Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Kina Securities at the time of publishing this article. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares.

Last week, I had the pleasure of meeting the senior management team of Kina Securities (KSL AU — US$193 million) — a Papua New Guinea- (“PNG”) based commercial bank listed on the ASX. Participants included Kina Securities’ CEO Ivan Vidovich and CFO Johnson Kalo.

The bank trades at a modest P/E ratio of 8.2x with a dividend yield of 9.2%. While the share price has risen recently, it remains well below its all-time high in 2019.

Having recently written about frontier market commercial bank Halyk Bank, I wanted to understand how the PNG banking market compares to other frontier markets. Specifically, I wanted to understand whether there might be an upside in PNG’s private sector credit penetration and whether banking super-apps might help bring individuals into the formal economy.

Table of contents:

1. The PNG macro backdrop

2. Introduction to Kina Securities

3. The bull case for Kina Securities

4. The upside from digital services

5. Kina’s capital allocation

6. Conclusion

1. The PNG macro backdrop

Papua New Guinea (“PNG”) is located east of Indonesia and north of Australia. Its capital is Port Moresby, but most of the population lives in rural areas.

It’s a small country. It has a population of 12 million people with a median age of just 21. The population growth has been close to 2% per year, though falling. With an aggregate GDP of US$31 billion, GDP per capita remains low at just US$2,600.

There have been tribes on the island for at least 50,000 years. Portuguese explorers came in the 16th century, calling the island “Papua”, referring to the frizzy hair of the local Melanesian people. In the 19th century, the Dutch claimed the Western part of Papua, the Germans the Northern part and the British the Southeastern part. Eventually, the Western part of Papua came under Australian administration, where it remained until independence in 1975. The new country’s new became Papua New Guinea (“PNG”).

Today, most of the population lives in the fertile central highlands. Poor employment opportunities in cities mean that most of the population survives on simple farming, with crops such as coffee, cocoa, and palm oil. Only 14% of the population live in cities such as Port Moresby, with its ~400,000 population.

PNG has a mixed reputation. It’s known as a violent country, with over 800 tribes— each with their languages — clashing in and outside of cities. Women, in particular, are advised to take precautions.

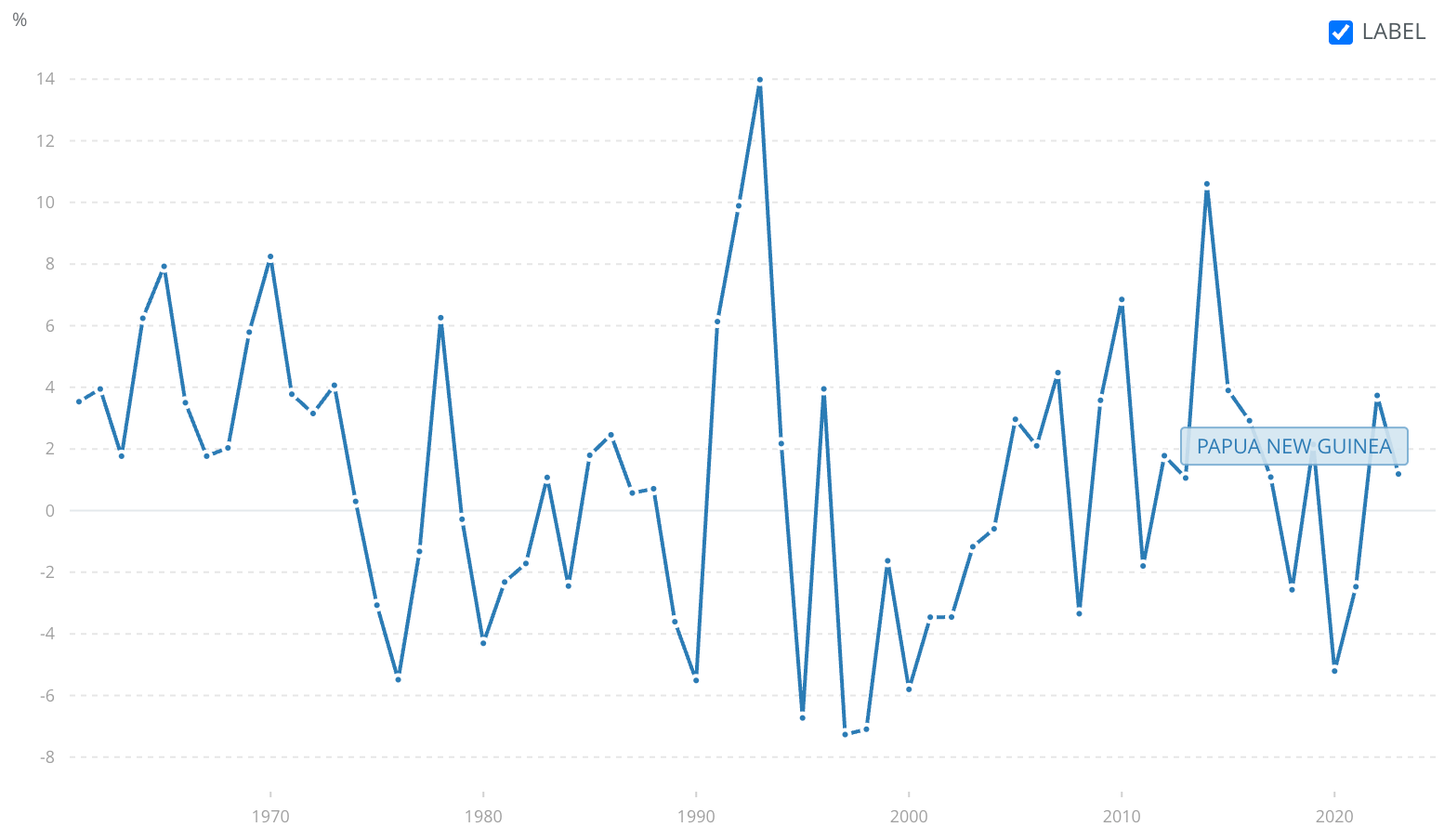

It is a resource-rich country, however. It has plenty of natural gas, crude oil, and gold developed by global resource companies such as Exxon Mobil, Total and Santos. Resource extraction is about 30% of GDP and is likely to grow. Four major resource projects are in the pipeline with aggregate investments of about US$30 billion. Hopefully, those will yield benefits for years to come. That said, PNG’s real GDP per capita growth has been modest in the past:

Politics have been stable. There have been elections since 1964, when it was still under Australian administration. The current administration under President James Marape has been in charge since 2019. Many of the institutions match those of its former administrator, Australia.

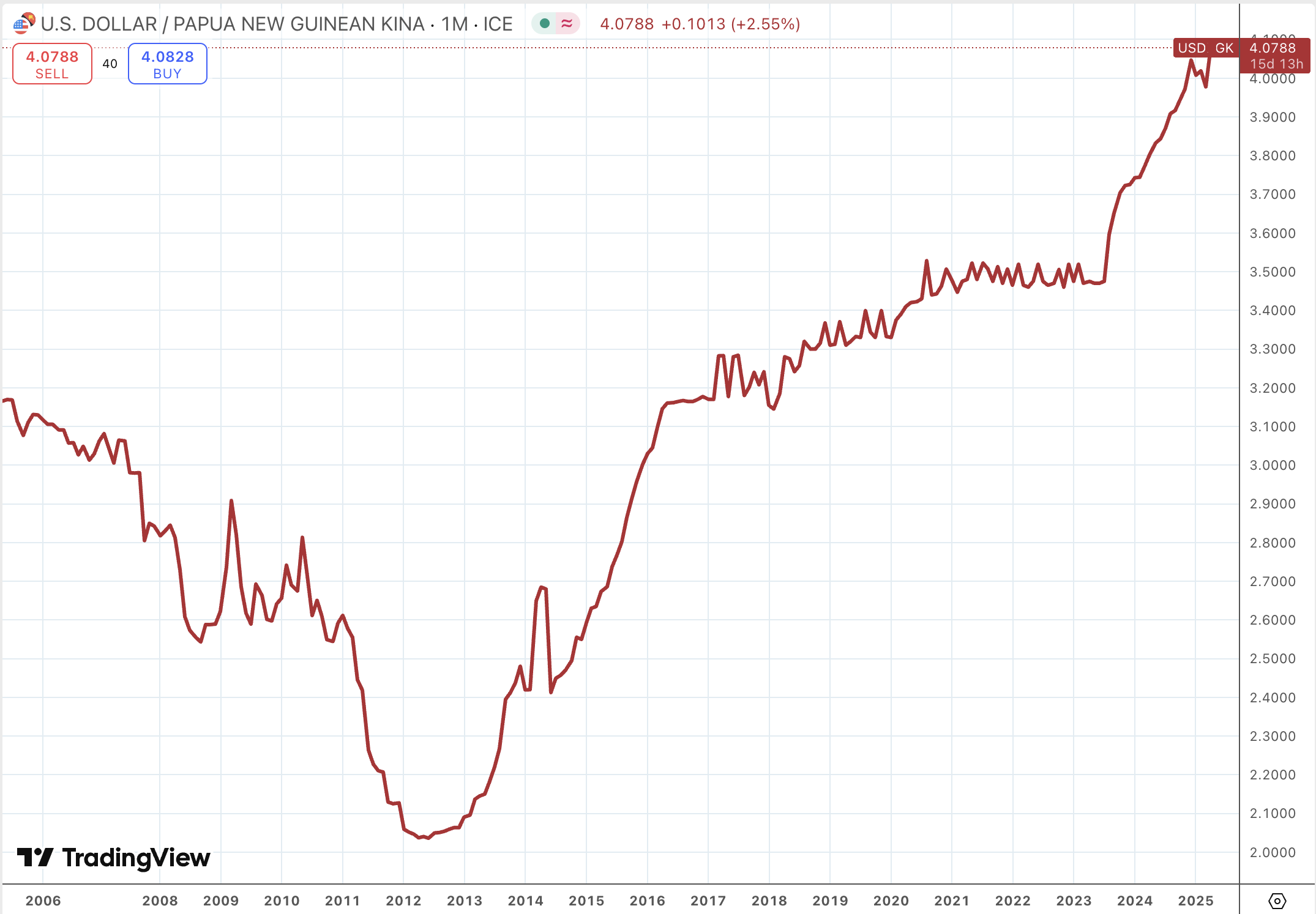

The country’s currency is the “Papua New Guinean Kina” or simply “Kina,” abbreviated as “PGK.” One US Dollar is worth around 4.1 PGK. I don’t expect significant volatility in the exchange rate.

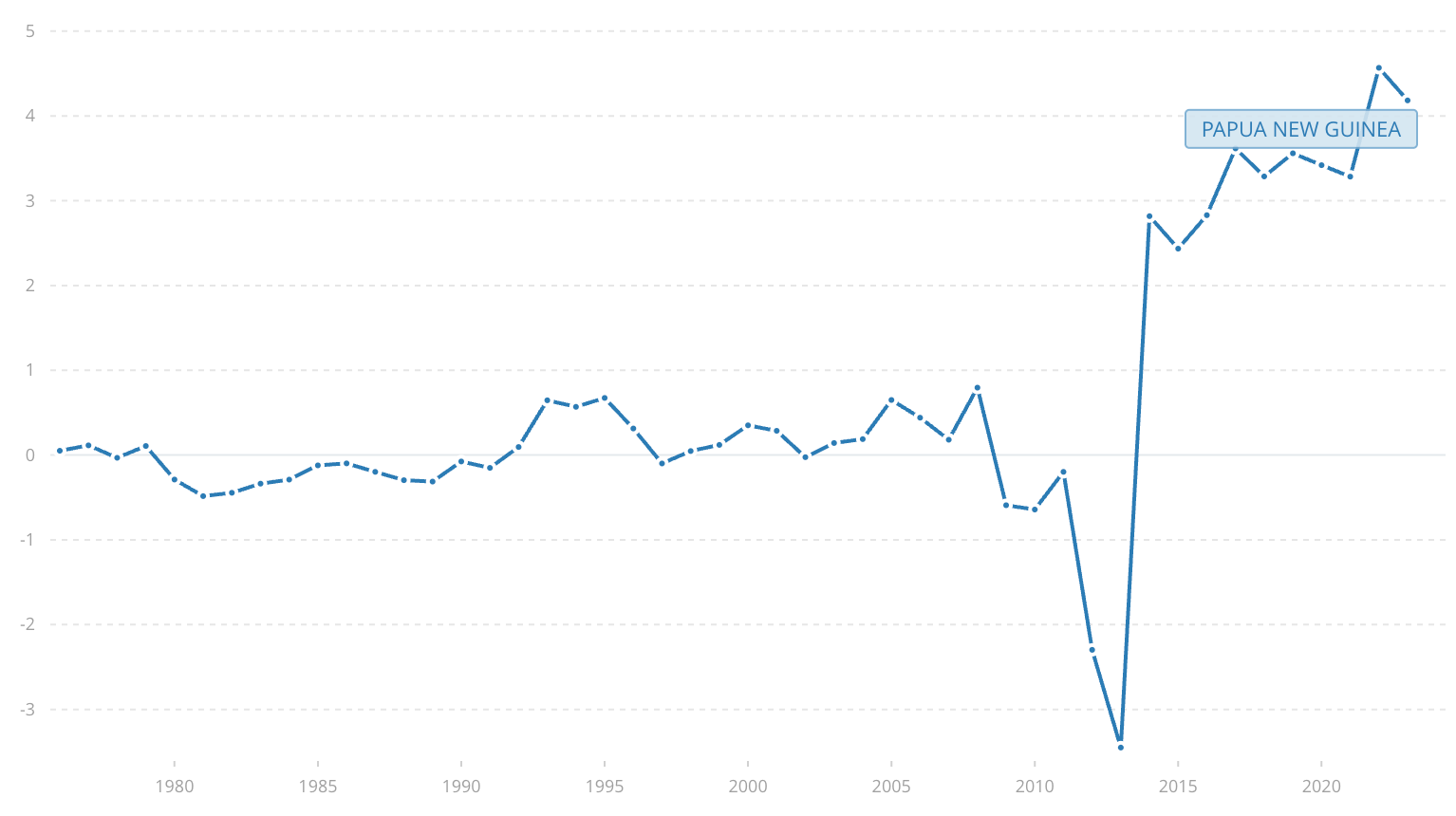

PNG’s current account balance shot up in 2014 thanks to a surge in LNG exports, supporting the currency:

The country’s budget deficits are modest at around 4% per year, and inflation is about 4-5% per year — better than many other frontier markets.

So overall, I think the macroeconomic backdrop is favorable. Especially when you consider that PNG’s private sector credit penetration is only 17%, with 80% of the population remaining unbanked. That’s where the opportunity is for the nation’s commercial banks, including challenger bank Kina Securities.

2. Introduction to Kina Securities

Kina Securities is a one of the larger financial services companies in Papua New Guinea, with a 14% market share in terms of deposits.

The company was formed in 1985, focusing mostly on finance and brokerage services in PNG. A few months after Kina Securities’ IPO, it acquired the PNG operations of Malaysia’s Maybank. Then, in 2019, it acquired the PNG retail and SME segment of Australian bank ANZ.

In September 2020, Kina Securities conducted a secondary offering to finance the acquisition of Westpac’s PNG and Fiji banking operations. But regulatory authorities in Papua New Guinea halted the acquisition on antitrust grounds. It looks like the regulator wanted the nation’s banking licenses to remain spread across at least a number of companies.

But despite the failure to acquire Westpac’s PNG and Fiji operations, Kina Securities has done well. The capital it raised in 2020 has been put to use, and it’s been able to grow organically since that time. From 2019 to today, Kina has increased its lending market share from 10-11% to 17%.

As of 2025, Kina Securities has two main segments:

- Kina Bank: Typical commercial bank offering corporate loans, home loans, and credit cards. It has 18 Kina-branded bank branches and 2 co-branded branches with micro-lending partner MiBank.

- Kina Wealth: Investment advice, fund management e.g. for superannuation funds, stock brokerage. It has roughly Papua New Guinean Kina

Roughly half of the bank’s revenues come from lending and 50% from non-banking services such as payments or wealth management services.

Competitor BSP Financial (BSL AU — US$2.2 billion) is the market leader in PNG and benefits from its close relationship with the government. The reason is that BSP took over former state-owned bank Commonwealth Bank when it was privatized in the year 2000. Thanks to BSP’s scale, its cost/income ratio is just 41%, giving it somewhat of an advantage.

On the other hand, Kina Securities seems to have an advantage in its technology stack, being at the forefront in terms of the payments market. Kina also has strong relationships with PNG superannuation funds, including the NASFUND, with about PGK 16 billion in funds under management.

3. The bull case for Kina Securities

There’s plenty of upside to further growth. What’s exciting about the broad macro picture is not just PNG’s population growth, but also the fact that 80% of the population remains unbanked. And the weighting between corporate and retail sector within the banking sector is another 80/20 split, suggesting there’s potential for retail banking to grow.

Kina’s own loan-to-deposit ratio is only 70%, below the regulatory ceiling of 90%. And its capital adequacy ratio is a comfortable 18%, well above the regulatory minimum of 12%.

So, Kina’s balance sheet has room to grow. Last year, the loan book grew by +13%. This year, Kina expects the loan book to grow single-digits or low-double-digits.

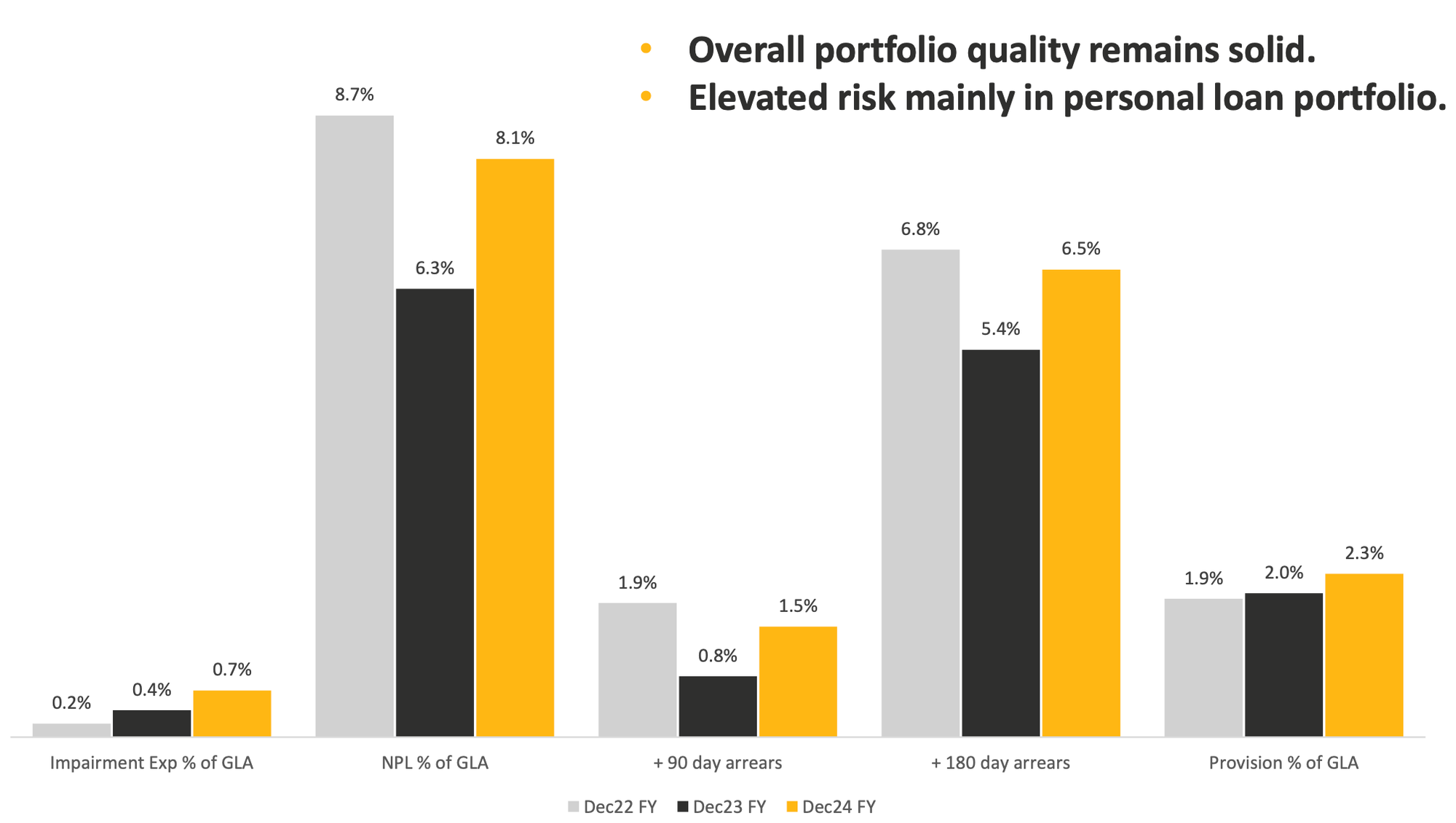

There’s been an uptick in the non-performing loan ratio in the past few years, perhaps as consumers feel the pinch from higher inflation. The NPL ratio is currently 8.1%. And most of the problems are in the unsecured personal loan portion of the portfolio. So Kina took action in the fourth quarter of last year, re-evaluating their product positioning to make sure the NPL ratio remains under control.

But still, Kina’s banking operations remain fundamentally profitable. Kina’s net interest margin is currently 5.8%. While the PNG’s policy rate has risen from 3.0% in 2022 to 4.0% today, the net interest margin has remained steady and is probably sustainable.

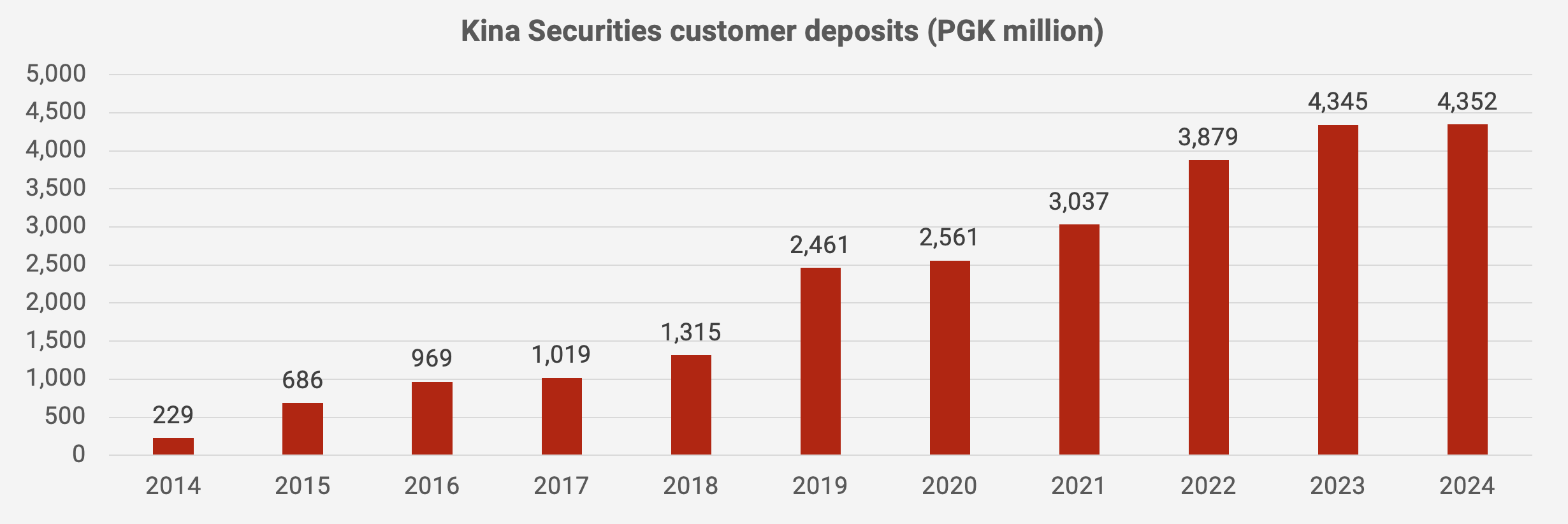

On the funding side, Kina relies mostly on demand deposits at 68% of the total, with little borrowing otherwise. Between 2020 and 2023, Kina’s deposit growth was about 10-13% per year. It’s been weaker recently, however, due to an overall decline in banking system deposits.

I suspect this decline is due to corporations moving capital to foreign currency deposits transferred overseas, perhaps to take advantage of a higher-yielding US Dollar.

Other than net interest income, there are also opportunities in fee & commission revenues. A few years ago, Kina made 90% of its banking income from lending. But today, it enjoys an almost 50/50 split between interest and non-interest income. Such income includes foreign exchange transactions, payments and digital banking. There’s also a smaller portion of about 8% from the wealth management side of the business. But what’s most exciting is probably the digital banking side, where Kina has proven adept at innovation.

4. The upside from digital services

The payment business has been a bright spot for Kina. After the acquisition of ANZ’s PNG banking business in 2019, Kina grew its exposure to point-of-sale (POS) machines in retail shops. It was one of the first in PNG to issue EMV chip cards to its retail customers.

Kina’s take rate on a local credit card transaction is typically 1.0%, and that will flow straight through to the bank’s top-line revenues. Compared to other regions, those margins are reasonably healthy.

The bank also works with local fintech companies and has a strategic partnership with NuPay, which is working with the PNG government to digitalize its services. NuPay makes money off each transaction and then shares that income with Kina in a joint venture.

Given its possession of this Internet payment gateway, Kina believes that it is best positioned when it comes to e-commerce. It has a front-end Internet payment gateway and a back-end Internet payment switch that routes transactions to the correct payment provider. The NuPay model is where they simply run the front-end of the payment — the website that pops up — and then connects to the back-end payment switch that Kina operates. In other words, NuPay is the distributor of digital payments, while Kina is the processor.

The digital payments market in PNG is growing by double-digits. Telecom operators such as Digicell have built around 800 towers across the PNG and have another 400 under construction. With these towers, they’ll soon reach 80-85% of the population. Prices for mobile plans have come down significantly, with K400 plans having come down to, say, K40 (about US$10 per month). With mobile network coverage, there’s a good chance that PNG’s unbanked population will finally start to use regular banking services.

Kina is now developing new mobile and desktop banking apps. They’re building a new corporate Internet banking service to try to get ahead of the market. And they’re also developing a digital wallet with lower payment thresholds.

What might the future look like? In nearby Fiji, the most successful banking innovation has been the M-PAiSA digital wallet, which originated from Kenya.

M-PAiSA allows users to transfer money to each other and deposit and withdraw money from agents such as retail shops and kiosks. The app quickly captured a big share of the non-bank payment market. Kina is now trying to replicate its success in PNG.

BSP has a rudimentary digital wallet product called Wantok. Kina is developing a supposedly more sophisticated digital wallet. These are new initiatives, so it’s too early to tell whether they’ll be successful.

In 2020, Kina invested in an Internet payment gateway, a digital equivalent of a POS terminal that collects payment information from the customer to the payment processor. Kina is also experiencing strong growth in its online bill payments, from which they take a cut.

5. Kina’s capital allocation

Kina’s capital allocation has been mixed. The bank’s return on equity has consistently been in the mid-teens. The 2020 secondary offering was done at close to 1x book. From 2019 to 2021, the share count rose by +75%.

Management is remunerated based on a balanced scorecard. Key inputs include financial, customer, people, and risk metrics. Net profit growth is heavily weighted in the calculations. Other key metrics include lending growth, the non-performing loan ratio, customer experience, market share growth, etc. It seems that many of these metrics are on an aggregate basis rather than per share.

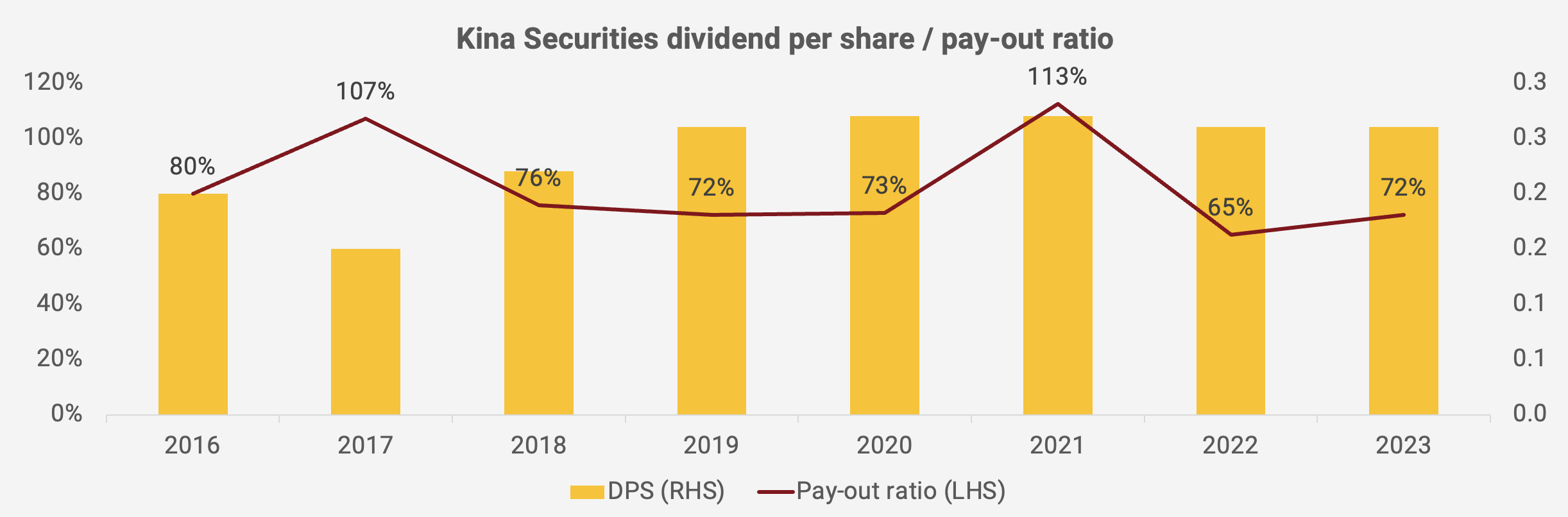

The dividend payout ratio has generally been 60-80%. Management is guiding for a long-term payout ratio closer to the mid-to-lower end of that range.

Share buybacks? They are not on the agenda right now. The company is dual-listed on the PNGX and ASX, with the latter counter being significantly more liquid. Kina is looking at Tier 2 capital options to support future lending growth, and they’re hoping to complete it within the next six months.

6. Conclusion

Both Kina Securities (KSL AU — US$193 million) and its larger competitor, BSP Financial (BSL AU — US$2.2 billion), are dual-listed on the Papua New Guinea Stock Exchange (PNGX) and the Australian Securities Exchange (ASX). Kina trades at a trailing 8.2x P/E with a 9.2% dividend yield and BSP at a trailing 8.3x P/E with an 8.5% dividend yield.

The big question is how the PNG banking sector is going to evolve. Kina’s NPL ratio has risen dramatically in the past two years, and it seems reasonable to expect provisioning for credit losses to rise. With a 5.8% net interest margin and a growing payment business, however, the problems in the unsecured personal loan book seem manageable.

With limited inflation pressures, it seems plausible that PNG’s policy interest rate will eventually decrease. Given the large current account surplus, I’m not worried about the exchange rate. And there’s an enormous opportunity if and when PNG’s large unbanked population starts to use basic financial services.

I’m finding it challenging to judge whether BSP’s Wantok digital wallet will be a game-changer. Or whether Kina will be the bank that takes market share in the transition to mobile banking.

It’s an exciting story, for sure. If they can replicate parts of what Kaspi has achieved in Kazakhstan in terms of digital banking services, then the Kina story is definitely worth tracking.