Asia links 24 Dec 2020: Vietnam, Jack Ma, Asian telecom operators

Latest

Structural Monitoring Systems (SMN AU)

Blue-chip avionics company at 1.6x EV/Sales with a near-term FAA approval catalyst

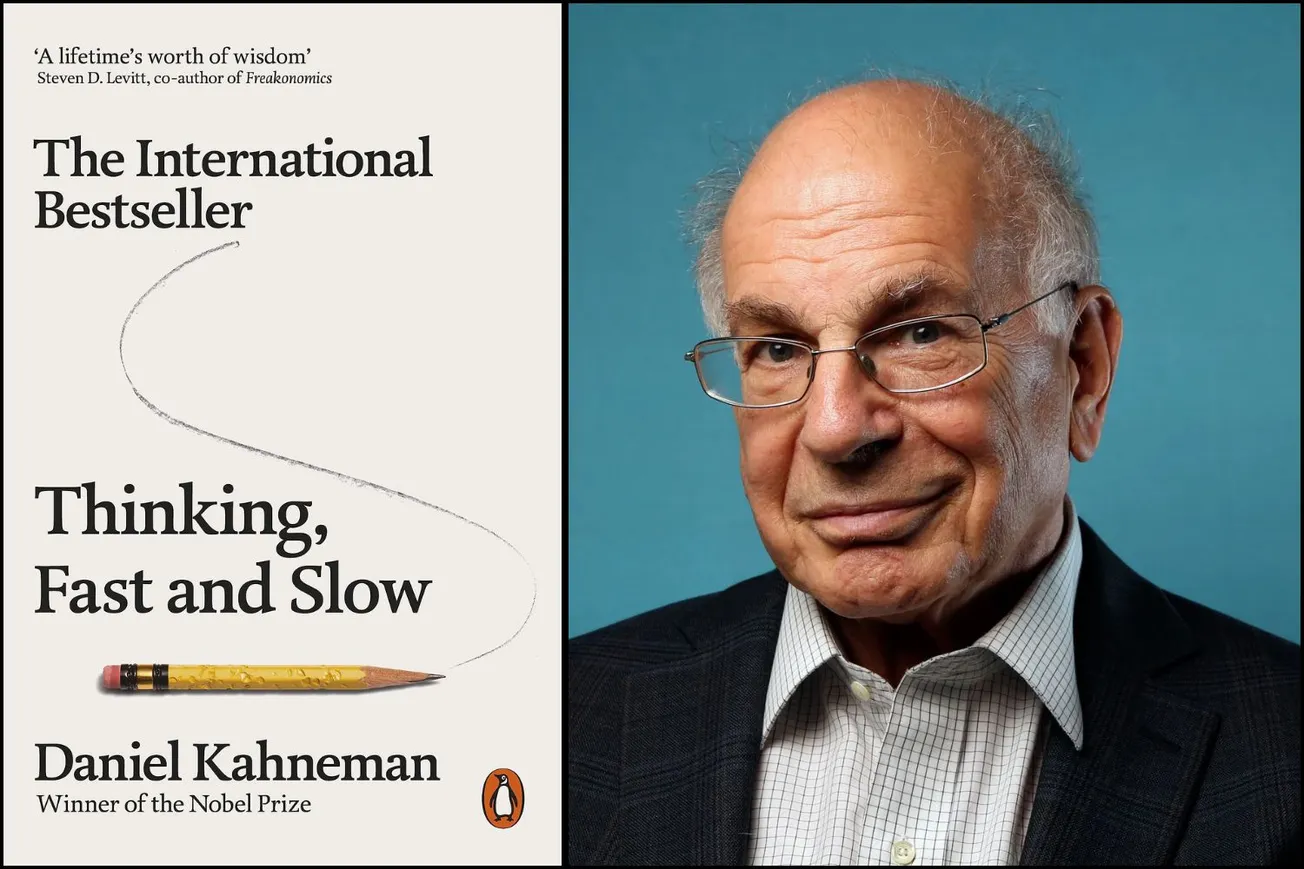

Investing, Fast and Slow

Reflections about Kahneman's book "Thinking, Fast and Slow"