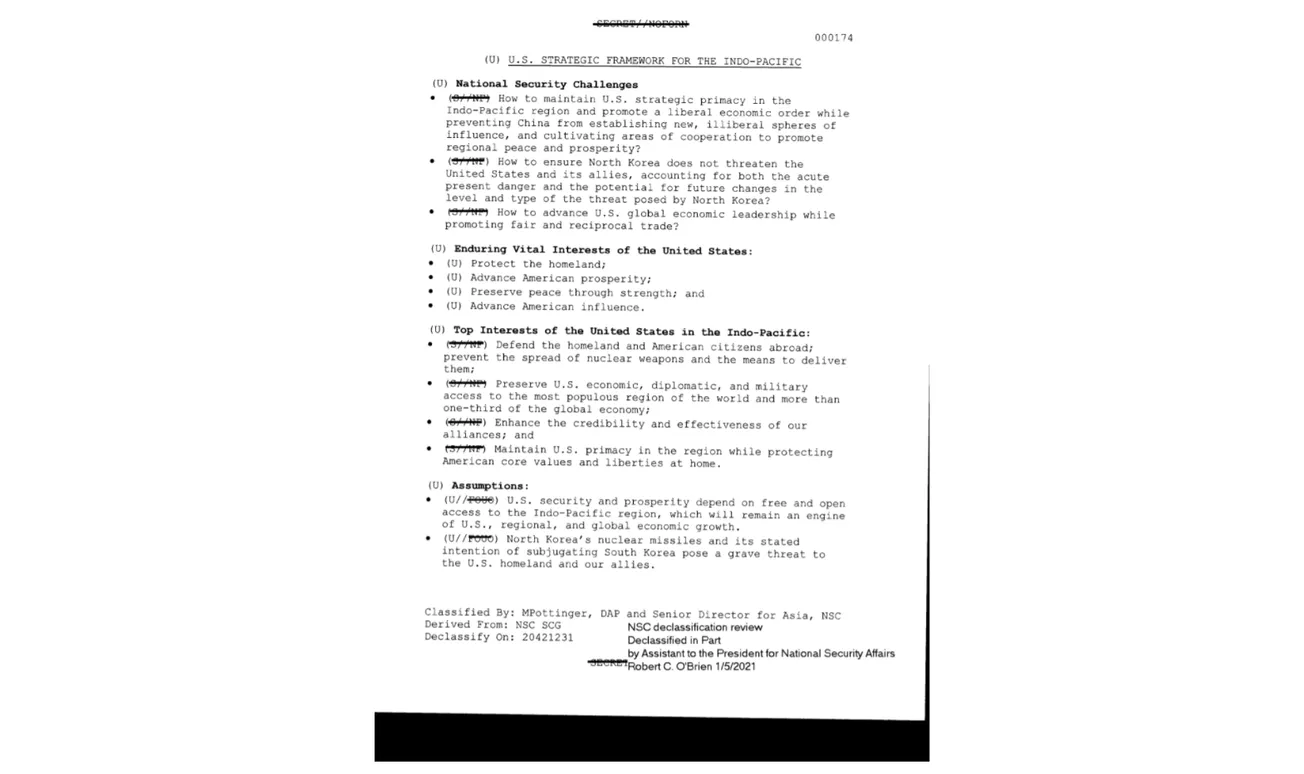

Asia links 14 Jan 2021: US Framework for the Indo-Pacific, Chinese property bubble, oil price vs oil stocks

Latest

Investing in Asia's myopia trend

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time,

Indonesian land seizures

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time,