Table of Contents

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author might hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

The biggest news story in Asia over the past week has been Bloomberg's reporting of the Indonesian government's recent land seizures.

These land seizures have been occurring for a while, but there hasn't been much news about them in the media. Since March 2025, more than 4 million hectares of oil palm plantation land has been taken over by the government. That's equivalent to the size of Switzerland, or 30% of Indonesia's total oil palm acreage.

Much of the land has now been transferred to a new state-owned enterprise called "Agrinas Palma Nusantara". Its board is made up of retired army generals associated with President Prabowo Subianto.

Initially, the government claimed that the land was seized because it was located within forest zones, which should technically not be used for agriculture. But once taken over, it seems that much of the land has now become legal, agricultural land. In the words of an industry professional:

“This is an extraordinary injustice. At the beginning, these plantations were taken over under the pretext of returning them to forest. In reality, they are being released into [agricultural land]”

It doesn't take a genius to figure out what's going on. The government is simply nationalizing private assets, much like during the reign of socialist former President Sukarno, who ruled Indonesia from 1945 to 1967.

What will this mean for the palm oil industry? Well, given that Indonesia accounts for 58% of global palm oil production, the seizures will most likely affect palm oil prices. Farmers have been offered 15% of revenues if they stay, but many have been reluctant to maintain plots now owned by the government. Large plantation companies such as IOI Corporation and Wilmar have also become cautious about investing new capital in the industry.

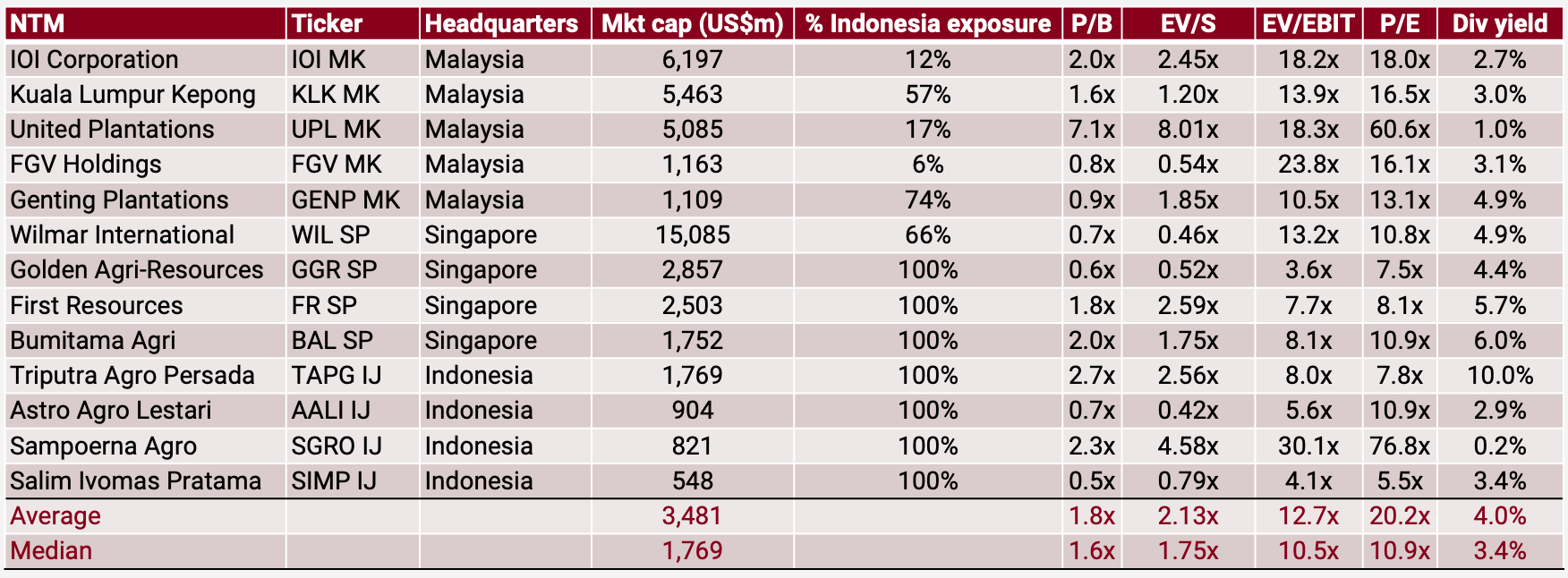

So I think you could argue that palm oil prices should be heading higher. The beneficiaries will be close-to-pure-play Malaysian producers such as IOI Corporation and United Plantations.

In October and November 2025, Indonesia's new state-owned holding company Dantantara issued so-called "Patriot Bonds" yielding just 2% — four percentage points below the government bond yield. 46 Indonesian conglomerates purchased close to US$4 billion of these Patriot Bonds when they were issued. The tycoons participating included the Salim, Hartono and Widjaja families.

Now the big question is whether buying these Patriot Bonds will shield their companies from expropriation. I don't have the answer to that. But I will certainly think twice before buying plantation companies with significant exposure to Indonesia.