Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in IH Retail when publishing this article. Note that this is a disclosure and not a recommendation to buy or sell.

Summary

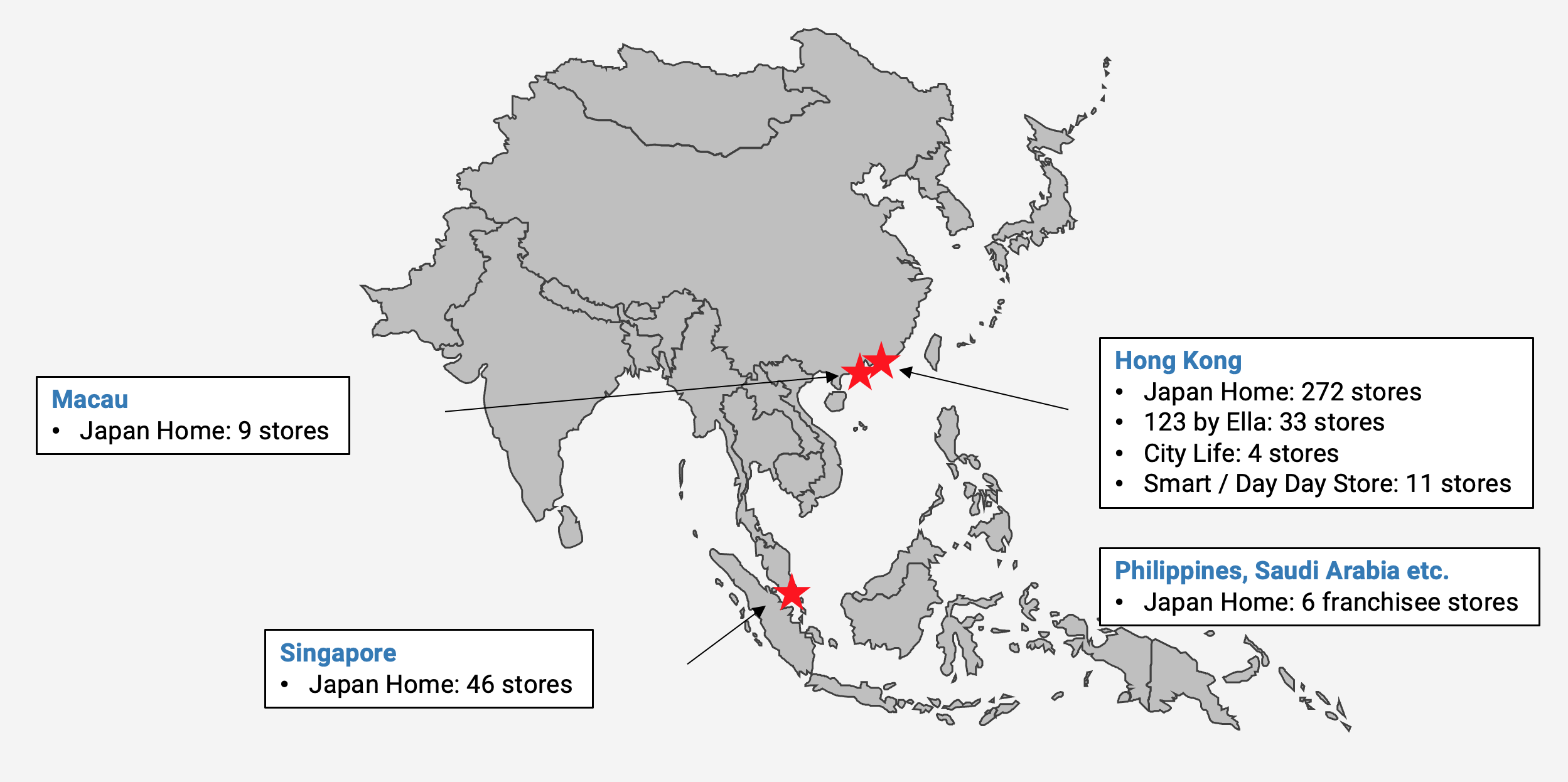

- I wrote about Hong Kong-based retailer IH Retail back in mid-2023. The company operates houseware discount stores in Hong Kong, Macau and Singapore under the “Japan Home” and “JHC” brand names.

- Since mid-2023, the stock price has fallen over 50% due to lower sales of pandemic supplies after Hong Kong eased its COVID-19 restrictions.

- In this post, I discuss exactly what went wrong since 2023 and what might happen in the future. In the final part of the post, I also project earnings into 2027 and discuss the valuation multiples the stock would end up trading at.

Table of contents:

1. Quick recap

2. Update since my first write-up

2.1. IH Retail’s financials

2.2. New store openings

2.3. Employee share awards

3. What will change for IH Retail?

3.1. Shenzhen revenge travel

3.2. Rising labor costs

3.3. The threat from e-commerce

3.4. The private label offering

4. Valuation multiples

5. Conclusion1. Quick recap

International Housewares Retail (“IH Retail”) is a stock I wrote about in July 2023. Here’s the presentation I put together on the company back then:

And here’s a short summary of that presentation:

- International Housewares Retail is a Hong Kong-based discount retailer of houseware goods with 380 stores across Hong Kong, Macau, Singapore and several other countries. Hong Kong represents roughly 90% of revenues, and the rest comes from Macau and Singapore.

- These stores operate under the “Japan Home Centre” / “JHC” / “日本の家“ brand names, selling products that are priced so cheaply the stores might well be dollar stores. The way the company can achieve such low prices is by cutting out the middlemen and dealing with over 200 factories in China directly. Over 40% of IH Retail’s products are private label goods, and that’s probably part of its success story, along with the fact that its inventory turnover is high. Since listing, the company has enjoyed an average average return on equity of 24%.

- The company’s same-store sales growth had been around 5%, though there was slow growth in the total store count, with organic growth of about 7% per year altogether.

- I knew at the time that Hong Kong had experienced emigration following the introduction of the 2020 National Security Law and that Hong Kong’s population had shrunk. But I envisaged a future whereby immigration from the Chinese mainland could make up for this population loss, especially if the government’s plan on building affordable housing for millions of people in the New Territories ever comes to fruition.

- I suspected that IH Retail’s profits would drop due to the onset of the COVID-19 pandemic. It had earned excess profits during COVID thanks the selling of face masks and rapid antigen test kits under the “SMILE 365” brand name. And during COVID-19, it also earned high-margin revenues from its e-commerce site, on top of government subsidies.

- But in the longer term, I believed that IH Retail would do well. Discount retailers have so far survived the onslaught of competition from e-commerce websites quite well as delivery costs can often exceed the price of an individual item. Discount retailers also offer a treasure hunt experience. And a feeling of comfort knowing that whatever you pick, it’s not going to break the bank.

- On 2025 numbers, I predicted a P/E ratio of 11.1x and, assuming a stable 85% dividend payout ratio, with a dividend yield of about 8%.

- I noted that IH Retail’s two co-founders kept buying shares in the open markets. I also noted that famed activist investor David Webb had been a long-term shareholder in IH Retail and continued to add to his position. Webb has an eye for well-governed companies, and I think that’s probably what attracted him to IH Retail, too.

2. Update since my first write-up

Due to a post-COVID weakness in earnings, IH Retail’s stock price has tanked and is down over 50% in less than a year:

2.1. IH Retail’s financials

So what happened? Here are the company’s financials up until the first half of FY2024, ending 30 April 2024.