Table of Contents

Daniel Tabbush is the Thailand-based owner of the Tabbush Report, a research publication analysing Asia-Pacific banks. Prior to launching the Tabbush Report, he was the Head of Asian Bank research at CLSA for most of his career, overseeing coverage of 80 banks and 10 analysts.

1. Could you tell us about yourself - your background, how you ended up as a banking analyst in Asia and what you’re doing right now?

I had studied economics and finance, and I was always interested in stocks.

After working as an analyst for a portfolio manager in downtown LA right after school, I decided to travel the world, which I did for about 3 years.

It became tiring after a while, and when I was in Thailand, I thought it was time to start working again. I picked up the Bangkok Post, and there was a classified ad for an equity analyst at one of the major brokers in Bangkok.

I ended up being their first expat hire, gradually starting to analyze banks after 1-2 months.

2. What do you think investors typically misunderstand about bank stocks?

Banks are the backbone of the Asian economies and for many companies that are not listed.

Having exposure to banks is one way to gain broad economic exposure to a country, especially in Asia - more so than in the United States.

The minutia of each bank's business is typically far less important than the overall credit cycle, provisioning for credit losses and interest rates.

Banks can appear expensive for a very long time, especially in a relatively high growth economy, and some may dismiss them as good investment options.

3. What are the major trends that will affect the fundamentals of the bank stocks that you cover?

Several major trends I am seeing are asset inflation, reflation, economic recovery, low interest rates and free money. The risk now is that banks see several positive facets concurrently.

A key trend is a recovery for credit costs. They are either benign or in reversal.

Low interest rates are spurring the demand for credit, both from pent up demand and delayed investment from the fiscal year 2020.

A re-pricing of the back-book from falling rates will run its course. This has positive implications for margins, especially with better loan volume.

There are huge deposits being held at banks in Asia and globally that earn nothing. This, too has implications for real asset prices - land, property - which form the collateral for most bank loans.

Capital management is next, where banks are over-liquid, having reduced dividends, and now well overcapitalized, even for new, re-invigorated demand.

4. How would you characterise the banking systems of Southeast Asia? Where do you see the most opportunity for investors?

Credit penetration in the Philippines and Indonesia is low compared with many other countries, as measured by credit/GDP. This can allow for longer-term natural growth in credit.

Indonesia is the most specialised banking market. Banks are not homogeneous like in Singapore, Australia, or even with the largest 4-5 banks in Thailand. This has important implications for relative margins, profitability, and competition. Indonesia should offer the most opportunity longer term.

India has grown credit/GDP faster than almost all countries in the region. It is the only country that has been engrossed in its own fundamental banking crisis before the man-made crisis of the fiscal year 2020. Inherent risks in India include questionable central bank oversight, policies, highly indebted corporate borrowers, and hugely understated bad loans.

5. What do you think will happen to Asian net interest margins now in an era of higher budget deficits, partly driven by a move towards Modern Monetary Theory (MMT)?

We do not view margins within the context of budget deficits or MMT. The latter is so incredibly flawed, and one must give it time for proponents to realize it. But that will probably only happen when it's “too late” for some countries.

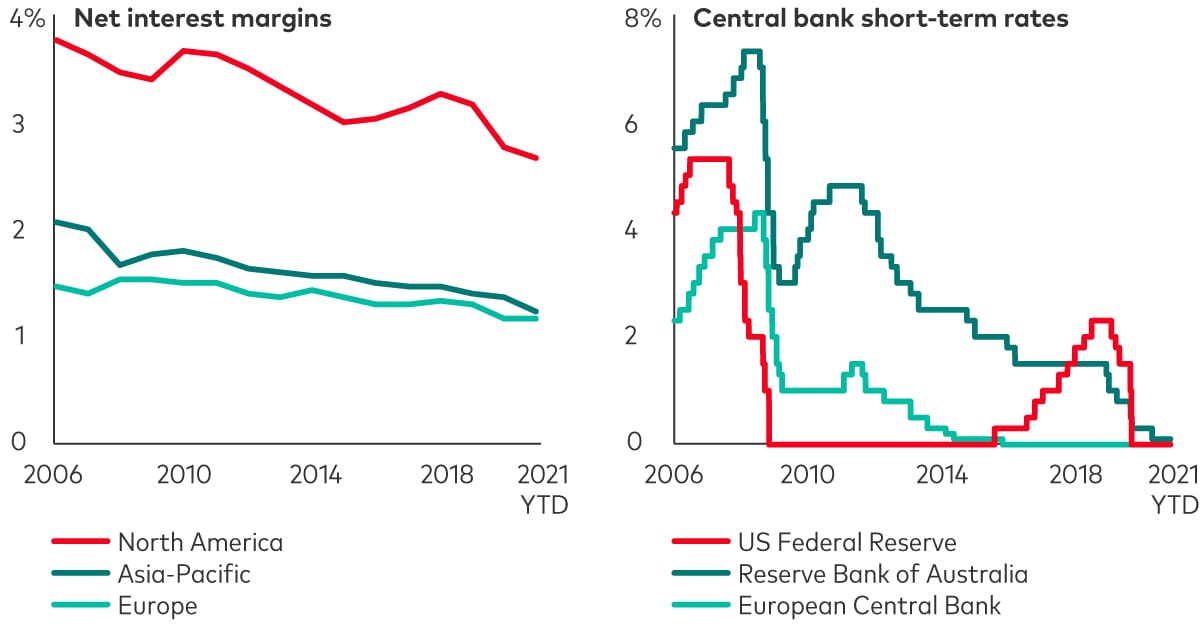

Margins naturally decline with development, with competition and with low interest rates.

Net interest margins can rise with loan mix shift, e.g. to consumer or subprime, away from very low-yield large corporates. Loan-deposit-ratio (LDR) management and asset-liability management (ALM) become more key to preserve, support and raise margins as a banking system evolves.

Initially, it does not matter; there are no loans, prices are high, and the demand for loans is high. Such economies include Indonesia, Vietnam and African countries.

There are many facets to NIM trends within what should be a lowering long term, but even during this LT experience, it need not hit the bottom line. Banks gradually develop fee income and focus on costs. The former has essentially no capital charge nor capital risk, so it is especially valuable.

6. How did it feel to live through the Asian Financial Crisis, and what did you learn from that experience?

It was exciting, at least if one was stable in their work, job and personal circumstances. We learned that it could all go terribly wrong, and banks can make sizeable losses.

There was never any modelling of bad loans and credit costs before 1996 or 1997. It was all about volume and margins, nothing more - at least in Southeast Asia and India.

We learned that banks themselves did not have institutional memory - of times with losses, of bad loans. Of course, at the time, none of the countries had the experience of high USD borrowing for local lending into local currency businesses and assets. So the devaluation in July 1997 meant immediate high bad loans - it was not gradual.

What we learned is that the fringes offer great insight to the mainstream; a cold hard look at finance companies or property companies in Thailand gave a clear warning of what could come. If one focused only on a few major banks, you could easily miss the credit deterioration; it started with finance companies.

Forecasting losses or forecasting dire numbers was not what the market wanted to see, and it was aghast at the number, in awe... until the real numbers came through. But sometimes, the numbers point us in the right direction and lead us to a conclusion. It can be hard to follow when the projected outcome seems so different from what had been the status quo for so long. For instance, Thailand from 1990 to 1995 was in a banking boom. Then it all turned.

7. How do you assess the quality of a loan book in Asia, where loans can so easily be rolled over without any hit to earnings?

There is no way to have 100% clarity from the outside. Even from the inside, I am not sure the view is completely clear.

Within these constraints, one can look at the accounting line item accrued interest receivables or interest in suspense accounts as a clue to loan quality.

Additionally, one can look at actually loan yields being booked compared with loan yields being stated, using public data on rates. If there is a widening gap here, that can be a red flag: getting less and less against the contract rate. We termed this as yield gap analysis which we did in Thailand pre-crisis, and it ended up being incredibly helpful in formulating a view on the sector.

8. Do you see red flags in any country’s banking system? I’m thinking of runaway loan growth, unregulated shadow banking sectors, asset-liability mismatches, etc.?

No. China comes to mind, but so it has for 20 years.

9. How is it that China’s banking sector is so stable despite massive credit growth and obvious misallocation of capital - something’s got to give, no?

It's a command economy, not identical to most others. It fared relatively well - their banks - during the fiscal year 2020 unlike the mania, panic with all other banks.

Some may argue that the China bank experience during the fiscal year 2020 is more valuable than the US bank experience at that time. This is because we often wish to discount variance - deviation.

Unless there is something dire with the capital account, I am not sure that “something has got to give”.

10. As a bank analyst, what are you most worried about in the next 1-2 years, and what could potentially ease your worries?

I am not generally worried about banks; they operate cyclically, and analyzing them is relatively straightforward. Regulatory concerns come and go, which is normal, and must be digested, well understood.

Fintech threats to banks' traditional business are partially real, but I do not feel that banks will lose out in any meaningful way in the next two years. We say “partially” real, as most banks will adapt and buy into or create their own fintech platforms so as to not lose out entirely.

Not specifically related to banking analysis, I am concerned about currency debasement - the future value of fiat money.

11. What are your favourite Asian bank stocks right now?

For large Asian exposure and for growth, I like DBS and Vietnam Maritime Commercial Bank.

For DBS, it can benefit from significant write-backs, higher oil prices compared with last year, and it has some of the best cost controls in Asia-Pacific.

For MSB, return on assets (ROA) has risen from 12-69bps a few years ago to 198bps at present, with an expanding loan to deposit ratio (LDR) and far higher net interest margins.

For yield and lower risk exposure, I like Thailand’s Tisco and Thanachart Capital (TCAP). The former is one of few surviving finance companies from the 1997 crisis, characterized by conservatism and something that remains visible even during the fiscal year 2020.

TCAP is a financial holding company with a broad range of exposures, but no Thai financial can beat its 9.3% dividend yield.

12. Where can we learn more about the Tabbush Report and your other writing?

You can find more information about my research on www.tabbushreport.com or email on daniel@tabbushreport.com. I also have a Twitter account with the handle @TabbushReport.