Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website.

Today, I’ll be interviewing InflationX, an anonymous Twitter account of a veteran fixed-income investor who has spent much of his career in the Asia Pacific.

I want to find out what the current US rate hike cycle means for bonds, equities and currencies in the region. Let’s dive in.

Table of contents

1. Background

2. Inflation outlook

3. Growth outlook

4. Fed policy

5. Ways to express a lower rates bet

6. TIPS vs USTs

7. Taking on credit or prepayment risk

8. Sovereign bonds in Asia

9. Asian FX

10. Where can readers go to learn more1. Can you tell us briefly about your background and what you’re focusing on right now?

I spent some time in fixed income on the buy side originally, but I have been investing in equities over the last decade.

In equities, I am typically looking for low valuations and/or high upside situations. This approach has taken me to energy, mining and other cyclical industries in recent years. These are generally not buy-and-hold names/sectors and you have to navigate the macro or commodity-specific cycle. Occasionally, a cycle can last quite long. One example I like to cite is Frontline's 55x total return from 1998 to 2008. It was a powerful and durable tanker cycle.

This year, I went back to my origins and have spent most of my time researching and purchasing fixed-income securities. There will be a better time (and price) to buy cyclicals and commodities, while bonds offer value. I have advocated reflationary trades in 2020, but the cycle is going into reverse now.

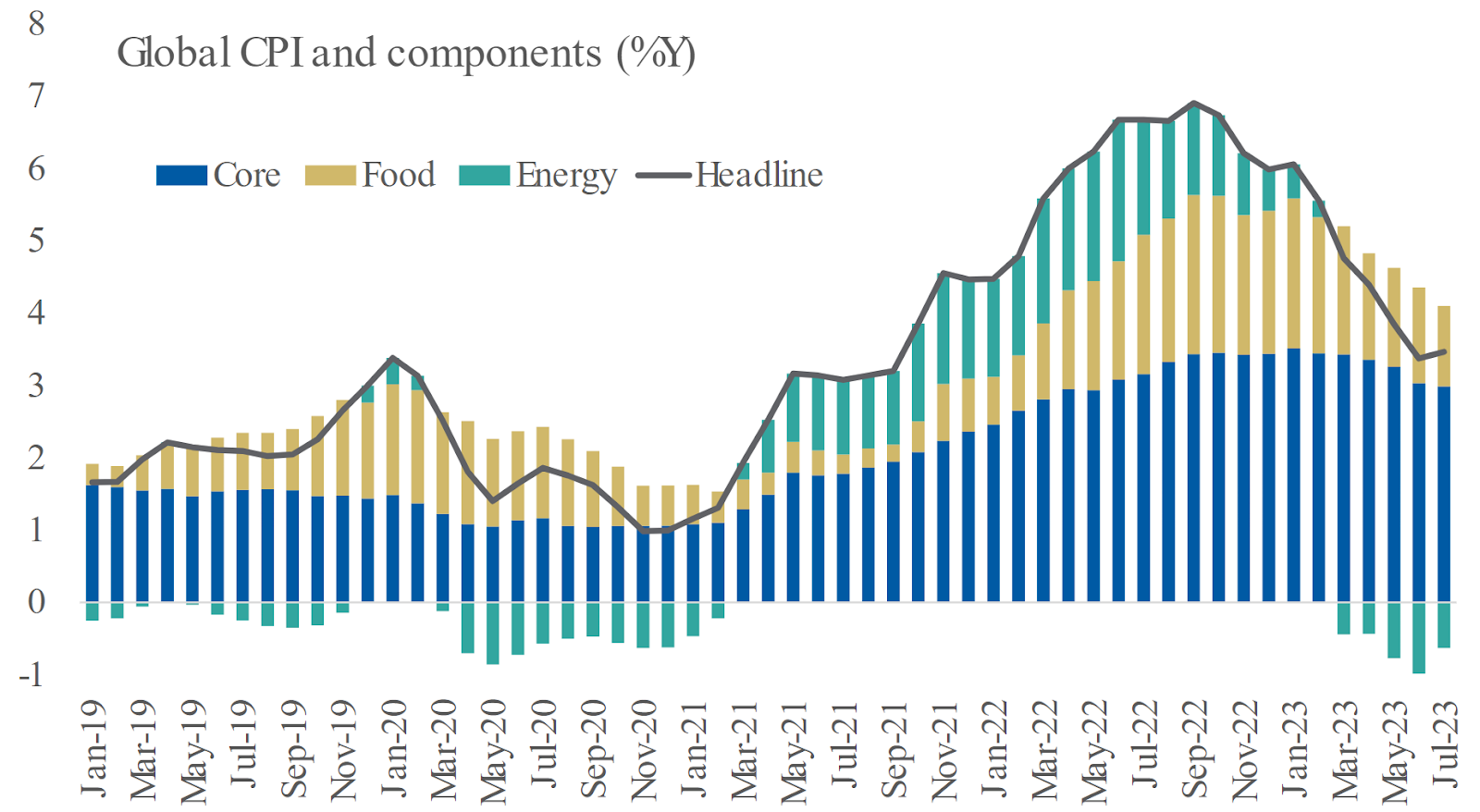

2. What’s your outlook for US and global inflation, and what factors do you see as the most important to push inflation in either direction?

On a medium-term time horizon (5-10 years), there will be upward pressure on inflation from several sources. Given the geopolitical tensions with China, supply chains are being reconfigured, no longer optimizing for the lowest cost. The green transition will require many years of significant investment and will result in higher costs, at least in the interim. Finally, the declining demographic profile should lead to a lower supply of people to work. So, I would expect inflation to average higher this decade than last.

However, in the short-term (12-18 months), the economic cycle is going to drive inflation and growth lower, and there may be an opportunity in bonds/rates at this juncture.

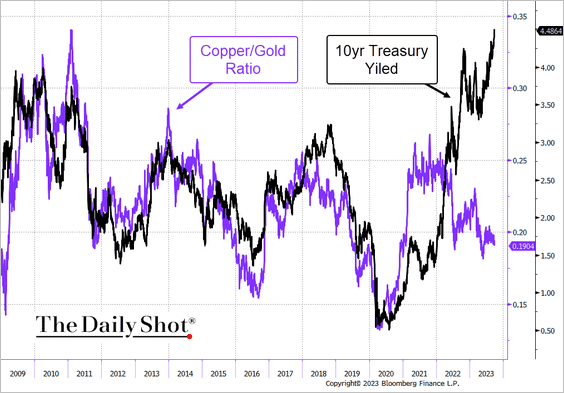

3. What’s your outlook for economic growth in the US and other major economies now that interest rates have gone up quite a bit?

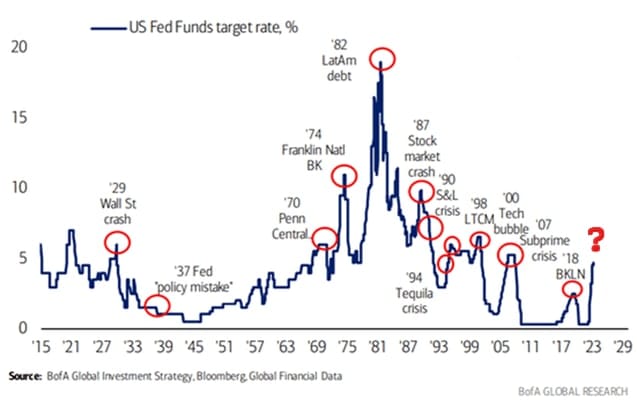

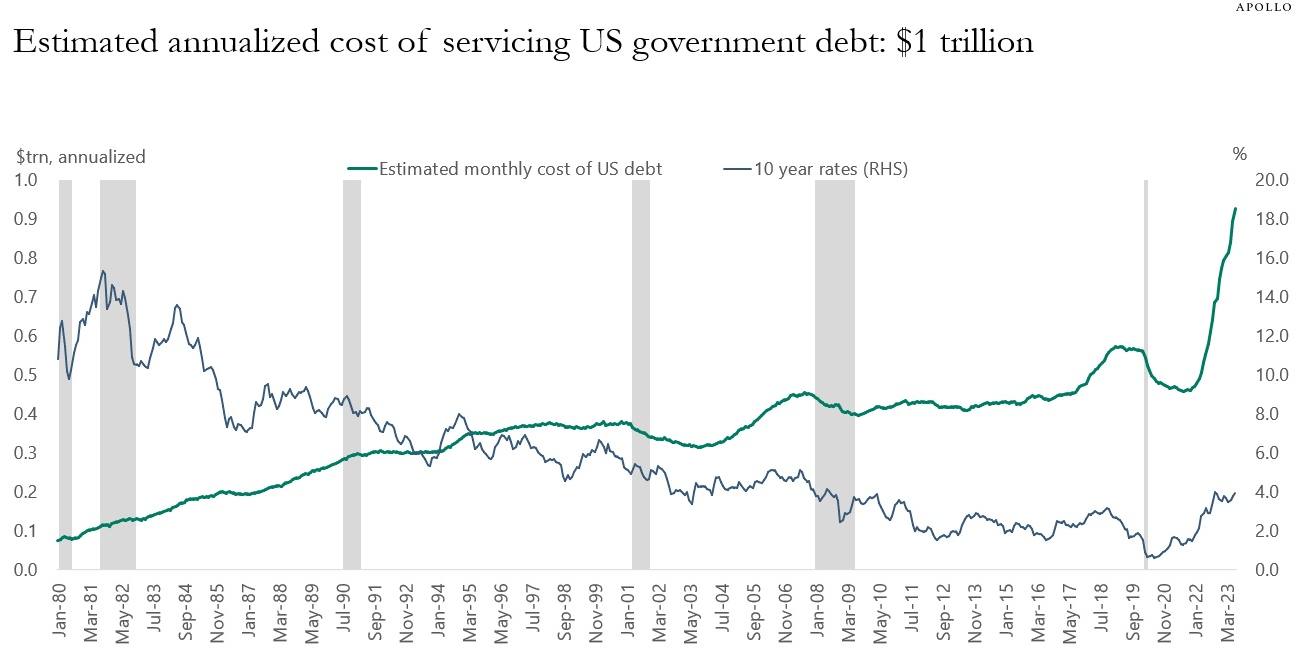

There is a famous chart from Bank of America, which shows how every major rate hiking cycle during the past half century, ended in some kind of crisis (LatAm Debt in '82, Market crash in '87, Tequila crisis in '94, LTCM in '98 etc). This cycle has seen the steepest and quickest increase in rates, not just in the US but across the world (with some notable exceptions in Asia). This monetary tightening takes place as the world has much more debt than before, while growth rates are lower than in the past. It also comes after a decade of ZIRP. I do not see how we do not end up in a crisis.

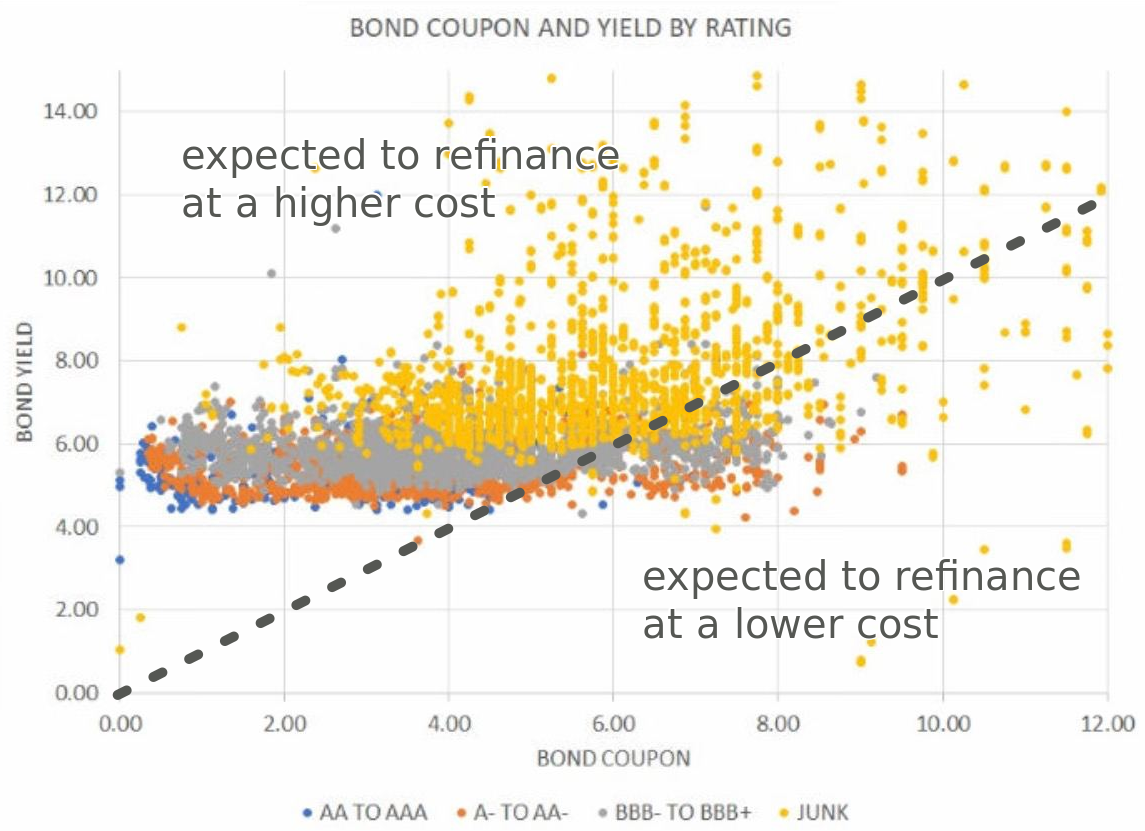

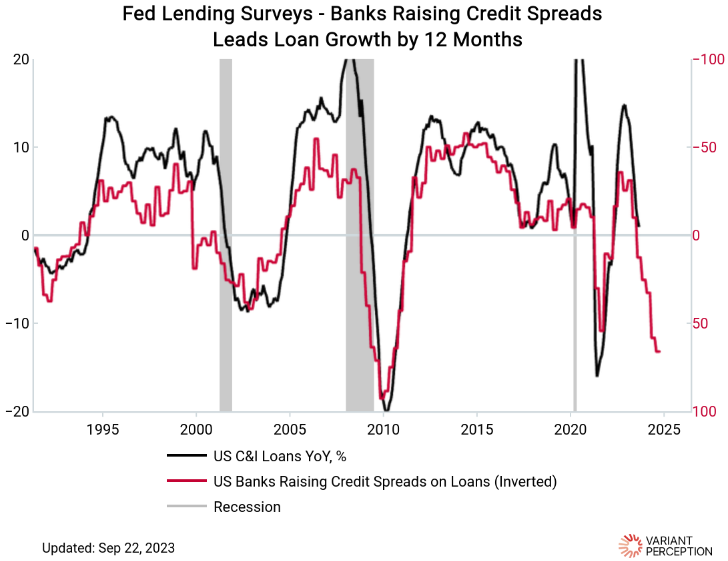

There is a well-telegraphed yet inevitable maturity wall of debt coming due. 2023 was a light year for refinancing, but during 2024 & 2025, many corporates have maturing debt, which will need to be refinanced at much higher interest rates. Some of these companies' capital structures are already stretched, and higher interest rates will lead to defaults. There is plenty of evidence that a default cycle has started already, particularly but not only in the US. It will get worse every quarter rates stay at these levels.

4. What are Jerome Powell’s current incentives, and what is he trying to achieve?

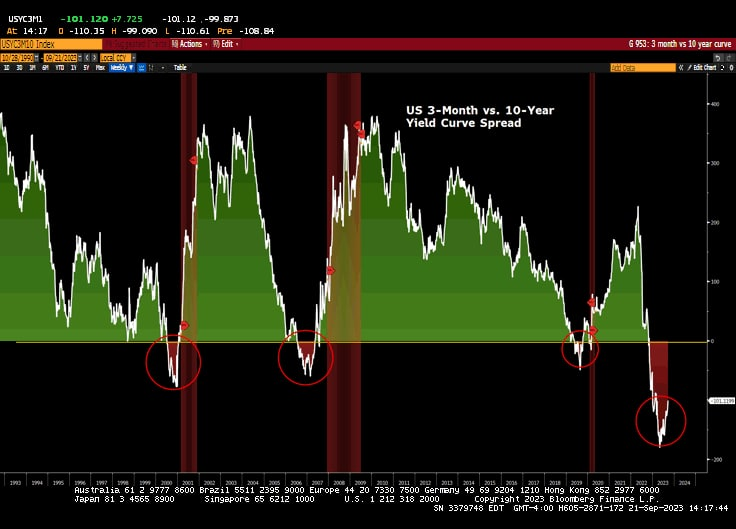

Central banks are navigating a difficult and volatile environment. They missed the inflation upturn in 2021 because they were focussing on the rear-view mirror. After a decade of very low inflation, a sudden pick-up in inflation was bound to surprise almost everyone. The fiscal roller coaster since COVID has not helped. Jerome Powell and his peers at central banks can only focus on one task at a time - tightening or easing - and they only make the switch when they have a high degree of certainty, which usually comes too late.

Interest rates famously impact the economy with "long and variable lags", and it will be another while before recent hikes show up in GDP data. By the time Jerome Powell can say with certainty that the inflation dragon has been slain, the economy will be in recession.

5. What are some of the ways to express a view on lower interest rates, and where do you personally see the best risk-reward?

There is a group of retail investors who have done well in stocks and don't see the point of owning bonds at all. I think this view is misguided, and there are good reasons why Bridgewater and other firms have done so well with 60/40 (60% equity + 40% bond) portfolios over the years - bonds and equities are often negatively correlated. Bonds often go up just as equities fall (2022 was a notable exception). In addition, there were few reasons to own bonds for the past decade as yields were too low, but that has changed. There is a reasonable "margin of safety" in this space now.

Broadly speaking, fixed-income is attractive. It's not difficult to construct a very safe portfolio yielding 6-7% in USD or GBP (5%-6% in EUR). There was a sea-change in this respect over the past two years, when ZIRP was the norm, and the high-yield credit index (the riskiest part of FI) yielded less than 4%.

But it's not just about clipping coupons. There is potential for price appreciation. The price of long-end bonds (20-30 year maturities) are much more sensitive to interest rate movements and could deliver 30%+ returns in a recession or market panic scenario. The most aggressive ETFs in this space - ZROZ - could retrace half of its drop and rally 50%. This would imply 30-year rates falling back to around 3%.

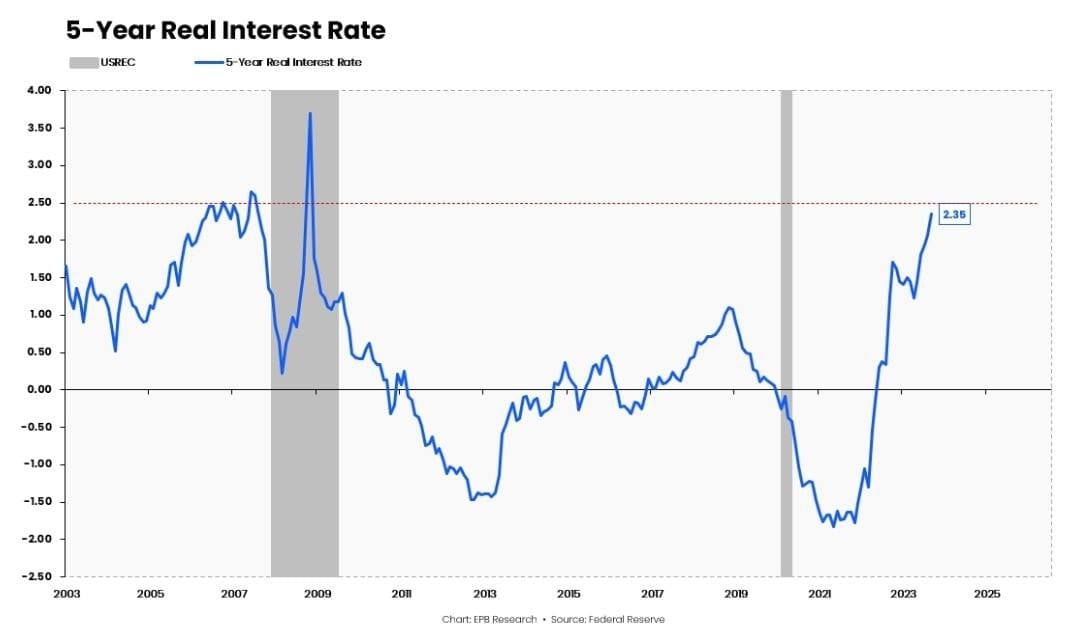

6. What’s your view on inflation-linked bonds compared to US Treasuries?

I suspect inflation-linked bonds (TIPs) will be a good investment for the next 5-10 years. With yields at CPI+2% currently, TIPs provide inflation protection and income. Nominal treasury bonds should be a good trade over the next 18-24 months. There will be disinflation pressure in the next few quarters, which will favour treasuries over TIPs.

7. Would you move up the risk curve into agency bonds, mortgage bonds or corporates?

Agency bonds are like treasuries with prepayment risk. They can be called by the issuer, and you may get your money back way before maturity. They carry no credit risk (the same rating as the US government). Currently, you get paid a lot to take this prepayment risk. Current coupon agency bonds offer yields around 6.4% vs. 4.6% on 30-year treasuries. That's very generous. This piece by the "Convexity Maven" covers the opportunity in some detail.

Corporates only offer an average yield pick-up compared to history. In a flight-to-quality scenario, corporates lag as credit spreads widen. From an income perspective, safe investment-grade bonds are fine, but if you are betting on economic trouble over the next year or two, treasuries are a cleaner bet.

8. What’s your take on sovereign bonds in Asia, especially given your outlook for the Fed Funds Rate and the increased indebtedness that we’ve seen in the past 10 years?

The US and Europe have experienced a surge in inflation post-covid and a rise in bond yields. Asia, for the most part, has not experienced either (Japan being a different story altogether), so the opportunity is less clear, and the pick-up in yield vs. Treasuries is historically low and, in most cases, negative.

Indebtedness is another challenge and not just an Asia-specific problem. Jamie Dimon recently said that governments are spending like drunken sailors. Others have expressed similar concerns. Debt dynamics are definitely worrying. But the end game is probably some time away.

9. If and when the Fed embarks on another easing cycle, how would you expect the exchange rates of the larger Asian currencies to move? Will the reversal of any carry trades matter for FX?

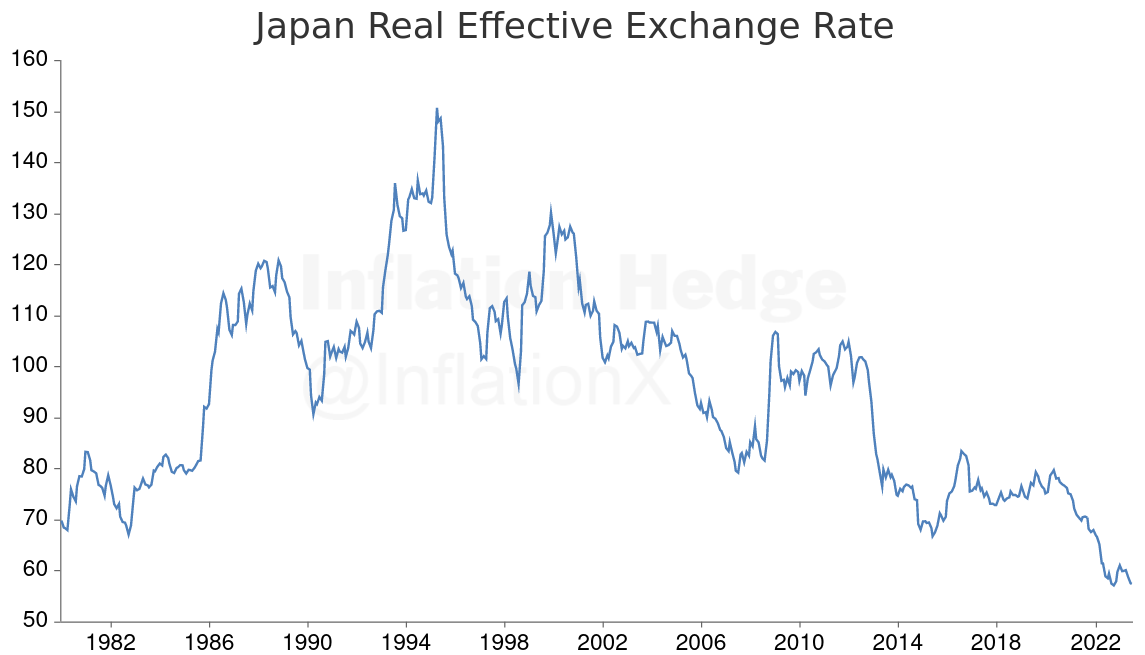

The biggest risk for Asian currencies is now, as the FED hikes and the rate advantage of the US dollar grows, leading to capital outflows from Asia. As recent quarters have shown, China is vulnerable to capital outflows despite a closed capital account. The yield differential vs. Japan is huge and has driven the yen to multi-decade lows. Eventually, Asia should benefit from interest rate cuts by the FED, but that will probably only happen after a recession, which will be disruptive.

10. Where can people go to interact with or learn more about you?

I am based in Kuala Lumpur, but I also spend time in Thailand, Taiwan and Singapore. I am @InflationX on Twitter/X.

If you would like to support me and get 20x high-quality deep-dives per year and other thematic reports like this, try out the Asian Century Stocks subscription service - all for the price of a few weekly cappuccinos.