Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

- IJW with a short update on Lufax (🇨🇳 LU US – US$2.8 billion)

- Value Zoomer on Haw Par Corporation (🇸🇬 HPAR SP — US$2.5 billion)

- Fair Value on FPSO owner Yinson Holdings (🇲🇾 YNS MK — US$1.7 billion)

- Acid Investments on datacenter proxy Wasion (🇨🇳 3393 HK — US$1.7 billion)

- Night Watch IM on Japanese PE firm Integral (🇯🇵 5842 — US$724 million)

- Healthy Stock Picks: Modern Dental update (🇭🇰 3600 HK — US$645 million)

- Stone Sentinel Capital on Able Engineering (🇭🇰 1627 HK — US$180 million)

- Iggy on Investing discussing Shin Maint (🇯🇵 6086 JP — US$143 million)

- Net-Net Hunter on property developer Noda (🇯🇵 7879 JP — US$72 million)

- Nitin Gupta on Japanese cult brand Hobonichi (🇯🇵 3560 JP — US$51 million)

Out of these, I would like to highlight:

- Acid Investments on the data center beneficiary Wasion. The company makes smart meters that help monitor energy usage. Acid makes the argument that Wasion benefits from China's GDS's overseas data center capex, especially in the Singapore-Johor-Batam AI hub. He expects CNY 1.1 billion of order delivery from GDS this year and another CNY 1.2 billion next year. On Acid's numbers, the stock trades at 7.8x current-year EBITDA, a significant discount to most other datacenter beneficiaries.

- Healthy Stock Picks' update on Modern Dental. The company primarily sells prosthetic devices, including crowns and bridges, to replace missing or damaged teeth. Last year's earnings were strong, bolstered by the strength of the European business and the strong Euro. Some investors are concerned that 3D printers could disrupt Modern Dental's business, as dentists will be able to produce crowns and bridges on-site. However, the quality of Modern Dental's products is superior to that of 3D-printed versions. And small clinics will struggle to justify significant investments in 3D printing machinery. Modern Dental's current-year P/E ratio is now 9.4x.

- Night Watch IM on the Japanese private equity firm Integral. It generates revenue similarly to Blackstone and KKR: by managing funds and collecting management and performance fees from them. In 2025, Integral launched Fund V, which caused assets under management to skyrocket by +135% overnight. Integral is now setting its sights on Fund VI, which could be even larger. Japanese pension funds allocate only 1% to PE, compared to 10-30% in the US. Integral is conservative in its valuation marks, averaging around 5-6x EBITDA. On my numbers, Integral now trades at 0.20x EV/AUM.

(estimated reading time)

- Russell Napier et al: Practical History of Financial Markets (116 pages)

- Sector Stories: Introduction to the flavours & fragrances industry (10 mins)

- Value Zoomer: An exploration of leveraged ETFs (8 mins)

- Raghav Kapoor: Value-Up as next chapter for Singapore equities (6 mins)

- John Hempton: Bucket shops, crypto, and flash crashes (5 mins)

- Pangolin Asia Fund: Notes from the Sep 2025 investor conference (5 pages)

- Compound with AI: How to use Google's NotebookLM (4 mins)

- Michael Dunne: How China is gutting Western automakers (4 mins)

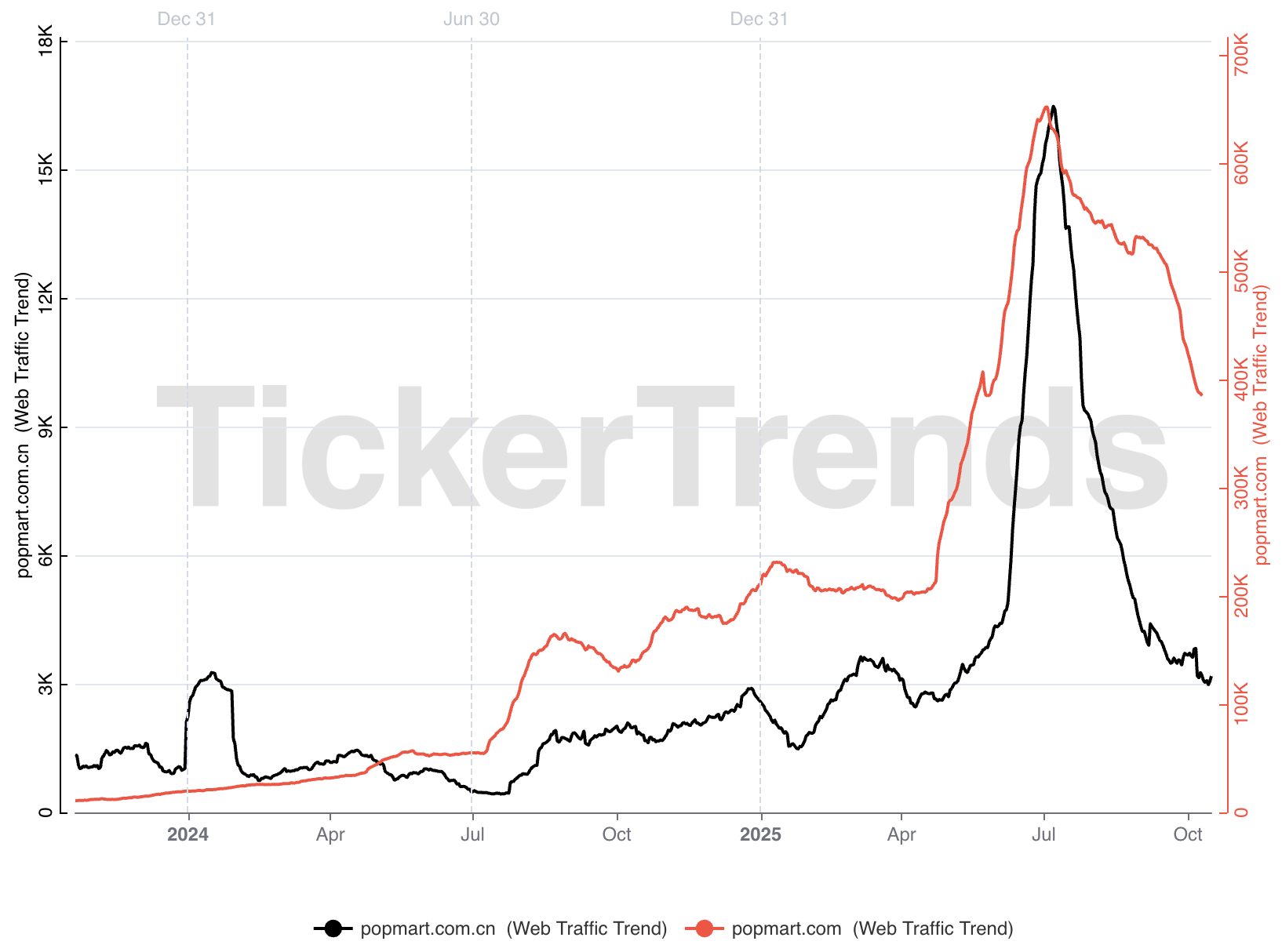

- TickerTrends: Pop Mart faces cooling demand for Labubu dolls (3 mins)

- Clark Square Capital's recurring idea thread, this from Sep 2025 (3 mins)

I think you will find Compound with AI's post on NotebookLM helpful. It's a tool from Google that helps you upload documents and analyze them through an AI model. The author provides a prompt for generating an analyst-style report within NotebookLM. He also discusses how you can upload 5-10 years' worth of annual reports, and then use NotebookLM to understand the drivers behind the historical performance. Finally, he argues that you can use NotebookLM to analyze management's behavior and hopefully spot patterns.

(listening time)

- Brad Setser on China's recent export boom (1:15 hours)

- Marc Andreessen on why Hollywood has done poorly recently (1:09 hours)

- Paul Cavey on China's property market, the value of the NTD, etc. (56 mins)

- Tian Yang thinks Chinese private sector activity is recovering (53 mins)

- Forrest Li on his experience building Singapore's Sea Limited (49 mins)

- Dom St George on HK conglomerate Jardine Matheson (44 mins)

- Shri Dodani on Japan's venture capital market (37 mins)

- Jim Mellon is bearish on US equities and bullish on Chinese (36 mins)

- J Michael Cole on the threat of a Taiwan invasion (30 mins)

- JapaneseIPO discussing the case for anime publisher AlphaPolis (8 mins)

I highly recommend listening to Marc Andreessen's explanation for Hollywood's current malaise. He argues that the 3-5 year lead time for producing a movie means that what's screening today was green-lighted in the midst of the COVID-19 pandemic. So the negative impact of the pandemic is still being felt. Furthermore, he thinks that online streaming cut off some of the financial upside previously provided by DVD sales. "Wokeness" also hurt the industry, as many movies became a form of political propaganda. Andreessen thinks the wokeness era is over. There's also newfound optimism about AI-generated films, which some believe might mark the beginning of a new era for the industry. If so, distributors such as cinema operators could potentially benefit.