Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

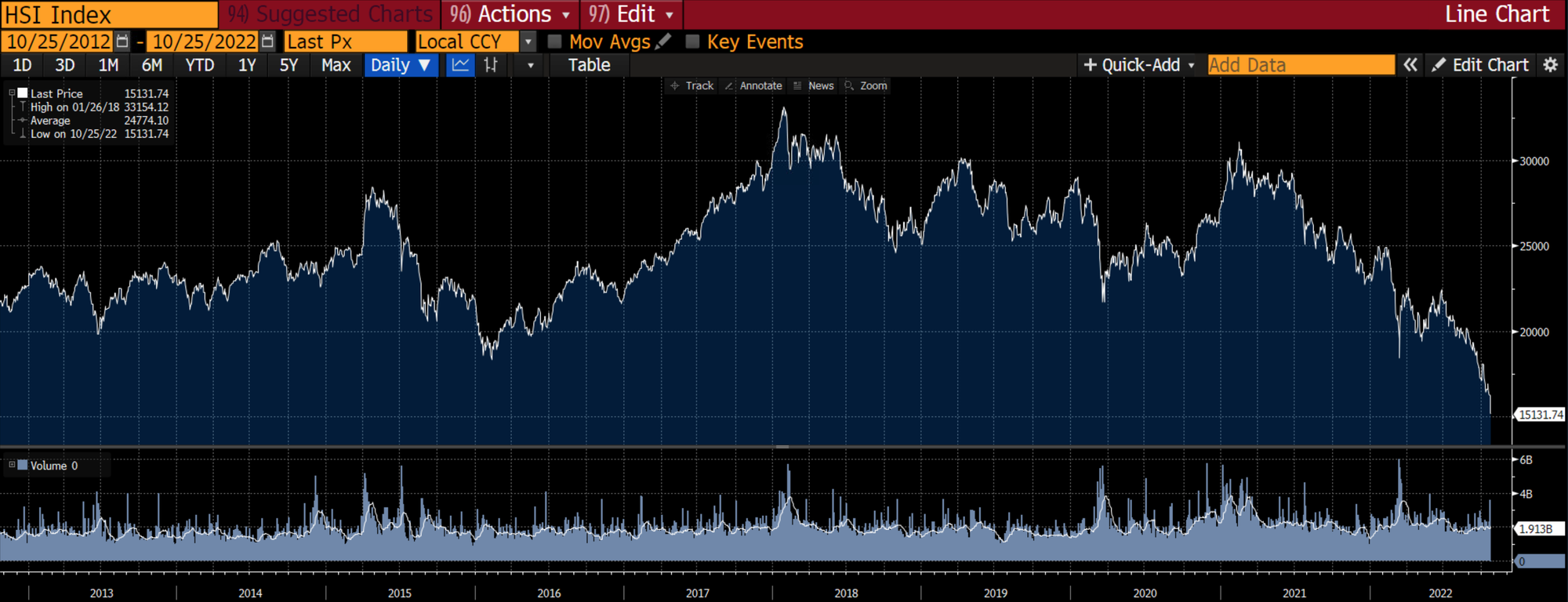

- The Hang Seng index is now getting closer to its 2008 lows.

- But the key constituents of the Hang Seng index are not particularly cheap. The P/E multiples of Hong Kong small-caps, on the other hand, seem far lower the key constituents of the index.

- A screen of Hong Kong-listed companies with market caps above US$100 million and management insider buying over the past three months gives an output of 89 stocks.

- A few of the stocks worth highlighting include Zhongsheng, Yuexiu Property, Yihai, Luk Fook, China XLX, Perfect Medical, Pacific Textiles, Tai Cheung, IH Retail and Pico Far East.

A Hong Kong insider screen

Monday’s drawdown in the Hang Seng index was brutal, down 7%:

It’s anyone’s guess where the index will bottom.

What’s surprising is that neither of the top holdings of the Hang Seng index looks particularly cheap. Except for China Mobile, which trades at a P/E multiple of 7x.

The good news is that certain Hong Kong-listed equities now trade at far lower multiples than what we saw at the post-COVID peak in early 2021.

To get a sense of the opportunities in Hong Kong-listed equities, I’ve run a screen on the Hong Kong-listed equities with the greatest management insider buying over the past 3 months.

Here are the top 20 stocks, ranked by the value in US$ of management buying, over the past few months:

- Xinyi Glass: Producer of float glass for autos

- Smoore International: Provision of vaping products in China

- Beijing Enterprises Urban Resources: Subsidiary of Beijing Enterprises

- SJM Holdings: Macau’s former casino monopoly operator

- Hang Lung Group: Privately owned property developer in HK & China

- China Renaissance Holdings: Chinese brokerage company

- Symphony Holdings: Producer of footwear and shopping mall developer

- Greentown Service Group: Private Chinese developer

- Productive Technologies: Semiconductor equipment for solar panels

- Luk Fook: Hong Kong-based jewellery company

- Digital China Holdings: A Lenovo-affiliated IT service provider

- C-Mer Eye Care: Eye and surgery centres in China

- Kerry Properties: Robert Kuok-affiliated developer & manager

- Dah Sing Banking: Hong Kong commercial bank

- Cathay Media And Education: Film & TV studio for PRC content

- China LNG Group: Privately owned LNG distributor in China

- Hong Kong & China Gas: Distributes town gas in Hong Kong & China

- Eagle Nice (Intl): Sportswear & garment body shop

- International Housewares Retail: Owner of Japan Home retail stores

- Longfor: Private Chinese developer of shopping malls

You can find the entire spreadsheet available for download here:

Here are a few stocks that I would like to highlight from the above list:

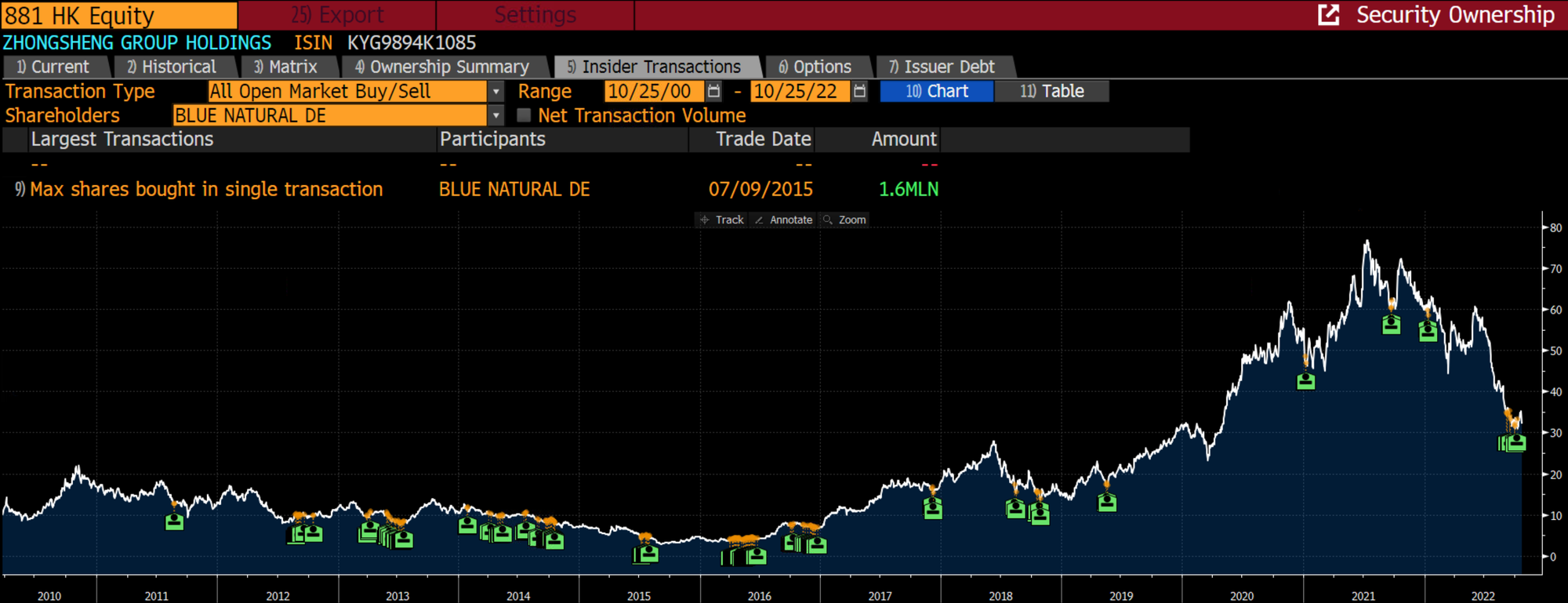

1. Zhongsheng (881 HK)

Zhongsheng (881 HK - US$10.5 billion) is a Jardine Matheson-backed auto retailer in China with 417 outlets. Its brand portfolio includes Mercedes Benz, Lexus, Porsche, Toyota, Honda, Audi, Volvo, Xpeng and Infiniti. In short: half-half exposure to German as well as Japanese brands. Like other auto dealerships, it makes much of its money through high-margin after-market services, which tend to be stable throughout the cycle. After excess capacity in the auto dealership industry in the early 2010s, the company has increased its earnings significantly since 2016.

The company has been suffering from COVID-19-related lockdowns and supply chain disruptions. Some also question the value of auto dealership after-market services in an era of electric vehicles, which tend to break down less often.

Today, the stock trades at a forward P/E of 6.9x and an EV/EBIT of 5.8x. The company’s historical P/E has been closer to 15x.

Major shareholder Huang Yi through his holding company “Blue Natural Development” has been buying shares aggressively in September 2022, in aggregate close to 3 million shares.

2. Yuexiu Property (123 HK)

State-owned property developer Yuexiu Property (123 HK - US$3.4 billion) owns an incredible portfolio of assets in its home city of Guangzhou. The company’s land reserves are mostly in the Guangdong-Hong Kong-Macau area, also known as the Greater Bay Area. The exposure is primarily to tier 1 cities, which are enjoying net migration flows. Its leverage is somewhat higher than COLI’s and CR Land’s, but still far below the worst offenders in the sector.

Ownership by the Guangzhou Metro makes it a state-owned enterprise and thereby protected from the current crackdown on private developers. Thanks to its status as an SEO developer, Yuexiu has been able to buy land at competitive prices, only 33% of ASP, enabling it to earn mid-cycle gross profit margins of around 25%.

It’s worth noting that Yuexiu’s contract sales in 2022 are actually up year-on-year, which is remarkable considering the sector’s broader slump. Despite this decent performance, the 2023e consensus P/E is only 5.3x with a dividend yield of 7.6%.

Director Lee Ka Lun has purchased 232,000 shares over the past month, though he is admittedly an active trader.

3. Yihai (1579 HK)

Yihai (1579 HK - US$2.0 billion) is a sister company of the hot pot restaurant chain Haidilao that produces hot pot-related food products sold to supermarkets around China. The products include soup bases and dipping sauces. Yihai sells both to related party Haidilao and third parties, and such related party transactions open up questions about transfer pricing.

Given that Haidilao has suffered during the pandemic due to COVID-19-related lockdowns, Yihai’s sales have also weakened, with growth decelerating from 50% to almost zero. Today, the 2023e P/E is 16.3x and EV/EBIT 10.2x.

CEO Guo Qiang bought about 100,000 shares in late August / early September 2022 for the first time ever.

4. Luk Fook (590 HK)

Luk Fook (590 HK - US$1.3 billion) is one of Hong Kong’s largest jewellery retailers. The company sells gold-, platinum-, diamond- and other types of jewellery. Many of Luk Fook’s stores are run through franchisees, with 1,355 franchisee stores and 152 self-operated stores as of 2017. Luk Fook makes money by selling its jewellery to franchisees at wholesale prices. But the self-operated stores are far more profitable. Only 50 or so of those stores are in Hong Kong, and the rest are mostly in mainland China.

Profitability suffered in FY2020, partly because of reduced tourism to Hong Kong but also due to the pandemic. Earnings have now almost fully recovered. But the enterprise value remains 40% below its 2019 level. Luk Fook’s 2023e P/E is 6.6x and has a dividend yield of 7.9%.

Chairman & CEO Wai Sheung Wong has acquired over 700,000 shares over the past few months. Board member Li Hon Hung acquired 100,000 shares in August and September 2022.

5. China XLX Fertiliser (1866 HK)

China XLX (1866 HK - US$526 million) is a Henan-based fertiliser company listed in Hong Kong since 2006. It also has operations in Xinjiang and Jiangxi, where its Jiujiang base opened in 2021. It focuses on the production of urea, methanol and a variety of other chemicals.

The stock trades at a 2023e consensus P/E multiple of 2.3x and a dividend yield of 6.0%. The P/B has almost come down to its 2020 lows.

Deputy General Manager Yan Yunhua purchased 650,000 shares in September. Chairman Liu Xingxu’s holding company Pioneer Top Holding also purchased almost 2 million shares in September.

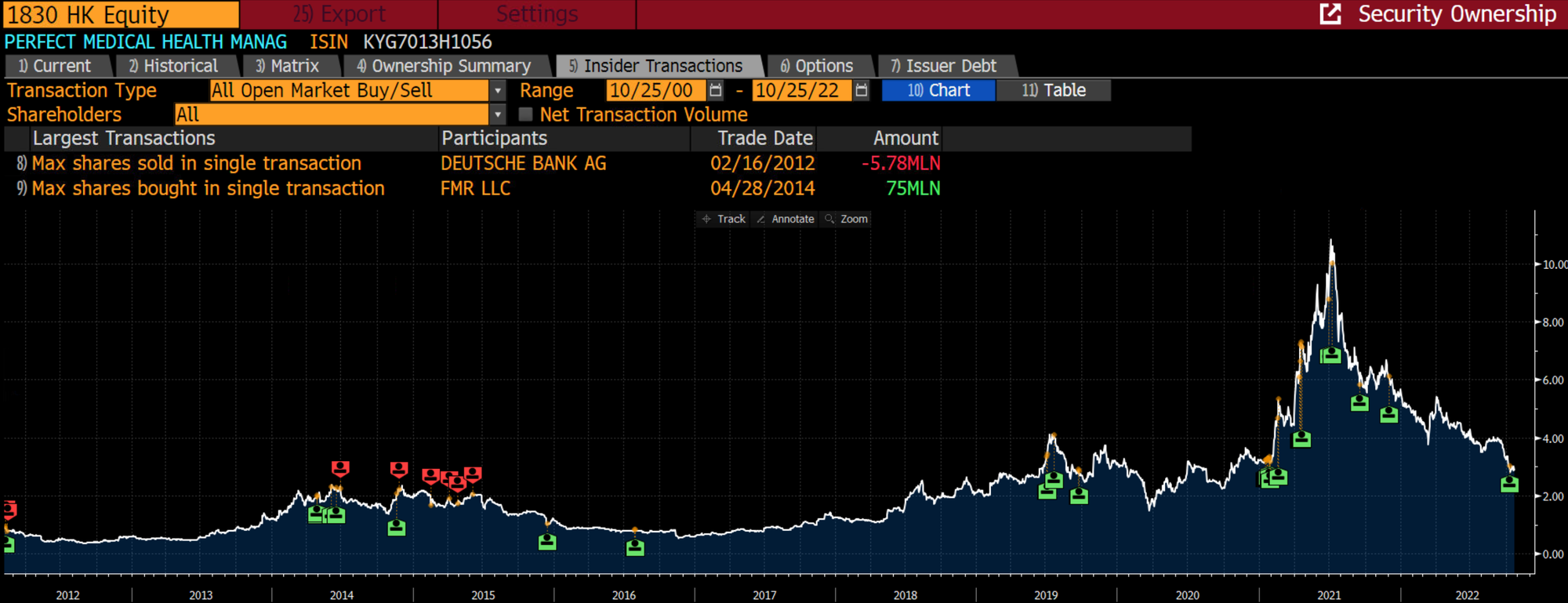

6. Perfect Medical (1830 HK)

Perfect Medical (1830 HK - US$476 million) is a Hong Kong-based company that offers slimming and beauty treatments, such as freckle removal, lymphatic drainage therapy and anti-ageing treatments. There are currently 57 branches in Hong Kong and mainland China. Reading the material, I can’t help wondering to what extent Perfect Medical treatments are effective vs just selling hope.

But the business is profitable, with a 50% return on equity for the last fiscal year. The stock currently trades at a 2023e consensus P/E ratio of 7.1x and a dividend yield of 8.6%.

Chairman and CEO Au-Yeung Kong bought 300,000 shares in October 2022.

7. Pacific Textiles (1382 HK)

Pacific Textiles (1382 HK - US$449 million) supplies knitted fabric to Uniqlo (50% of revenues), Target, Walmart, Victoria’s Secret, etc. Its main products include innerwear and outerwear, which represent 50/50 of revenues.

Most of its factories are in mainland China. But Pacific Textiles is now actively expanding into Vietnam, as cotton prices and labour costs are higher in China.

The return on equity has consistently been around 20-30%. The product seems to be more or less a commodity, so it’s surprising to see such high ROE.

The company was formed by Choi Kin Chung (蔡建中) in 1997. Then in 2017, Japan’s Toray Industries became a substantial shareholder by purchasing shares from Mr Choi. Toray is now bringing in Japanese customers to the company, but the new management also begs the question of whether Choi’s absence will cause organisational issues.

Pacific Textiles trades at a 2023e consensus P/E of 6.2x and a dividend yield of 13.5%.

The company’s capital allocation seems strong. The balance sheet is strong, with a net cash position. It pays out a dividend of about 85% of net profit each year. And since October 2022, it’s been actively buying back shares. CFO Tou Kit Vai bought 200,000 shares in September for the first time since March 2020.

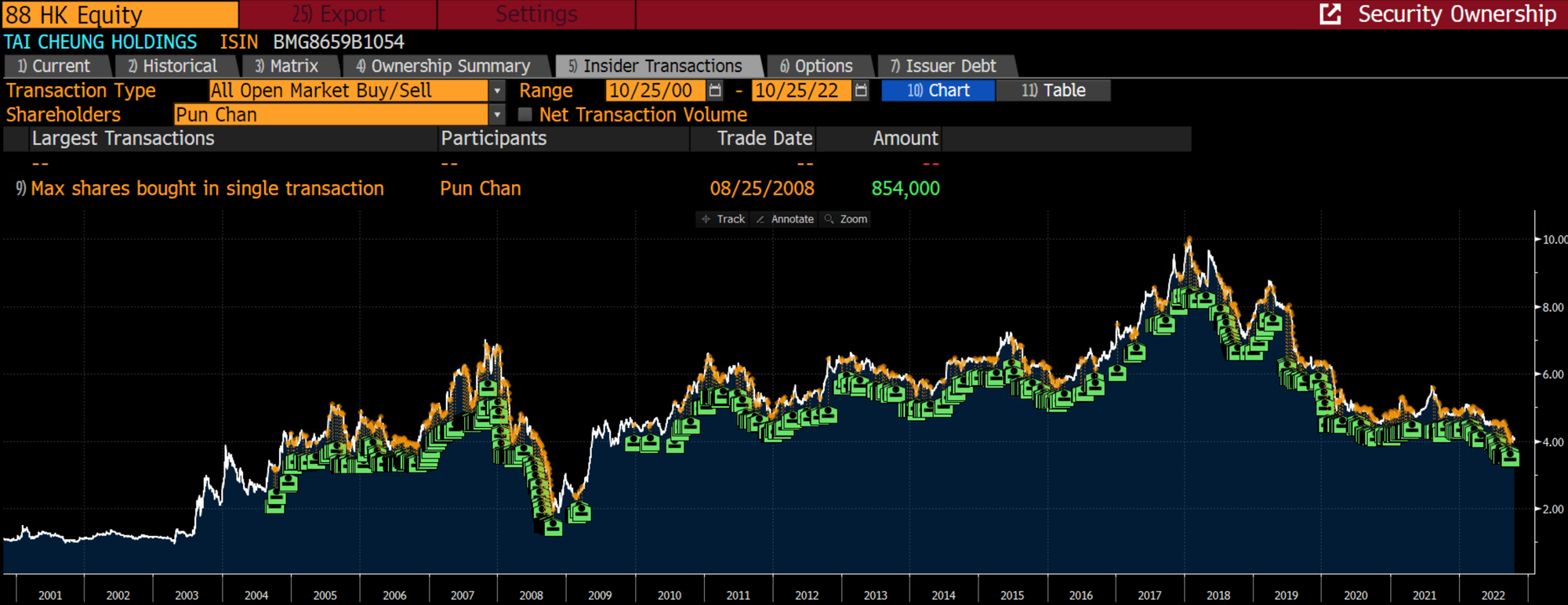

8. Tai Cheung (88 HK)

Tai Cheung (88 HK - US$315 million) is a small-cap property developer and manager that’s owned by Hong Kong’s Chan family. It was initially set up as a construction company in the 1950s and then a developer through the 1960s and 1970s.

Today, the company is run by the founder’s son David Pun Chan, who Marc Faber has spoken fondly of, and who I believe is a man of integrity.

Tai Cheung owns a great set of assets, including a 35% interest in the Sheraton Hotel in Tsim Sha Tsui and the next-door shopping mall. It owns the office building Metropole Square in Sha Tin, residential developments at 3 Plunkett’s Road on The Peak and Pulsa in Repulse Bay. It also owns a logistics building in California and land on Ap Lei Chau island in Hong Kong.

Price/book is today 0.37x, i.e. a fraction of the company’s liquidation value. Historically, it’s traded at 0.6x. The current dividend yield is 6.0%. While the stock is thinly traded, and David is, therefore, reluctant to buy back shares, it announced a buyback program of 10% of shares outstanding in July 2022.

Chairman and CEO David Pun has been buying consistently throughout 2022 but more aggressively in September with about 200,000 shares.

9. International Housewares Retail (1373 HK)

International Housewares Retail (1373 HK - US$244 million) is most known for its key brand name Japan Home in Hong Kong and Singapore. But it also runs a number of other retail concepts, including 123 by Ella and DayDayStore. Japan Home provides houseware items at very competitive prices. Think IKEA but with lower-priced and more everyday types of items.

The company was established in 1991 and was listed in 2013 after a brief period of private equity ownership under a fund run by Sweden’s EQT. IH Retail currently runs 380 stores, most of them in Hong Kong, Singapore and a few other geographies. David Webb is a major shareholder with about 7% of the shares outstanding.

The stock currently trades at a P/E of 8.7x, an EV/EBIT of 7.3x and a dividend yield of 8.4%. There’s a risk that IH Retail was a COVID beneficiary, given the company's strong growth during the pandemic.

Chairman and CEO Lisa Ngai bought 4.8 million shares in May 2022, and board member Lau Pak Fai bought over half a million shares in October and over 1 million shares in August.

10. Pico Far East (752 HK)

Pico Far East (752 HK - US$169 million) is a service provider for the global exhibitions and events industry. Organisers hire Pico to decorate and set up exhibition booths, with a one-stop service. It’s also involved in the interior designs of museums, theme parks, physical signage and event management.

The company is run by the Chia family, who came from Singapore. But the business is now run out of Hong Kong due to the fact that half of the revenues come from Greater China.

Pico has suffered during the pandemic through border closures and related quarantine restrictions. But there are early signs that border restrictions to Hong Kong and China are easing, at least for business travellers.

The company has been profitable throughout the pandemic, and the balance sheet remains strong with a large net cash position. In a full-recovery scenario, you might expect Pico to return to its 2019, which would yield a P/E of 5.6x and a dividend yield of 12.6%.

A key question mark is Pico’s attempt to enter high-tech businesses through expensive acquisitions. Many view those initiatives as an endless money pit.

Chairman and CEO Lawrence Chia bought 2 million shares in September 2022.

I wrote about Pico Far East in this prior write-up:

Conclusion

The Hang Seng index doesn’t necessarily look all that cheap. But among Hong Kong’s small-caps, you can easily find stocks trading at single-digit P/E multiples and high-single-digit dividend yields, despite underlying growth.

Zhongsheng, Yuexiu Property, Yihai, Luk Fook, China XLX, Perfect Medical, Pacific Textiles, Tai Cheung, IH Retail and Pico Far East are just a few of them.