Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- This write-up is about Hikari Tsushin — a Japanese sales organization run by a visionary founder called Yasumitsu Shigeta

- It’s been much talked about on Twitter and Substack, but few of the write-ups discuss Hikari Tsushin’s portfolio of publicly listed equities

- I am personally not particularly interested in Hikari Tsushin itself, as it is primarily a sales organization helping other businesses find customers

- But what I am impressed by is Hikari Tsushin’s capital allocation and investing discipline. You’ll find them on the shareholder register of some of Japan’s best-performing small caps.

- In this post, I identify 218 publicly listed Japanese companies where Hikari Tsushin is a 5% or larger shareholder. These companies are small, but often undervalued, and growing.

- In the past week, I’ve gone through this entire list and narrowed it down to ten companies that I think warrant further attention. It includes larger companies such as Daito Trust but also SaaS companies like Broadleaf.

In this post, I go through Hikari Tsushin’s history, its current valuation, its investment portfolio and ten holdings that I think warrant greater attention.

Table of contents

1. The company's background

2. Hikari Tsushin as an investment

3. The current portfolio

4. Ten Hikari stocks on my watch list

5. Conclusion1. The company's background

Japanese compounder stock Hikari Tsushin (9435 JP — US$13 billion) has been the subject of much discussion on Twitter.

Some people call it the “Berkshire of Japan”. Many find it encouraging to see a Japanese company that finally understands capital allocation. I am not sure I’d go that far, but the company is certainly worth a deeper look.

Hikari Tsushin was set up by an entrepreneur called Yasumitsu Shigeta back in 1988. He had just dropped out of college and was looking to make money fast. So he teamed up with a few friends to sell office phones door-to-door across Tokyo.

He chose the name “Hikari Tsushin”, meaning “light communication” in Japanese. At the time, Japan had just deregulated the telecom industry, so it was a market ripe for disruption. It terminated the monopoly that NTT had once had and allowed companies like Hikari to start selling telecom products to the general public.

The company was a sales organization from the start. Yasumitsu Shigeta hired young and hungry individuals eager to make a mark on the world, paying them nothing but commission and encouraging them to use hard sales tactics.

From 1993 onwards, Hikari Tsushin added mobile contracts to the mix, and growth took off like a rocket. By the late 1990s, it had set up 1,500 phone shops across Japan, becoming an Internet darling just a few years after its IPO.

At the peak of the Dotcom bubble, Yasumitsu Shigeta became one of Japan’s richest men. Investors competed with each other to figure out how big an impact the Internet could eventually have on our society.

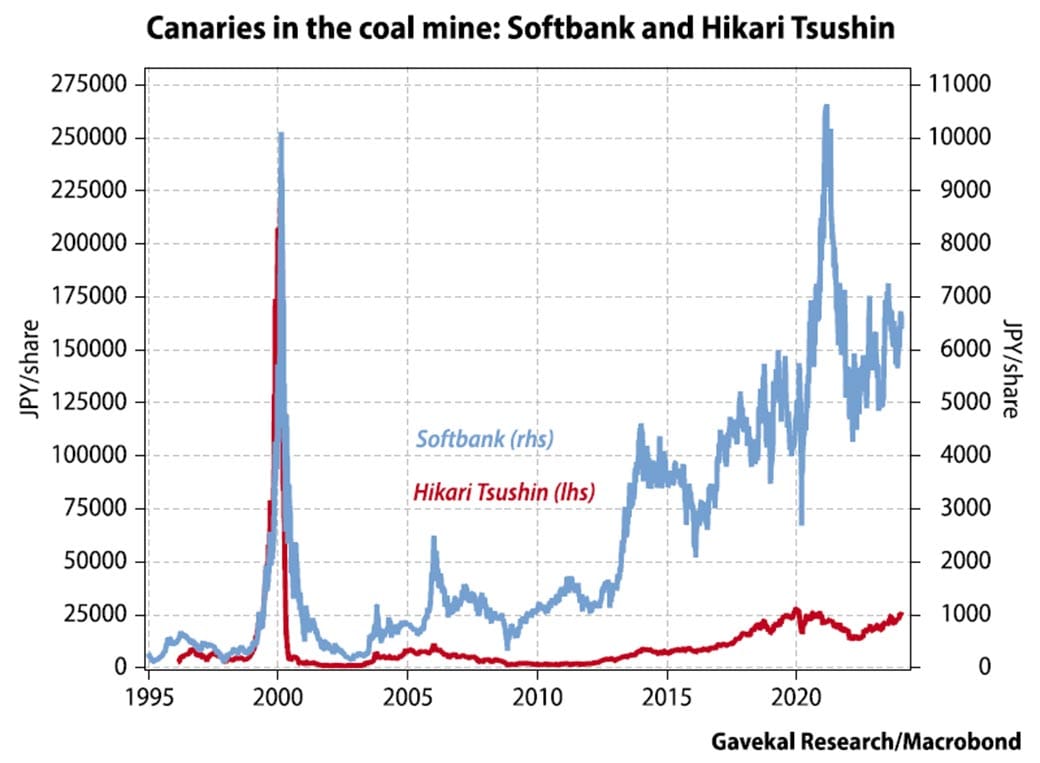

And it all came crashing down. In the late 1990s, Hikari had increasingly turned to aggressive accounting to spur growth. For example, it had sold mobile phone contracts and booked all revenues on day one. It had fabricated contracts with the predecessor of Telecom company KDDI. Finally, Hikari had stuffed franchisee stores with inventory to boost quarterly revenue numbers.

The original guidance of JPY 6 billion in profit for the year 2000 turned into a loss of JPY 13 billion. In just six weeks, the stock price had lost 96% of its value. Shareholder lawsuits continued for years, and Hikari Tsushin’s reputation was shattered.

Part of the blame could surely be put on the company’s high-pressure sales tactics. Shigeta had hired high school graduates without career prospects and asked them to achieve his vision no matter what. The sales staff were likened to “street fighters”, doing whatever it takes to close deals.

After the crash, Shigeta sat down with his lieutenants to try to reimagine the business. He expanded beyond telecom into office suppliers to small- and medium-sized enterprises. The focus was now on recurring revenue business — anything that would make earnings stable and predictable.

However, the street fighter mentality remains. If you survive Hikari Tsushin’s Darwinian environment, you can achieve anything. The high-pressure sales model remains, often helping other companies sell products door-to-door. The sales tactics employed by Hikari Tsushin work, and despite the post-1999 crash, the company survived and has continued to thrive to this day.

2. Hikari Tsushin as an investment

In 2025, Hikari Tsushin continues to be a sales organization, with great success. It employs 20,000 people selling electricity and gas, telecom products, mineral water, insurance, office equipment and more. The contracts are long-term in nature, with 80% of revenue considered recurring. And the business throws off huge amounts of cash, which is then reinvested into stocks.

In the past few years, I’ve written about a large number of Japanese small caps. I’ve often been surprised to find Hikari Tsushin in the shareholder register, across niche businesses such as pet insurance company Anicom and SaaS company Poper. They clearly know what they’re doing.

Yasumitsu Shigeta has now stepped down, but CEO Hideaki Wada has similar views on investing and capital allocation. Jake Barfield’s interview with Wada was among the most refreshing I’ve ever heard in my life. Finally, someone who gets it!

Hideaki Wada and Yasumitsu Shigeta see capitalism as the answer to Japan’s troubles. They think that a lack of understanding of capital allocation is the reason why Japan, as a market, has been underperforming. Companies have been unable to lay off employees. CEOs do not need to take shareholder interests into account to retain their jobs.

At the same time, that spells opportunity for Hikari Tsushin itself. It’s able to buy stakes in high-quality companies cheaply, and then guide them in the right direction. In their main businesses, they strive for a 30% internal rate of return over a five-year period. And the equity portfolio has compounded at 17% per year over the past seven years, far above TOPIX. And they’ve been able to employ leverage, juicing returns further.

I’m not that interested in Hikari Tsushin itself. It does look undervalued, with the company quoting an intrinsic value of JPY 56,000 — far above the current share price of JPY 42,000. In its presentation materials, it reports look-through earnings on its investment portfolio of JPY 115 billion, which, along with core earnings, leads to total look-through earnings of JPY 193 billion.

Compared with Hikari Tsushin’s total market cap of JPY 1.8 trillion, you can therefore see the stock as trading at an adjusted P/E of 9x.

That said, I wonder how much of a “moat” Hikari Tsushin has when it comes to its main businesses. Why don’t power companies sell electricity themselves? Or why do companies making mineral water not sell the water themselves? One Yahoo message board user commented that other companies use Hikari Tsushin to employ high-pressure sales tactics on their behalf, with the company taking the hit if there’s ever any reputational damage from these types of activities. Someone else likened the sales model to multi-level marketing schemes. I have read Cialdini’s books, so I can imagine what tactics they refer to.

So my research into Hikari Tsushin itself has made me less keen on the company itself, and more keen on its investment portfolio. If they can achieve a +17% internal rate of return over time, then we should be able to copy their approach and achieve similar — if not better — results.

3. The current portfolio

To that end, I’ve gone to great lengths trying to identify Hikari Tsushin’s current investment portfolio. Its stocks carry the following characteristics:

- Recurring revenues and consistently rising profitability

- Strong balance sheets that can endure crises

- Smaller, and sometimes illiquid companies

- Earnings yields of 15% or higher

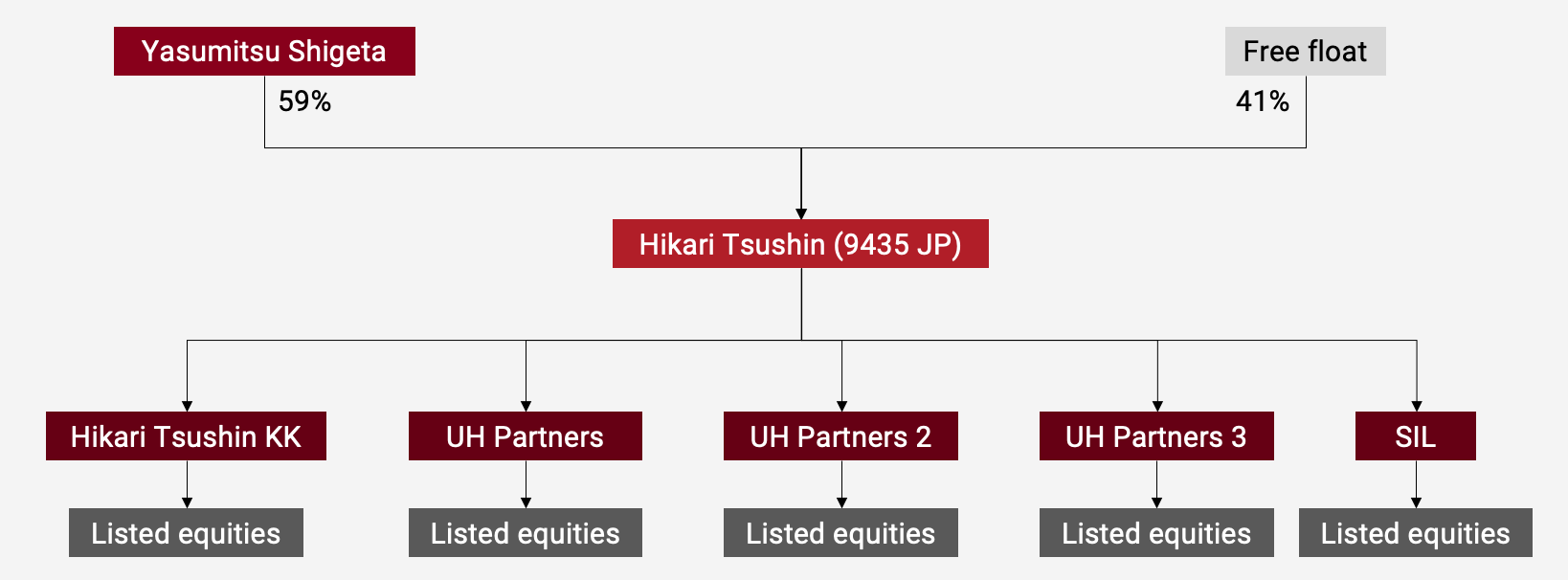

Its investment activities are mostly done through key subsidiaries “Hikari Tsushin KK” and “UH Partners 2”:

If you go through Hikari Tsushin’s investor relations materials, you won’t find the full list. But luckily, Japanese securities law requires companies accumulating 5% stakes to disclose that information within five days.

This information ends up on EDINET — the “electronic disclosures for investors network”. But to make it easier for myself, I’ve instead used the website IRBank.net to download the data for each of Hikari Tsushin’s subsidiaries. And by triangulating, I ended up with a list of 219 Japanese publicly listed stocks currently owned by Hikari Tsushin.

Other than the recurring nature of their revenues, there is no common denominator. The stocks are in industries as varied as industrials, distribution, financials, software, consumer and more. Here is the entire spreadsheet, with the stocks listed from the highest market cap to the lowest: