Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

I mentioned a few weeks ago that Indonesian equities have performed poorly. In my view, much the recent underperformance is due to new president Prabowo Subianto.

Indonesians seem disgruntled by the new administration. There have been reports of corruption in his school lunch program. High interest rates and recent austerity measures have hurt consumer confidence. People are suspicious of Prabowo’s new sovereign wealth fund.

I wrote about Prabowo last April, arguing that his military background was a concern and that his ascent potentially signals a return to a dictatorial past.

However, Indonesian stocks have now come down to very attractive levels. So, how concerned should we be about Prabowo? Are there perhaps winners from his new policies? And what kind of valuation multiples are Indonesia’s growth companies now trading at?

Table of contents

1. New President Prabowo Subianto

2. Prabowo’s ambitions

2.1. The Free Meal program

2.2. Enhancing state revenue

2.3. The Million Housing program

2.4. Health and education

2.5. Diplomacy and defense

2.6. The Danantara sovereign wealth fund

3. The investable universe of stocks

4. Ten highlighted companies

5. ConclusionI’m aware that many of you don’t have trading access to Indonesian equities. For those of you who don’t have access, I suggest you set up a pan-Asian brokerage account with Phillip Securities in Singapore or Boom Securities in Hong Kong.

1. New President Prabowo Subianto

On Sunday, 20 October 2024, Prabowo Subianto was sworn in as the next president of the Republic of Indonesia.

Indonesia is a massively large country bordering Malaysia in the North and Australia in the South. It has a population of 280 million people living across 17,000 islands. Most of these are Muslim, explaining the high birth rate and the nation’s outstanding demographics. The GPD per capita is currently close to US$5,000 per year — twice that of India’s, but materially less than China’s.

Growth has been slow, but study. The export of natural resources has ramped up gradually and these include palm oil, coal, natural gas and industrial metals such as nickel. However, red tape and a malfunctioning bureaucracy have prevented the rise of the manufacturing sector. That explains the lack of a broad middle class, like the one that has emerged in China.

Up until 1945, Indonesia was a Dutch colony. After independence, President Sukarno was inspired by the Soviet Union’s anti-imperialist movement and thus nationalized Dutch businesses. This was the start of Indonesia’s state-led model of development. Which, I might add, has not worked very well.

His successor, Suharto, was not a communist, but an autocrat nonetheless. As documented in the book Asian Godfathers, he teamed up with minority businessmen — providing them with exclusive licenses that guaranteed profits to himself and his cronies.

Suharto’s reign ended in 1998 after heavy protests. The country became a functioning democracy. However, the election of Prabowo Subianto has caused some to express concern. Prabowo was married to Suharto’s daughter for many years, and he was a senior military commander working directly under Suharto.

In addition, Prabowo’s father, Sumitro Djojohadikusumo, served as a Minister of Economy under socialist president Sukarno and built the nation’s first state bank, Bank Negara Indonesia. Prabowo’s father was also minister of trade in the late 1960s and early 1970s.

So when Prabowo won last year’s presidential election, many started fearing a return to the past. Prabowo used social media channels such as TikTok to portray himself as a person who cares about the everyday man. He promised free school meals, free medical checkups and the large-scale construction of affordable homes.

I think investors have legitimate reasons to question Prabowo. His party, Gerindra, frequently criticizes liberal democracy as being unsuitable for Indonesia. Instead, it favors “culturally aligned democracy”, which is a code word for providing more power to the state. And himself, obviously.

In Prabowo’s election campaign, he presented an overarching vision called “Asta Cita”, which serves as a roadmap to becoming a wealthy country by 2045. This vision includes the typical buzzwords you might see in such documents: strengthening human rights, creating employment, improving defense, industrialization, etc.

But to understand the near-term future, let’s go through Prabowo’s policies in greater detail and see which companies might end up as winners in Prabowo’s Indonesia.

2. Prabowo’s ambitions

2.1. The Free Meal program

One of the highlights of Prabowo’s campaign was the promise to provide free school meals for Indonesia’s 80 million children and expectant mothers.

The initial stage of the program was rolled out earlier this year on 6 January 2025. On that day, close to half a million children started receiving free school lunches. This was behind the day-one target of 3 million and a far cry from the ultimate goal.

Netizens also discovered that the quality of food differed from school to school, with reports of corruption in some of Indonesia’s poorer regions. The budget of the school lunch program was also slashed by a third to just 10,000 rupiah per box (US$60 cents), causing concern about the quality of the food.

But still, malnutrition remains a problem, so one could well argue that the program is a step in the right direction. It’s still unclear how the free meal program will be financed. Funds might be freed up by cutting energy subsidies. There is also hope that tax revenues could be raised in the medium- to long term.

2.2. Enhancing state revenue

The informal sector remains about 30-40% of Indonesia’s economy. There are probably 100 million or more working-age individuals who don’t pay much tax at all. That presents a huge problem for the funding of the state. And it explains why Indonesia has had a persistent government budget deficit, causing the currency to depreciate.

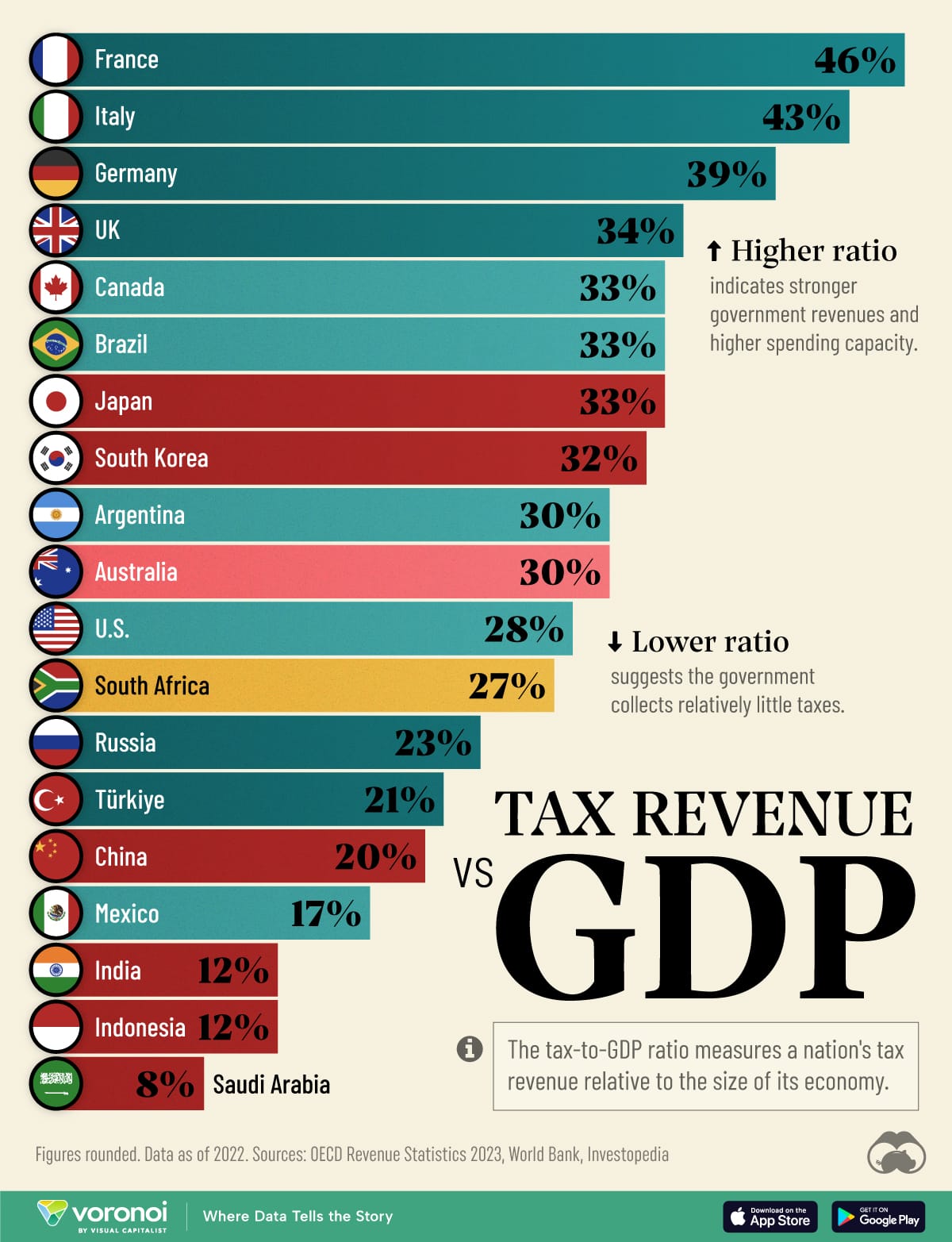

Prabowo has set out to improve the situation. His goal is to raise the tax revenues/GDP ratio from 10% today to 23% by the end of his term in 2029. Indonesia’s ratio is about the same as India’s but lower than China’s 20%.

There are initiatives to improve tax collection. For example, Prabowo is pushing for a new digital tax system to be implemented in 2025.

However, many observers remain skeptical. And the 2025 target is for the ratio to remain flat due to a one-percentage-point decline in the VAT rate.

What’s more worrisome is that Prabowo wants to create a separate institution to manage tax revenues, overseen by the executive branch. Specifically, it will be overseen by the vice finance minister, who happens to be Prabowo’s nephew.

2.3. The Million Housing program

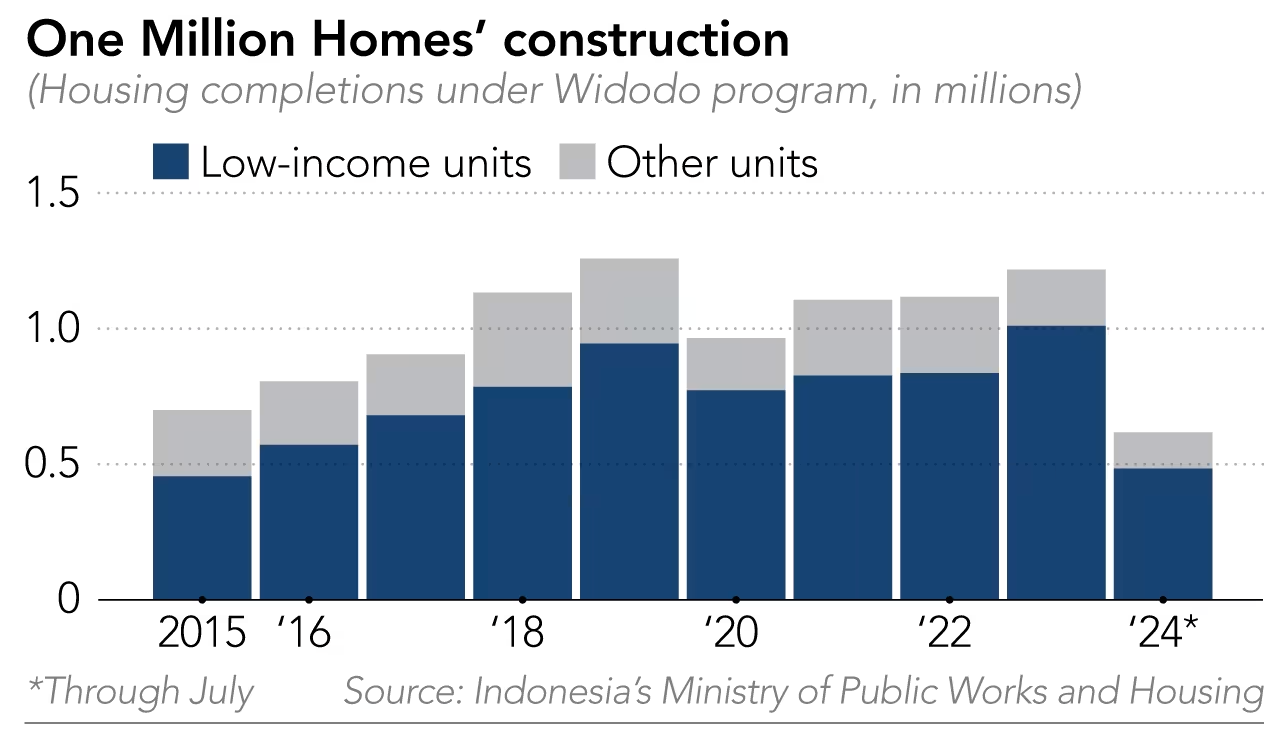

Roughly a decade ago, then-president Joko Widodo (“Jokowi”) embarked on a project to build one million housing units per year. It was meant to support the nation’s lower-income population. The project was first launched in 2025 and gradually ramped up to 1 million units per year.

At that time, the government subsidized mortgages capped the interest rate at 5% for 20% years and required only minimal down payments of 1%. Until today, roughly 10 million units have been delivered

However, the quality of construction has been shoddy. The homes are often in remote areas, making them impractical even for lower-income families.

Nevertheless, Prabowo is doubling down on the program, vowing to build 3 million homes annually. His brother Hashim Djojohadikusumo will lead the effort through a new housing task force and a standalone housing ministry.

Hashim’s track record isn’t great. He previously worked for mining company Bumi and Nations Energy and did not do well for minority shareholders.

It’s also not clear how Prabowo will fund the construction of these 3 million homes. Investment banks in Indonesia are assuming that greater budget deficits will be necessary to achieve these goals.

2.4. Health and education

Starting in 2025, Prabowo’s government will start offering free medical checkups to 60 million Indonesians. It will then gradually move up to 200 million annually.

From a humanitarian point of view, this makes perfect sense. Over 100,000 citizens die of tuberculosis each year, and these deaths are totally preventable.

The idea is that preventative medicine like this will save on future healthcare costs. However, in the short term, it is likely to lead to higher costs, somewhere around US$300 million annually.

In addition to free checkups, Prabowo has pledged to establish 300 new medical facilities. However, he’s recently backtracked from that goal, given the challenges involved. The government is instead switching its attention to improving the productivity of existing healthcare facilities through better medical equipment and a more equitable distribution of doctors. This will also add to government burdens, though less than the free medical checkups.

2.5. Diplomacy and defense

As I mentioned earlier, Prabowo held significant roles in the military under former President Suharto. He was also the nation’s defense minister from 2019 to 2024. Prabowo is well-versed in global politics, having studied abroad and studied at military academies in Indonesia.

One of Prabowo’s key priorities upon becoming president was to travel to China to sign deals. He quickly announced that Indonesia would join the BRICS organization of emerging markets cooperating with the People’s Republic of China. Indonesia has also joined China’s China’s Community of Shared Destiny of like-minded countries forming a closer relationship politically and economically.

When in China, Prabowo put his name on an official statement accepting overlapping claims in the South China Sea, suggesting that China’s 9-dash line claims are legitimate. This has angered ASEAN neighbors who have taken the People’s Republic of China to international courts for perceived aggressions along their coastlines. At the same time, under Prabowo, Indonesia purchased Rafale jets from France and F-15EX jets from the United States.

So in summary, it seems like Prabowo is trying to maintain positive relationships globally, which should be positive for trade.

"Indonesia has a desire to maintain good relations with all countries in the world, all economic blocs where we want to maintain a close relationship”

2.6. The Danantara Sovereign Wealth Fund

What’s more concerning is Prabowo’s new Danantara sovereign wealth fund. Countries that set up sovereign wealth funds do so to manage the capital received from selling natural resources to foreign countries. However, Indonesia has a current account deficit.

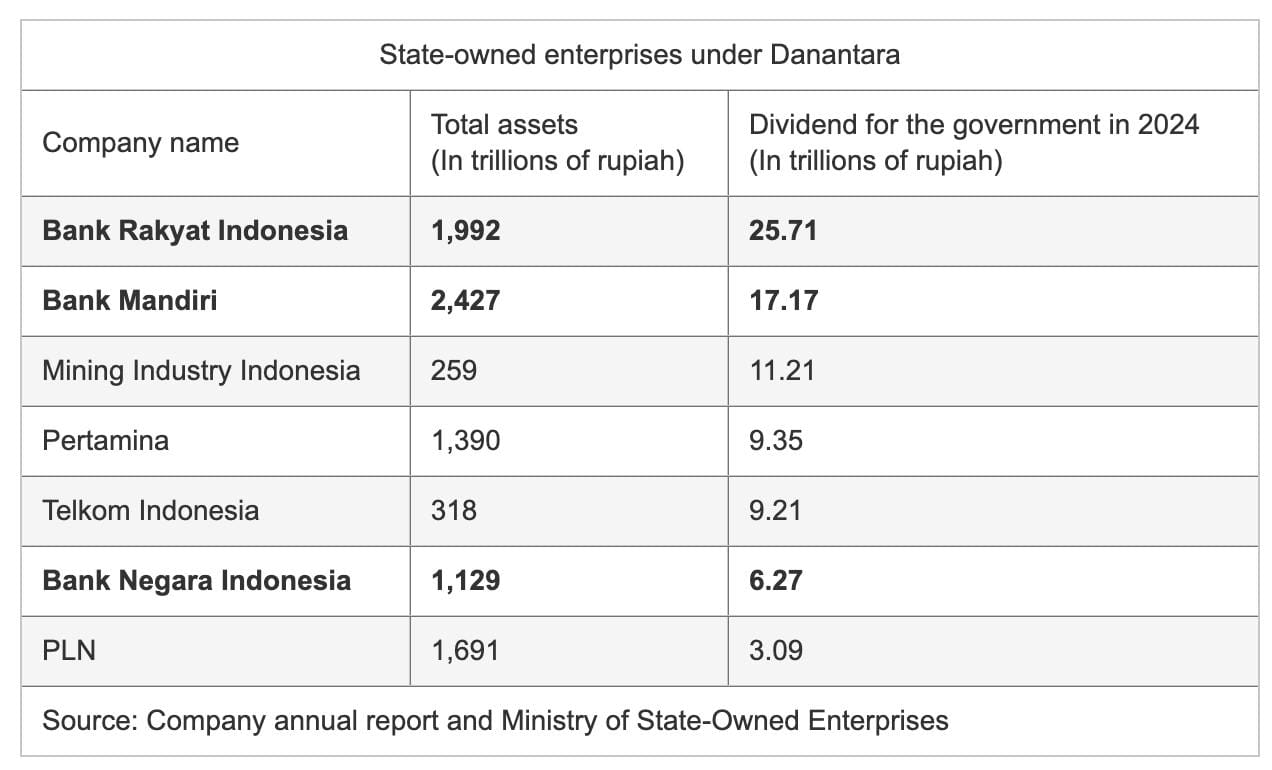

Instead, Danantara has been set up to take control of 65 state-owned enterprises from the Ministry of State-Owned Enterprises. The total amount of SOE assets to be injected into Danantara will amount to nearly US$1 trillion — a significant number, even for Indonesia.

I don’t understand why Danantara is needed. Indonesia already has a sovereign wealth fund: Jokowi’s Indonesia Investment Authority, which was launched in 2021. And it’s not clear why taking over the assets from the Ministry of SOEs will make any difference. Danantara will even be managed by the same person — the Minister of Investment, Rosa Roeslani.

In addition to the SOE assets taken over, the government will also inject US$20 billion of capital to be invested by the fund. The fund will focus on “sustainable sectors”, including real estate, advanced manufacturing, food production, etc.

Investors have responded negatively to the news of Danantara. There is a fear that if banks are taken over by the fund, they will be run for political purposes — perhaps to enrich vested interests. So far, it does look like Danantara will be staffed by politicians rather than investment professionals.

The recent US$12 billion corruption scandal at Pertamina highlights the risks of capital extraction from state-owned enterprises. I don’t see how Danantara will solve the problem — quite the opposite.