Insight #1 – Asia’s RCEP agreement is a win for China, but not so much for other Asian countries

RCEP stands for “Regional Comprehensive Economic Partnership” and is the new trade pact closed between 15 Asian nations. It will come into effect in late 2021 or early 2022. On the face of it, RCEP looks like it’s benefitting smaller Asian countries, with lower tariffs across the board. But it's a massively inferior deal than what the alternative TPP could have achieved. The main issues with RCEP are that there are no rules covering competition, subsidies to SOEs or product standards. Rules on environmental standards were dropped at the last minute. While TPP followed the Union Nation’s declaration of labour rights, RCEP does not make any commitments on fair labour practices such as worker exploitation or prison labour. With no unified food safety standards, cheaper tainted products will find it easier to cross borders. At the last minute, the Chinese Communist Party managed to insert a special provision, making state-owned enterprises exempt from oversight. And in contrast with TPP, there are no rules at all for cross-border data transfers and cyber security. As economics textbooks tell us, free trade usually increases overall utility. But if there is a lack of IP protection, environmental rules, labour laws and product safety standards, free trade is likely to lead to a race-to-the-bottom. The cheapest product wins and other countries will be forced to copy China’s lax regulation in order to compete.

Insight #2 – We might see bargains in Chinese telecom operator stocks early next week

NYSE confirmed it will halt trading of the ADRs of all three Chinese telecom operators on 11 January. In addition, US Treasury confirmed that subsidiaries of companies on the entity list will also be subject to sanctions. That means that Americans from 11 January onwards can no longer buy shares in China Mobile, China Telecom and China Unicom - not even the shares listed in Hong Kong. Funds will probably scramble to get out of the shares, because otherwise they would not be able to take on new American investors. Sounds like a deadly combination to me. Perhaps the Chinese government’s “National Team” will step in and buy. If not, we will probably see bargains among these three stocks as we get closer to Monday. The valuation multiples are very attractive at 7x earnings and 3-7% dividend yields, so I can see why you might want to buy on a dip.

Insight #3 – The Asian cinema industry is recovering nicely

Some interesting data out of Japan about how the Asian cinema industry is recovering from the pandemic. A record number of people saw movies in IMAX theatres in Japan over the weekend. In China, December IMAX customers jumped 28% year-on-year. Those numbers should probably not be extrapolated to the industry as a whole. But I remain bullish. Here in Singapore, it seems that individuals are willing to go back to the cinema, as long as they don’t run the risk of getting infected. Vaccines will help assuage such fears. Some investors think that delays in Hollywood blockbusters is a negative for the industry. But at the same time, those delays also mean that the 2021 movie slate will be the strongest in many years.

Asian stock ideas

Articles worth reading

Xi Jinping’s Central Military Commission took full control of military on 1 Jan

Kevin Warsh’s WSJ op-ed: Beijing’s Bid for Financial Supremacy

CXJ Research: PBOC is trying to cap China’ real estate market

Chinese regulators try to get Jack Ma’s Ant Group to share its consumer data

Jack Ma is simply lying low, not missing

Alibaba looks to raise up to $8 billion

China sentences ex-finance chief to death after taking $277 million in bribes

Dozens of Hong Kong opposition figures arrested under national security law

The Scholar’s Stage: Why I fear for Taiwan

The Diplomat: Taiwan’s overall defense concept, explained

Globalstockpicking’s summary of 2020

Exante Data: China’s digital currency is a game-changer

Alex Turnbull on Australia’s dependence on Chinese trade

Pekingnology: What’s the next big thing on Beijing’s self-reliance list?

Japan’s Prime Minister Suga: China may have difficulty joining the TPP

Suga to declare emergency in Tokyo area over the Wuhan virus

SoftBank’s Masayoshi Son poised for an IPO windfall in 2021

Thailand’s economic conditions tipped to worsen as virus spreads

WSJ on India’s Oyo Hotel Chain

Delays over pricing holds back India’s vaccine roll-out

Podcasts and videos

Sam Zell interviewed by Kirill Sikiloff (non-Asia related)

Carson Block on The Exchange podcast

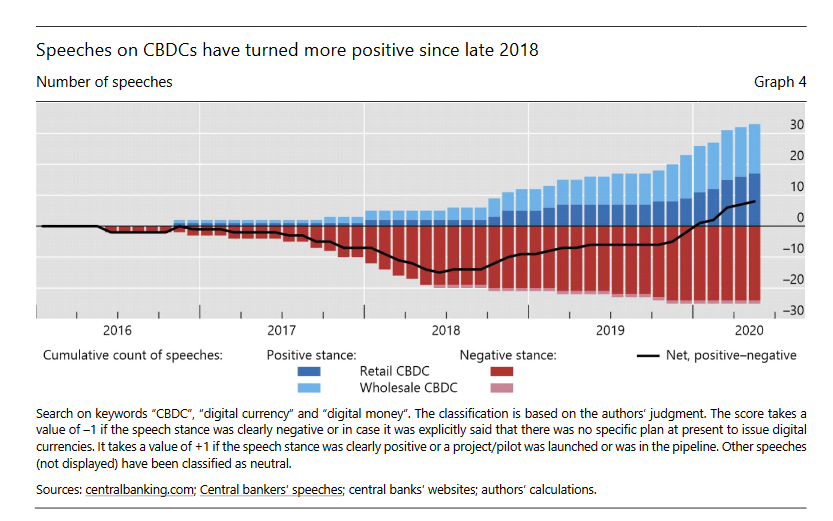

Chart of the week – Governments around the world are turning positive on central bank retail deposits

Source: Bank for International Settlements

How would you rate this week's newsletter? 🤔

Thanks for reading!

If you’re finding this newsletter valuable, consider sharing it with your friends.

Or subscribing if you aren’t already.