Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Haad Thip at the time of publishing this article. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares.

Last week, I had the great pleasure of meeting with Chief Financial Officer Amrit Shrestha and several of his colleagues at Coca-Cola bottler Haad Thip (HTC TB - US$193 million). The company is the exclusive producer and distributor of Coca-Cola products across Thailand’s 14 Southernmost provinces.

The stock has performed beautifully over time, though sideways since 2021. It trades at a 9.6x P/E ratio and a 6.4% dividend yield.

In this post, I’ll discuss what I learnt from the meeting with Amrit and what the future holds for the Haad Thip.

Table of contents:

1. Introduction to Haad Thip

2. The growth journey until today

3. New product introductions

4. Haad Thip’s capacity expansion

5. A few question marks

6. Conclusion1. Introduction to Haad Thip

I first wrote about Haad Thip (HTC TB - US$193 million) in February this year:

It’s one of the very few Coca-Cola bottlers listed in Asia, dominating 14 states in the south of Thailand. Haad Thip’s primary business is buying syrup and blending it with other ingredients, putting the final beverage into bottles or cans and finally selling them to supermarkets, restaurants and other customers.

The company’s economic moat is strong. Haad Thip faces practically zero competition in its key markets. Its contract with the Coca-Cola Company of Atlanta, Georgia, is long-lasting and tends to be renewed every few years without any issues.

In Thailand, Coca-Cola is an incredibly strong brand name. The company has an 84% market share in carbonated beverages. It’s the gold standard — Pepsi or Est Cola don’t even come close.

Since 2019, Haad Thip has been run by a man called Patchara “Dollar” Rattakul. I think he’s talented, with a great track record as Chief Operating Officer for over a decade before taking over as CEO. Under his watch, Haad Thip’s margins have improved drastically and the company continues to be a generous dividend payer.

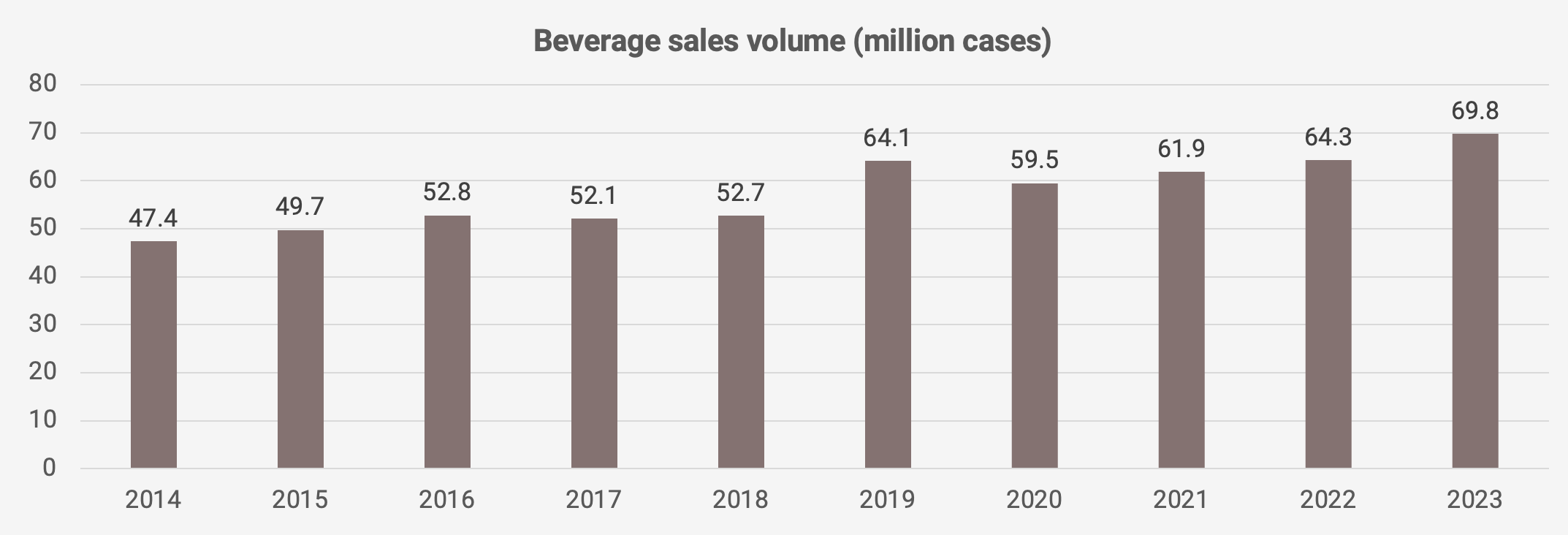

Haad Thip’s volumes have grown at a +4.4% CAGR in the past eight years. On top of volume growth, we’ve also seen price increases, including +6.0% in 2022 and another +1.5% in 2023.

The bull case for the Coca-Cola Company in Atlanta, Georgia, is its new CEO, James Quincey. Since taking over in 2017, he’s reworked the company’s incentive structure and allowed each subsidiary to experiment with product introductions. We’ve seen a number of new flavors and variants pop up, including a no sugar version of Coke that’s becoming increasingly popular. Haad Thip’s Coke Zero revenues are growing at over +20% annually.

When I wrote my first deep dive in February, I projected a forward P/E of 9x. With a 70% dividend payout ratio, I expected the dividend yield to creep up to 7-8% in the next few years.

However, a few questions remained. I wanted to ask Haad Thip’s management team about Thailand’s planned increase in sugar taxes and to what extent it would affect the company’s sales volumes. Another question mark was a broader trend towards healthy beverages and whether this trend could affect Coca-Cola’s future in Thailand. Finally, CEO “Dollar” Rattakul has been selling shares in the market.

These three points have been weighing on market sentiment and could explain why the stock trades at just 9x P/E. But let’s hear management’s side of the story.

2. Haad Thip’s transformation