higher purchasing power is a good place to invest. In Sri Lanka we like consumer and pharmaceutical companies like Hemas Holdings and Sunshine Holdings. Wood coatings producer JAT Holdings could be a good long-term bet. In Pakistan Lucky Cement looks to be good value. In addition to cement, it assembles Samsung phones and Kia cars and has a majority stake in one of the country’s largest fertilizer and chemical businesses. They allocate capital very well. We also like Indus Motors, which has the Toyota business in Pakistan.

Closer to home, Hong Kong stocks are all over my value screens, with many trading at very attractive valuations. Also, select counters in SE Asia are also looking very good. They are not at the widespread blood-in-the-streets valuations that generally occur during a financial crisis, but there are some very enticing situations, as you continue to highlight in the excellent Asian Century Stocks Substack.

10. How can people contact you or follow what you do at Fusion Wealth Management?

People can follow me on X (formerly Twitter) @MichaelMcGaughy, or connect with me on LinkedIn. My blog can be found here.

I’m always happy to connect with fellow investors and music lovers interested in off-the-beaten-path ideas.

Thanks for reading Asian Century Stocks.

Consider becoming a subscriber! You’ll get 20x high-quality deep-dives per year, thematic reports and full portfolio disclosure — all for the price of a few weekly cappuccinos: