Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- Thailand is a medium-sized country in Southeast Asia, dependent on tourism, manufacturing and the export of agricultural goods.

- It’s been one of the worst-performing stock markets over the past year, partly due to weak credit growth that’s led to persistent selling of local equities.

- In this post, I run through a number of screens, and then propose 25 Thai companies with “hidden champion” characteristics, i.e. monopoly-like businesses with strong competitive advantages.

Asian Century Stocks reader “William” asked a few weeks ago whether I could write about “hidden champions” in Thailand.

Thailand has been among the worst-performing stock markets globally in the past year, partly due to restrictive monetary policy. But it’s also a fascinating market with hundreds of high-quality businesses.

So in this post, I’ll dig into companies that Hermann Simon might have considered to be hidden champions. Such companies dominate their niches and are able to compound their capital at a high return on equity. This post follows similar write-ups on hidden champions in Malaysia, Taiwan, Indian ADRs/GDRs, Chinese ADRs, Hong Kong and Singapore.

Note that I pay zero attention to share prices. Don’t take the following discussion as investment advice — I’m simply trying to identify hidden champions. Nothing more, nothing less.

Table of contents:

1. A top-down view of Thailand

2. Screening for candidates

3. Hidden champions of Thailand

4. Conclusion1. A top-down view of Thailand

Before we dig into it, let’s talk about the country and its stock market. The country has a population of 72 million and sits between Myanmar, Cambodia, Laos and Malaysia.

It’s one of the very few countries in Southeast Asia that was never colonized by foreign powers. Instead, it’s maintained its independence throughout, allowing foreign businessmen to trade on its soil through much of history without impacting governance.

During the Second World War, the Thai government sided with Japan and declared war against the Allies. And after the war, it spent years paying reparations, before eventually forming a relationship with the United States and pushing a more pro-market agenda.

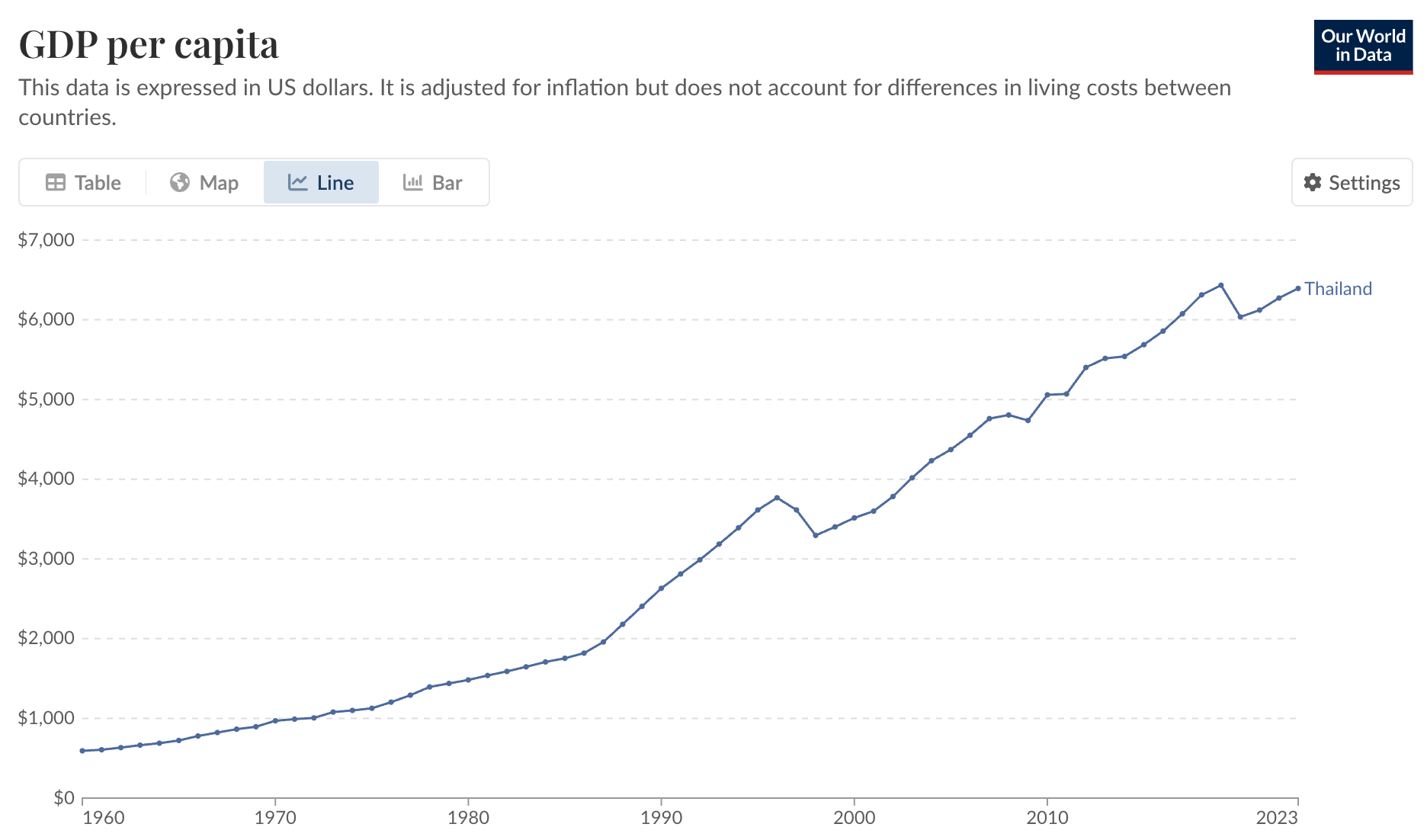

So while the economy was mostly state-led after the war, it shifted towards export promotion from the 1960s onwards, with GDP per capita growing rapidly thereafter:

A significant event for Thailand was the Plaza Accord in 1985, which caused the Japanese Yen to be revalued upwards. Since the Thai Baht was more or less pegged to the US Dollar, it became very cheap compared to the Yen. And in the next decade, droves of Japanese companies outsourced manufacturing to Thailand. This caused a boom that lasted for well over a decade.

However, while the boom initially stimulated foreign direct investment, it ended up pushing market prices too. And in the process, Thai companies built up significant external debt, hoping that the currency would be a one-way bet.

When portfolio flows reversed in 1997, the government was unable to defend its currency peg, and the Baht dropped from THB 25 to the US Dollar to 56. A severe recession followed.

Another important event in Thailand’s history was the election of Thaksin Shinawatra in 2001. He was a businessman who had entered Thai politics in the mid-1990s. He quickly won the hearts of the Thai people through populist policies that promised cash handouts to rural and lower-income voters. But the economy grew fast under his tenure, before being ousted by the military junta in 2006.

And that’s been a recurring theme since 2006. Thai politics has been a back-and-forth between the Thaksin family and the military reasserting power, over and over again. For example, Thaksin’s sister Yingluck Shinawatra took over as Prime Minister in 2011 before being ousted by the military in 2014. And now, the military has changed the constitution in such a way that it has the ability to veto any future prime minister.

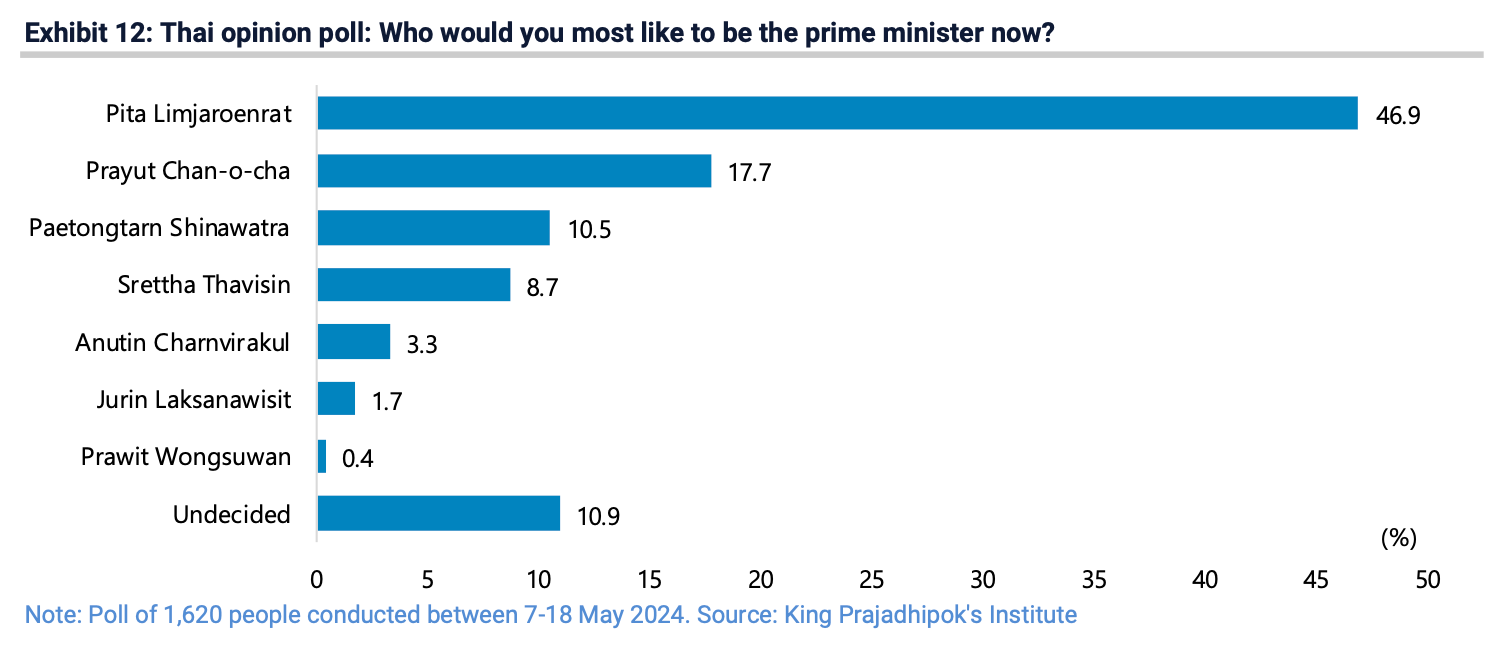

A case in point: In 2023, a young Harvard-educated former businessman called Pita Limjaroenrat enjoyed immense success in the general election. His new Move Forward Party received 36% of the votes, and his coalition controlled 313 seats in the 500-member House of Representatives.

But because the military controlled the Senate, they were able to block him from becoming Prime Minister. And his Move Forward Party has been dissolved by the Constitutional Court, and its executives banned from politics for 10 years. Pita continues to be popular among the Thai people, but there is no way for him to re-enter politics.

Instead, Thaksin’s daughter Paetongtarn Shinawatra became Prime Minister in August 2024. Earlier this year, however, an audio clip emerged in which Paetongtarn was found to criticise the Thai military. So the Thaksin family was pushed out of politics, yet again.

So the Thai military continues to be in control of the country. It’s allied with the royal family and establishment businessmen. Pita Limjaroenrat had promised to break up monopolies. He therefore faced significant opposition from the establishment.

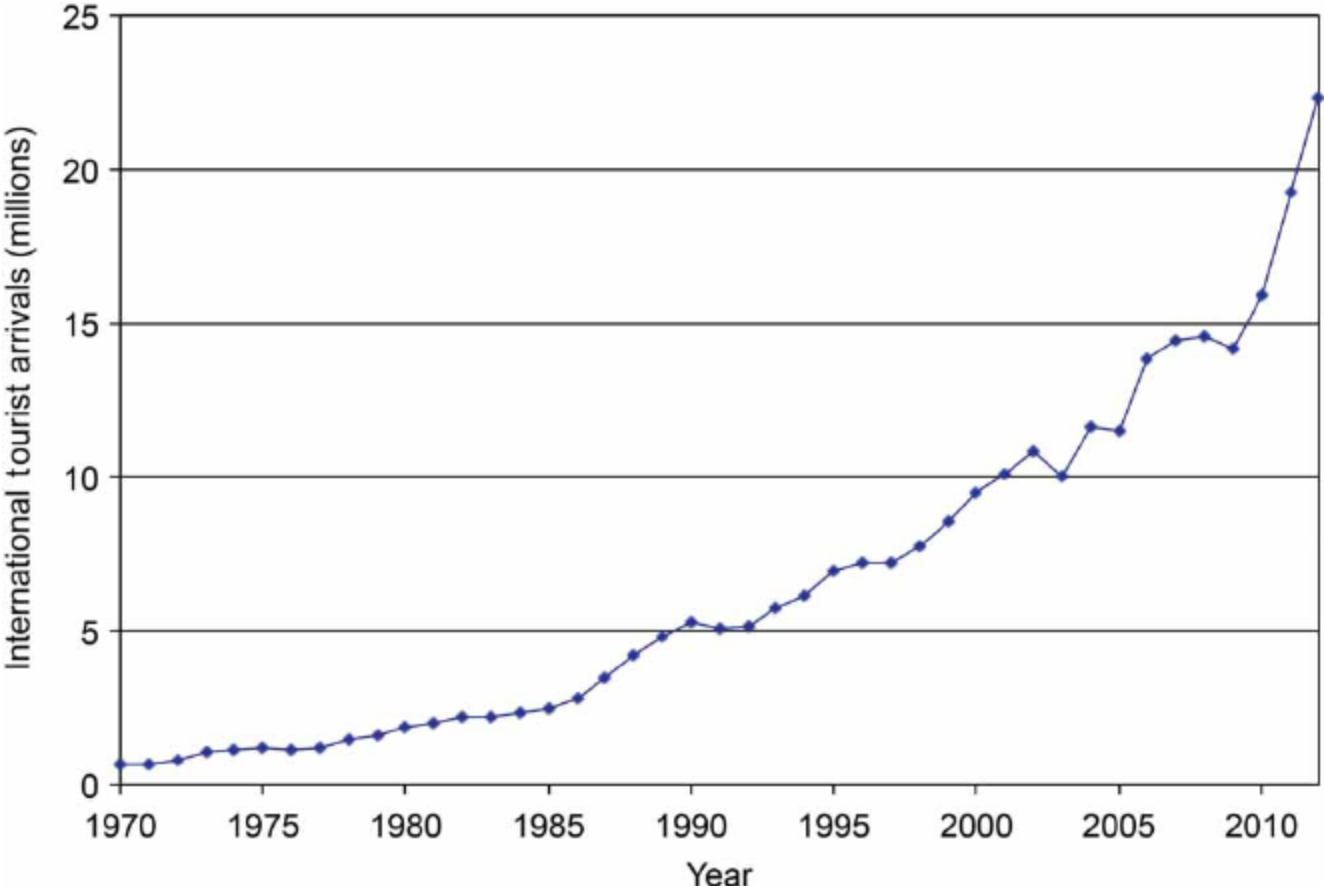

Throughout this political turbulence, the Thai economy ticked along as usual, with no major impact on either tourism or trade. Today, the economy relies on a mix of agriculture, tourism, and manufacturing across electronics, autos, machinery, and more.

Thailand’s income inequality is the third highest in the world, trailing just Russia and India. Half of the population are farmers, selling rice, coconut, corn, rubber, soybeans, etc. And the rest of the population is in a mix of the service sector and industry. It’s a deeply divided society controlled by an elite that also dominates many of the publicly listed companies.

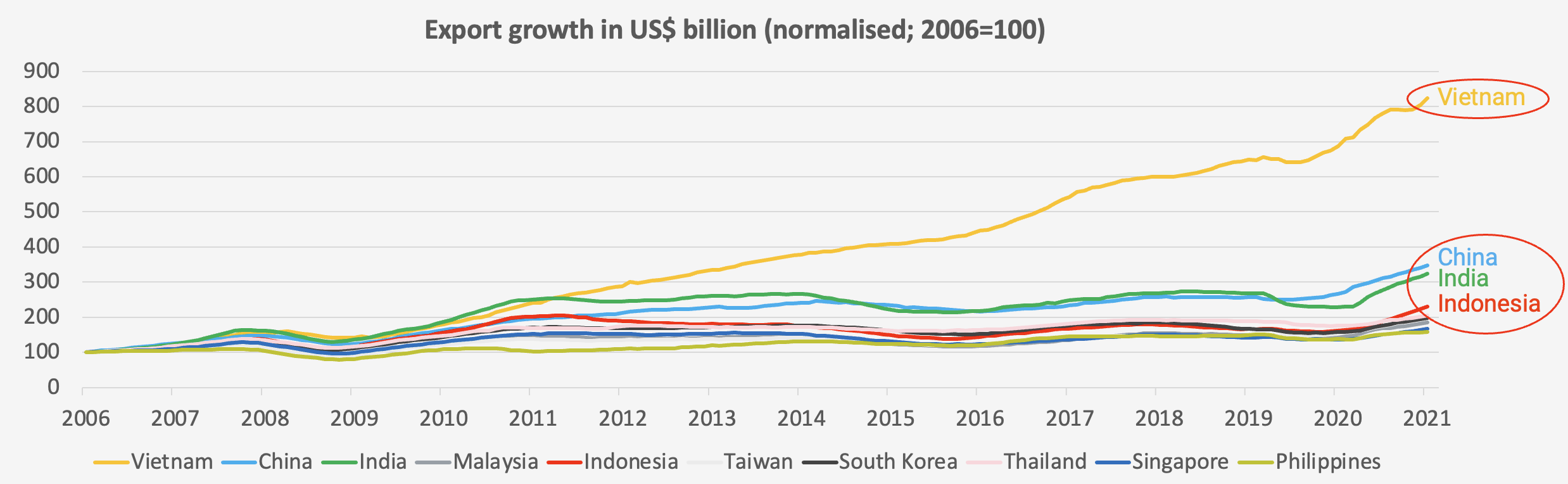

In recent years, growth has been somewhat sluggish due to manufacturing salaries that remain higher than those in nearby Vietnam. That’s why Vietnam continues to gain market share in global manufacturing.

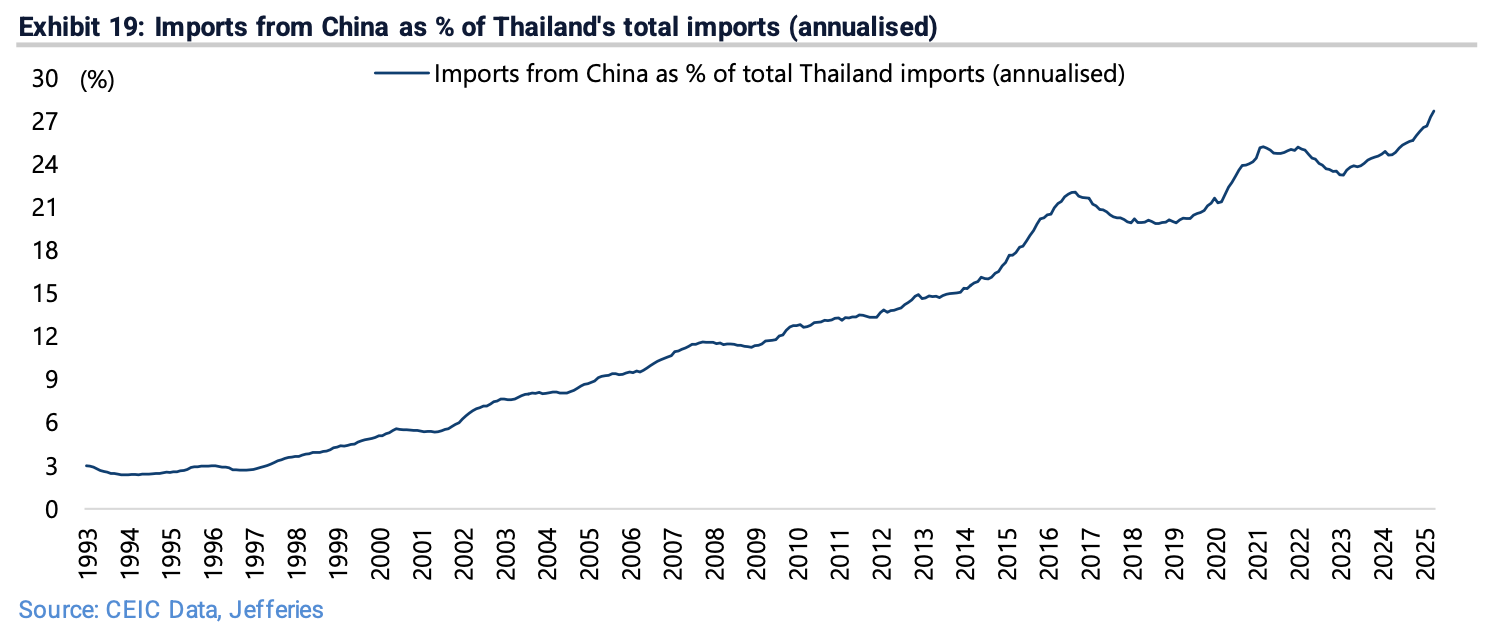

Thailand became wealthier from the 1960s to the 1990s. This growth journey caused it to become dominant in several industries that were hot at the time, including hard-disk drives and the assembly of Japanese vehicles. But in these two instances, they’re now facing competition from solid-state drives from South Korea and electric vehicles from China. Thai industry is now facing an onslaught of competition, and it doesn’t look like the situation is changing anytime soon.

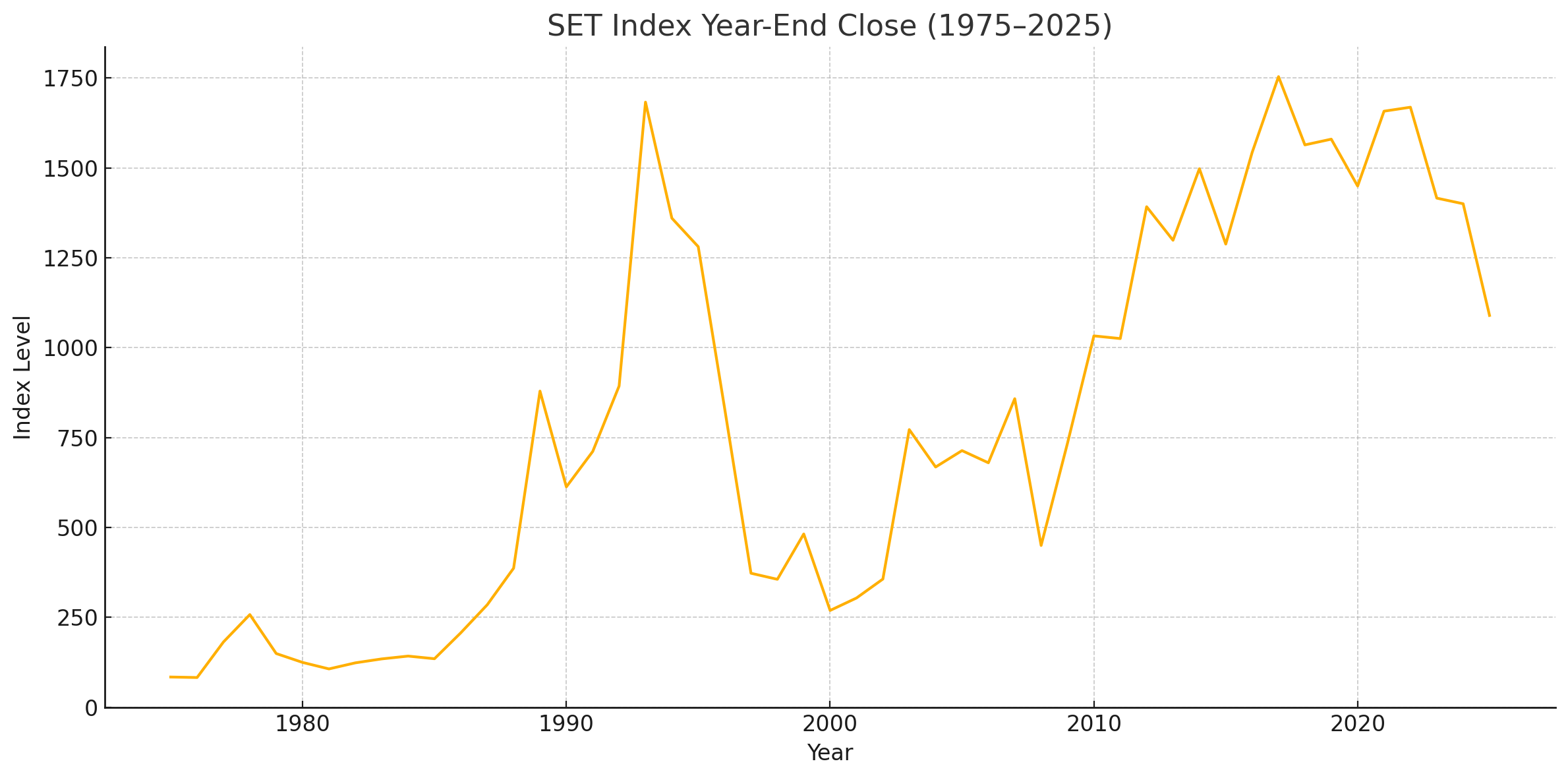

Trading in Thai equities has taken place since the 1960s, but the local stock market only became mainstream with the government-backed Securities Exchange of Thailand in 1975, later renamed the Stock Exchange of Thailand (SET).

In the early days, it was challenging for foreign investors to participate. As described in Claire Barnes’ book Asia’s Investment Prophets, good quality companies could in the early 1980s be picked up for 1.5x yearly cash flows with dividend yields often exceeding the local interest rate of 18%. The market took off after the Plaza Accord in 1985, and even more after exchange controls were removed in 1991:

After the Asian Financial Crisis in 1997, the Thai stock market went on another run until the late 2010s. In the past few years, Thai equities have been in a bear market with locals preferring to invest overseas and foreigners deserting the market.

The weak sentiment might be related to politics, specifically the military blocking Pita Limjaroenrat from becoming Prime Minister.

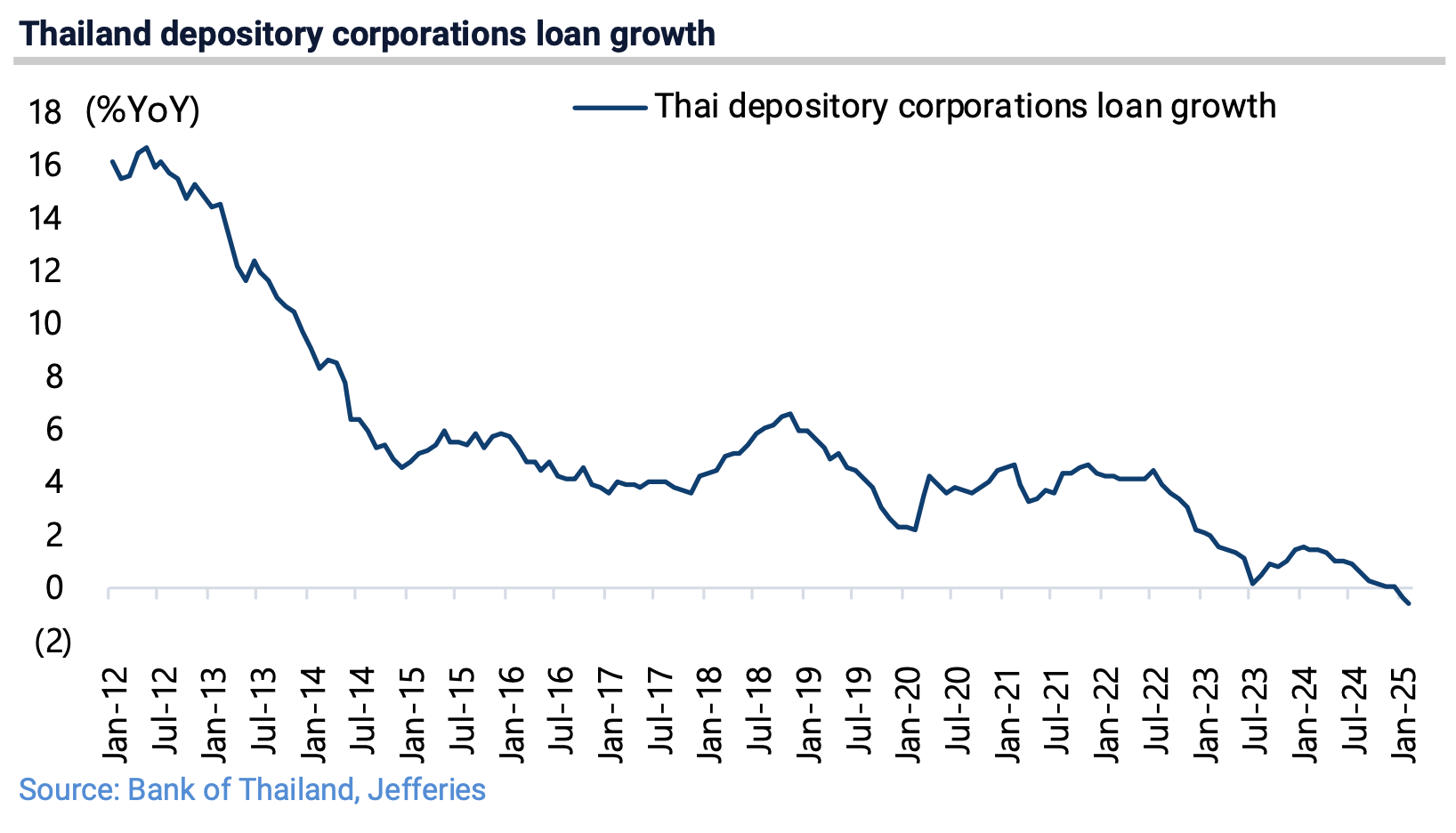

But two other, perhaps even more important factors, include an almost complete lack of loan growth. Household debt is high, and the government seems unwilling to raise the already-high budget deficit beyond the current 4.5%. With real money supply growth close to zero, there’s no inflow to Thai equities. Meanwhile, foreigners keep selling.

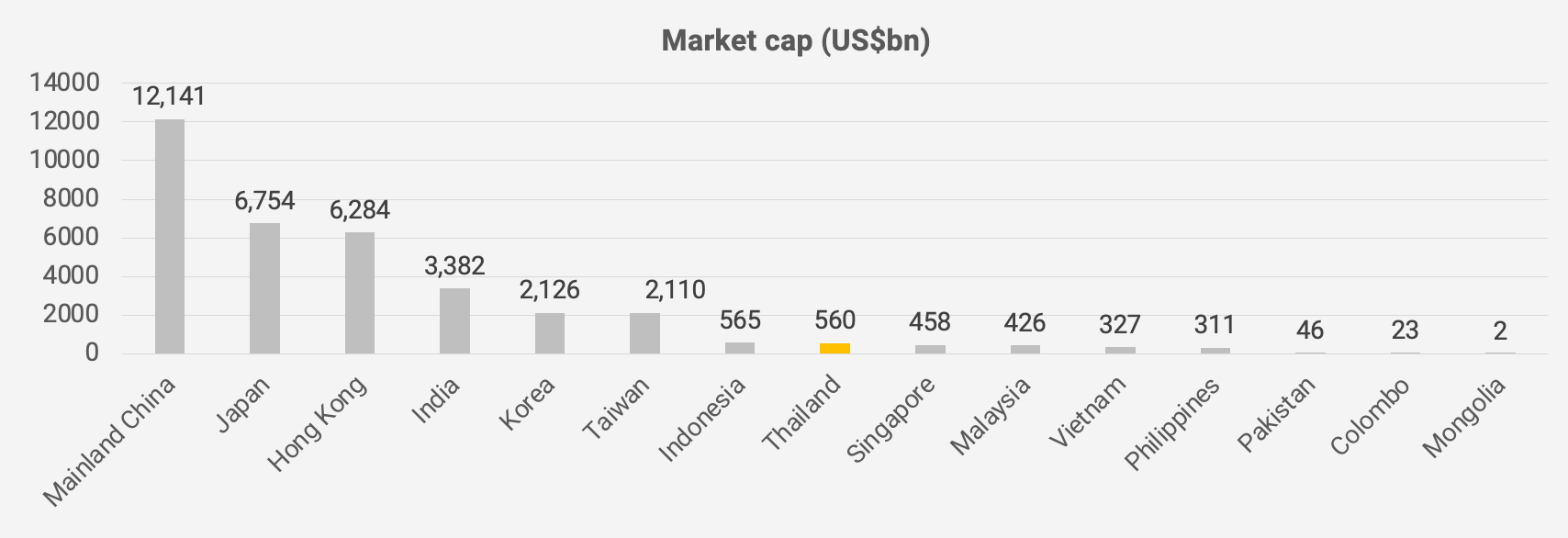

The Thai stock market is fairly small, on par with those in Indonesia, Singapore and Malaysia. But it’s much smaller than Taiwan, South Korea, Japan and China. And its trading volumes are only about US$25 billion per day, just slightly ahead of Singapore’s US$21 billion.

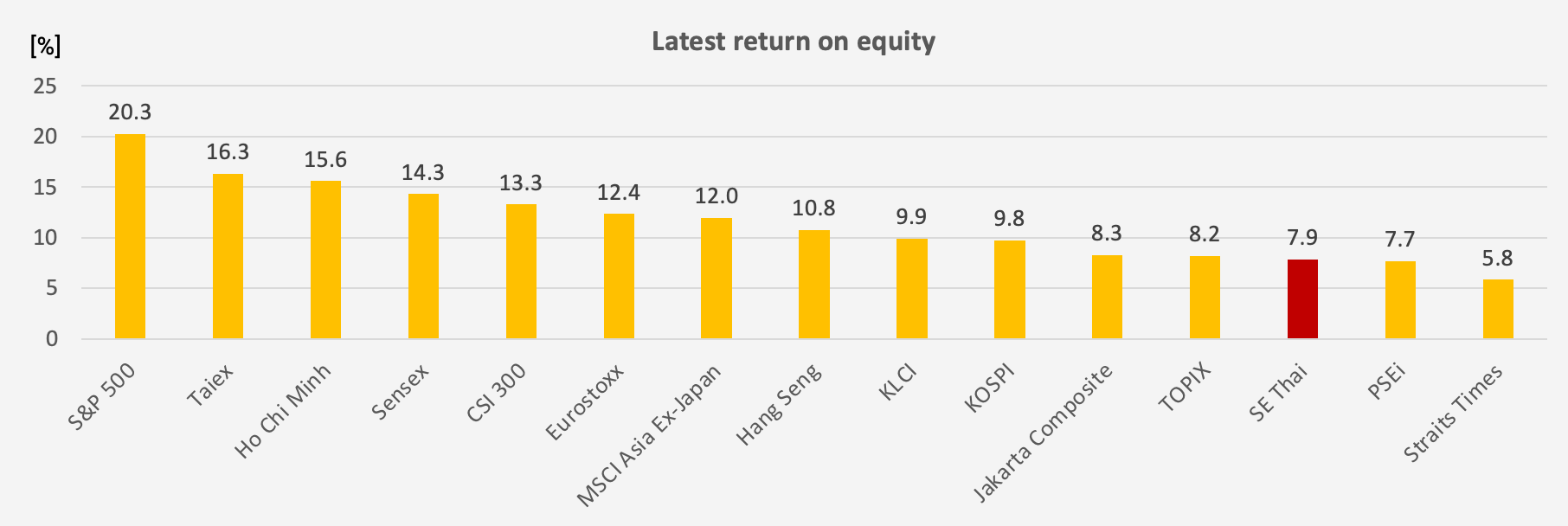

The return on equity has historically not been impressive compared to Taiwan and India, with many asset-heavy businesses in real estate and financials bringing down the average.

Is the market cheap? It’s come down a great deal. But at around 14x 2025 earnings, it’s still more expensive than Indonesia and the Philippines. The Stock Exchange of Thailand is looking at various measures to boost the market. And we might be seeing tax benefits in Thailand ISA accounts from the second half of this year. But the main problem — weak credit growth — hasn’t turned yet.

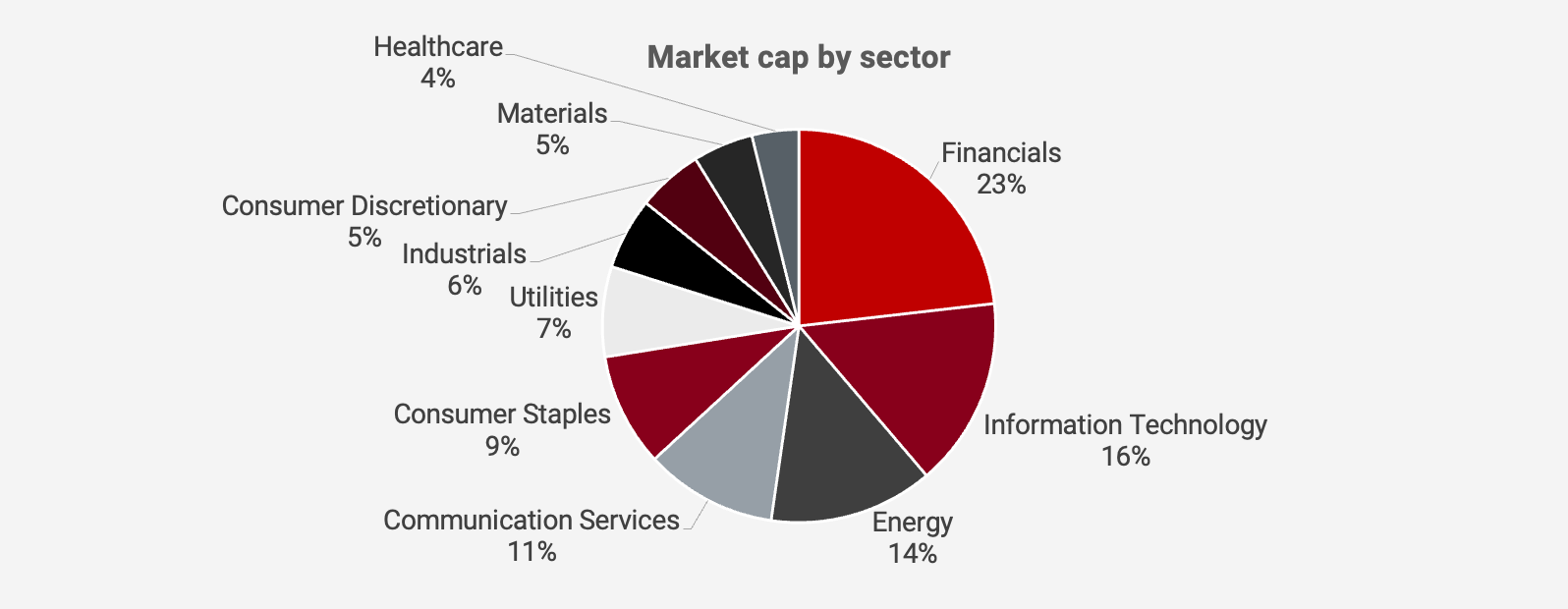

In Thailand, there are 446 companies with market caps above US$50 million. Among these companies, 23% are in financials, 16% in IT, 14% in energy, 11% in telecoms and communication services and 9% in consumer staples. So it’s a well-diversified group of companies to choose from:

The largest companies in each of these sectors include Thai oil company PTT, hospitals such as Bangkok Dusit, the Charoen Pokphand Group, Central Retail, etc.

To summarize, the Thai stock market has a great deal of diversity when it comes to the types of companies on offer. The market is small and illiquid, so if you’re running a large fund, it will be challenging to go below the top 50 companies in terms of market cap. But after 3 years of poor performance, value is finally starting to emerge.

For those of you who are unable to buy Thai equities through your broker, I suggest opening an Asian brokerage account with the likes of Phillip Securities in Singapore or Boom Securities in Hong Kong. For a complete guide, check out my post on Asian brokerage firms here:

2. Screening for candidates

Let’s dig deeper into individual companies that exhibit hidden champion-like characteristics:

- A high historical average return on equity

- A high growth in earnings per share

- Strong share price performance

I’ve ranked the entire list of 446 companies along these three metrics.

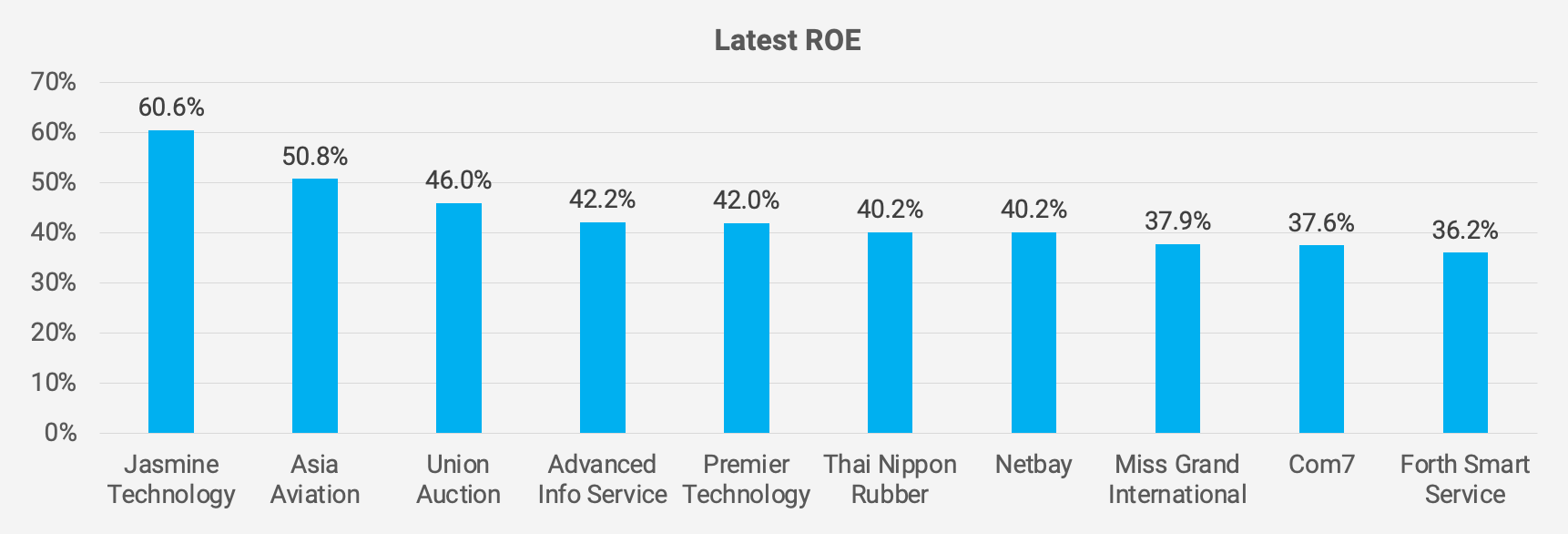

To start with, here are the top ten companies in Thailand in terms of a high return on equity:

The highest ROE companies include Jasmine Technology, a subsidiary of the Thai telecom company Jasmine International. It’s a Bitcoin miner that’s probably earning windfall profits right now thanks to the high valuation of Bitcoin. The second company on the list is Asia Aviation, the owner of low-cost airline AirAsia in Thailand, which has been taking market share but has a complex corporate structure. Union Auction runs auctions of used cars and motorcycles on behalf of banks and dealers. Advanced Info Services is a wireless and broadband telecom company that has a decent dividend payout ratio but isn’t growing much. Premier Technology sells enterprise hardware and customized software for customers throughout Thailand. Thai Nippon Rubber manufactures condoms for third parties and also has its own brand called ONETOUCH. Netbay is a rare Thai SaaS business that has built a platform for the Thai customs agency. Miss Grand International runs an international beauty pageant with some recent controversies. Com7 is Thailand’s biggest tech retailer through brands such as BaNANA and Studio 7. And finally, Forth Smart Service runs kiosks called Boonterm which can be used to top up phone credit, pay bills, deposit cash, borrow money, etc.

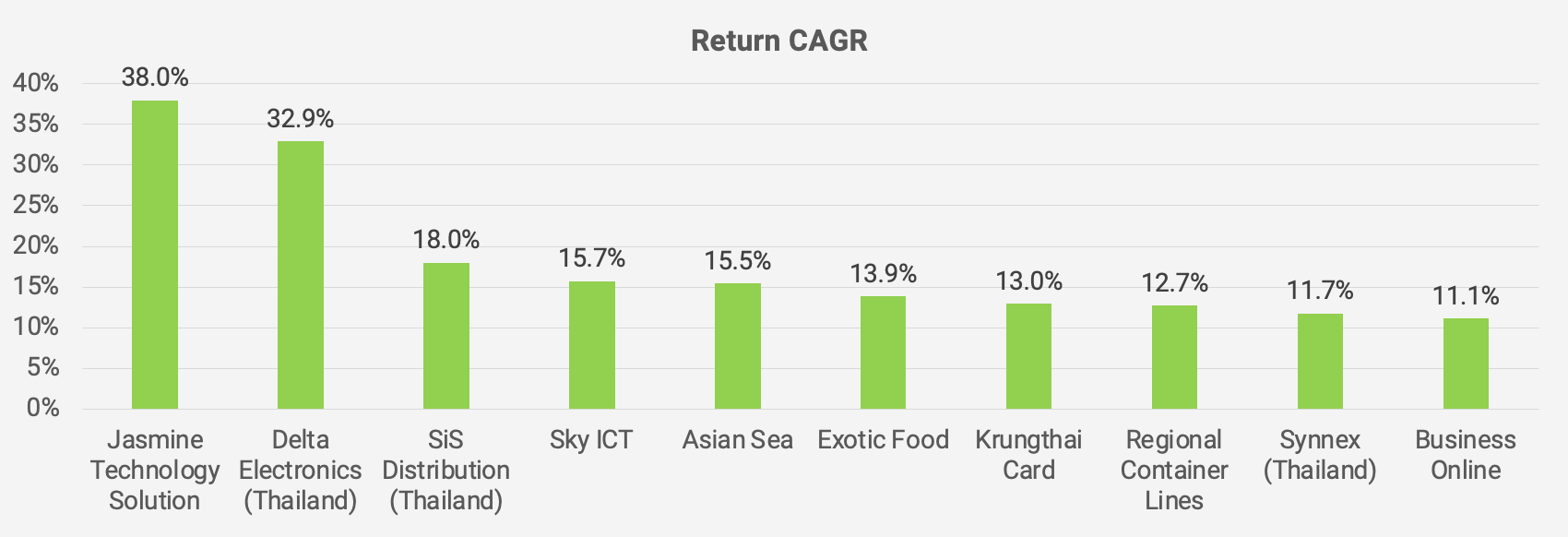

Here are the top ten companies in Thailand in terms of share price return CAGR:

The companies with the highest 10-year stock price returns include Bitcoin miner Jasmine Technology. The second on the list, Delta Electronics (Thailand), is a subsidiary of Taiwan’s Delta Electronics that was acquired in 2019. It sells power supplies, cooling fans and automation parts to global tech companies operating in the region. SiS Distribution (Thailand) distributes PCs, phones, servers, etc. to Thai retailers and corporate clients. Sky ICT is another government tech consultant for airports, building biometric gates, security cameras and passenger apps. Asian Sea is one of the largest producers of tuna, shrimp and pet food in Thailand and beyond. Exotic Food sells Thai chilli sauces and sriracha for export markets. Krungthai Card issues credit cards and makes small personal loans. Regional Container Lines is a container shipping line operating in Asia. Synnex (Thailand) is the Thai peer of Indonesia’s Metrodata, distributing hardware and software products to local customers. And finally, Business Online runs a database of Thai companies’ credit and risk information data and is partly owned by Dun & Bradstreet.

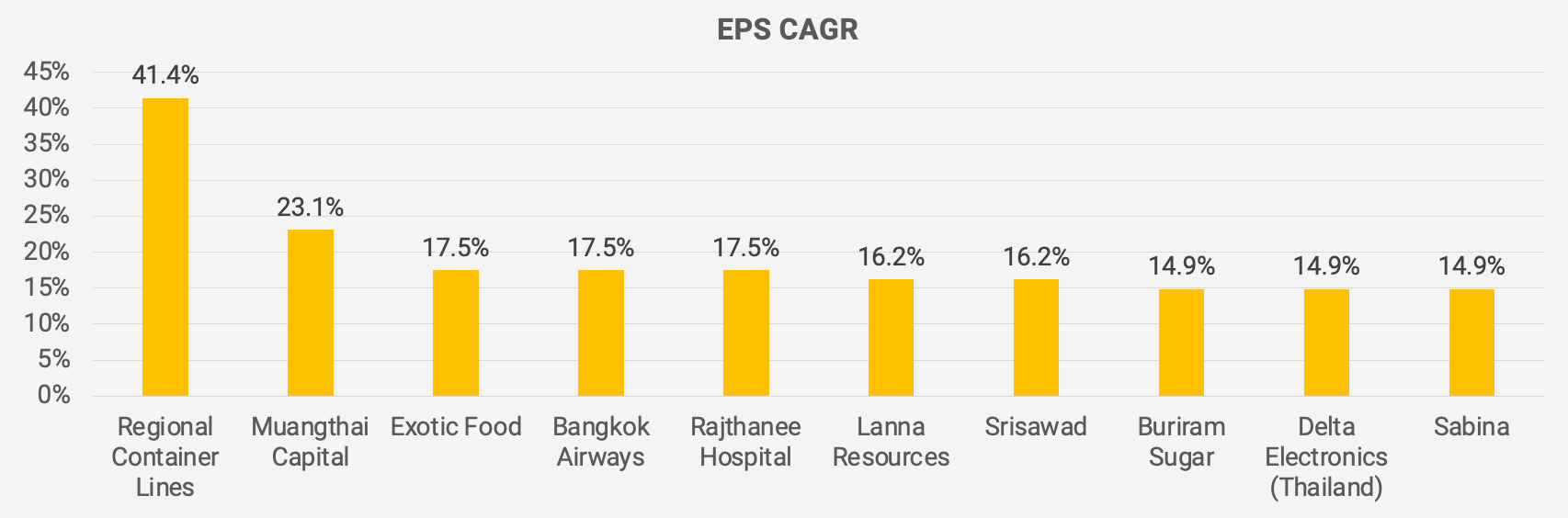

Finally, here are the top ten companies in Thailand in terms of EPS CAGR:

The fastest-growing companies have been Regional Container Lines, the container shipping line that’s benefited from higher shipping rates. Muangthai Capital runs branches that hand out small, high-interest loans secured by customers’ vehicles. Exotic Food sells Thai chilli sauce, such as sriracha. Bangkok Airways is a smaller full-service airline with a large exposure to tourism. Rajthanee Hospital is a private hospital in Ayutthaya, north of Bangkok. Lanna Resources owns coal mines in Indonesia, mining for thermal coal that’s then sold to Asian power utilities. Srisawad is a pawn shop operator doing microloans secured by jewellery and similar assets. Buriram Sugar crushes sugarcane into raw sugar. Delta Electronics (Thailand) makes power supply units, cooling fans and industrial automation gear as mentioned before. And finally, Sabina is a rare example of a Thai luxury brand selling women’s underwear.

After this exercise, I also went through the entire list of 446 companies line by line to identify companies that could be seen as hidden champions. These have all been ranked in terms of return on equity, historical share price performance and earnings per share growth. Companies with a return on equity of above 10%, a yearly total return / EPS growth, are marked with a green background colour. Here is the entire spreadsheet: