Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is disclosure and not a recommendation to buy or sell.

Here’s yet another edition of my reviews of the key holdings of Asia-focused funds.

I will release new editions as I find more high-quality funds to track.

Summary

The CIM Dividend Income Fund is a veritable gold mine for stocks with high dividend payments. Such stocks include fertiliser company China BlueChemical with its 13.1% dividend yield, PTC India’s 11.0% and China Suntien Green Energy’s 8.0%.

Hong Kong’s VTech has returned to its March 2020 lows due to temporary headwinds related to high raw materials and shipping costs. It trades at a P/E of 7.8x with a dividend yield of 12.6%.

There’s significant value in Quality Houses’ 19.8% stake in HomePro, given that the stake is worth more than the entire enterprise value of the company.

Thanks to rising oil prices, Japanese oil company Inpex now trades at a forward P/E ratio of 5.1x and should benefit from the weakening of the Japanese yen.

Saigon Cargo Services is likely to become a long-term compounder, given secular growth in Vietnamese cargo traffic, despite competition from the new airport in Ho Chi Minh City. The stock trades at a P/E ratio of 11.8x.

Santa Lucia Asset Management’s CIM Dividend Income Fund

Singapore-based Santa Lucia Asset Management is an old-timer in the Asian investment scene. Several of the funds managed by Santa Lucia have been managed continuously by founder James Morton since 1994, though only since 2010 under the name of Santa Lucia.

James’s career spans Bain & Co, Arthur Young, Citicorp. His management of the Mackenzie Cundill Recovery Fund won him several awards from Morningstar and Lipper. He has an MBA from Stanford. He’s also written several books, including the 1996 book Investing with the Grand Masters: Investment Strategies of Britain’s Most Successful investors.

Santa Lucia now has roughly US$900 million in assets under management. Its CIM Dividend Income Fund focuses on dividend stocks with a targeted yield of 6%.

The CIM Dividend Income Fund has now made a total return of 1,268% since inception in 2001 in USD terms, with dividends reinvested or 12.9% per year.

The latest portfolio has an unusual mix of stocks compared to most other Asia-focused fund managers. You can tell that the fund is index-agnostic.

The fund’s largest position is Yuexiu Property, the Guangdong-based state-owned property developer and manager. Yuexiu owns a significant portfolio of investment property in Guangzhou. Its debt levels are low, and its SOE status protects it from the current crackdown on indebted developers. The price/book ratio is now 0.54x, and the dividend yield is 6.8%, broadly in line with its historic averages.

China Everbright Environment Group operates waste treatment plants in China. While the company has a significant amount of debt, it’s a state-owned enterprise. The stock trades at a 2023e P/E of 3.1x and a dividend yield of 10.1%.

India-listed IRB InvIT Fund is an infrastructure investment trust that owns a portfolio of 24 toll roads across ten states in India. The company is backed by GIC, an arm of Singapore’s sovereign wealth fund. An introductory presentation of the trust is available here. The dividend yield appears to be 13.5% but with a forward P/E of 14.5x (earnings yield of 6.9%), I’m not sure whether the dividend is fully funded.

China Hongqiao Group is the world’s largest aluminium producer. It’s based in China’s Shandong province and has a yearly aluminium output of 5.6 million tonnes. The management team is highly regarded. The P/E ratio is currently 3.4x, with a dividend yield of 13.5%. Hongqiao has been accused of under-reporting its production costs through related party transactions, most notably by Emerson Analytics here.

West China Cement is a Shaanxi-based cement producer with a leading market position in the province. It also has a presence in Xinjiang and Guizhou. The total production capacity is 29 million tonnes across 17 production lines, most of which are in Shaanxi. It also produces aggregates and commercial concrete. The stock is down significantly over the past year and now offers a reported 2.5x P/E ratio and a 14.2% dividend yield. You can find an introduction to the company here.

REC Ltd (Rural Electrification Corporation) provides financing for Indian power generation, transmission and distribution projects. The borrowers are state-owned utilities. Despite its stated purpose of raising finance for the electricity sector, the share count has remained flat for over a decade. The stock trades at a P/E ratio of 2.5x with a dividend yield of 12.3%.

Media Nusantara Citra (“MNC”) is an Indonesian media company that owns several free-to-air television channels, including RCTI, MNCTV, GTV and iNews. It also owns 19 pay-TV channels. Other businesses include radio, print media, talent management and TV-related content production. The stock’s P/E ratio is currently 4.6x but with a dividend payout ratio of just 5% since a few years back. Investors are worried about the impact of streaming services such as Netflix on MNC’s TV channels.

China BlueChemical is a Chinese fertiliser producer owned by CNOOC. It used to be called CNOOC Chemical but changed its name to BlueChemical in 2006. It sells urea, phosphorus, methanol and compound fertilisers. Its cost structure is more or less fixed, and compared to its peers; it has less exposure to coal prices as a raw materials input. The stock has been more or less flat for the past five years and now offers a P/E ratio of 3.7x and a dividend yield of 13.1%.

PTC India (“Power Trading Corporation of India”) is also involved in the Indian power sector, trading electricity and financing power projects. It has a renewable energy portfolio of 290 MW, primarily consisting of wind power projects. The stock trades at a run-rate P/E ratio of 5.4x and a dividend yield of 11.0%.

Sinotrans is a Chinese logistics service provider that’s owned by China Merchants Group. It offers transport services across air, road, rail and shipping. It’s a significant freight forwarder across Chinese ports. The P/E ratio is currently 3.5x despite modest debt levels and offers a 9.8% dividend yield.

JB Financial (“Jeonbuk Bank“) is a Korean financial institution that owns two commercial banks, asset managers and a few overseas subsidiaries. The bank is based in Jeonju, a smaller city in South Korea’s southwest. The stock should benefit from higher interest rates in Korea, but on the other hand, the Korean housing market is starting to wobble. The P/E ratio is 2.3x, and the dividend yield is 10.6%.

China Suntien Green Energy sells natural gas and constructs natural gas pipeline-related infrastructure, owning seven long-distance pipelines in China. It also develops wind farms and solar power plants. Total wind power installed capacity of 5.7GW. It’s also involved in property leasing. The P/E ratio is 4.1x, and the dividend yield is 8.0%.

Chongqing Rural Commercial Bank is a small commercial bank serving the Chongqing municipality in China. It owns 1,760 branches across Chongqing, mostly focusing on retail banking services. The P/E ratio is 2.3x, and the dividend yield is 11.9%.

PineBridge Asia ex-Japan Small Cap Equity

PineBridge Investments is a subsidiary of Pacific Century Group, an Asia-based investment group connected with Richard Li and PCCW.

The Asia ex-Japan small cap equity fund is run by Hong Kong-based Elizabeth Soon. She has been running the small-cap fund since 2008. Before PineBridge, she worked for Schroders in Hong Kong for a decade and Allianz Global Investors. She has degrees from the National University of Singapore and Manchester Business School.

The fund seeks capital appreciation by investing in companies throughout Asia ex-Japan. Soon seems to have an eye for compounder-type stocks that may seem expensive in terms of their P/E ratios but end up doing wonderfully over the long run. At least half of the fund is in companies with market caps less than US$1.5 billion at the time of purchase.

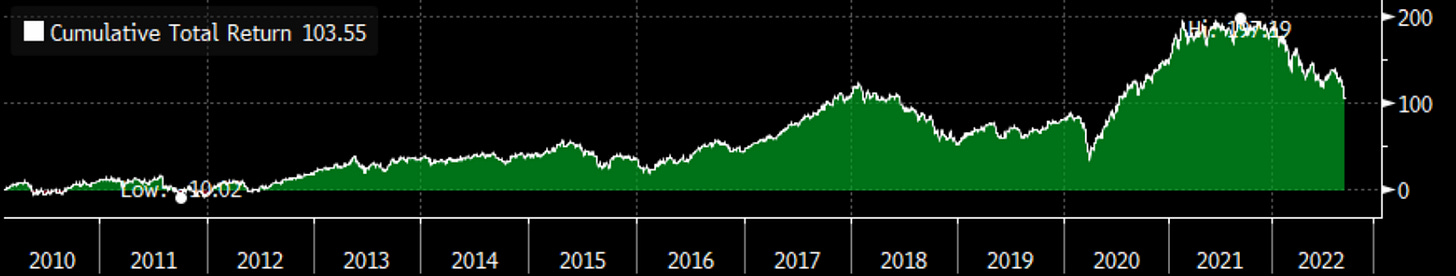

Since its inception in 1999, the fund is up 1,044% in USD terms with dividends reinvested, or 10.8% per year.

The fund is quite large at US$1.5 billion. It has therefore been forced to diversify across 86 names. The stocks are not the typical stocks pushed by investment banks. Many of them don’t have any analyst coverage at all.

The largest position is Taiwan’s Sinbon Electronics. The company is a producer of cable assemblies and connectors. Customers range from automotive companies, network equipment, medical devices, etc. Those customers typically approach Sinbon asking for customised solutions with low volumes. For what seems like a commodity business, the return on equity is surprisingly high and steady at around 20-25%. The P/E ratio is 19.9x, but the company has practically no debt.

Divi’s Laboratories is a Hyderabad-based pharma company, producing both generics and active pharmaceutical ingredients across six manufacturing facilities in India. The company has 60-85% market shares in generic naproxen, dextromethorphan and gabapentin APIs, and 20-30% market shares in pregabalin and methylamine APIs. The return on equity is impressive, and the earnings have grown immensely over the past 20 years. P/E ratio of 39.5x.

Voltronic Power produces uninterruptable power supplies (UPS), inverters for solar panels and other power-related products. Uninterruptible power supplies are electrical devices that provide emergency power when the main power fails. The products are used in home electronics, servers, and industrial-, medical- and network equipment. Customers include Schneider, Emerson, Socomec and Riello. It’s a true compounder with a return on equity consistently around 30-40%. EPS has gone up tenfold in the past 12 years. The high P/E ratio of 32.7x reflects this growth profile.

Nantong Jianghai Capacitor is one of China’s largest producers of capacitors, which are used for temporary electric energy storage. Combing (super-)capacitors with lithium-ion batteries help prolong the life span of batteries, improve performance and efficiency and speed up charging time. The stock is seen as a “play” on the electric vehicle theme. The forward P/E is currently 24.6x but note that earnings have gone up five-fold over the past decade.

Chow Tai Fook Jewellery is a Hong Kong-based jewellery retailer with a long history. Today, the business has expanded from Hong Kong to mainland China where it has a large retail network and is one of the largest jewellery retailers with an estimated 13% market share. The brand name is excellent and is seen as one of the most trusted in the industry in Hong Kong. The company is owned by the Cheng family, which is also involved in the property sector through New World Development. The stock trades at 20.3x P/E against earnings that were potentially elevated during COVID-19.

Techtronic is widely regarded as one of Hong Kong’s highest-quality businesses. It’s a global leader in power tools for the DIY market, used for home improvement, construction and infrastructure industries. Its brands include Milwaukee, Homelite, Ryobi, etc. America’s Home Depot is its largest customer. Its major competitors include Stanley Black & Decker and Bosch. The company benefitted from COVID-19 as the US home improvement industry experienced a temporary boost in demand. The stock is trading at 13.8x P/E but be careful with the E in that equation.

SITC International is a Hong Kong-based shipping company, owning 74 container ships and leasing two dozen more. The company also has freight forwarding, warehousing and similar services. SITC has done well during COVID but suffered more recently as container shipping costs have come down. The company’s run-rate P/B of 2.3x is now back to pre-pandemic levels.

Shree Cement is a major cement in the North Indian market with an annual capacity of 43 million tonnes. It sells cement under the Shree Jungrodhak, Bangur Cement and Rockstrong brand names. Shree’s margins are market-leading thanks to the company’s low-cost structure. And growth has consistently been around 15% per year in volume terms, helping the company take market share over time. The stock trades at an elevated EV/tonne of US$184 and a P/E ratio of 39.7x.

Alchip Technologies is a Taipei-based fabless semiconductor company designing CMOS ASICs. Its first major order was for the graphics ASIC for the PlayStation 2. Since then, it has diversified its customer base to Cisco, Investar, AcerVC, etc. Most of its chips are produced TSMC, which also owns 20% of Alchip. A major negative event was Alchip’s loss of China’s Phytium after US sanctions on the company. Phytium represented almost 40% of Alchip’s revenues at the time. But the company has done well despite this headwind. The stock trades at a 2023e P/E ratio of 19.1x.

YTO Express is one of China’s largest delivery companies, now ranked #3 with a 15% market share. It’s a competitive sector, and YTO’s reliance on key partner Alibaba makes it vulnerable. Parcel delivery prices have dropped significantly over the past decade. And since YTO doesn’t control the entire network as SF Express does, there aren’t many network effects. But it does benefit from secular growth in e-commerce parcel deliveries. The stock trades at 17.2x P/E.

Airtac is a Taiwanese manufacturer of pneumatic components such as valves, cylinders, and linear motion guides. Its products are used for process automation in industries ranging from oil & gas, chemicals, etc. AirTac has been taking market share from Japan’s SMC, especially in the Chinese market. It looks like a secular compounder with a return on equity of 22%. The P/E ratio is 20.6x.

VTech is a Hong Kong-based toy manufacturer selling electronic learning products under the VTech and LeapFrog brand names. It also sells cordless phones for office use (a declining industry) and contract manufacturing for professional audio equipment, hearing aids, etc. (a growing segment for VTech). The business has a high return on equity and pays out 90-100% of earnings as dividends. The 2023e P/E ratio is currently 7.8x, with a dividend yield of 12.6%.

Hansol Chemical is a Korean producer of hydrogen peroxide for the semiconductor, paper and fabric industries. The company also sells materials needed for the quantum-dot resin used in Samsung Quantum Dot TVs and the paint for Samsung’s smartphones. The business is surprisingly profitable, with a return on equity above 20%. The forward P/E ratio is currently 9.7x, but in a typical Korean fashion, the company hardly pays any dividend.

Niwes Hemvachiravarakorn

According to Magnus Angelfelt’s The World’s 99 Greatest Investors, Thailand’s Niwes Hemvachiravarakorn earned a yearly CAGR of 38% for 15 years. While Nives used leverage and Thailand enjoyed a stock market boom from the early 2000s, it’s clear that he has talent. He’s written a large number of books, but unfortunately, they’re only available in Thai. Channel News Asia interviewed Hemvachiravarakorn a few years ago. The video is available here.

His strategy is to find companies that are experiencing problems that are either short-term in nature or solvable. His portfolio is concentrated among 5-7 stocks, and he’s not reluctant to make big bets.

Today, Niwes is listed as the shareholder of only four companies. But his wife Paopilas Hemvachiravarakorn also shows up on the shareholder register of convenience store operator CP All, with a stake worth US$65 million.

Quality Houses is a Thai property developer specialising in residential properties. Low-rises represent the majority of revenues, with condominium sales having dropped to only 6% of revenues. The company owns a 19.9% stake in building materials retailer HomePro, worth US$942 million, compared to Quality Houses’ own enterprise value of just US$929 million. The condo business has been weak, potentially due to lower investment demand for properties during COVID-19, especially from Chinese buyers. The 2023e consensus P/E is 9.5x, despite the large hidden value in Quality Houses’ stake in HomePro.

Bangkok Aviation Fuel provides aviation fuel services at several airports in Thailand, including Suvarnabhumi (Bangkok), Don Mueang and Koh Samui airports. It also has pipelines that connect Suvarnabhumi Airport with an oil refinery in Bangkok’s Chong Nongsi district. Competition is limited since a single airport will not have more than two or three jet fuel providers at most. The company has a significant amount of debt, causing its EV/EBITDA to remain high despite a falling share price. The current market cap is currently around 22.9x pre-pandemic earnings vs a historical level of 20-25x. It’s historically been a growth stock with a return on equity of around 30%.

Eastern Water Resources supplies water to seven provinces in the Eastern part of Thailand. There’s a dispute between Eastern Water and the Central Administrative Court about the government’s takeover of key pipelines in the Eastern region. The stock trades at a P/E of 11.6x and a forward dividend yield of 5.5%, but note that the dividend yield dropped during COVID-19. Over the past 10 years, the stock has traded at a P/E ratio of 16.0x.

Muramoto Electron Thailand (“METCO”) is a subsidiary of Japan’s Muramoto Group. It produces electronics parts for office automation and the automotive industry. Its products include big tank printers, car audio panels, PCBs for car cameras, car sensors and car keys. The stock trades at 9.5x run-rate earnings, despite having 38% of its market cap in net cash. Growth appears to be tepid.

Convenience store operator CP All runs 12,000 7-Eleven outlets across Thailand. CP All has exclusive rights to run 7-Eleven shops across the country with an 80% market share. The majority of those outlets are in the Greater Bangkok area. Some outlets are fully owned, and some are franchised out. Since 2013, CP All also owns cash-and-carry operator Siam Makro, which is gradually taking share from wet markets, serving restaurants across the country. Thailand’s convenience store sector suffered during COVID-19 due to weak foot traffic and a lack of tourism, but it’s now recovering. The stock is not cheap though, at a 2023e P/E of 23.8x.

PYN Elite Fund

Finland’s PYN Elite Fund is a fund with a 23-year track record across Southeast Asian and Chinese equities. Today, most of the investments are in Vietnam since it believes in the macroeconomic fundamentals of the country. PYN’s latest 3Q2022 investor letter describes the company’s strategy well and why it believes in Vietnamese bank stocks.

The company is involved in long-term value investing, aiming to outperform funds that are focused on equities globally. And the performance has been more than decent, returning 3,309% since inception in 1999 in USD terms with dividends reinvested, or 16.1% per year.

PYN Elite’s portfolio manager is Petri Deryng, who has run the fund since its inception in 1999.

Prior to starting PYN, he was an entrepreneur in Finland’s radio and TV industry. He’s been based in Vietnam for many years back.

The portfolio is concentrated across some 20-odd Vietnamese stocks.

PYN Elite Fund’s largest position is Vinhomes, Vietnam’s largest real estate developer. It has a massive land bank supporting its current sales for the next 30 years. Vietnam’s living area per capita is currently about half that of China, suggesting catch-up growth still ahead of it. The consensus 2023e P/E ratio of 6.1x looks low, but the gross margin of 57% may or may not be sustainable, depending on how land prices continue to develop.

The second-largest position is VietinBank is the largest listed bank in Vietnam in terms of its branch network, total assets and profitability. The state has been selling down its stake in the company, and it’s now controlled by IFC and BTMU. Other than its retail banking arm, it’s also involved in brokerage, fund management, insurance, money transfer and leasing. The bank trades at a 2023e P/E ratio of 4.5x.

VEA (“Vietnam Engine & Agricultural Machinery Corp”) is a producer of agricultural machinery such as ploughs, combustion engines, rice husking, tractors, water pumps, etc. Almost all sales are to the domestic market. Earnings have come down during COVID-19, but even at the current level, it still trades at around 8.2x 2023e earnings.

Vincom Retail is a Hanoi-based shopping mall operator that’s part of the Vin group. It has a 60% market share in modern retail in Vietnam under the Vincom Center, Vincom Mega Mall, Vincom Plaza and Vincom+ brand names. Vietnam has recently relaxed its COVID-19 restrictions, which should help the company. The stock does not appear cheap at first glance at 25x 2019 (full-recovery) earnings, but property is typically capitalised at low cap rates, especially in a fast-growing market like Vietnam.

TPBank (“Tien Phong”). TPB is a retail-oriented bank with a fat net interest margin and low NPLs. It’s a first-mover in digital banking, backed by key shareholders FPT, DOJI and Vietnam National Reinsurance Corporation (Vinare). It seems like a well-operation. The stock trades at a P/E ratio of 4.6x.

Airports Corp of Vietnam is the operator of 22 out of 23 civil airports in Vietnam. The company is run like a typical Vietnamese SOE, with the Chairman being a former government official from the Civil Aviation Authority. Utilisation in ACV’s airports is high, and the company is now investing heavily to increase capacity. There remains significant potential in the non-aeronautical segment since the contribution is only 12% of revenue vs 50% for most modern airports. The main hurdle remains regulation, which in Vietnam remains restrictive and not conducive to high profitability. The stock trades at 26.6x pre-pandemic revenue with a strong balance sheet.

Military Bank is one of Vietnam’s three-largest private sector banks and one of the most profitable ones. It has exposure to retail and SME lending. Its link to military-related enterprises enables it to enjoy a low cost of funding since those tend to have accounts with the bank. The stock trades at a 2023e P/E of 4.2x.

Saigon Cargo Services is one of the two cargo support operators at Tan Son Nhat Airport - and the only international airport in Vietnam’s Ho Chi Minh City. The main shareholders are the airport company ACV, the Vietnamese army and logistics operator Gemadept. Passenger and cargo volumes grew in the mid-teens before the pandemic. A few years ago, total air freight volumes in Vietnam were only half those of Singapore despite having a 20x greater population. It’s plausible that SCS’s cargo volumes will continue to grow for many years ahead. Sargon Cargo Services recently increased its capacity, but it might face pressure from HCMC’s new airport, which is scheduled for completion in 2025. The stock trades at a run-rate P/E ratio of 11.8x.

The other stocks in the portfolio are primarily in the construction industry, property development or infrastructure investment. One can tell that Petri believes in the Vietnamese growth story and therefore doesn’t mind holding cyclicals, despite fears about a rising interest rate environment.

Belgrave Capital Management’s Vitruvius Asian Equity Fund

The Vitruvius Asian Equity UCITS Fund is run by Mattia Nocera, the founder of London-based Belgrave Capital Management. It’s a small fund of US$55 million, but only one of many managed by Belgrave.

Mattia started Belgrave in 1995 and has been running the Vitruvius Asian Equity Fund since its inception in 2010. Prior to starting Belgrave, he worked for Bankers Trust. He’s an American citizen with degrees from Brown University and NYU.

The Vitruvius Asian Equity Fund is up 118% since its inception in 2010 in US Dollar terms, or 6.3% per year.

What stands out about the fund is the fact that it invests with total disregard for the index. It’s focused on capital gains and investing across Asia Ex-Japan.

Here are the current largest positions of the fund. As you can tell from the August 2022 fact sheet, the fund has outsized exposure to Japan and the technology hardware industries.

The fund’s biggest position is Taiwan’s E Ink Holdings, the monopoly supplier of e-paper displays for Amazon’s Kindle and other e-readers, as well as supermarket price tag displays. The benefit of e-paper is the long battery life, high contrast, wide viewing angles, lightweight and low glare. The company holds patents that make it difficult for peers to gain entry into the sector. The company is launching colour e-readers, which could drive growth in the future. The stock is listed through a reverse merger. It now trades at 20.8x 2023 earnings.

Hitachi is a producer of machinery across tech, power systems, construction machinery, automotive, etc. The largest “IT” business is about systems integration, consulting and IT solutions for business customers. The second-largest segment, “social infrastructure & industrial” builds industrial machinery systems, elevators, escalators, railway systems, and power generation equipment. It’s also involved in semiconductor manufacturing equipment, MRI machines, etc. The stock is undergoing a restructuring and trades at just 10.0x forward P/E.

Anhui Gujing Distillery produces Chinese rice wine “baijiu”. Vitrius owns the B-share, which is denominated in Hong Kong Dollars and trades at a 61% discount to its A-share equivalent. The forward-looking P/E ratio is 14.8x.

Inpex is a Japanese oil company formed through the merger of Inpex and Teikoku Oil. It has pure upstream exposure across crude oil and natural gas. The government is the largest shareholder, and it may therefore have certain priorities other than shareholder wealth maximisation. It’s involved in three main projects: the Ichthys LNG project, the Abadi LNG project, and the Kashagan oil field. Inpex should benefit from the weakness of the Japanese yen, given that its revenues are all priced in US Dollars. The 2023e forward P/E ratio is 5.1x.

Toyota Motor is the largest car manufacturer in the world, with exposure to all major markets globally. Its brand names include Toyota and Lexus. Some say that Toyota is lagging behind in the shift to EVs, but on the other hand, it has a strong portfolio of hybrid vehicles and is also advanced in fuel cell technology.

Hyundai Heavy is the world’s largest shipbuilding company. It also produces heavy equipment. The types of ships built include oil tankers such as VLCCs, container ships, LNG carriers, barges and naval vessels. It also constructs oil rigs and marine engines. The company is not profitable but trades at 1.85x book and 1.02x revenues.

DFI Retail Group (“Dairy Farm International”) is a retailer owned by the Jardines / Keswick family. It has 7,181 outlets across Asia, ranging from supermarkets, health & beauty stores, convenience stores, etc. The cash cow has been the Hong Kong and Chinese businesses, but they’ve been hurt by COVID-19 restrictions and a lack of tourism to Hong Kong. The Southeast Asian business has been loss-making for many years, and the restructurings have not had a material impact yet. E-commerce is a potential threat to DFI’s recovery. The stock has a forward 2023e P/E ratio of 16.0x but note that estimates are low. I wrote about Dairy Farm in early 2021 here.

ASE Technology is the global leader in the assembly and testing of semiconductor chips, based out of Kaohsiung but with facilities across China. The company was formed from ASE’s acquisition of Siliconware Precision back in 2018, which was financed through debt. The stock trades at P/E 6.8x with an 8.4% yield on 2023e consensus numbers, but earnings during COVID-19 may have been unsustainable.

SK Hynix is one of South Korea’s two large memory chip makers, along with Samsung Electronics. DRAM represents 70% of revenues and NAND around 20%, but DRAM represents the majority of revenues. While Hynix has always lagged behind Samsung, its acquisition of Toshiba enabled it to catch up in R&D. Memory prices are currently weakening, causing Hynix’s earnings to drop. So take the 2023e P/E multiple of 11.5x with a grain of salt.

Komatsu is Japan’s largest construction machinery maker, with sales from every region of the world and second to only Caterpillar. It has particular exposure to mining equipment such as dump trucks. It’s unique in the sector in that most components are produced internally, ensuring quality control. Komatsu’s acquisition of Joy Global also strengthened its product portfolio. Thankfully, Komatsu apparently does not have much exposure to China’s property sector. It should benefit from the weakening of the Japanese yen, given that 86% of revenues are from overseas. The P/E ratio is 9.2x on next year’s earnings.

Japan’s Nikon operates across four business segments: lagging-edge lithography machines for semiconductor manufacturing, cameras, healthcare equipment such as microscopes as well industrial metrology. It’s lagging behind ASML in lithography machines but still has a strong position in DUV machines. Nikon has recently lost market share to Sony in DSLR cameras, and there’s a question mark whether smartphone cameras will eventually outcompete DSLRs. On the positive side, content creators are keen buyers of DSLRs. The P/E ratio is 11.2x.

Plug Power is an American company that manufactures fuel cells for hydrogen fuel cell systems. Such fuel cells are meant to replace gasoline engines. Plug Power has been subject to shareholder class actions due to misleading statements during the IPO. I also think the company seems somewhat promotional, and the shares have been subject to constant dilution from follow-on offerings. The company is not profitable but trades at a forward-looking EV/Sales of 8.0x.

Japan’s Bridgestone is the world’s largest manufacturer of tires globally. The name comes from an English translation of founder Shojiro Ishibashi’s name (Ishi = Stone, Bashi = Bridge). In 1988, Bridgestone acquired America’s Firestone and thereby increasing its presence in the US market, now the biggest for Bridgestone. Rubber prices have recently come off, and the company should benefit from the weak Japanese yen, given that the company sells the majority of its products overseas. The stock trades at 9.8x P/E and 7.4x EV/EBIT on 2023e consensus estimates.