Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares.

A reader called JackB asked whether I’ve ever written a post on withholding taxes on dividends. So, I thought I should discuss the issue once and for all.

Withholding taxes can add up quickly if you invest in dividend-paying international stocks, so it’s an issue worth paying attention to.

Table of contents:

1. Introduction to withholding taxes

2. Dividend withholding tax rates

3. Double taxation agreements

4. How to reclaim withholding taxes

5. Conclusion1. Introduction to withholding taxes

“Withholding tax” refers to the prepayment of tax.

For example, in cross-border transactions, governments usually take a cut of dividends, interest and royalties paid out to companies and individuals outside the country. Any time there’s a payment out of a country’s borders, part of the payment will be “withheld” and sent to the local tax authority.

Why? Without withholding taxes, there would be a risk that non-residents would shift profits between countries to avoid paying taxes entirely. Governments would end up without tax revenues.

If you’re an international investor, withholding tax will automatically be deducted from your dividends. In the following example of a dividend from an emerging market company, 20% is deducted and sent to the tax authority:

If you pay tax on your dividend income at home, too, you’ll pay tax twice. Some countries have entered into “double taxation agreements” to avoid such double taxation.

They then offer tax refunds or tax credits to ensure that a stream of income isn’t taxed twice. In my example above, making a claim might help get some of that paid withholding tax back, say 10 percentage points of what you paid.

2. Dividend withholding tax rates

Here are the withholding tax rates for dividends from publicly listed companies to non-resident individuals. These are the withholding tax rates that non-resident individuals pay when there are no double taxation agreements:

Note that the country of domicile refers to where it is incorporated — not where it’s listed. For example, Chinese companies listed in Hong Kong (“H-shares”) deduct withholding tax of 20% rather than 0%, since they’re domiciled in Mainland China. The first two characters of the security’s ISIN code will tell you where it’s domiciled.

In Australia and New Zealand, profits already subject to corporate tax will carry so-called “franking credits” or “imputation credits” and thus enjoy lower withholding tax rates. This lowers the withholding tax in Australia from 30% to 0% and in New Zealand from 30% to 15%.

Finally, note that the Philippines is planning to reduce dividend withholding taxes from 25% to 10% if the new CMEPA bill is signed by President Marcos later this year.

3. Double taxation agreements

As mentioned earlier, the withholding tax rate mentioned in the table above can be reduced if “double taxation agreements” exist between the country where the company is domiciled and where you are a tax resident.

You achieve this reduction by reclaiming the paid tax from the tax authority in the source country.

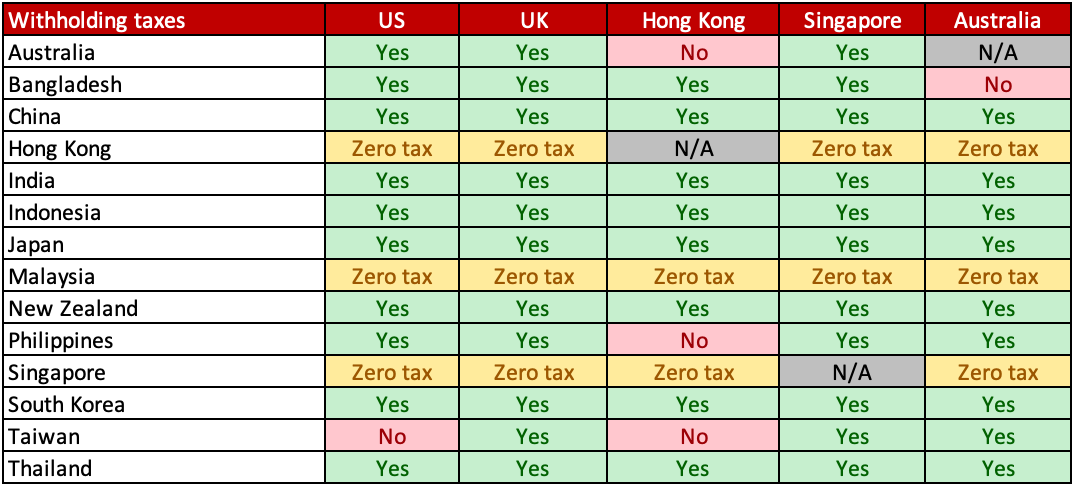

Most readers of Asian Century Stocks come from either the United States, the United Kingdom, Singapore, Hong Kong or Australia. So, to simplify, I’ll focus on these five countries regarding double taxation agreements.

Here are the countries that have double taxation agreements with the United States, the United Kingdom, Hong Kong, Singapore and Australia:

For example, if you’re a Singapore tax resident, you can reduce the South Korean non-resident individual dividend withholding tax from 22% to 10%.

4. How to reclaim withholding taxes

If withholding tax has been deducted at the source and there’s a double taxation agreement between your country and the source country, here’s how you can get it back:

- First, you need evidence that the dividend deducted is higher than expected. Ask your broker to determine how much withholding tax you’ve paid on your dividend.

- Second, you must fill out a form to reclaim paid withholding tax. For example, this form is called W-8BEN in the United States. But the name of the form differs from country to country. In your application, you may need to include a “certificate of residence” to prove you’re paying tax in your home country.

Here is what the forms are called in each of the countries in the Asia-Pacific:

Processing times can vary from several months to a year. You’ll have to apply for a refund within a specific time frame, ideally within a few years.

Is it worth the trouble? Probably not. Only if the amounts are high enough to justify the labor hours.

Alternatively, if you cannot get a refund from the source country, you might be able to claim tax credits when you submit your annual tax filing in your home country. But you better check what the rules are in your specific country.

5. Conclusion

I’ve never tried to reclaim withholding taxes paid on dividends received from overseas. However, one of my foreign employers — a family office — did have processes for trying to reduce paid withholding taxes.

In my view, the main takeaway from this post is that dividends from certain countries, such as Indonesia, South Korea and Taiwan, will be subject to high withholding taxes. So bear that in mind when you invest.

Then again, I rarely invest for dividends alone. I just use the dividend yield to determine whether a stock is undervalued. So, if withholding taxes reduce my total return by a per cent or two, so be it.

If you’d like to get smarter about Asian equities and get 20x high-quality deep dives per year, try out the Asian Century Stocks subscription service - all for the price of a few weekly cappuccinos: