Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Micro-Mechanics at the time of publishing this article. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares.

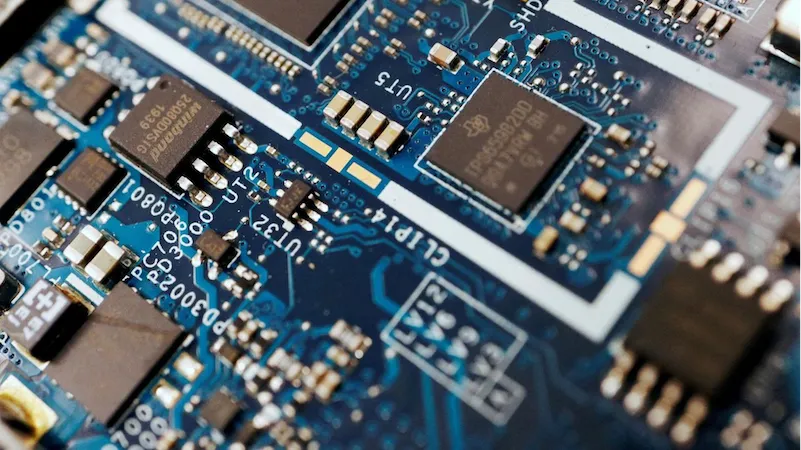

Micro-Mechanics (MMH SP - US$147 million) is a manufacturer of precision tools used in the back-end processes of semiconductor chip manufacturing.

The company’s founder, Chris Borch, is an American who was sent to Singapore as an expat working for a semiconductor equipment maker. After two years, he left his job and used his US$600 of savings to build a precision manufacturing company in the back of a hat factory in suburban Singapore.