Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I hold a position in Lion Rock at the time of publishing this article. To reiterate, this post and the presentation below are for informational and educational purposes only — not a recommendation to buy or sell shares.

Summary

- I first wrote about Hong Kong-based printing company Lion Rock back in August 2024. It's run by self-made entrepreneur CK Lau, whose previous company, Recruit Holdings, compounded capital at a +23% annual rate.

- 70% of Lion Rock's revenues come from printing illustrated books, but it also owns a majority stake in UK book publisher Quarto. The printing business has significant exposure to Mainland China and is also expanding its printing operations in Malaysia and Australia.

- Investors have been concerned about the risks of higher US tariffs on books imported from Mainland China. However, the tariffs remain low at just 7.5% and there's no indication that they will rise anytime soon. In addition, Lion Rock has prepared itself for such a scenario by ramping up capacity at its Malaysian plant.

- Lion Rock's P/E ratio is currently about 5x with a dividend yield of 10%. It also has a net cash position equivalent to 30% of the market cap. Lion Rock's earnings growth has historically been around +4% per year, partly thanks to clever acquisitions. On 3 October, CK Lau purchased 2.2 million shares at an average price of HK$1.29/share.

- That said, Lion Rock's earnings guidance is cautious, with no obvious turnaround in its slow-growing book printing business.

A quick background

Lion Rock Group (1127 HK – US$126 million) prints books for publishers around the world, including Penguin Random House and Simon & Schuster. It was founded by a visionary entrepreneur called Chuk Kin ("CK") Lau. I had the pleasure of meeting him in Hong Kong in mid-2024. And my research culminated in a deep dive, which I published in August last year:

CK Lau has been in the printing business for over 30 years. In 1990, he was working for a printing company when he and several colleagues decided to jump ship and start their own company. This business was named Midas Printing and was listed on the Hong Kong stock exchange in 1996.

In the year 2000, CK Lau decided to sell his share in Midas Printing. That was close to the Dotcom bubble peak, and he managed to sell his shares at an 8.8x P/E.

Flush with cash, CK Lau started looking for ways to deploy his cash. He quickly found the perfect acquisition target: Hong Kong-based job information portal Recruit. This company suffered after the Dotcom bubble, with the share price falling 94%. CK Lau accumulated a 34% stake in Recruit, took over management, and turned it around. Within a year, Recruit had become profitable again.

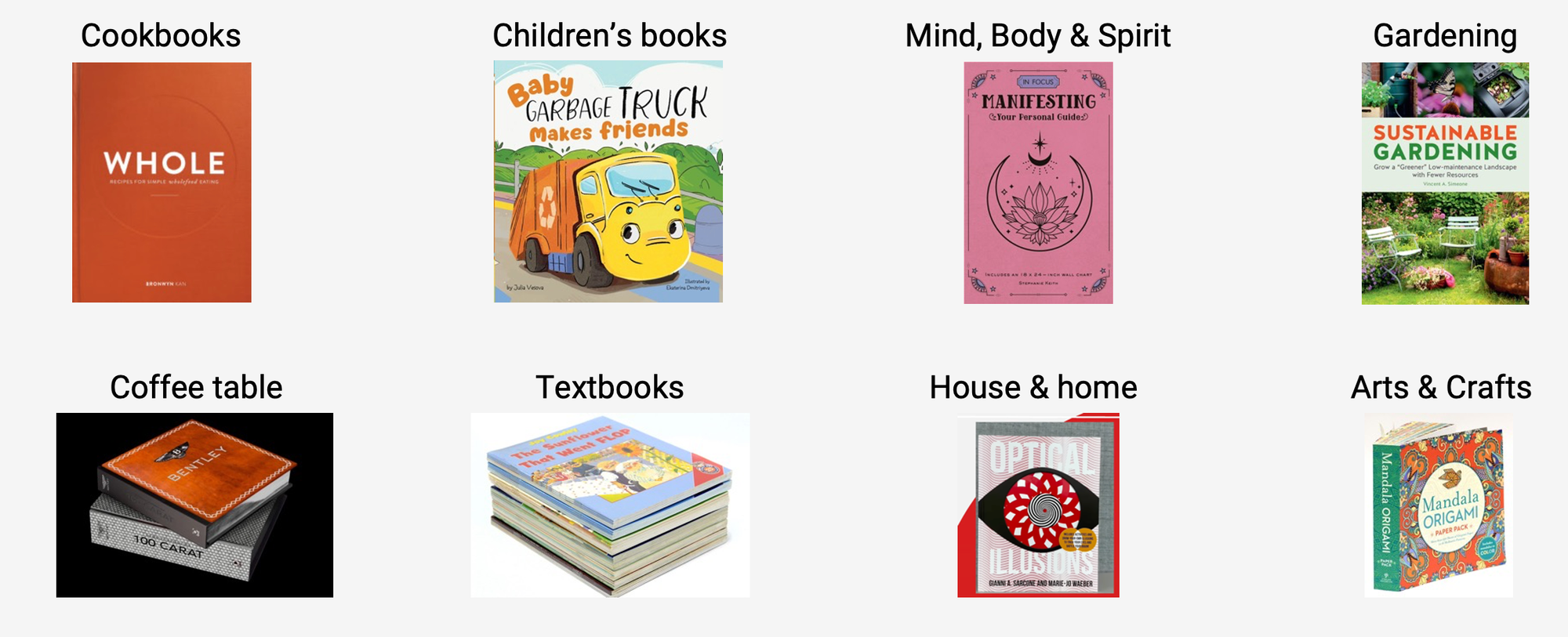

In 2005, CK Lau pushed Recruit to set up a new printing business called 1010 Printing. The idea was to focus on cookbooks, coffee table books, children's books and primary textbooks as those segments enjoyed stronger-than-average growth compared to, say, printed novels.

His new business, 1010 Printing, became a success. In 2011, it became separately listed on the Hong Kong Stock Exchange and was distributed to Recruit's shareholders three years later. By then, Recruit's shareholders had enjoyed a +23% annual return over a period of 13 years – all thanks to the brilliance of CK Lau.

Now, 1010 Printing continues to be listed on the Hong Kong Stock Exchange under its name, Lion Rock. It refers to a famous landmark in Hong Kong, which many locals feel emotionally attached to. And since separating from Recruit, Lion Rock has gone through an acquisition spree, starting with Hong Kong-based print services management company Asia Pacific Offset in 2012, then Australian printer Opus Group in 2014, Singapore-based printer COS in 2016, UK publisher Quarto in 2017, Malaysian printer Papercraft in 2020 and finally, Australian printer Griffin Press in 2022.

These acquisitions weren't all successes. But overall, CK Lau's discipline when it comes to M&A has proven second to none:

- First of all, he only paid HK$6.3 million to acquire the initial 34% stake in Recruit. Within a year, he turned it around and achieved a profit of HK$2.6 million. That's equivalent to a P/E multiple of just 2.4x.

- Second, Asia Pacific Offset was acquired for only HK$158 million in 2012. That year, it reported roughly HK$40 million in net profit, so the purchase price equated to a P/E ratio of about 4.0x.

- Finally, the predecessor of Lion Rock acquired Opus Group during its bankruptcy. It bought its debt at 44 cents on the dollar for a total of HK$150 million (about AU$30 million). After the bankruptcy, the debt was converted into equity, and the business soon showed a net profit of AU$15 million. And since then, the net profit has doubled again. With a 62% stake, that implies a forward P/E of less than 2x.

So as you can tell, CK Lau is a master of M&A – a true serial acquirer, without being perceived as such.

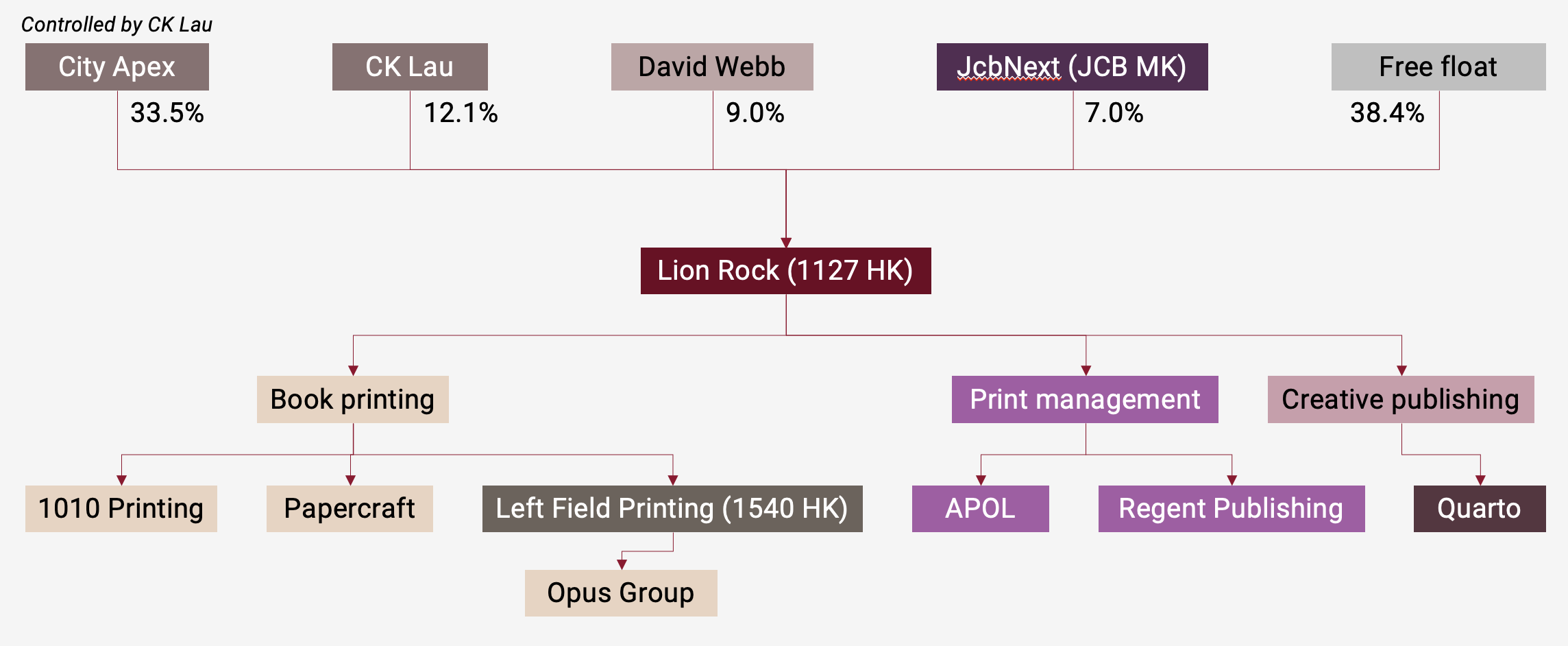

After all these acquisitions, Lion Rock has become somewhat of a printing conglomerate, centered around book printing, print management and publishing. Here's the corporate structure of the business:

Let me explain what each of these segments means:

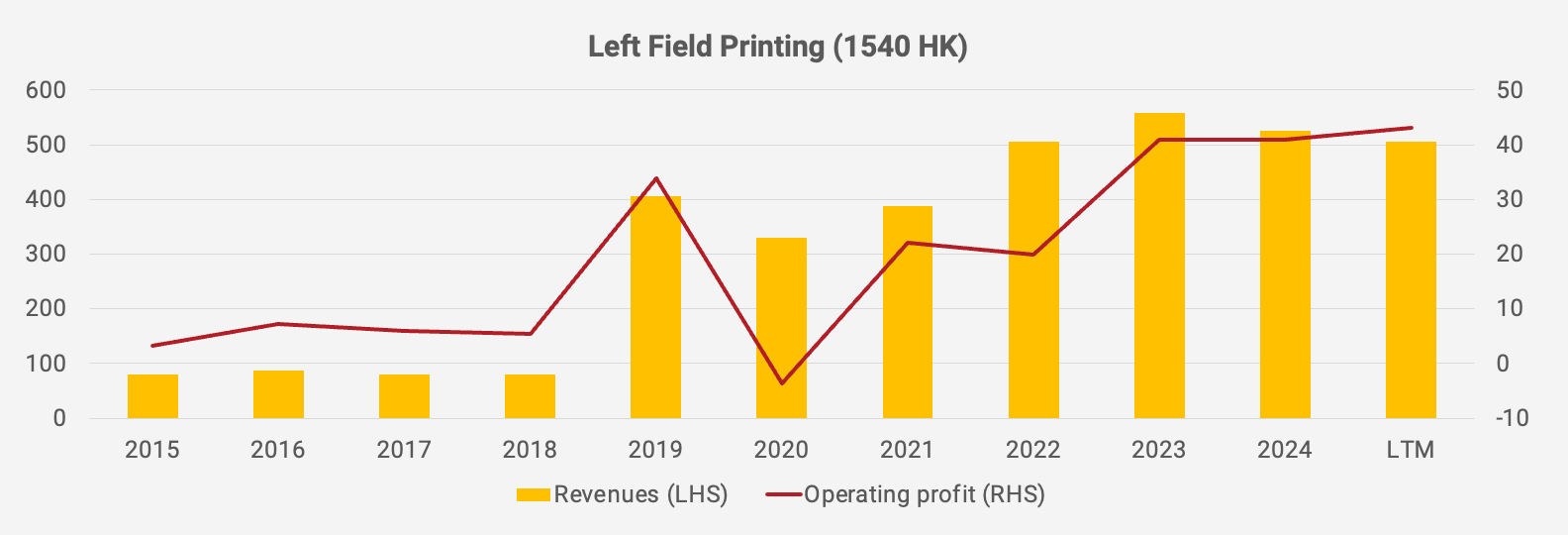

- Book printers run factories with big presses that turn PDFs into physical books, complete with folds, binders, covers, etc. The printer then ships the finished books to publishers. Printers run on thin margins, and it's all about minimizing cost. Some of the higher-end books use color pages and special paper, and these books typically carry higher margins. That's why CK Lau sees opportunity in coffee table books and the like. Lion Rock's printers include China's 1010 Printing, Malaysia's Papercraft, and Australia's Opus Group, which is now listed separately as Left Field Printing (1540 HK — US$28 million).

- Book publishers have relationships with authors and pay them for writing new books. They often provide authors with advances and then help them edit the script, the cover design, etc. Once the books have been written, publishers submit orders to printers, which then distribute them to bookstores, Amazon, libraries, schools, and so on. Bookstores pay wholesale prices, and publishers then pay royalties to the authors. Lion Rock now owns UK publisher Quarto, which focuses on arts & crafts, cookbooks, gardening, and children's books.

- Finally, print management services are basically brokers that help publishers source, price, and coordinate printing across multiple suppliers. They help consolidate freight, handle quality controls, and manage schedules to ensure that enough inventory is available at all times. By running tenders, they'll usually be able to source the best printer at the lowest price. Publishers pay a margin on top of what the printer charges, but it could be worth it through a broker if timelines are tight, volumes are low, or complex materials are used. Lion Rock owns two print management services businesses: Asia Pacific Offset and Regent Publishing Services. From Lion Rock's point of view, owning these print management services businesses helps them direct business to their own printers and thereby maximize their overall utilization rate.

Lion Rock now has printers in China, Singapore, Malaysia and Australia. Roughly half of revenues come from the United States and almost 30% from Australia. There is a threat that the United States will increase its current 7.5% tariff on books imported from Mainland China. Lion Rock is, of course, aware of this risk. So it has been proactive in setting up new facilities in Malaysia that can satisfy US orders.

Most investors have an impression that the printing industry is a melting ice cube — that demand is declining on a secular basis. There is some truth to it, but not so much for Lion Rock's niche. Readers typically do not buy coffee table books, cookbooks and children's books on their Amazon Kindle devices. They are much better suited for the printed format. Overall, I think Lion Rock's business is non-growth. I don't expect much earnings growth, but no decline either.

That said, COVID-19 was a difficult period for the company. Initially, it had to close down all its printing operations. Freight costs skyrocketed as consumers stayed at home and bought items online with their stimulus checks.

When I met CK Lau in 2024, however, its margins had already recovered, and CK Lau said that he was "looking at the golden years for the printing business”.

At that time, the stock traded at 6.5x P/E with a 7.0% dividend yield. Its separately listed Australian subsidiary Left Field Printing (1540 HK — US$28 million) traded at 7.5x P/E with an 8.0% dividend yield. Finally, one of Lion Rock's parent companies, JcbNext (JCB MK — US$56 million), traded at a 34% discount to its net asset value per share.

The key risks, as I saw them, included continued Houthis attacks in the Red Sea, which kept freight costs high. I also speculated that we might see a stronger Japanese Yen, in which case margins would compress. Finally — and perhaps most importantly — I wondered whether we might be seeing higher US tariffs on books imported from Mainland China.

An update to my original post

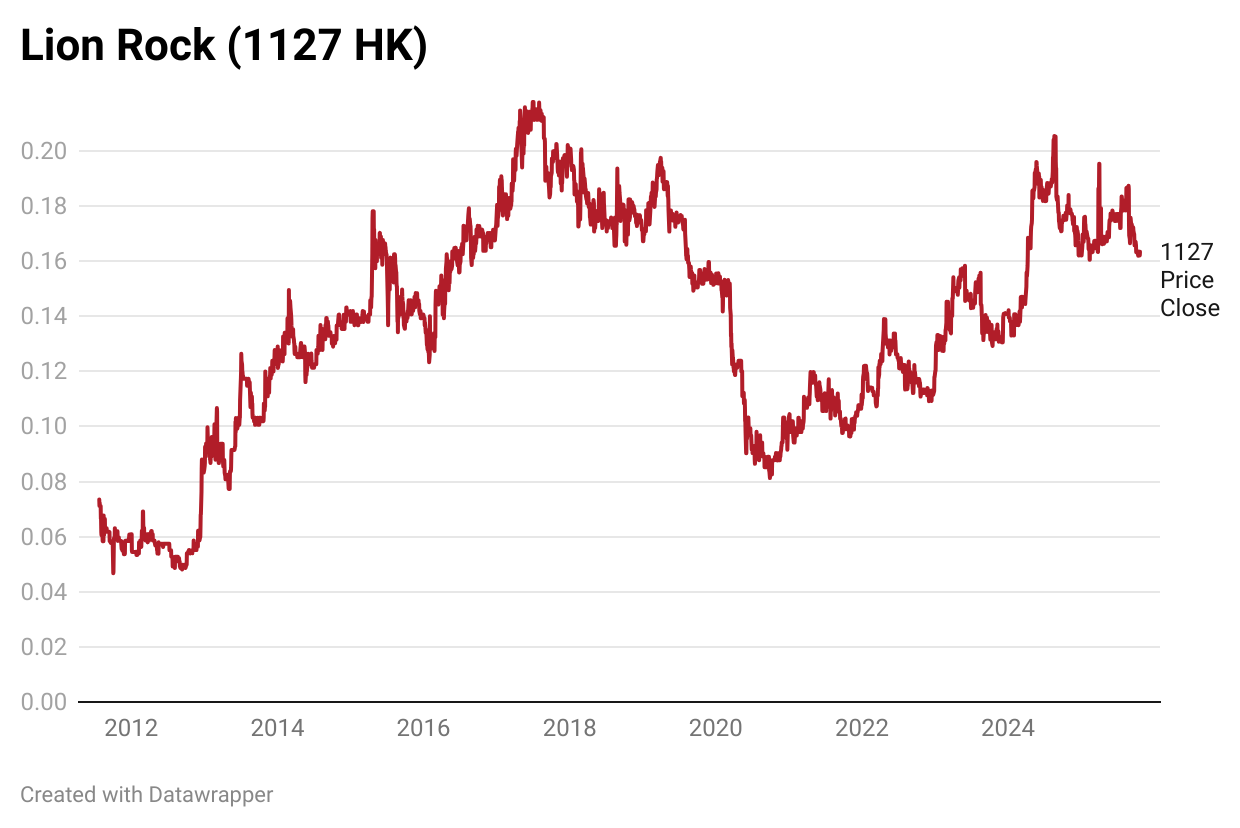

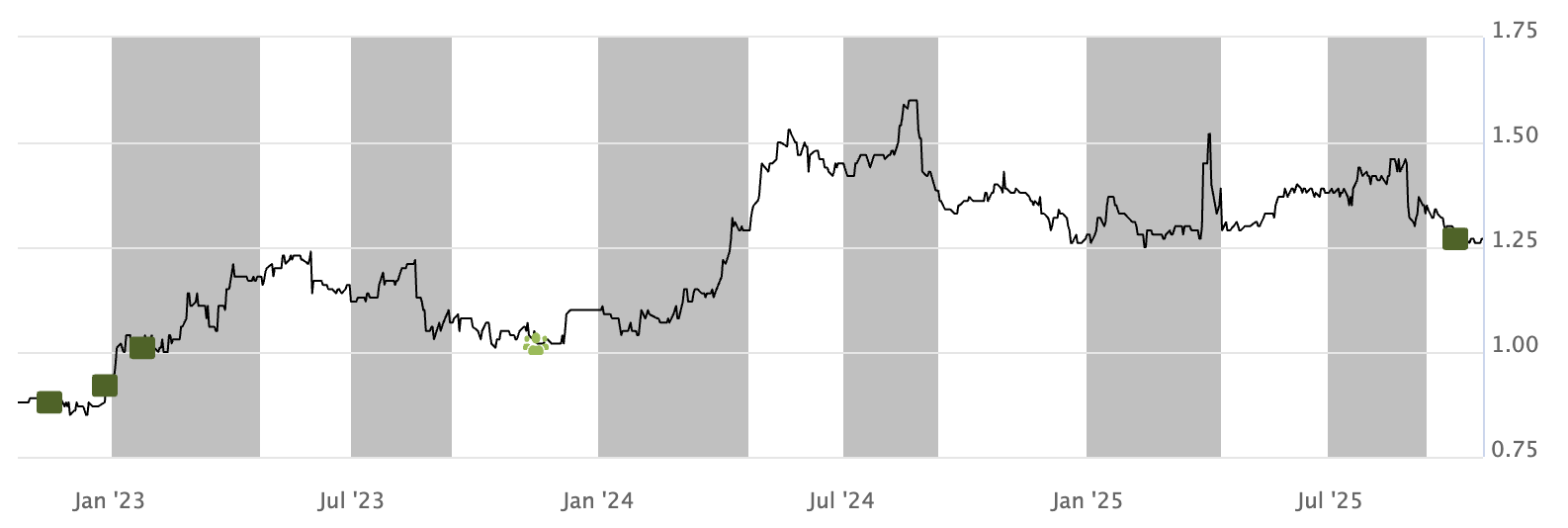

Since Lion Rock's IPO in 2011, the share price has risen nicely – almost doubling, while paying generous dividends. However, over the last year, the share price has barely budged:

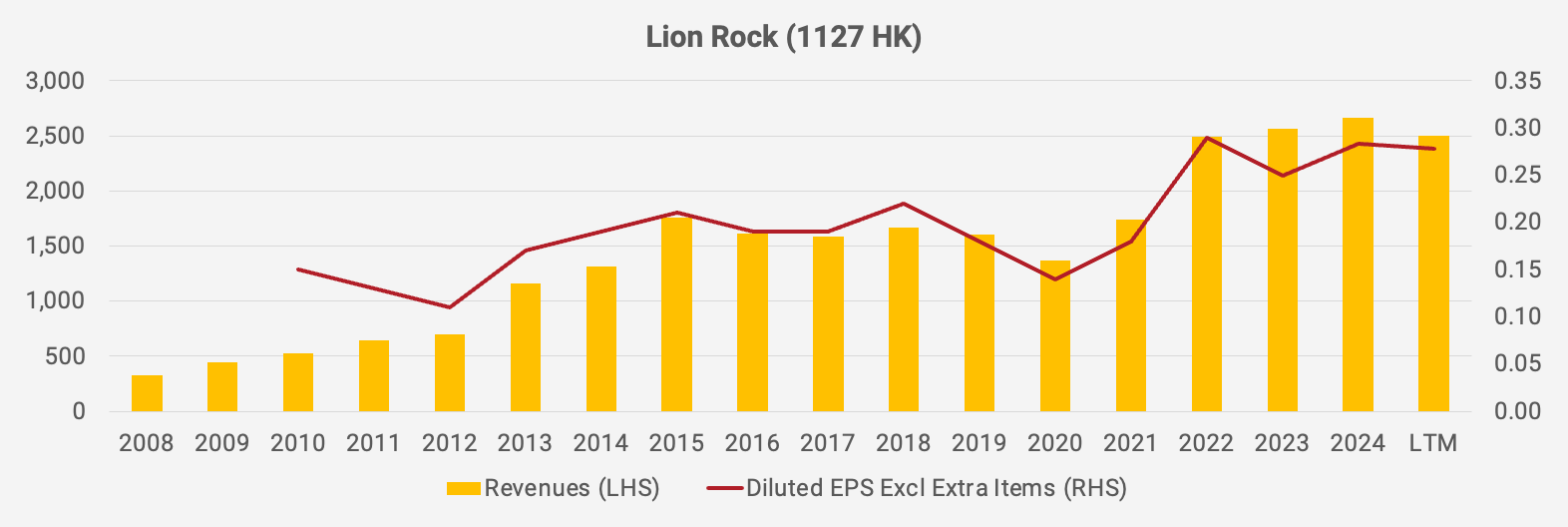

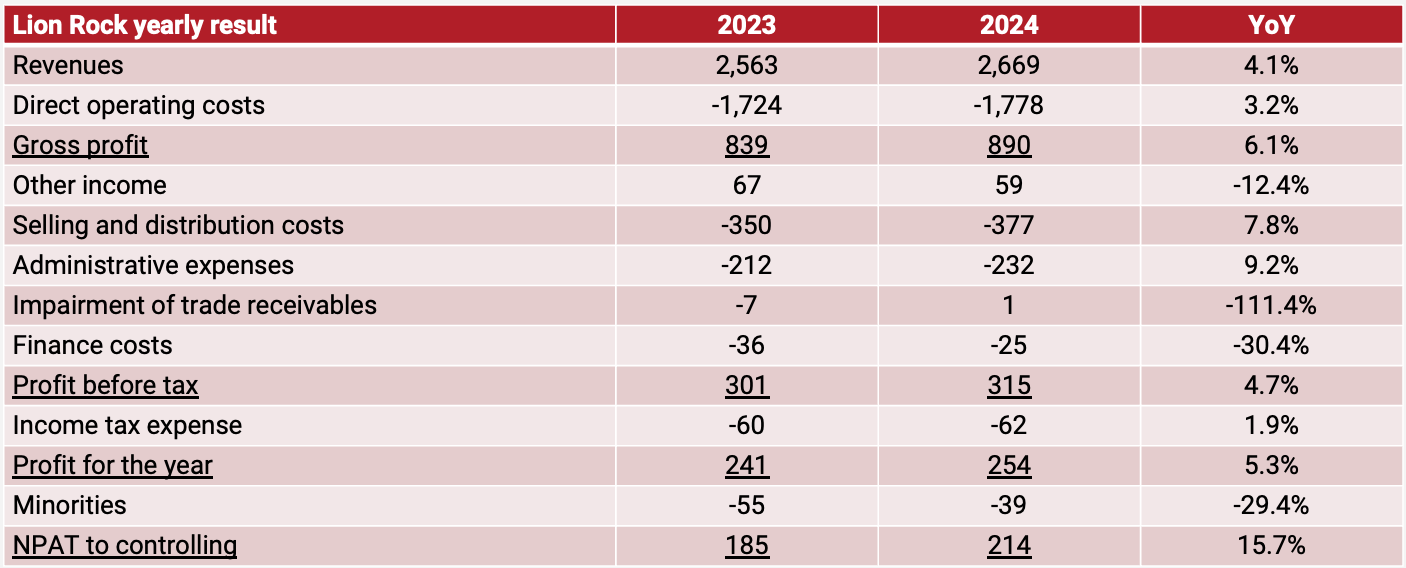

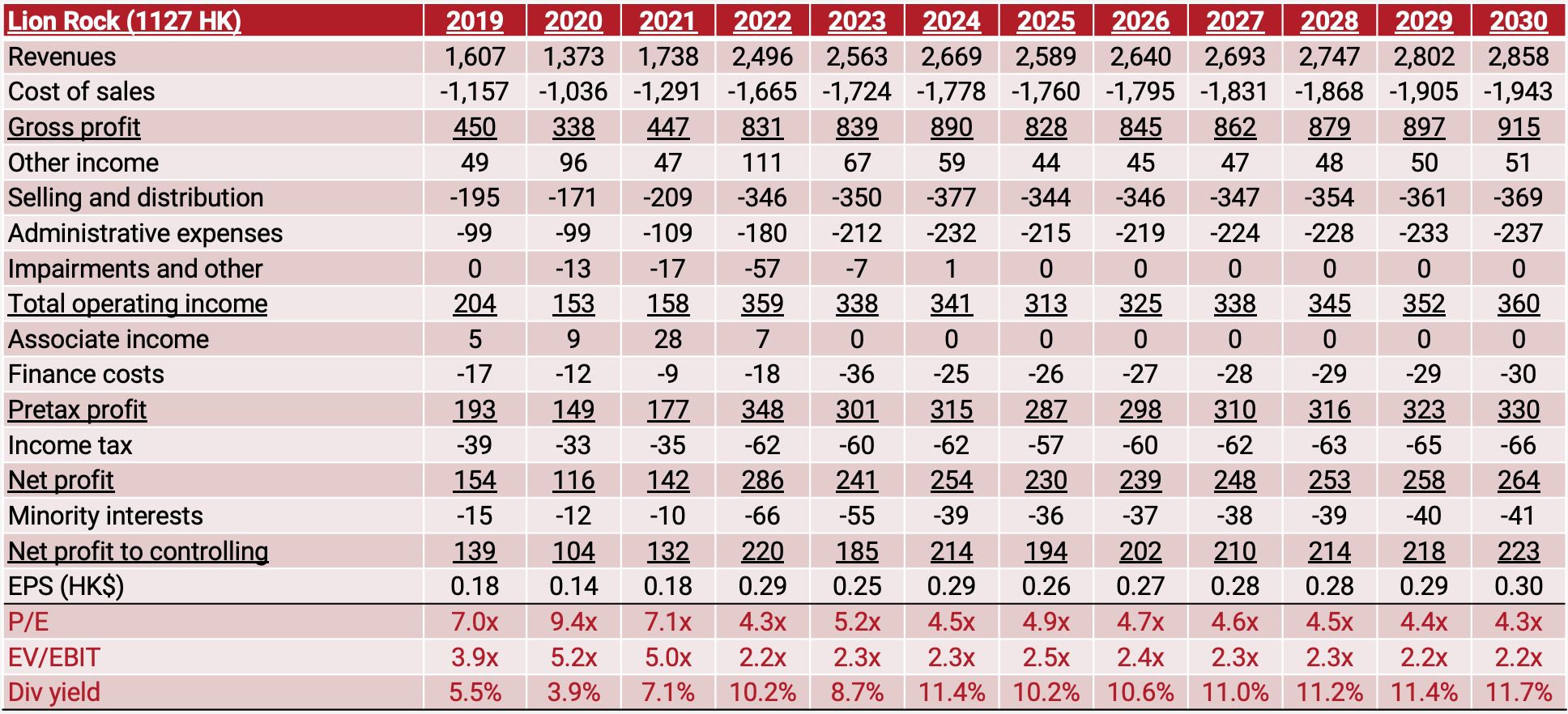

2024 proved to be a strong year. Lion Rock's revenues increased +4.1% year-on-year. And thanks to strong cost control, the net profit margin rose from 7.3% to 8.0%, causing the bottom-line to rise by +13.2% year-on-year. Here is what Lion Rock's historical revenue and earnings per share has looked like:

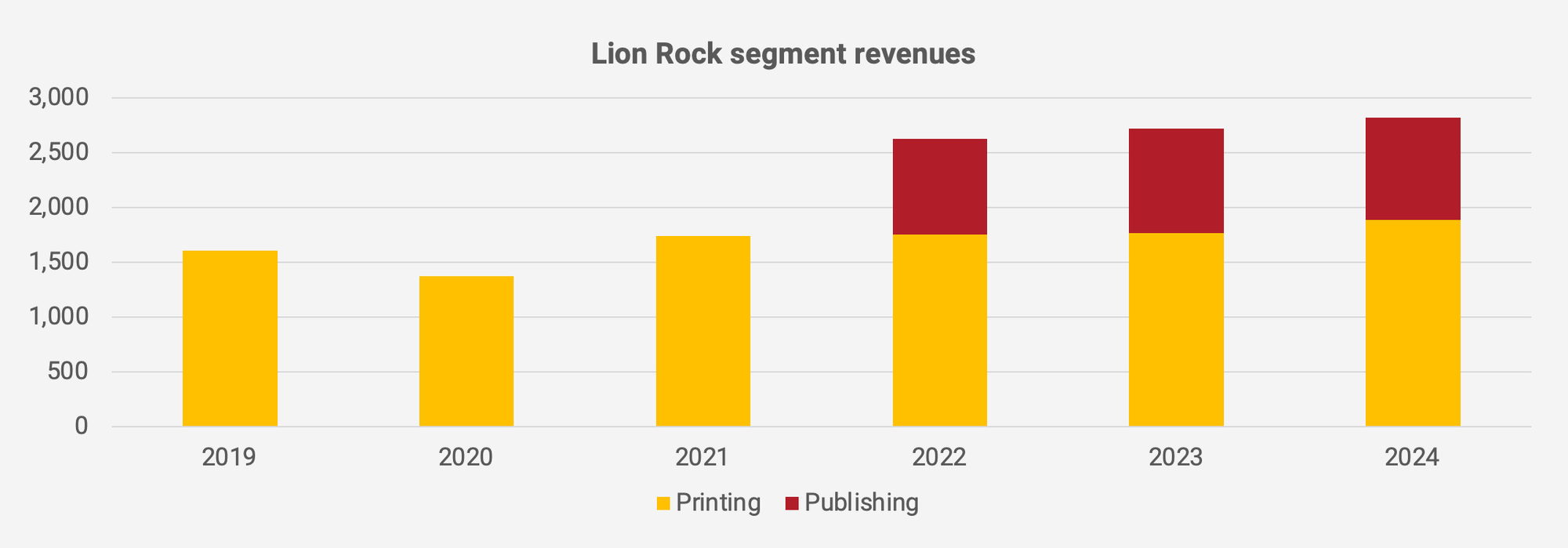

Roughly 70% of Lion Rock's revenues come from printing, and the rest from publishing. In 2024, the printing business reported a +6.8% increase in revenues, while the publishing business reported a -1.9% decline:

I think this improvement in Lion Rock's printing business was partly driven by a post-pandemic recovery in printing orders. Growth in China was particularly strong, with revenues increasing by +21% year-on-year. And that growth was almost entirely driven by the export market. It seems that many publishers rushed orders to mitigate the risk of Donald Trump becoming US President for a second term in early 2025.

To mitigate the risk, Lion Rock has long sought to expand capacity at its Malaysian facilities, operated through subsidiary Papercraft. And in 2024, Papercraft's revenues rose a whopping +95% year-on-year, though it remains loss-making. Efforts continue to cut costs and to fulfil orders diverted from Mainland China.

Lion Rock's Australian subsidiary, Left Field Printing, reported a lower revenue of about -6% in 2024. However, heavy cost cuts led to a 7% decline in Left Field's direct operating costs. Its profits, therefore, increased slightly.

Publishing subsidiary Quarto reported a -1.9% decline in revenues in 2024. It published three books about Taylor Swift, including Big Dreams: Taylor Swift, which became a New York Times bestseller. According to Lion Rock, Quarto Group is currently undergoing a reset to focus more on its core strength in illustrated books, including children's books.

Here is a summary of Lion Rock's 2024 financials. To summarize, revenues grew marginally in 2024 thanks to rush orders before possible increases in US tariffs on Chinese books. There was also a HK$14.5 million one-off foreign-exchange gain in 2024, which boosted overall earnings.

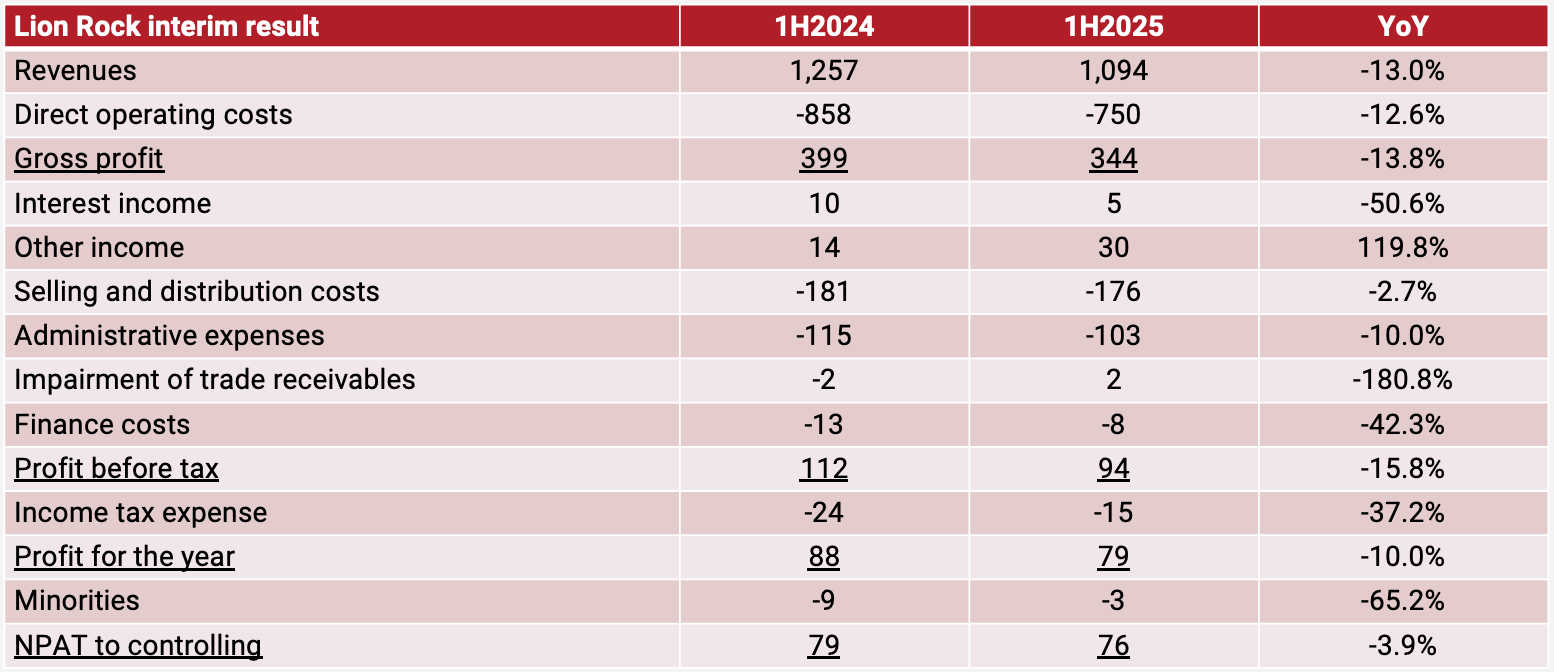

This growth did not continue. In fact, in the first half of 2025, Lion Rock's top-line revenues declined by -13% year-on-year, driven by weakness in the global illustrated book market and a slump in orders due to an inventory build-up. Thanks to a HK$17.8 million increase in foreign exchange gains, net profit declined by only -3.9%. It also helped that freight rates fell, with the cost of a 40-foot container dropping by roughly half. If it weren't for these two factors, the decline in earnings would have been much greater.

By segment, Lion Rock's printing revenues declined by -12.3% year-on-year, and publishing revenues declined by -14.1% year-on-year. China contributed negatively, while Malaysian orders continue to rise, and Australia held up well.

In other news, Lion Rock's CFO, Ms Lam Mei Lan, retired back in August 2025. She had been with the company since 2015 and was seen as a safe pair of hands. The company has now appointed Colin Wong as the new CFO. He's a Certified Public Accountant from Canada who previously served as the finance director of Hong Kong's Citybus. I think he will be a good fit for the job.

So to summarize, Lion Rock's earnings in 2025 have not been strong, and I can understand why the share price has declined somewhat. That said, the lull in orders after Donald Trump's election appears to reflect a prior inventory buildup. And I don't expect this sequential decline to continue.

A 2025 earnings projection

When I dug into the Lion Rock story back in 2024, I noted that the company had borrowed capital from banks to acquire assets on the cheap. However, CK Lau eventually repaid those bank loans after he found it challenging to identify suitable acquisition targets. He continues to remain disciplined.

Today, Lion Rock has a net cash position of HK$347 million, equivalent to roughly 30% of the market cap. This cash pile is a drag on the return on equity, but I am hopeful that CK Lau will eventually find a good use for it.

The latest earnings outlook is cautious, with the company noting that competition is fierce:

"Competitive pressures among book printers are expected to intensify in the second half. A double-digit contraction in market size during the first half prompted larger printers to adopt aggressive pricing strategies to protect their market share. Smaller players have followed suit, often engaging in unsustainable pricing practices. This challenging environment is likely to persist until supply and demand realign, potentially through market consolidation and the exit of less competitive operators.

It doesn't rule out US higher tariffs on Chinese and Malaysian book imports either:

The management is taking a cautious approach as tariff rates and exemption statuses may continue to evolve. One possible scenario is that US courts could rule the IEEPA tariffs unlawful, prompting the Trump administration to shift to other tariff frameworks such as Section 301 (unfair trade practices) or Section 232 (national security), under which informational books may lose their exemption. To mitigate this risk, we are proactively diversifying both geographically and across the book publishing value chain.

Quarto remains the problem child, but CK Lau is proactively moving towards emerging authors, with data-driven decision making:

Quarto is currently undertaking a strategic reset of its publishing operations, encompassing both editorial focus and business processes. The initiative to publish higher-profile titles proved unsustainable, as the company’s current sales and marketing capabilities were not sufficiently equipped to support such initiatives. In response, Quarto is refocusing its publishing program toward its core mid-market audience, prioritizing acquisitions of emerging authors and reducing the overall number of titles to ensure greater impact and quality. On the operational front, the company is enhancing workflow systems and adopting data-driven decision-making to boost efficiency and responsiveness.

That said, Lion Rock's earnings guidance has always been cautious. Given that Papercraft remains unprofitable and that management expects an eventual turnaround to happen, I do think that Lion Rock's net margins will hold up at the current 8% level. The foreign exchange gains in the "Other income" line item are obviously unsustainable. And I don't expect much growth in top-line revenues, at least not until CK Lau identifies a new acquisition target.

So with this backdrop, I foresee Lion Rock's earnings per share dropping in 2025 and then stabilizing in the high 20s in HK$ cents, putting the P/E ratio between 4x and 5x.

Historically, Lion Rock has traded around 6x P/E, as you can tell from the following chart:

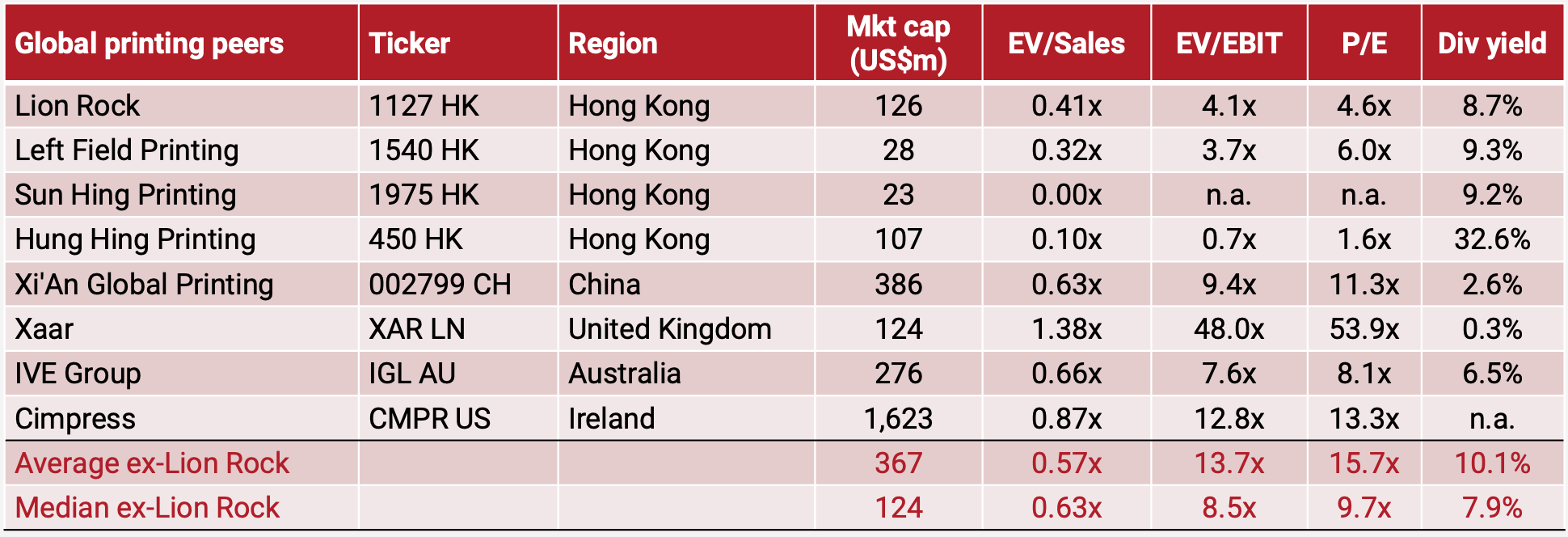

It's hard to say where a printing business "should" trade. The other Hong Kong-listed printing companies are hardly profitable. But overall, if you include companies like Cimpress, the peer group trades closer to 10x P/E:

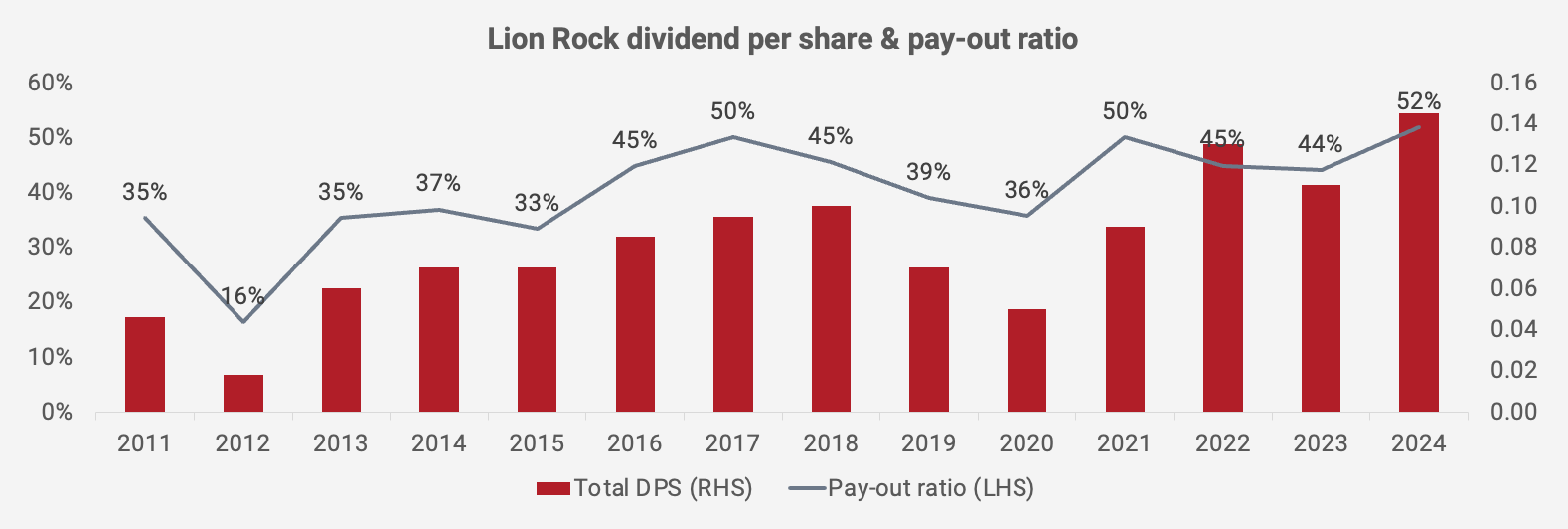

With Lion Rock paying out roughly 50% of earnings as dividends, I expect it to continue paying HK$13 cents per share, leading to a dividend yield of 10%.

At the April 2025 annual general meeting, Lion Rock received the board's approval to repurchase 10% of its outstanding shares. However, no shares have been repurchased to date, and the share count has remained flat since 2013. So I'm not holding out hope for any significant share buybacks.

On the positive side, I'm noting that CK Lau purchased shares on 3 October 2025 through an off-market transaction. He bought 2.2 million shares at HK$1.29 per share – slightly above the current share price. This was his first buy since early 2023.

Conclusion

I think CK Lau is a genius. He's ruthless about cutting costs and disciplined in acquiring new companies. That's how he's achieved a +4.1% compound annual growth rate in earnings per share over the past decade, despite operating in a no-growth industry.

There are some near-term challenges, including the risks of higher US tariffs on books imported from Mainland China. In such a scenario, there's no guarantee that Lion Rock's Malaysian operations will be able to compete effectively against its Eastern European competitors.

It is encouraging, however, to see CK Lau purchase 2.2 million himself. On my numbers, Lion Rock now trades at around 5x P/E with a 10% dividend yield. Printing is not the sexiest business, but the multiple is certainly on the lower side.

Thanks for reading,

Michael

Further material:

- Lion Rock's 2024 annual report

- Lion Rock's first half 2025 interim report

- Value Praya's write-up on subsidiary Left Field Printing