Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website.

Today, I’ll be interviewing Chris Beselin, who runs a Vietnam-focused activist fund and two tech businesses from his base in Ho Chi Minh City.

I know Chris from Stockholm School of Economics, where we both studied in the mid-2000s. Just to be transparent, I also served on the board of Endurance Group from 2015 to 2017.

In this conversation, I’m interested in Chris’s thoughts on investing in Vietnamese equities, the country's future, and entrepreneurship in general.

Table of contents

1. Background

2. Learnings from being CEO at Lazada Vietnam

3. Vietnam's success

4. Experience investing in Vietnam

5. Misconceptions about Vietnam

6. Corporate governance

7. Where he finds value

8. Long-term compounders

9. The anti-corruption campaign

10. Where can readers go to learn more1. Could you tell us about yourself - your background, how you ended up in Vietnam and what you’re doing right now?

My background originally is from European activist investing, with a firm called Cevian Capital - I believe its Europe's largest activist investor.

I left Cevian to do a turnaround as CEO for a small retail chain in Sweden and thereafter I relocated to Vietnam in early 2012 to start up the e-commerce group Lazada from scratch in Vietnam. I was the first CEO in Lazada Vietnam and later also CEO in Lazada Malaysia during a turnaround period. Subsequently, the Lazada group was sold to Alibaba for just above US$3 billion.

After Lazada, I moved on to start up a number of businesses of my own in Vietnam and Southeast Asia. We started the first local activist investment fund, Endurance Capital, in Vietnam in 2015 and in parallel we built up a range of tech-related companies from scratch in the region. Some of them we started under our listed investment company, fram^ (which IPO’d on Nasdaq First North in Sweden in 2017).

All in all, we have started 10-15 companies in Southeast Asia and exited 4: Fram IT dev, Pangara, Intrepid and Lazada - the latter two are both among the top 15 largest tech exits in Southeast Asia to date, at least if you believe Tech In Asia. 😉

Today, I'm primarily CIO for Endurance Capital and Chairman of Fram and Intrepid.

2. What did you learn from your time as CEO of Lazada in Vietnam?

There were endless struggles and learnings. We were aiming to build the company at such a high pace and were hiring 100s of new people to keep up with that pace. That type of ramp-up inevitably creates chaos, fire fighting and struggles – which in turn fosters learning after learning the hard way. 😉 If I had to pick three core learnings straight off the bat it would probably be i) with enough willpower, most timelines (both short and long) can be compressed to 1/10th or less of what was estimated from the outset, ii) never take no for an answer and iii) the critical importance of a robust company culture, both as a competitive advantage (as everything else can and will be copied by competition) and as a perpetual performance driver.

Lazada was an exhilarating and intense experience. After 3-4 years from starting up, the company was about to enter a very different phase, being in the process of being acquired by a large corporation (Alibaba) and all the changes and bureaucracy that come with it. At a juncture like that you should really ask yourself if you are ready to go all in for 3-4 years more (given new post-transaction incentive programs and similar that typically come into place) and if it’s your type of challenge or not. I’m not a big-corporate operator kind of person or leader - I much prefer the earlier phases where it’s much more about rapid ramp-up and scaling (e.g. from 0 to 500 employees) to the phases thereafter where it’s a lot about managing an evermore complex organization and bureaucracy.

Don't get me wrong - the latter one also requires extraordinary skills which I deeply admire, it's just not my preferred phase of organizational development in the CEO role. There are however other roles that interest and deeply excite me in those phases, e.g. executive Chairman, board member and/or active investor.

In parallel, I had also gotten to know Vietnam and Southeast Asia, as well as its "growth model", talents and stock markets quite well by that time and I had a feeling that it could be the perfect backdrop for building new businesses and helping listed ones unlock tremendous long term value.

3. Why do you Vietnam has been so successful as an economy - why has it developed faster than almost any other nation on earth?

There are a range of factors, of course, but just to outline a few:

It’s a balanced economy and growth model - it's not your typical emerging market, where the economy is overly dependent on one or a handful of commodities.

Rather, the Vietnamese growth model has multiple core engines: its one of the most trade-focused economies in the world (measured as (export+import)/GDP) with free trade agreements signed with countries representing 60% of global GDP, it has a young and well-educated population where English proficiency is on par with e.g. India and South Korea, it has a sizeable and confident middle class that is rapidly growing and it has a stable government that has been focused on pro-market deregulations for the past 35 years.

And in contrast to what many people think from the outset, Vietnamese exports are primarily engineering-driven (as opposed to lower value-add textiles and similar). Around 45% of the exports are electronics, smartphones, laptops and machinery components. In this sense, my conviction is that Vietnam is much more the next South Korea or Japan than the next China.

To me, this all boils down to the fact that the number one asset of the country is its young, savvy and hungry engineering population (ca. 100,000 engineers are educated per year in Vietnam, of which around 50% are within software). The attractiveness of the Vietnamese engineering talent pulls foreign capital to invest in onshore engineering-centered manufacturing, which in turn has vast ripple effects on the employment of thousands of additional factory workers around the engineers.

4. What has your experience been investing in Vietnam so far? Any success stories you’d be willing to share with us?

We've been investing in the Vietnamese stock market via Endurance Capital for almost a decade.

We are collaborative activist investors, so we both take financial exposure in our target companies (typically as a top 3-10 owner) and offer support with resources (both via board seats and from outside of the board in a direct and close dialogue/collaboration with management teams). In this context, we have had both financial success stories and mishaps/learnings as well as activist ones.

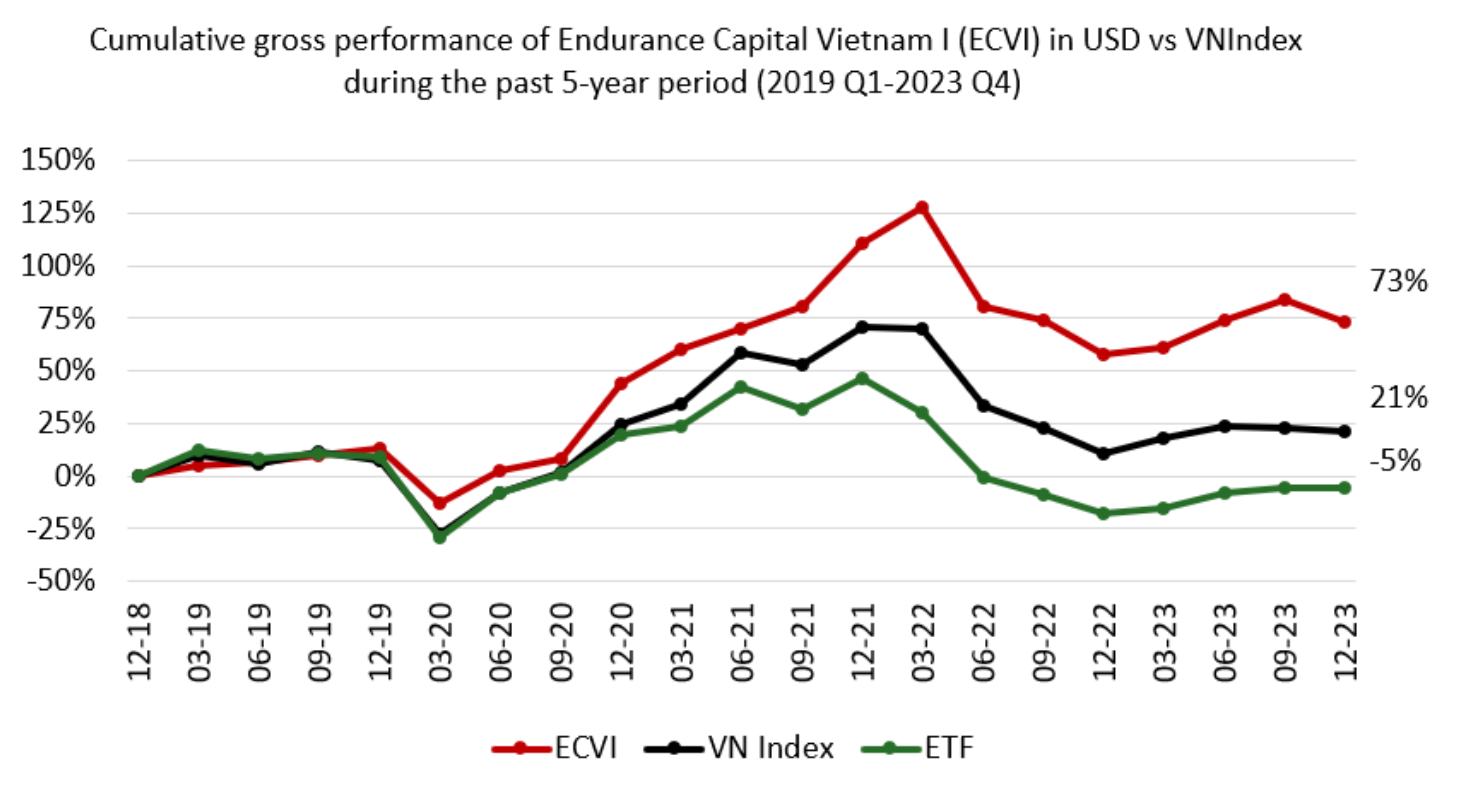

So far we have managed to outperform most benchmarks and peers over e.g past 5 years - in this sense, overall perhaps the success stories have outweighed the mishaps in a purely financial sense. Some of our more successful investments have been a locally leading securities broker and a niche chemicals company.

On the activist side, I would perhaps highlight a locally leading car retailer where we managed to implement most/all of the agenda we set out to do (selling non-core real estate, improving margins, improving IR, consolidating minority ownership in subsidiaries etc) and were represented through two board seats, well aligned with a large group of other shareholders and the company's management team - the final exit was done at a significant premium to the market price, which was a positive ending to the story.

5. What misconceptions do you think foreigners typically have about the country?

I think there are many. Just to name a few:

The first one is perhaps "Vietnam is almost like China, but smaller and less developed". I went through a bit of the difference in the fabric of the economies and demographics previously, but then there is also the very important difference in politics. Geopolitically, Vietnam is not and will never be or perceive itself to be a global superpower like China - it doesn’t have any geopolitical ambitions outside its own borders like China has.

Vietnam is primarily interested in developing its economy through trade and FDI, this in turn means that Vietnam in practice benefits from being geopolitically neutral between East and West and by trading/being friends with "everyone". So far the country has managed this balance very astutely for decades.

Another common misconception (particularly for Westerners growing up during the Vietnam War) is that "Vietnam is just getting back on its feet after the recent war". Obviously, this perspective is wildly outdated, but it’s still surprisingly common among foreign visitors. To put it into perspective, perhaps a suitable analogy is if you would have been saying/thinking similar things about France or the UK in the mid 90s... (also then ca. 50 years from the end of the Second World War, just like Vietnam is today 50 years away from its war ending in 1975).

6. Your fund has an activist angle - what’s been your experience working together with management teams to improve corporate governance practices?

In general, this aspect has been surprising us in a positive sense. There is first of all a general openness for outside ideas, as long as a) they are backed up by sound fundamental reasoning and/or data, b) they can be realistically implemented, c) there is a willingness to be part of the execution of implementing them, and d) there is a long term perspective in the investment to see it through (99% of public investment funds can't credibly commit to these aspects as they trade in and out of holdings on a monthly/quarterly basis, driven by the liquidity requirements of a e.g. the common UCITS-structure or similar).

In addition, over the years we've been positively surprised regarding the robustness of the Vietnamese legal framework for shareholder influence. It is reasonably straightforward to exert influence while participants and stakeholders respect the frameworks for e.g. nominating board directors, voting via proxy at AGMs etc.

7. In the vantage point of 2024, where do you see currently see value in the Vietnamese market?

At Endurance Capital, we hold a concentrated portfolio of companies (around 10 at any one point in time). Hence, I think much more in terms of individual company names than in terms of sectors.

That being said, banks in Vietnam have done tremendously well this year and there is/was great value there as a sector, and particularly in the most well-governed names.

I also see recovery potential in consumer-related names that had a tough 2023 - e.g. retail and related.

Fairly soon I think we will see broad based recovery in the listed export names as well, given how strong export data have been YTD on a country level, but of course depending a bit on industry and target country mix of each particular exporter.

We are also slowly seeing recovery in real estate, but I don't think we are fully there for rapid take off just yet. Let's watch.

8. Any stocks you’d be potentially willing to hold forever (i.e. long-term compounders)?

With our funds, we have a 3-5 year holding horizon (can be longer in individual cases), so it’s not the typical approach we take. That being said, I’m doing some work at the moment for my personal investments where I’m specifically deep-diving into long term compounders (both in and outside of Southeast Asia). So I'll have to get back to you on that one ;)

9. What is your view on Vietnam's recent anti-corruption campaign - what are the potential implications for investors in the country?

Overall, I see this as something positive for the country in the long run (albeit I strongly disagree with the practice of capital punishment anywhere in the world). Corruption in any country is a great and very challenging inhibitor of growth. Over the past decade, Vietnam has done tremendous heavy lifting to root out corruption. For sure, they are far from done. That being said, the fact that they dared to take down the president twice for corruption-related issues shows the world that there is a deeply rooted and serious will to tackle the problem head-on (even if it short-term means scaring markets and risk losing international face temporarily).

I was looking at some data the other day from Transparency International - over the past decade, Vietnam has jumped from 2.7 to 41 (today being just below the global average) on their corruption index, PCI (higher score means "cleaner") - that's a good 15x improvement in roughly a decade.

10. Where can people learn more about you and Endurance Capital?

Please visit us at endurance-group.com or reach out to myself at christopher.beselin@endurance-group.com

If you would like to support me and get 20x high-quality deep-dives per year and other thematic reports like this, try out the Asian Century Stocks subscription service - all for the price of a few weekly cappuccinos.