Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I hold a position in Fairwood at the time of publishing this article. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares.

I bought shares in Hong Kong restaurant operator Fairwood in late December 2022. At the time, the city’s COVID-19 restrictions had just been removed, and the Hong Kong-China border was about to open, too.

But since that point, Fairwood’s share price has continued lower:

This begs the question: what the hell happened?

The answer is that Hong Kong’s restaurant industry has faced incredible challenges throughout COVID-19 and even until today.

But if we look beyond those challenges, will Fairwood end up in a better place? Or is the business facing a secular decline?

Table of contents:

1. Quick recap

2. Update since my first write-up

2.1. The post-COVID experience

2.2. The new Fairwood app and website

2.3. Related party transactions

2.4. Fairwood’s repriced options scheme

3. What will change for Fairwood?

3.1. Positive recent guidance

3.2. The 4th generation store design

3.3. A potential supply response?

3.4. Government initiatives to solve the manpower crunch

4. Valuation multiples

5. Risks

6. Conclusion1. Quick recap

Have a look at my original Fairwood (52 HK - US$117 million) report. It was written back in 2021. At the time, I considered Fairwood to be a bet on its recovery from COVID-19.

For those who don’t want to read the entire presentation, here’s a quick summary:

- Fairwood is a Hong Kong fast-food restaurant operator. At the time of the report, it ran 172 restaurants in Hong Kong and Mainland China. Most of its restaurants carried the “Fairwood” (大快活) brand name, serving a mix of Chinese and Western food.

- The founder has a family connection to competitor Cafe de Coral. And the two restaurant chains look alike, too. But I think the two restaurants, together with Maxim’s, continue to fill a niche of reasonably-priced fast-food that’s probably healthier than what’s on offer at McDonald’s. I believe all three can co-exist.

- Up until the 2019 democracy protests in Hong Kong, Fairwood had done okay, with fast-food outlets taking market share from casual dining restaurants. Back then, it enjoyed a return on equity well above 20%. But after the protests broke out, foot traffic ground to a halt and inbound tourism from Mainland China stopped as well.

- Then came COVID-19, which led to a complete halt in tourism, along with dining-out restrictions and social distancing measures.

- Fairwood continued to sell food throughout the pandemic by setting up an online ordering system, yet profitability continued to lag due to lower margins on takeaway food.

- I thought there was a good chance that it would recover following the COVID-19 pandemic, with margins back to its prior levels.

- I foresaw a 2025e EPS of HK$1.71, putting Fairwood at a sub-10x P/E ratio at the then-prevailing share price of HK$16.7x, despite a strong balance sheet.

When I eventually bought shares in Fairwood myself in December 2022, I saw evidence that foot traffic was returning. All COVID-19 restrictions had been removed, and the border was also about to open up. And that’s indeed what happened in the subsequent two years.

2. Update since my first write-up

2.1. The post-COVID experience

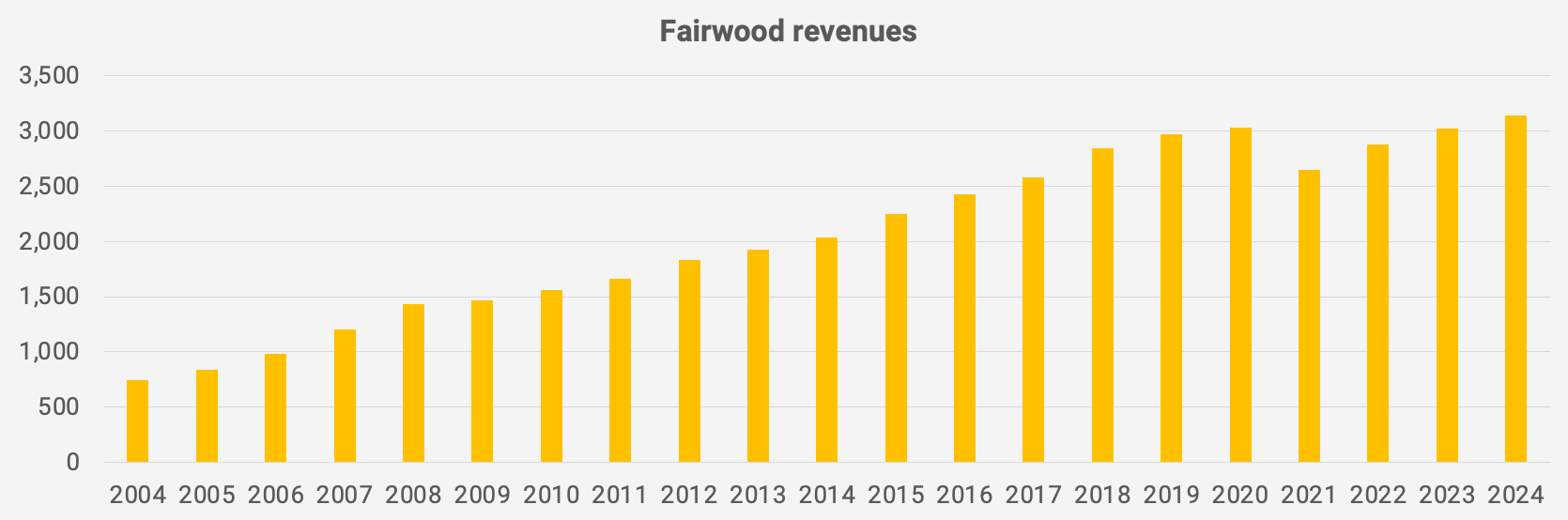

Fairwood’s revenue recovery has played out nicely:

The two major factors were the removal of Hong Kong’s dining-out restrictions in October 2022 and the reopening of Hong Kong’s border in January 2023. It took a while for the face mask mandate and the arrival PCR test requirements to be removed, but eventually, they were. Hong Kong’s government even introduced spending vouchers to lure tourists back to the city.