Table of Contents

Thanks for giving us the opportunity to learn more about you, Aaron.

1. Could you start by introducing yourself: what is your background and what are you focusing on right now?

Thanks Michael, it’s great to be here. My name is Aaron Pek, in a former life I used to work as an equity fund manager overseeing both a Malaysian and an Asia Ex-Japan portfolio with an aggregate AUM of about USD 100 mil. Currently, my partners and I are working on setting up an equity research outfit that caters to institutional clients worldwide who are interested in investing in the region.

My current expertise is primarily in Malaysia and the USA, although we’re planning to expand our scope to the rest of ASEAN over time. The general idea is to capitalize on the ASEAN growth story in the coming decades – where ASEAN is poised to become the next China, as the global manufacturing center shifts southwards from China today.

2. How would you describe the Malaysian stock market to say a foreigner who knows nothing about the country?

From a traditional standpoint Malaysia is an emerging market (‘EM’) economy, with all the classic nuances of an EM economy that you’d normally expect – relatively high growth compared to the global average; slightly higher risk in terms of having a still-nascent economic infrastructure (business, regulatory and political); a young growing population with a burgeoning discretionary income base; and a polity that was previously more preoccupied with economics and is only now starting to figure out its aggregate socioeconomic identity.

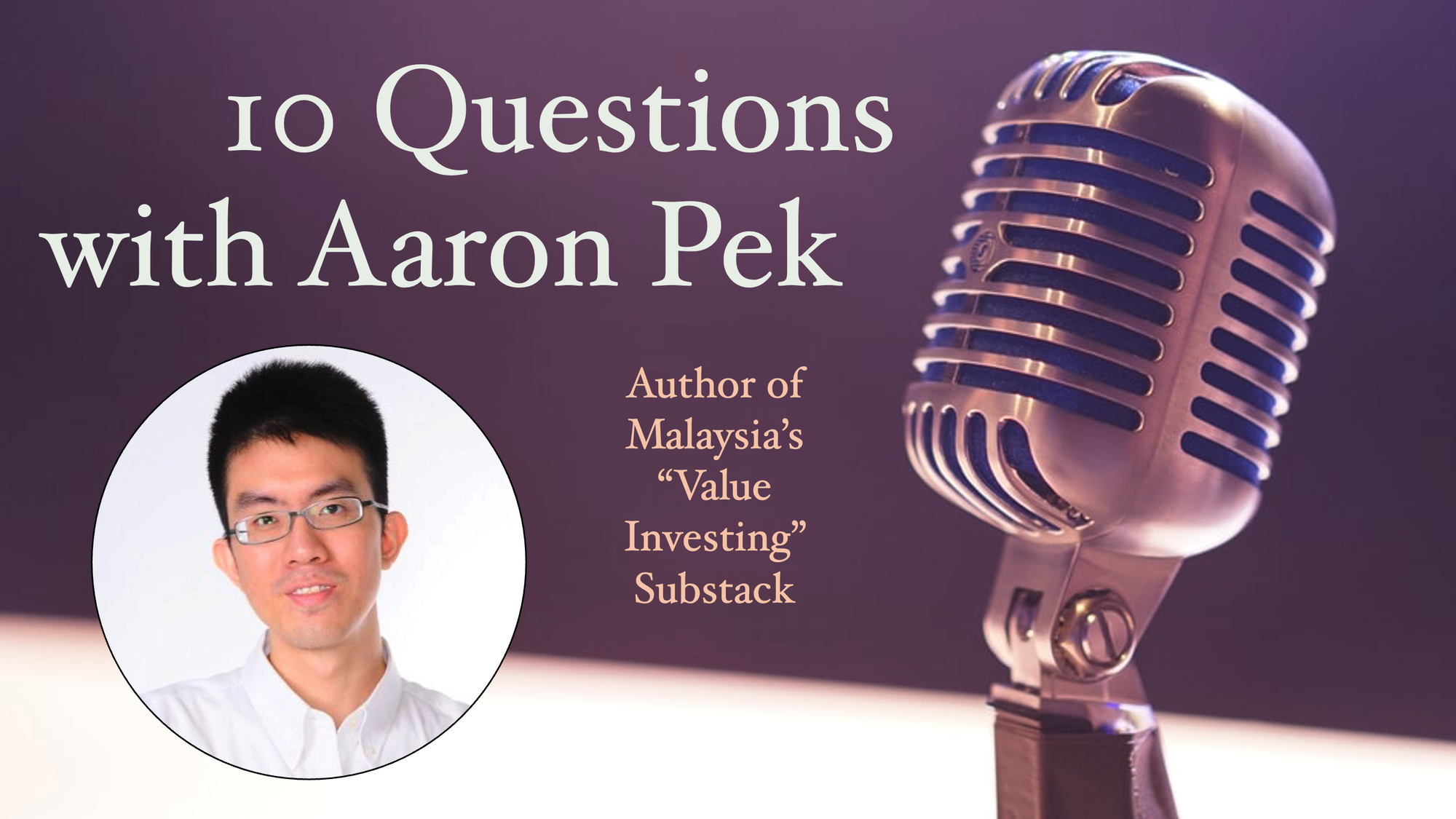

I don’t want to wax lyrical at this point for the sake of brevity; but there are a couple of things I would like to highlight about the local investing landscape to the complete stranger. Firstly, while the government’s revenue base is still dependent on oil revenue (2020: 22%), the country has long matured from its commodity export and agricultural economic roots. It has a well-developed manufacturing sector and service sector and is widely expected to attain developed nation status within the next decade. There are concerns about political instability and sanctity of rule of law, but to be fair you get that in any emerging market. Also, I would just like to mention that I consider our investment regulatory oversight and enforcement to be at the developed-nation level – in the form of our central bank (BNM) and the securities commission (SC).

The country has a rich history, both politically and economically – but that’s perhaps a story for another time. Its population also happens to be 25% Chinese, which I have a feeling will go a long way in its coordination with China in the coming decades compared to neighboring countries.

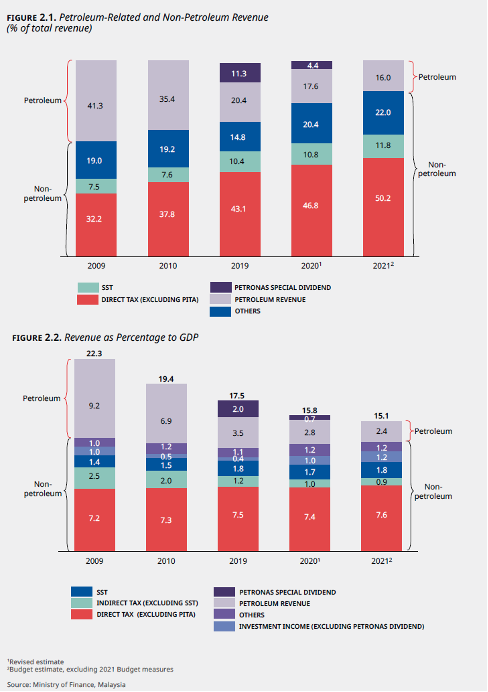

On sector focus, Malaysia has a very strong electronics (‘E&E’) export sector which mainly operates in the upstream supply chain of the global technology sector – think semiconductor assembly and testing companies (‘OSAT’). Oil & gas (‘O&G’) is clearly one of our stronger industries as well, considering our roots as a commodity exporter. We contribute to about 25% of global palm oil production; and together with Indonesia, in excess of 80% of global palm oil production is sourced from our two countries. The manufacturing sector is quite robust as well, as to be expected from a country expected to graduate to developed nation status within the next decade. The services sector – while relatively unexciting compared to developed markets – can also hide some gems from time to time.

In terms of key earnings drivers, I would say as someone who has invested in Malaysia for a while that global macro plays an outsized role vis a vis domestic factors in determining the profits of local companies at any particular point in time. For instance, during the pandemic the profits of our tech and glove companies soared; while O&G stocks have been relatively stagnant for the latter half of the past decade. As a small country, the unfortunate reality is that you find yourself perpetually hostage to a much larger global business environment that is far out of your control – as a result, I find that it is usually better as a business to be flexible to change rather than rigid. Having said that, a rigorous focus on identifying companies with excellent fundamentals is a time-tested path to investment success.

Ownership of listed companies is heavily weighted towards their founding families; or otherwise government-controlled, if not government-owned. The local pension funds and sovereign wealth funds hold material stakes in many of the large-cap companies and are able to exert significant influence over them. However, the small-mid cap space remains largely untouched by the government; although still owned to a large extent by their founding families. Corporate governance is sometimes an issue; I would recommend getting very familiar with IFRS accounting standards if you want to feel comfortable investing in this space.

As I mentioned earlier, I have a very high opinion of our regulatory authorities. The central bank has impressed me on more than several occasions – with their incredibly deep understanding of the inner workings of emerging market economics (where best practice sometimes differs from developed market economics). The securities commission is top-notch in its robustness of regulation setting as well as proactive enforcement. The country’s bourse actively recognizes the lack of a fully developed domestic securities environment and is doing its best to guide it to maturity – e.g. by expanding the depth of the derivatives market. I have a lot of optimism for the future of our domestic investment landscape, and genuinely feel that the government is doing a good job of preparing the country for the deluge of portfolio capital that will inevitably hit our shores in due time.

3. What’s your view on Malaysia’s long-term growth prospects? What long-term trends are you seeing and what concerns do you have?

I’m actually highly optimistic about Malaysia’s long-term growth prospects. And it has a lot to do with China.

As most of us know, the manufacturing center of the world shifts about once every 30-50 years. Immediately after the post-war period, it was in the United States as the global economy slowly rebuilt itself under the Marshall Plan. In the 70’s to late-80’s, it was in Japan with its electronics and automobiles; and since then for the past 30 odd years, it was in China and to a lesser extent in South Korea and Taiwan. Now we’re slowly starting to see that manufacturing base coalesce around ASEAN, as wages in low value-added sectors climb in China amidst its developmental miracle.

I’m going to oversimplify, but I think there are a few countries in ASEAN that Chinese businesses looking to offshore their manufacturing operations to will show a preference towards. Obviously, Vietnam has already been aggressively courted, as evidenced by both Western and Chinese brands gradually shifting their factories there over the past decade. The next likely target is Singapore, due to its established regulatory infrastructure, sanctity of rule of law, as well as low corporate tax rates. It is an ideal business environment to run an HQ from within ASEAN.

However, there is only so much land in Singapore; and inevitably the cost of doing business will rise as demand increases over time, and businesses start looking elsewhere for space to set up their factories. In my humble opinion, the next ideal country to do business in within ASEAN will be Malaysia. Here’s why.

The first reason is simply Malaysia’s proximity to Singapore. A foreign brand that has established a regional HQ in Singapore and is looking for overseas locations to expand into – due to lack of space in Singapore – is going to make Malaysia top-of-mind. The Malaysian ringgit is 3x weaker than the Singaporean dollar yet prices are often the same in nominal terms, making currency exchange factors favorable. We can already observe the Johor state government in Malaysia (which borders Singapore) making investments in the region in anticipation of this expected FDI hype – e.g. the RAPID project in Pengerang, Southern Johor sponsored by the Malaysian NOC Petronas and Saudi Aramco.

From an ease-of-doing-business perspective, Malaysia ranks highly on the list at 12th place out of 190 countries according to the World Bank. The reasons are manifold, but I’ll just focus on a few. As I mentioned before, sanctity of rule of law here is relatively sacred in Malaysia – with the regulatory environment and its enforcers earning my utmost respect. Bureaucracy is relatively robust, which has downsides but also means that applying for business permits, export permits and digital banking licenses is relatively straightforward; unlike in certain neighboring countries where getting anything done requires a bribe of some sort. The political environment – while appearing incredibly volatile from the outside due to a frequent changing of the guard in the past few years – actually hides the fact that the makeup of Malaysia’s polity isn’t conducive to radical social upheaval the likes of Thailand. For instance, the kingmakers in any particular Malaysian general election are generally the centrist polity in the Malay heartlands; not the active urban grassroots base on the political left nor the heavily conservative rural polity. There are of course significant areas for improvement – for instance, a moderation of affirmative action policies would enable higher growth – but compared to the rest of ASEAN, our political profile almost looks like the United States of America.

Thirdly, I think the fact that 25% of the population identifies as Chinese is a huge lever at the negotiating table with Chinese businesses – when the latter inevitably decides to build their factories in ASEAN and have to decide where. This has nothing to do with racial discrimination – businessmen just prefer familiarity, as it reduces business risk and the overall cost of doing business. It’s never fun to have to tiptoe around cultural differences, especially if your entire survival is potentially at stake. Besides Singapore, no other ASEAN country has such a concentrated population of Chinese citizens.

For these reasons and more, I think that Malaysia is likely to attract a disproportionate quantum of the FDI capital flowing into ASEAN over the next few decades compared to its regional peers – after Vietnam and Singapore. This will likely also lead to an incremental inflow of portfolio capital, which in aggregate should help to stabilize both the nation’s Balance of Payments and Current Account. If there’s one thing I would be excited to see happening over the next few years, it is the Malaysian government strengthening the country’s underlying capitalist infrastructure – in anticipation of the outsized capital inflows that the country is likely to attract in the near-future.

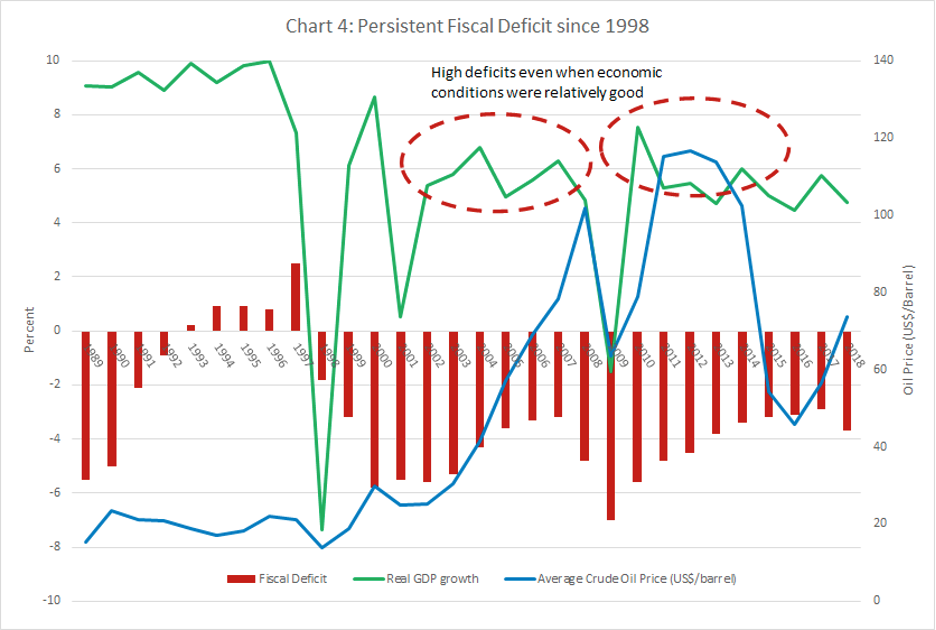

However, I’ll be the first to admit that not everything is hunky dory within our borders. On the financial side, policymakers haven’t seemed to figure out how to let free markets be free (i.e. laissez faire) without also inviting catastrophic risk to the economy – as evidenced by the lack of internationalization of the local currency (Ringgit Malaysia, or ‘RM’) and the recurring implementation of quasi-capital controls every time the global economy sneezes. Our debt-to-GDP ratio of 77% is worryingly high for an emerging market economy without the ability to print fiat willy-nilly; and the country hasn’t seen a fiscal surplus since the Asian Financial Crisis in 1997. I struggle to imagine how the country can realistically maintain its long-term historical average GDP growth of 4% in the absence of the ASEAN growth narrative.

On the political side, clearly there is a lot more that needs to happen in order for Malaysia to be considered a safe haven for foreign businesses. Having said that, I don’t see political risk in Malaysia being much higher on a relative scale when compared to other ASEAN countries. For instance, compare us to Vietnam – where the communist government can potentially nationalize your business at any time; Myanmar – where a military coup can spring out of nowhere after two decades of peacetime; or Thailand – where the polity is split down the middle between the Yellow Shirts and the Red Shirts. It wouldn’t be inaccurate to say that for foreign businesses looking to offshore their manufacturing operations to ASEAN, Malaysia represents the least bad choice.

I think famed value investor Claire Barnes of Apollo Asia Fund encapsulates the concerns of foreign investors looking to invest in Malaysia well with the following quote in her 1Q21 investor letter:

Malaysia, fortunately, is not a major market for the fund – but it is the location of your investment manager. It has huge natural advantages and human potential, but has been frittering the profits of extraction, and we hope it does not become a failed state. The government democratically elected in 2018 was irregularly toppled in March 2020; its replacement failed to impress MPs or electorate, so avoided seeking endorsement. The situation deteriorated further when a state of emergency was declared in January, suspending parliament and the state legislative assemblies, and preventing the Public Accounts Committee from scrutinising spending. Without accountability, decision making appears increasingly haphazard, and the cost to the economy is growing. Examples are legion, but by way of example, the importance of telecommunications infrastructure could hardly be overlooked after a year of movement controls and home working, so frustrated internet users hoping for an end to the outages have been infuriated by the predictable consequences of a protectionist decision favouring one small and unsuitably-equipped company over the representations by the largest national & international telecom/IT companies, and all of the most relevant ministries, on the necessity of efficient maintenance of the undersea international cables. (A review has belatedly been ordered, but the loss of investment may not be reversed.) Politicians of all parties seem to be preparing for a second-half election; we hope that better days will be ahead.

4. Could you talk about your own experience investing in Malaysian stocks - what have you learnt over the years?

Contrary to the popular narrative on the ground about Malaysia having a dearth of good investment opportunities, my personal experience has in fact been quite the opposite. This is especially the case in the small-and-mid-cap space (listed companies with market capitalizations of say <RM 2.0 bil) – which get very little attention from even domestic investors outside of sector upcycles, and nearly zero attention from foreign investors. A good example is the domestic gloves sector, where the largest player Top Glove Corporation attracted a wave of global investor attention in 2020 – by virtue of being the largest glove OEM company in the world currently. Prior to the corona crisis of 2020, almost nobody even bothered to look at the smaller listed glove companies.

As a result, my own anecdotal observation has been that the share prices of small-and-mid-cap (‘SMcap’) listed companies can sometimes be woefully mispriced. This is not to say that Malaysian SMcap’s are automatic buys; nor does it mean that buying the domestic equivalent of the Russell 2000 (the FTSE Bursa Malaysia Small Cap Index) is a guaranteed path to success. It does mean, however, that potential gems are far easier to find than in more developed equity markets – if only because their share prices have fallen to unbelievably low levels.

Let me give you a current example. On my investment blog, I have written at length about several of my favorite picks over the last year – including BAT Malaysia, Hibiscus Petroleum, Innature and AirAsia. Throughout 2019 and 2020 – when share prices were too high and too low respectively – I have managed to find stock picks in the domestic SMcap space with immeasurably outsized risk:reward dynamics. This is not because they had huge earnings growth prospects, but rather the reverse – their share prices had cratered to the point where the potential upside far exceeded the potential downside, despite the lack of growth visibility. For instance in Hibiscus’ example, I estimated at the time of my investment that they had enough cash runway to last them approximately two years at $20 oil prices; whereas the upside from their share price recovering if oil prices bounced back was almost 200%.

I think domestic investors are right to be concerned about the lack of attractive earnings growth prospects in Malaysian companies – especially when compared to international companies with huge moats and established track records the likes of Apple or Tencent. However, it pays to remember that the equity investor in secondary markets doesn’t make money from a company’s absolute profits, but rather the relative difference between what you pay for them and what you get. If you pay too much, even the best business can earn lower returns than a poorer business acquired at an attractive price. And I can provide full assurance that it is entirely possible to find attractively priced businesses for sale much more easily in Malaysia than in say the USA or China, where markets tend to be more crowded.

One other thing I’d like to touch on is the quality of corporate management. The management teams at some of the domestic listed companies I have come across have exhibited exemplary stakeholder stewardship – once again, in utter contrast to the popular view. There is a recurring narrative about how corporate governance in the listed companies of emerging markets remains incredibly wanting – and while that is true for a material portion of the Malaysian stock market, I find it absolutely unnecessary to throw the baby out with the bathwater. There are certain local business leaders that I have learnt so much from, and observed in their business ethos cultural similarities with the legendary likes of Apple, Southwest Airlines, TCI Communications, and even Berkshire Hathaway. As with anywhere else, there absolutely are businessmen among the Malaysian listed company community who deserve our admiration – and if someone wants to offer their shares to me at an affordable price, I’m more than willing to oblige.

5. Some stocks in Malaysia have done incredibly well over the past decade, including the rubber glove companies. But what about the future: in what sectors do you expect the next compounders to emerge?

As a value investor at heart, my honest answer is that I have no idea what the future holds. My experience with investing in emerging markets is that the macroeconomic environment matters – and that it is entirely unpredictable. Who could have imagined in 2018 that the global airline industry would be brought to its knees in such dramatic fashion today? Also, government policy matters as much as trends and market cycles – as we’ve seen with the US-China trade war during the Trump era, and borderline reckless monetary policy amidst the corona crisis.

This is even moreso in an emerging market economy, which is hostage to the whims & fancies of the global superpowers. Malaysia’s apparent snuggling up with China in recent months presents huge opportunities should China emerge victorious in the upcoming US-China “Cold War”; but also presents outsized risks should the Western bloc decide to brand us as a co-conspirator (whether justified or not). My humble opinion on this subject is that China has an uphill climb to emerge victorious – there are just way too many obstacles for it to overcome, e.g. its excessive systemic debt load; the apparent faltering of OBOR as a geopolitical strategy in light of the USA’s B3W; its highly intertwined economy presenting serious contagion risk; the global semiconductor siege being laid around its walls; the Western bloc demonstrating a united military front with NATO; the cracks seemingly apparent in their credit house-of-cards (Peking, Huarong & Evergrande); etc. This is in no way discounting China’s incredible growth potential; but without a crystal ball, I feel that the only prudent way to approach China is under a lens of risk:reward – in contrast to exclusively reward.

A good local example of the heightened unpredictability in macro risk can actually be observed in our glove industry. Most of us can agree that without the benefit of hindsight, it would have been impossible to predict the COVID-19 pandemic happening prior to 2020; yet this single event – which was barely under the control of Top Glove, the biggest glove company – mattered most to its long-term average returns. Similarly, this one event mattered most to the average returns of AirAsia. In much the same way, I feel that it is impossible to identify the largest compounders over the next 30 years today. A slight shift in Lady Destiny’s card shuffling could tilt the winds in favor of an entirely different sector.

Having said that, I do believe that wearing fundamental-tinted glasses while looking for the potential winners of tomorrow is a timeless approach of revealing compounders. Companies which adopt a prudent approach towards capital allocation, risk, cost discipline and brand building – and instill this within their corporate culture such that it survives successive generations of management – will always do well regardless of their external circumstances. Two examples of Malaysian companies which I’ve seen practicing this are quite ironically private companies – Tealive, the largest bubble tea brand in Malaysia; and Ghostbird Coffee, a coffee bean roastery and wholesaler (full disclosure: I’m friends with Ghostbird’s management). Both understand the crucial role that branding plays in the F&B and FMCG sectors respectively, and both are first movers in their respective categories. I look forward to following their progress.

6. Where do you find value right now in Malaysia - any particular stocks that you think are worth buying?

Actually, all my favorite picks are already on my blog – go read it! I happen to prefer the concentrated approach to investing in my own portfolio, and some of the Malaysian stocks I think are worth considering at their current prices are Hibiscus, Innature, AirAsia and Berjaya Corporation.

I haven’t written about Berjaya Corporation (BJCORP) on my blog yet, but you can do some digging yourself to understand the potential appeal. They have a stable of incredible assets under their corporate umbrella, including control over both the country’s Starbucks and 7-11 operations (which are independently listed as well).

BJCORP’s crown jewel in my opinion is really their control of 7-11’s existing middle-mile distribution infrastructure – with its daily-roundtrip nationwide reach. Their capacity to build out a domestic e-commerce competitor to Shopee (SEA Ltd’s e-commerce darling) – or even just the potential to layer an e-commerce strategy over the dozens of existing foreign retail brands within BJCORP’s portfolio – is mouth-wateringly tempting.

As most of you should already be aware of, the cost tradeoff in the e-commerce industry vs the B&M retail industry is: no rental fees but high delivery fees. Hence the competitive bottleneck lies in possessing the lowest cost delivery channel; similarly to how having competitive rental costs allows B&M retail players to offer customers lower prices. The current domestic e-commerce market leaders – Shopee and Lazada – have yet to completely bring their respective distribution channels in-house, with both still relying on 3PL service providers for last-mile delivery to a significant extent. BJCORP could in theory leapfrog the above two with 7-11’s middle-mile, by achieving a lower-cost delivery model from Day 1 – potentially offering a Malaysian equivalent to Amazon Prime. And in a commoditized industry like e-commerce, attaining the lowest cost matters most for the purpose of competitive strategy.

There are also a bunch of other assets that BJCORP owns which are quite intriguing – but it would take me half an hour just to lay them all out here, so I’ll restrain myself. A short summary of the thesis is to assume that they can achieve a steady-state long-term ROE of 5% on their equity base of approximately RM 10 bil (i.e. RM 500 mil earnings). This can be achieved by changing the business model, which the new CEO describes in his LinkedIn article here. The notable aspects are described under the headline ‘Details’, where he mentions implementing KPIs for each operating company (where HQ was previously hands-off); incorporating a Big Data-esque digital strategy to mine the treasure trove of consumer data which they have been sitting idle on for decades; the establishment of a corporate strategy team (which previously didn’t exist); and outlining specific capital allocation goals. None of these are demanding requirements; they are simply baseline expectations for any normal conglomerate. Assuming that they can achieve the aforementioned 5% ROE by streamlining the company and synergizing the respective operating subsidiaries within 5 years, their shares are currently trading at a forward 2026 PE ratio of just 3x (current market capitalization: RM 1.5 bil).

To be fair, there could be another legitimate reason why BJCORP’s shares are trading at such depressed levels – potential corporate governance (CG) risk. The legacy management team prior to this new one had a less-than-sterling reputation on the CG front; but the new CEO has directly addressed this in his LinkedIn article and by inviting 5 new independent directors to the board. He has himself also been on a buying spree, acquiring approximately 3.6% of outstanding shares by end-May (see Bloomberg chart below).

Just to drive the point home, this is what I meant when I stated earlier that Malaysia definitely has stocks in the SMcap space which are currently trading at highly attractive prices on a risk:reward basis. BJCORP may not be an Apple or an Alibaba; but if you can cut its intrinsic value by half (and then half again) and still find yourself above breakeven from the current share price, I’d consider that a sufficient margin of safety.

7. What do you think are the pitfalls that foreign investors typically fall into when they invest in Malaysian equities?

I think the most egregious mistake you can make as a foreign investor is buying the Malaysian index. In much the same way that the US indexes are heavily tilted towards Big Tech, the Malaysian indexes are heavily weighted towards just a few key sectors – banking, utilities and telecommunications. Understandably, these aren’t growth sectors; and even if they were, these index constituents happen to be the largest companies within their sectors – leaving very little earnings upside, assuming a steady-state industry growth rate.

The next mistake that I’ve noticed foreign investors making from observing their habits is gravitating towards buying the large-cap index constituents – and in many cases only them. Read the factsheet of the typical foreign institutional fund that invests in Malaysia; these tend to make our Top 30 stocks >80% of their Malaysian exposure. As mentioned above, there is very little earnings upside to be had from these stocks relative to our SMcaps – under even the most optimistic expectations. Making matters worse is that because these tend to be the most visible stocks, most of their shares are usually already trading at fair if not wildly excessive valuations. For instance, Nestlé Malaysia is currently trading in excess of 50x PE <changed hyperlink>, despite having a negligible growth outlook. While there is an argument to be made for acquiring lower risk businesses at above-average prices, you might as well buy Coca-Cola (KO) shares at such nosebleed prices.

By extension, I think that most foreign investors are missing out on significant opportunities by eschewing the SMcap space in Malaysian equity markets. There is this popular notion that domestic SMcap companies are rife with corrupt business dealings and accounting shenanigans and are therefore not worthy of consideration – no doubt exacerbated by the not-so-recent 1MDB saga that captured headlines around the world. This might be true if you’re a Bloomberg keyboard warrior – but if you actually heeded Buffett’s advice and read their annual reports starting from the A’s, my personal experience has been that you are bound to stumble upon some undiscovered gem hiding in the cesspool which are the EM equity markets. I would imagine that anyone who has spent enough time wading in said cesspool can confidently back me up on this grandiose assertion. This is where I think that hiring a local expert such as Michael or myself to mine these gems for you can be a great return on investment.

8. Are there any red flags that you think foreign investors should be on the lookout for when researching local companies? How do minority investors typically get screwed?

So this question is actually quite timely, as I recently did an article on a local company which has captured headlines for all the wrong reasons. That’s one example, I suppose.

I wouldn’t say that minority investors have historically gotten screwed by Malaysian companies any more than they have by US companies. While it’s true that the USA’s Sarbanes-Oxley Act imposes a stricter rule-based checkbox compliance model than the principle-based UK equivalent we inherited, those who want to commit fraud will always be able to find loopholes in the system. Some say that there are management teams here that opportunistically take their companies private at the expense of minority shareholders, but that’s no different from your everyday activist investor in the USA. Others might point to the government’s decision to impose capital controls during the Asian Financial Crisis in 1997, but that’s also not so different from what China is doing today. And as far as I can see, there’s no lack of love for China from Western investors today.

In my personal experience, I find that Malaysia is a corporate environment that goes by the book 90% of the time – so as long as you do your job adequately, you should be able to easily weed out potential offenders. I would even go so far as to say that if you are comfortable investing in China, you shouldn’t have an issue feeling at home investing in Malaysia. Just get comfortable with IFRS accounting standards, rigorously enforce the absolute minimum risk management standards with regards to fundamental analysis and portfolio management – and you should be fine.

Also, as I’ve mentioned above, I have a great deal of respect for our regulators – the central bank (BNM), our securities commission (SC), as well as the enforcement arm of the local bourse (Bursa Malaysia). Spend a little time pouring through the historical statements of our central bank – and you’ll find that they’re often of the same exemplary quality as any US Fed announcement. The foresight and precociousness behind their words – as well as their ability to adopt best practices in developed nations for the local environment, with all its unique quirks and idiosyncrasies – is simply a sight to behold. I challenge you to read this speech by our former central bank governor and keep your jaw from dropping. It is fine.

Having said that, I would caution anyone trying to DCF model their way to discovery. As in any other emerging market, this sector didn’t earn its gray reputation in a vacuum – there have certainly been many examples in the space which have disappointed stakeholders over the past decades. But don’t let the bad apple spoil the whole barrel – there is unquestionably no need to throw out all the exceedingly cute babies with the bathwater.

9. What local investors in Malaysia do you admire, and what is it about them that you like?

Obviously Claire Barnes from Apollo Asia Fund gets a mention here, but I think she needs no introduction to this audience.

To be honest, I haven’t really gone around the block enough to be an authority on this subject. I like the reports from the guys at Saturna Capital (Malaysia), but I haven’t actually met them in-person. I have also met Amundi Malaysia’s risk management guys; they are good. If you need a quick primer on the local O&G, Petrochemical and Consumer sectors, I would recommend looking for the respective sellside analysts at CGS-CIMB (a Big Five bank); likewise for the Palm Oil and Banking sectors, I would recommend the respective sellside analysts at Maybank (the biggest bank). They are extremely thorough in their research, and perhaps more importantly are nicer people.

I actually find myself gravitating towards the capital allocators inside companies over those outside of them (e.g. myself). Hibiscus Petroleum’s MD Kenneth Pereira strikes me as someone who understands risk management inside and out, wielding optimal capital allocation principles with more grace than someone with a CFA. The management team at AmBank (one of the Big Five banks) are incredibly sharp and extensively thorough in their thought process when describing their corporate strategy; and AirAsia’s Tony Fernandes deserves to carry the mantle of Southwest Airline’s founder Herb Kelleher in the ASEAN region. Two small-cap management teams I think I will really enjoying following are those of DPI Holdings and SamChem – their business ethos goes beyond just maximizing returns, and their ability to articulate their vision belies their age. Poh Huat’s (as well as Hibiscus’) MD&A section in their annual report has tickled my fancy with its depth of scope; and likewise for the Sustainability section in Innature’s annual report. And of course, I’m also looking forward to following Tealive’s and Ghostbird’s progress.

10. Where can people learn more about your Substack and how can they get in touch with you in case they want to reach out?

Thanks for asking! My investing blog ‘Value Investing Substack’ can be found at valueinvesting.substack.com; or you can also reach out to me on my LinkedIn profile. Alternatively, you can follow my Twitter handle @investorinvest3.

Also, as I’ve mentioned before, we are currently in the middle of establishing an independent equity research outfit. It’s not up yet, but we’re open to a preliminary Zoom call if you so desire. If you’d like a free trial or want to negotiate an early-bird discount (half-joking), feel free to say hi!

Lastly, if you consider yourself a true-blooded value investor, I would love to just be your friend. As I joked recently with some friends, value investing knows no borders. Cheers!