CK Hutchison update (1 HK)

Blue-chip conglomerate facing inflation pressures. Estimated reading time: 18 minutes

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in CK Hutchison when publishing this article. Note that this is a disclosure and not a recommendation to buy or sell.

Summary

In January 2022, I published a post on Hong Kong conglomerate CK Hutchison. I argued that the company is professionally run but suffered from weak foot traffic in its retail stores during COVID-19 and low energy prices.

Since then, CK Hutchison’s retail traffic has recovered nicely, and energy prices are up. But earnings have still come down. Blame a weak Euro, high inflation and high-interest rates. All are related to Fed policy, in my view.

The company is now transitioning towards a more asset-light company, selling European telecom assets and spending at least a portion of the proceeds on share buybacks. That could help the return on equity rise from the current ~7% level, which explains why the stock trades at 0.3x book.

Assuming that CK Hutchison’s interest payments reprice higher as the debt matures, that margins rebound in the telecom and infrastructure segment as they deal with the higher inflation pressures, and that the retail segment continues to grow post-COVID-19, I get to a mid-single digit P/E. With a 30% payout ratio, the dividend yield would stay around the 5-7% level.

The big wild card is inflation since it affects US monetary and fiscal policy and the strength of the US Dollar. A best-case scenario would be lower inflation, lower US Dollar interest rates and a stronger Euro.

A commonly cited concern about CCP interference is probably exaggerated given 1) CK Hutchison’s incorporation in the Cayman Islands, 2) only 13% exposure to Hong Kong and mainland China, and 3) little evidence of any backlash so far.

1. Quick recap

My initial report on CK Hutchison (1 HK - US$20 billion) was published on January 2022. You can find the link here (no paywall):

At that time, I argued that:

Li Ka-Shing has been an incredible business leader and capital allocator, able to acquire high-quality assets on the cheap and manage them well.

While it is true that Victor Li has now taken over the company, he’s been personally groomed by Li Ka-Shing for over 30 years. Victor is known as a cost cutter and a safe pair of hands.

CK Hutchison has exposure to slow-growing oligopoly industries such as health & beauty retail, port services, utilities, telecom, and energy exploration & production. That said, the return on capital had come down to just 8-9%.

The company suffered during COVID-19 for two separate reasons: a reduction in foot traffic in the company’s retail stores as well as low energy prices, at least during the height of the pandemic in 2020.

I predicted that these challenges would blow over as Omicron spread worldwide and brought some measure of herd immunity to those infected.

Using a sum-of-the-parts approach with a 25% conglomerate discount, I got an intrinsic value of HK$85/share.

However, I also pointed out that if you applied market multiples to each of CK Hutchison’s segments, the calculated intrinsic value would easily exceed the HK$85/share estimate by a wide margin.

I felt at that time that the biggest risk was Li Ka-Shing’s fraught relationship with the top Communist Party leadership. It’s well known that General Secretary Xi Jinping does not like Li Ka-Shing, partly because of his implied support for Hong Kong’s democracy activists and his decision to sell many of his assets in mainland China. On the other hand, CK Hutchison only had 13% total exposure to Hong Kong and China and is no longer incorporated in Hong Kong. It should be seen as a global conglomerate with its main exposure to European infrastructure and telecom assets.

2. Update since early 2022

Since my post on CK Hutchison, the share price has dropped another 24% to HK$42/share:

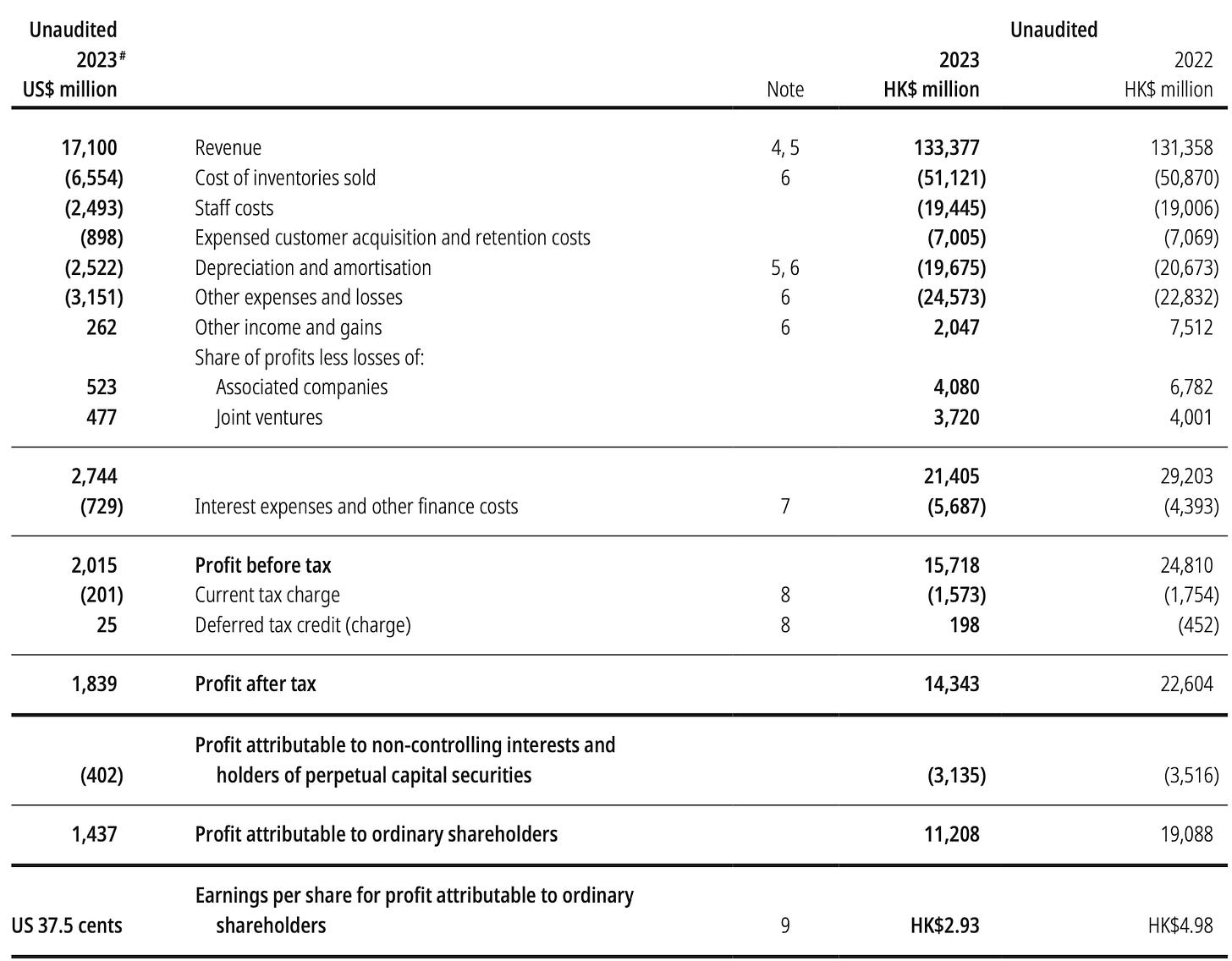

The headline numbers have been decent, with a rebound in EPS in 2022 but a drop in the first half of 2023:

The 2022 result was not too bad. After adjusting for one-off gains, such as the sale of telecom towers in Europe and Indonesia, profits were down just slightly. EBITDA fell -5.7%, which tells you the direction of underlying cash flows. But if you consider the higher profits from CK Hutchison’s Canadian energy assets through equity method-accounted associate Cenovus Energy (CVE CN - US$38 billion), adjusted EBITDA would have been up somewhat.

By segment, you can see that the ports business did well in 2022. Retail suffered from weak foot traffic and store closures during COVID-19. Meanwhile, the infrastructure and European telecom segment saw cost pressures emerging. Higher energy prices brought up CK Hutchison’s associate income.

2023 has been a much tougher year, especially on the margin side, with headline EBIT margin down from 22% to 16%. However, note that headline 2022 numbers represented a high base given the HK$7.2 billion gain on the disposal of CK Hutchison’s Indonesian telecom business. Still, EBITDA fell -13% year-on-year, mostly due to weaker profits in the telecom segment.

Let’s look at the segment breakdown for 2023 as well. The key factors behind the negative top-line growth were lower goods demand post-COVID-19, lower year-on-year energy prices, continued cost pressures in telecom and infrastructure and better retail profits after China deserted its zero-COVID policy.

Let me break down what has happened in each of CK Hutchison’s main segments:

Ports: The COVID-19 lockdown in China and Hong Kong affected the container port operation in 2022. Subsequently, the total TEU in the container ports industry globally fell by 7%. This was due to the post-COVID cliff in goods demand. The operations also suffered from lower storage income compared to the COVID-19 peak, when port congestion caused such income to be boosted temporarily. CK Hutchison also owns a container shipping company, whose profits rose dramatically in 2021 and subsequently came back to earth. More recently, CK Hutchison’s China/HK ports operations have recovered after the zero-COVID policy was lifted in November 2022. To summarise, the port segment saw its profits rise during COVID-19 but is now reverting to the mean.

Retail: CK Hutchison’s Watsons’ health & beauty retail business in China suffered during the 2022 zero-COVID policy. But this year, it’s recovered nicely, though not as much as management had initially hoped for. The performance in Europe was described in the earnings call as “robust,” with revenues now exceeding their pre-pandemic levels. There is clear potential for the retail business to recover and grow beyond COVID-19.

Infrastructure: Profits in CK Hutchison’s infrastructure segment had been flattish until 2022 when inflation pressures caused costs to rise. While regulated assets tend to have inflation hedges in tariff or fee calculations, these adjustments occur with 6-12 month lags, causing CK Hutchison’s infrastructure segment profits to dip temporarily. Management is now expressing confidence that the business will eventually recover.

Telecom: This has been the main problem child for CK Hutchison. Management mentioned rising wages and higher energy costs, especially in the European telecom business. Tower service fees also increased in the UK. Eventually, phone subscriptions will reprice, but only with a certain lag. To deal with the adversity, capex has been reduced. The focus has shifted towards divestment, including European tower assets and through the merger between Three UK and Vodafone, enabling CK Hutchison to sell off its exposure to the UK telecom industry.

Finance & Investments: This segment includes investments such as Canadian energy business Cenovus, tech company TOM Group, CK Life Sciences, TPG Telecom, etc. Profits rose significantly in 2022 thanks to higher energy prices but fell again in 2023 as prices dropped again. Cenovus also suffered from reduced production volumes as unplanned outages occurred and delays in completing downstream infrastructure in Canada.

Below the EBIT line, it’s worth mentioning two other important factors: the weak Euro of late and higher interest rates.

A weak Euro: CK Hutchison benefits from a strong Euro due to its exposure to European telecom and infrastructure assets. But from 2021 onwards, the Euro has weakened against the US Dollar and HK Dollar, causing profits to weaken. Almost 40% of CK Hutchison’s debt is denominated in US Dollars, and very little of its revenues.

Higher interest rates: The company benefits from a strong Euro because CK Hutchison has large European exposure through the telecom and infrastructure segment. But from 2021 onwards, the Euro has weakened against the HK Dollar, causing profits to weaken relative to its predominantly USD-linked borrowing and corporate expenses.

With an aggregate debt of almost HK$400 billion, including non-consolidated subsidiaries, CK Hutchison certainly has leverage. However, since its cash is repriced faster than its liabilities, we have not yet seen the full impact of the current higher interest rate environment on the company’s financials. The weighted average maturity date is 2029, so the debt will take a while to reprice.

3. What will change for CK Hutchison?

3.1. Operational improvement in most segments

It looks like most of CK Hutchison’s businesses will improve in the next 1-2 years:

Ports: While there’s been a post-COVID cliff in demand for goods with weak manufacturing activity in mainland China, CK Hutchison’s port segment profits have already returned to its pre-pandemic level. Management is now guiding for demand to recover moderately in the second half of 2023 as global goods inventory levels are reduced. Aggregate volumes in TEU terms are expected to grow year-on-year in the fourth quarter of 2023.

Retail: Thanks to the end of the zero-COVID policy in mainland China and Hong Kong, CK Hutchison’s retail segment - dominated by the Watsons health & beauty store chain - is already recovering. In the first half of 2023, comparable store sales rose 11% year-on-year. And the European retail business is already above 2019 in terms of profitability. Management’s latest guidance is that “the European and Asian businesses should continue to deliver strong performances, while further recovery is also expected for the Mainland operations.”

Infrastructure: While cost inflation has been an issue for CK Hutchison’s 76%-owned subsidiary CK Infrastructure (“CKI”), there are adjustments that offer at least partial hedges against inflation. Several CKI’s British and Australian are scheduled to enter new regulatory regimes in 2023, facilitating revenue predictability for the next five years.

Telecom: While costs rose significantly in 2022, in-contract repricing began in 2023 and is expected to ramp up throughout 2023. Management is guiding for an improvement in profitability in the second half of 2023 as the pricing ramp continues. CK Hutchison will also realise GBP 1.7 billion in cash from the Three UK and Vodafone merger of another EUR 2.44 billion from the restructuring of Wind Tre in Italy.

Finance & investments: There have been two problems with CK Hutchison’s Canadian associate Cenovus, representing most of the profits in the Finance & Investments segment since it was deconsolidated. The first problem is that commodity prices fell year-on-year in the first half of 2023. But crude oil price has just hit all-time highs, and the outlook appears to be constructive, at least if you believe experts like Anas Alhajji. The second problem is that volumes declined in the first half of 2023 due to unplanned outages and delays in the construction of Canadian downstream energy infrastructure. However, these issues have now been resolved. Management is guiding for volumes to recover in the second half of 2023.

3.2. Reduced involvement in European telecom

Regarding capital allocation, the biggest change we’re seeing today is that CK Hutchison is reducing its involvement in the European telecom business. It’s now divesting those assets. This will free up cash and, in my view, improve group-wide return on equity.

The merger between Three UK and Vodafone will require antitrust approval by the UK Competition and Markets Authority (CMA). It looks like CK Hutchison will obtain approval for the merger, given that the combined entity will become better equipped to compete with Virgin Media O2 and British Telecom. The transaction will also need national security approval. A problem there might be that CK Hutchison is seen as a Chinese company, though alleviated by the fact that CK Hutchison will only control 49% of the combined entity.

Meanwhile, CK Hutchison will restructure its Italian business by setting up a joint venture with Swedish private equity firm EQT. CK Hutchison’s Italian wholesale mobile and fixed communication services will be injected into the JV, in which CK Hutchison will hold a 40% stake. The combined entity will be worth EUR 3.4 billion, and CK Hutchison will receive EUR 2.44 billion in cash after the deal is completed. However, note that the Italian retail telecom business will continue to be fully owned by CK Hutchison.

3.3. Inflation problem easing

High inflation caused margin pressure in both the infrastructure and the telecom segment, where wage growth and higher energy expenses caused costs to spike. Meanwhile, while regulated assets have some inflation protection, they typically operate with a 6-12-month lag. Similarly, in CK Hutchison’s telecom business, subscriptions typically only reprice every two years, meaning temporary margin pressure until revenues can catch up.

In any case, the inflation pressure we’ve seen since 2021 is now starting to ease, at least in the United States.

On the other hand, high energy prices benefit associate Cenovus, so inflation pressure indirectly benefitted CK Hutchison’s associate income. This segment thus served as a partial hedge.

3.4. Higher effective interest rates

With higher interest rates since 2021, it’s reasonable to think that interest expenses should rise gradually as CK Hutchison’s debt matures. For example, let’s take CK Hutchison’s 2024 senior unsecured bonds with a coupon of 3.625%. The yield to maturity on these bonds has now risen to 5.9% from just ~1% at the bottom in 2021. CK Hutchison’s parent-level bonds trade at similar yield-to-maturity. If interest rates stay at these levels, we could see borrowing costs double from the weighted average level.

3.5. Cash used to lower aggregate debt burden

In the past two years, we’ve seen consistent efforts to reduce the company’s debt burden. Net debt/net total capital has dropped from 25% in 2019 to just 17% in 2022. I believe that much of the cash freed up by the divestment in the European telecom sector will be used to lower the company’s debt burden.

3.6. Buybacks

On my numbers, CK Hutchison has repurchased roughly 23 million shares in the past two years. This is a minuscule amount compared to the total shares outstanding of 3.8 billion (about 0.6%).

CK Hutchison’s original promise was that it would use the proceeds for share buybacks after the UK tower sale. But since then, the company has only spent a few hundred million US Dollars on share buybacks.

Management said that their plans for share buybacks in 2022 were cancelled as they wanted to conserve cash in a “difficult environment”. However, they also said that the buybacks may resume in the second half of 2023, depending on “market conditions”.

In any case, I would not assume significant share buybacks, at least not the entire amount they will receive from their sale of European tower assets (estimated proceeds of roughly EUR 10 billion). But these divestments will help crystallise value in other ways.

3.7. Victor Li taking over from Canning Fok?

Today, CK Hutchison is run by Li Ka-Shing’s son, Victor Li. But one cannot help notice that Li Ka-Shing’s right-hand man, Canning Fok, continues to have a significant influence over the operations. Whether Canning Fok continues to take orders from Li Ka-Shing remains unknown.

I have concerns about Canning Fok. In Joe Studwell’s book Asian Godfathers, Canning Fok is described as Li Ka-Shing’s “chief slave” who does the dirty work on behalf of Li Ka-Shing. In 2005, his Canadian home was found to be used as a meth laboratory. While he’s known to be a tough negotiator, he might not be a great strategist. Canning Fok has long been in charge of CK Hutchison’s telecom business, one of the few segments performing poorly.

In 2008, Victor Li said he “[hopes] to cooperate with Canning Fok for years to come”. But now that Canning Fok is nearing retirement age at 71 and Li Ka-Shing has already reached the ripe age of 95, one cannot help but wonder whether Victor Li will one day be able to lead without interference. I believe such a scenario would benefit CK Hutchison, given that a single leader would help with accountability. And Victor Li does seem to care about operational excellence and capital allocation, given his focus on payback periods, at least in the retail business.

3.8. Potential crackdown on HK tycoons

It’s well known that Li Ka-Shing has an adversarial relationship with CCP Chairman Xi Jinping. Li had been on good terms with previous CCP leaders, including Jiang Zemin and Deng Xiaoping.

He faced criticism from Chinese state media after he switched CK Hutchison’s incorporation from Hong Kong to the Cayman Islands. And his “loyalty” to the PRC was also questioned after he started offloading properties in Shanghai.

The situation worsened after he published a message in a local newspaper suggesting halting violence on Hong Kong streets and stressing freedom, tolerance and the rule of law. A top Chinese government agency accused Li Ka-Shing of encouraging crime.

It is rumoured that Li Ka-Shing has a close relationship with Zhang Gaoli, whose downfall in 2021 was sparked by his relationship with tennis star Peng Shuai. The loss of a confidante in the senior party echelons must have hurt Li Ka-Shing’s access to the CCP leadership.

Otherwise, nothing has changed in the past two years. There’s no evidence of any CCP actions against Hong Kong tycoons. Watsons has not suffered any negative publicity in Chinese state media. And there’s been no evidence of any other interference. I will not rule out that the situation may change. I can only say that Cayman-incorporated CK Hutchison is mostly out of reach for the CCP. In my view, this is by design and the primary reason why Li Ka-Shing pushed the company to restructure back in 2015.

4. Valuation multiples

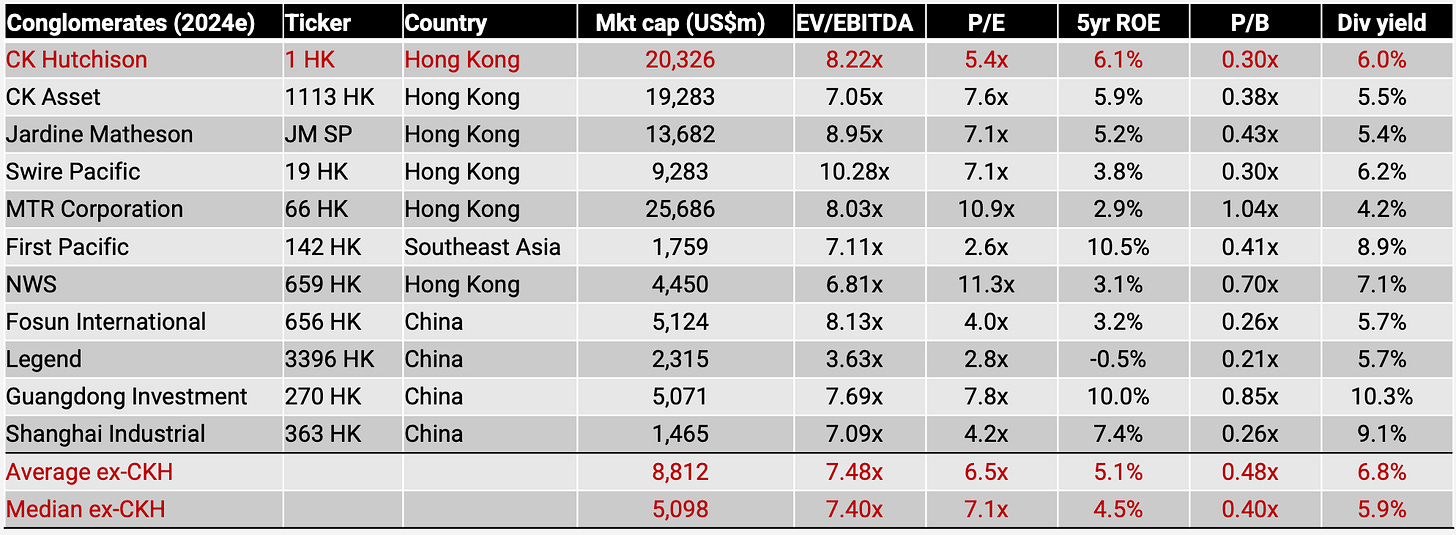

CK Hutchison now trades at a certain discount to the peer group at a 2024 consensus multiple of P/E 5.4x and P/B 0.30x, while the dividend yield aligns with the peer group at around 6%. But once the debt is considered, it’s not cheaper than peers, at least not on EV/EBITDA.

A chart illustrating CK Hutchison’s return on equity vs. its P/B ratio shows how it scores somewhat better than its Asian conglomerate peers. If you exclude First Pacific and Shanghai Industrial, CK Hutchison is among the cheapest conglomerates in Asia, given its ROE profile.

CK Hutchison’s P/E and P/B multiples are also remarkably low compared to their historical trading ranges. Historically, CK Hutchison has traded at P/Es of around 5-10x.

CK Hutchison’s dividend per share has remained stable since the restructuring in 2015, when CK Asset was spun off from its former parent. With a dividend per share of about HK$3, you’re looking at a dividend yield of about 7.2% against today’s share price of HK$41.8.

When it comes to an updated projection, I use the following assumptions:

Interest expenses might double. According to CK Hutchison’s disclosures, the weighted average cost of debt for 2022 was just 1.6%. Following the implementation of IFRS 16, interest expenses now include lease payments for the retail segment. If you just take interest paid in the cash flow statement of HK$9 billion and divide it against total consolidated debt of HK$286 billion, you get to 3.2% which is almost exactly the weighted fixed coupon calculated by Bloomberg. In any case, with interest rates at these levels and a weighted average maturity of 6 years, I would imagine that interest payments will probably double in the next decade or so, adding another HK$9 billion in interest payments, all else equal. However, with a staggered maturity schedule, the yearly increase will remain small. And besides, I believe that interest rates will come down in the next year or two.

Operationally, I think retail will continue to be a growth driver post-COVID, that ports segment profits will bottom out in the next year, and profits in the infrastructure and telecom will improve as they deal with greater inflation pressures.

An effective tax rate of 15%, in line with historical levels

Payout ratio of 30%, also in line with historical levels

Here’s what you end up with regarding future multiples, essentially P/Es in the mid-single digits for the foreseeable future, along with 5-7% dividend yields.

It’s probably best not to seek false precision. Profits from the infrastructure business are predictable, but profits in the energy and telecom segments are less so. But in any case, my main point is this. It seems unlikely that profits will fall so much that the P/E will go above 10x anytime soon. CK Hutchison continues to have one of the lowest P/E ratios of any blue-chip conglomerate globally.

5. Conclusion

CK Hutchison is essentially a bet on lower inflation, lower interest rates and a stronger Euro. In other words, the stock is a bet on disinflation. The company has been caught between a rock and a hard place with an exceptionally challenging macro environment.

CK Hutchison has long been considered one of Asia's most professionally run businesses. Certainly one of Hong Kong’s most blue-chip conglomerates. It doesn’t hurt that most of CK Hutchison’s businesses enjoy oligopoly-like market positions.

Underlying growth is probably sluggish, and the return on equity of about 7% is not impressive. While the company is moving towards an asset-light business model, the business is still barely earning its cost of capital. Any prospective return must come from either the 5-7% dividend yield or a re-rating through a higher P/E multiple from the current 6x level.

The future direction of CK Hutchison’s earnings will depend on the inflation rate in the United States and elsewhere. I believe that inflation pressures are easing, but your view may differ.

Thanks. I am hoping for acquisitions in the Infrastructure space, and growth with Capex in ports.

at the same time, cash balance starts to bring interest income. Nice that they exit little by little the Telecom business.