Table of Contents

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author might hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

In a recent interview, Joe Bauernfreund of AVI Global Trust said that he recently shifted capital away from Japan to South Korea.

Why? Because he sees real change taking place in Korea. A series of measures to protect minority shareholders has been introduced. And bit by bit, we're starting to see the "Korea discount" finally disappear.

I first wrote about South Korea's "Value Up" program in May 2024. At that time, I argued that the main reason for the low valuation multiples in Korea was a low return on equity. Historically, many of Korea's largest companies have been capital-intensive, and capital allocation hasn't served the interests of minorities.

There were three main reasons for the poor treatment of minorities:

- One is that Korea has historically had a high inheritance tax of 50%, and effective rates for controlling shareholders can be even higher. After the controlling shareholder dies, the next generation will need to sell down their shares to pay for the taxes. But they'll be keen to maintain control. And for that reason, many of Korea's family-owned businesses have established complex corporate structures to maintain control. The problem is that the interests of minorities in different parts of the corporate structure often diverge. And the family will have a strong incentive to keep stock prices low to minimize the tax burden when the controlling shareholder eventually passes away.

- Another issue has been Korea's high dividend taxes. In South Korea, the average dividend payout ratio has been around 20% - much lower than the world average of 45%. That's because in Korea, dividend income is included in your overall taxable income. So high-income individuals have therefore paid taxes on dividends at the top 49.5% marginal tax rate. To avoid tax payments, many controlling shareholders have simply preferred to accumulate cash within the company.

- The final issue has been recurring related-party transactions. In the past, companies haven't needed shareholder approval for related-party transactions. They've only needed to disclose the transaction after the fact. Under-priced mergers between group companies have been a common occurrence, much to the chagrin of minority shareholders.

The start of the ongoing reform program was the Corporate Value Up program, launched by Korea's regulator and the Korea Exchange in early 2024. Listed companies were encouraged to develop plans to improve their returns on equity. If you go to the websites of publicly listed Korean companies, you'll often find slide decks outlining their plans to realize shareholder value.

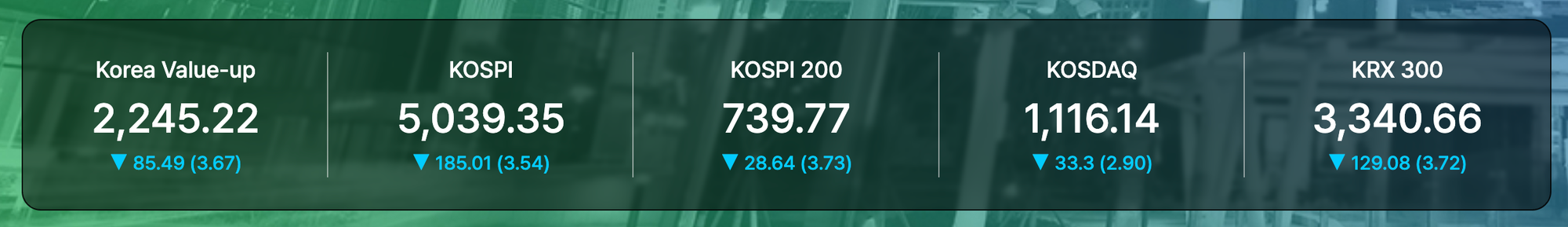

Late in 2024, the Korea Exchange created the Korea Value-Up Index, comprising companies that perform well in their of their treatment of minorities. The assets under management of exchange-traded funds that track this index now exceed KRW 1 trillion (close to US$700 million).

Another major forward was the July 2025 amendment to Korea's Commercial Act, which required directors to act in the best interests of all shareholders, not just the company itself. Today, if a director is found to benefit a parent company at shareholders' expense, he or she can now face shareholder litigation.

On the tax side, the government has now started offering tax credits for companies that significantly increase shareholder returns. For example, it's lowered dividend taxes for companies with a dividend payout ratio of more than 40%, from a 49.5% tax rate to 30% or lower. And it's also also offered lower inheritance tax in the removal of the control premium in the valuation of publicly listed family companies. There are also discussions about reducing the inheritance tax rate from 50% to 40%.

A sign of how seriously Korea Exchange is taking the Value Up program is that, if you go to its website today, the Value Up index is promoted first, even before Korea's benchmark KOSPI index.

Another positive piece of news is that, from March 2027, every company within the KOSPI will have to provide English-language disclosures to its investors.

They're clearly hoping to attract foreign capital to Korea. In 2023, they removed the requirement for foreigners to seek investment registration certificates. And starting in July 2026, foreigners will be able to trade Korean won 24 hours a day. I personally think that Interactive Brokers will begin offering access to Korean equities by the end of the year.

Despite South Korea being the 10th-largest stock market in the world and having a high GDP/capita, it's still counted as an emerging market. But as Douglas Kim of Smartkarma has pointed out, we could well see Korea be upgraded to a developed market in 2027. That would lead to greater flows from international investors, who have so far been mostly absent from Korean equity trading.

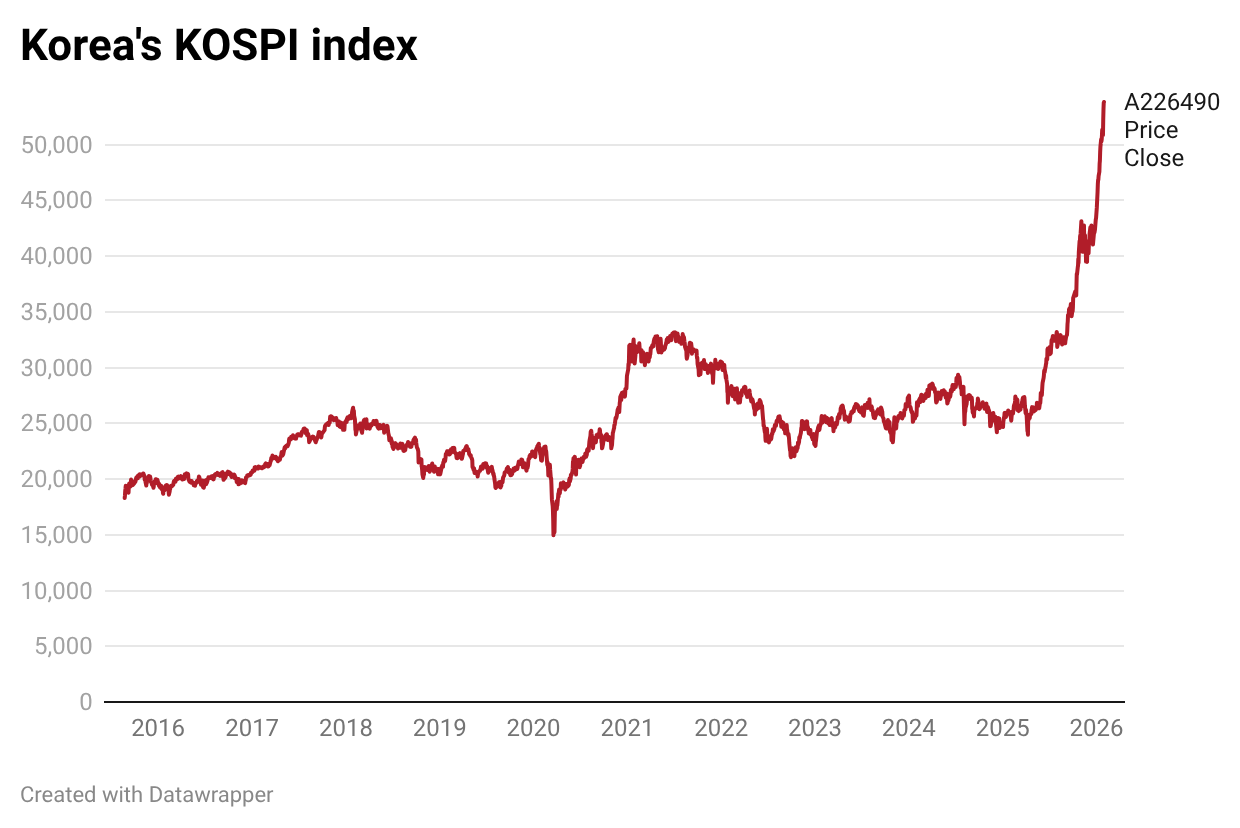

The recent rally in Korean equities is not just about the country's corporate governance reforms. SK Hynix and Samsung Electronics are benefitting from an epic bull market in DRAM, pushing the KOSPI benchmark index +24% in just a month:

I personally think that the memory chip cycle will prove fleeting. But Korea's corporate governance reforms are here to stay. Beneath the larger index weights, you'll find hundreds upon hundreds of smaller companies trading at single-digit P/E multiples.

And big activist funds are starting to see the value, too. Joe Bauernfreund's Asset Value Investors is one of the firms that has shifted its attention to Korea. But there are others, too. Dalton also set up an office in South Korea in 2025. Oasis added to its Korea team in late 2025. And Palliser continues to run activist campaigns in Korea, including against Samsung C&T, SK Square, and LG Chem.

Now that dividend payout ratios are rising, I think the obvious beneficiaries will be Korea's higher-yielding (non-voting) preference shares, which I discussed in March 2022 here.