Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- Spin-offs can lead to value dislocations, especially if the spun-off entity is smaller than its parent, the parent is an index constituent in unrelated industries, or the spin-off is “icky” in some respect.

- Spin-offs are rare in the Asia-Pacific, but there are a few dozen per year in Australia and Asian developed markets such as South Korea, Hong Kong and Singapore. Since early 2021, there have been 40 spin-offs leading to two separately listed entities.

- I’ve chosen to highlight a number of companies with low valuation multiples, including SK Square, Tabcorp, LX holdings, China Conch Environment Protection, Jinmao Property Services, Central China Management, Sierra Rutile and Juno Minerals.

Spin-off theory

In Joel Greenblatt’s 1997 book You Can Be a Stock Market Genius, he discusses special situation investing.

Such special situations include spin-offs, tradable rights issues, merger securities, stocks of companies coming out of bankruptcy, leveraged recapitalisations and corporate restructurings.

A common denominated between all of these special situations is that something causes value dislocation, with stock trading below their fair values temporarily. It’s a lucrative part of the market to focus on.

In this post, I’ll focus on spin-offs in the Asia-Pacific, also known as demergers. A spin-off occurs when a company splits itself into two separate entities. Shareholders of the old company receive shares in the spun-off entity in direct proportion to their original stakes. You then typically end up with two separately listed entities, each with its own stock ticker.

Spin-offs can create value for shareholders in the following situations:

- Saving on taxes: While selling a subsidiary can lead to significant tax consequences, a spin-off often allows for separating two businesses without paying any tax.

- Highlighting value: If investors value the spun-off entity differently than the parent, then the aggregate market cap of the two new entities might go up. For example, if the spun-off entity is a fast-growing but loss-making technology company, it might be valued much higher than it would be as part of, say, a slow-growing parent.

- Improving management incentives: Spin-offs can create value by incentivising the new management team through stock options. They’ll be more accountable for their actions. No longer will the spun-off entities be used to support other parts of the larger group. And the spun-off entity may become more agile - less constrained by policies set by the former parent.

- Getting rid of liabilities: If the parent wants to rid itself of certain liabilities such as debt or, say, asbestos claims, it can transfer those liabilities to the spun-off entity and shield itself from such risks.

- Paving the way for a takeover: If potential acquirers are not interested in any particular part of the business, a spin-off might be the best solution to facilitate a takeover.

But even if a spin-off doesn’t create value, it’s still worth paying attention to. That’s because shares of the spun-off entity often end up trading below fair value after the original shareholders often sell the shares they receive without paying attention to value.

In Joel Greenblatt’s own words:

“The spinoff process itself is a fundamentally inefficient method of distributing stock to the wrong people… once the spinoff’s shares are distributed to the parent company’s shareholders, they are typically sold immediately without regard to price or fundamental value”

Such selling pressure tends to be particularly acute when:

- The parent is an index constituent: In that case, index funds will automatically sell their shares in the spun-off entity to comply with their mandates, and the spin-off’s share price will go down.

- The spun-off entity is too small: Some fund managers are unable to or unwilling to own shares in companies with low market caps due to risk management or liquidity and time constraints.

- Unrelated business area: If the spun-off entity is in an entirely different sector than its former parent, investors are more likely to sell it without paying attention to its value.

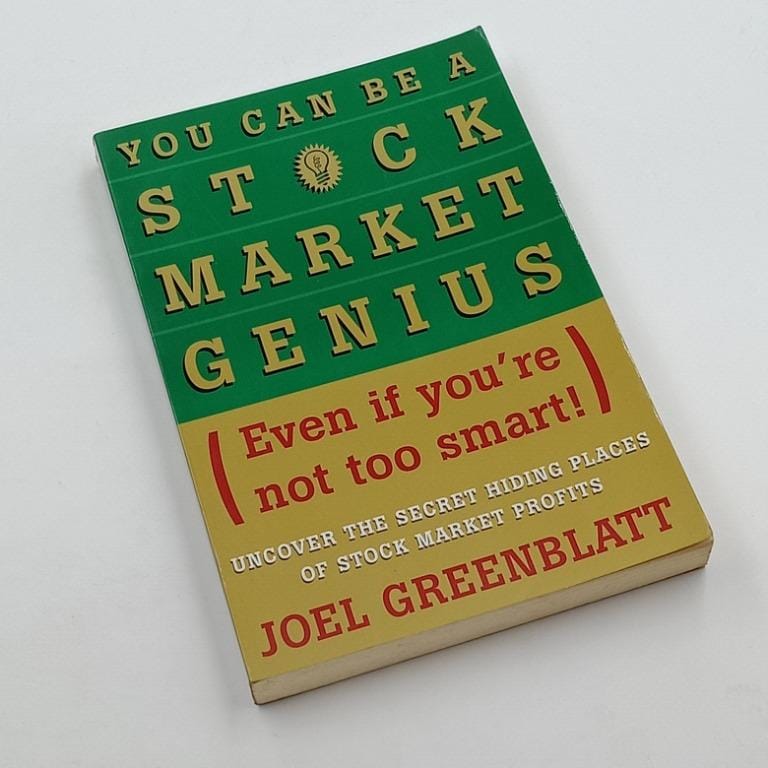

A 2012 study by Credit Suisse showed that spin-offs typically trade down about -4% vs the index in the first five days but proceed to recover over the next 30 days. And in the next 12 months, the parent / the spun-off entity outperformed the index by +10 percentage points / +13% percentage points.

A 2014 study by Deloitte and the Edge Consulting Group found that spin-offs generated a 22% return in their first 12 months of trading, outperforming MSCI World by 21% in the time period they studied.

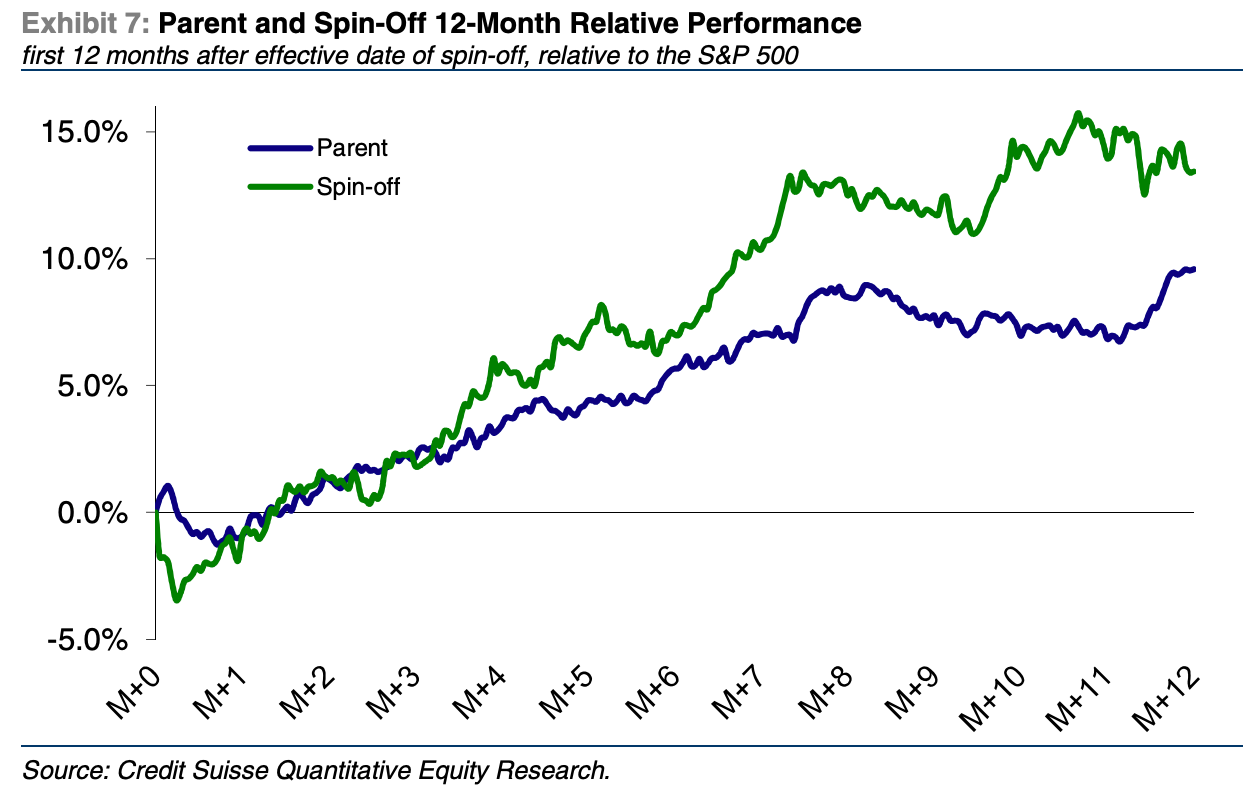

A 2015 study from JP Morgan found that during the first two years after a spin-off announcement, the combined market value of the two entities rose 16% on average, exceeding market returns by 8 percentage points.

So clearly, investing in spin-offs can be profitable, especially when forced selling has the price of the shares fall way below fair value.

Asia-Pacific spin-offs

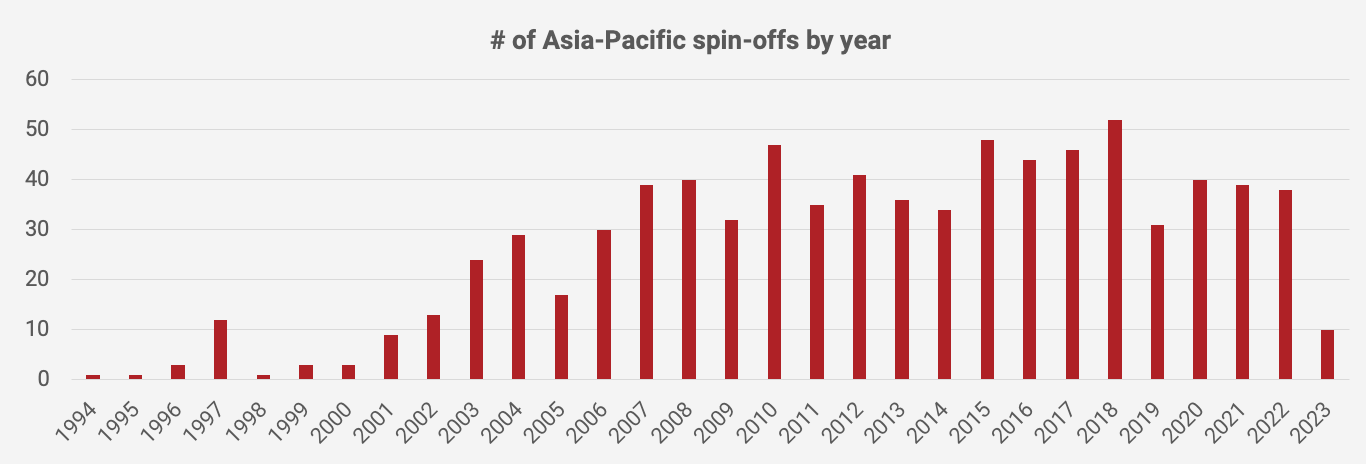

Spin-offs are rare in this part of the world. Whenever I run an Asia-Pacific spin-off screen, many of the spin-offs I identify seem to be Australian nano-cap miners. But there are exceptions.

In the 1990s, almost all spin-offs occurred in Hong Kong or Singapore, two of the more developed capital markets at the time, and both allowed for the favourable tax treatment of spin-offs. Since the early 2000s, we’ve also seen more spin-offs from India, South Korea and Australia.

The Japanese tax code didn't allow for spin-offs until 2017, with the first Japanese spin-off being karaoke bar operator Koshidaka (2157 JP - US$634 million), which I wrote about in a previous deep-dive here and has performed very well.

Most spin-offs in South Korea occur with the intent to consolidate family control. By splitting a business into a Holdco and an Opco, the largest shareholder can retain control of the board in the Opco with a much smaller investment. And since inheritance taxes are high in South Korea, such Holdco/Opco restructurings via spin-offs can help the family sell part of their shares to pay for inheritance taxes without losing control. Such restructurings are not in the best interests of minority shareholders, in my view.

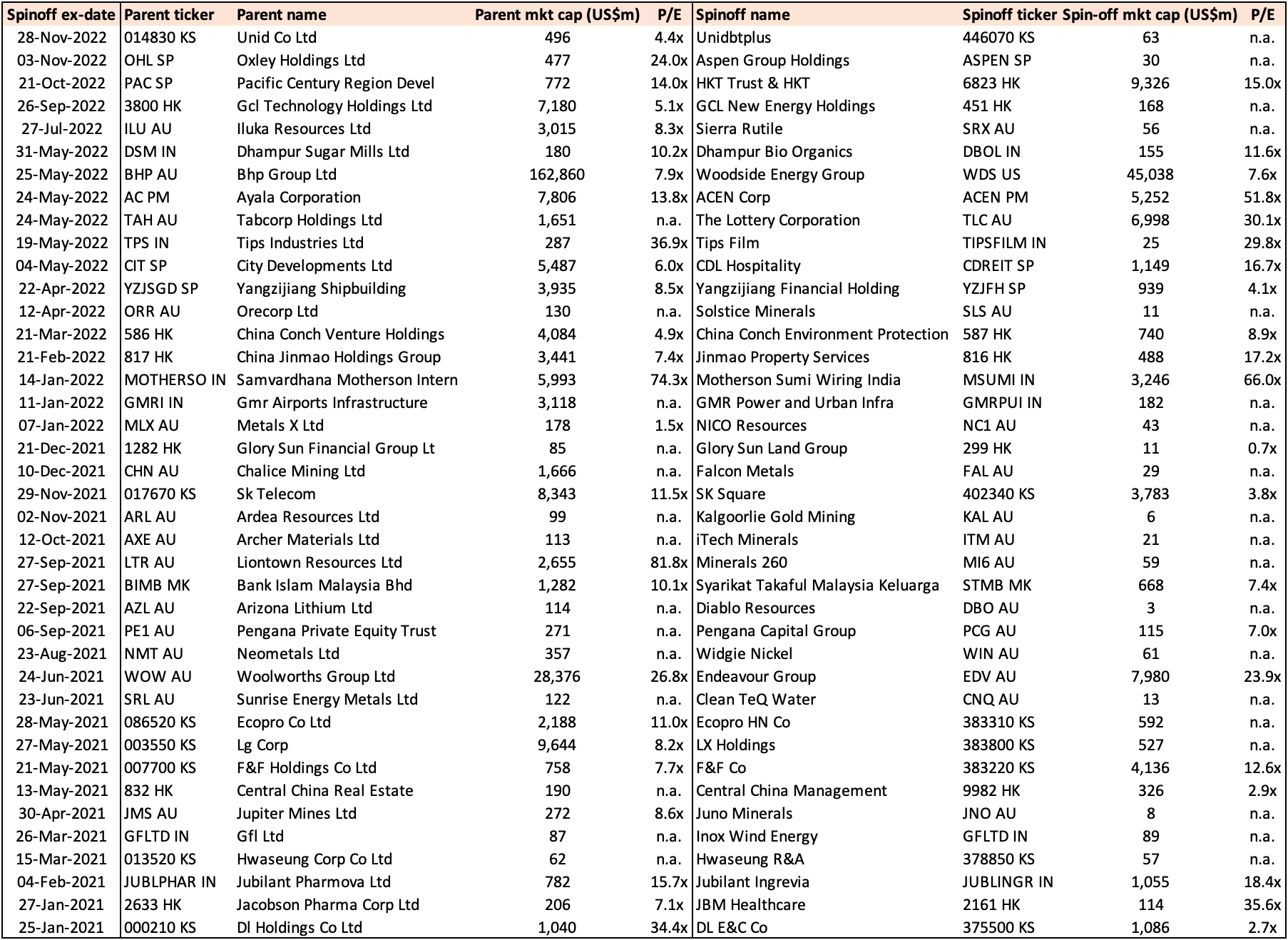

I downloaded a sample from Bloomberg of all the spin-offs that have taken place in the Asia-Pacific since early 2021. I used a parent market cap hurdle of US$50 million. That sample contains a total of 40 Asia-Pacific spin-offs.

Out of these 40 spin-offs, most of them occurred in developed markets such as Australia, South Korea, Hong Kong and Singapore, along with a few cases in India, the Philippines and Malaysia:

Here is a full table of those 40 spin-offs that have occurred since the beginning of 2021:

You can download the full list of the 40 spin-offs here:

Eight situations worth highlighting

Let’s now dig deeper into eight spin-offs that I think are worth highlighting, ranked by the highest market cap to the lowest.

1. SK Square (402340 KS)

The spin-off of SK Telecom’s (017670 KS - US$8.2 billion) ICT and semiconductor business SK Square (402340 KS - US$3.8 billion) took place in November 2021. It’s a rare case of a Korean spin-off that’s not done for the purpose of consolidating family control. The spin-off structure is detailed in the 2021 AGM document available here.

SK Square’s main asset is a 20% stake in memory semiconductor company SK Hynix (000660 KS - US$42 billion). Hynix’s technology has been inferior to Samsung Electronics but has been catching up in recent years. It now has a larger market than Micron. Other businesses now part of SK Square include security service company ADT Caps, e-commerce operator 11th Street and Korean Netflix competitor Wavve.

Former parent SK Telecom is engaged in wireless and fixed broadband telecom services and has a market cap almost twice as big as SK Square's own market cap. Since SK Square is the more attractive business of the two, I don’t believe the forced selling was particularly severe in SK Square’s case.

SK Telecom’s stated purpose of the spin-off was to highlight the value of the company’s technology investments and semiconductor business. In their own words:

“The Company seeks to receive appropriate market valuation and ultimately intends to enhance its corporate and shareholder values”

That makes sense to me - semiconductor businesses tend to be valued differently than telecom operators.

What I find fascinating is that SK Telecom’s CEO, Park Jung-Ho, joined the smaller, spun-off entity as its CEO. He must see greater potential in SK Square than in SK Telecom. And the spin-off suggests that he’s not a pure empire-builder.

SK Square is a hard stock to value. Where its mid-cycle ROE will end up is anyone’s guess. The DRAM cycle is volatile and still in a downtrend. And the valuation multiples of e-commerce companies have also come down. For what it’s worth, SK Square trades at just 4.3x trailing twelve-month earnings and 0.3x book.

SK Telecom originally acquired its 20% stake in SK Hynix for US$2.6 billion back in 2012. Today, SK Square’s stake in SK Hynix is worth US$8.4 billion, more than double SK Square’s entire enterprise value. If management were rational, it would sell its stake in SK Hynix and buy back shares in SK Square as long as the current valuation disparity exists. But you rarely see such forward-thinking capital allocation in South Korea. I’ve met SK Square’s management team, and I doubt they’ll be proactive in closing the valuation gap. But the stock is indeed very cheap at 0.3x book.

There has been insider buying in SK Square, including by Park Jung-Ho himself. But his buying has been small at just around US$60,000 in total.

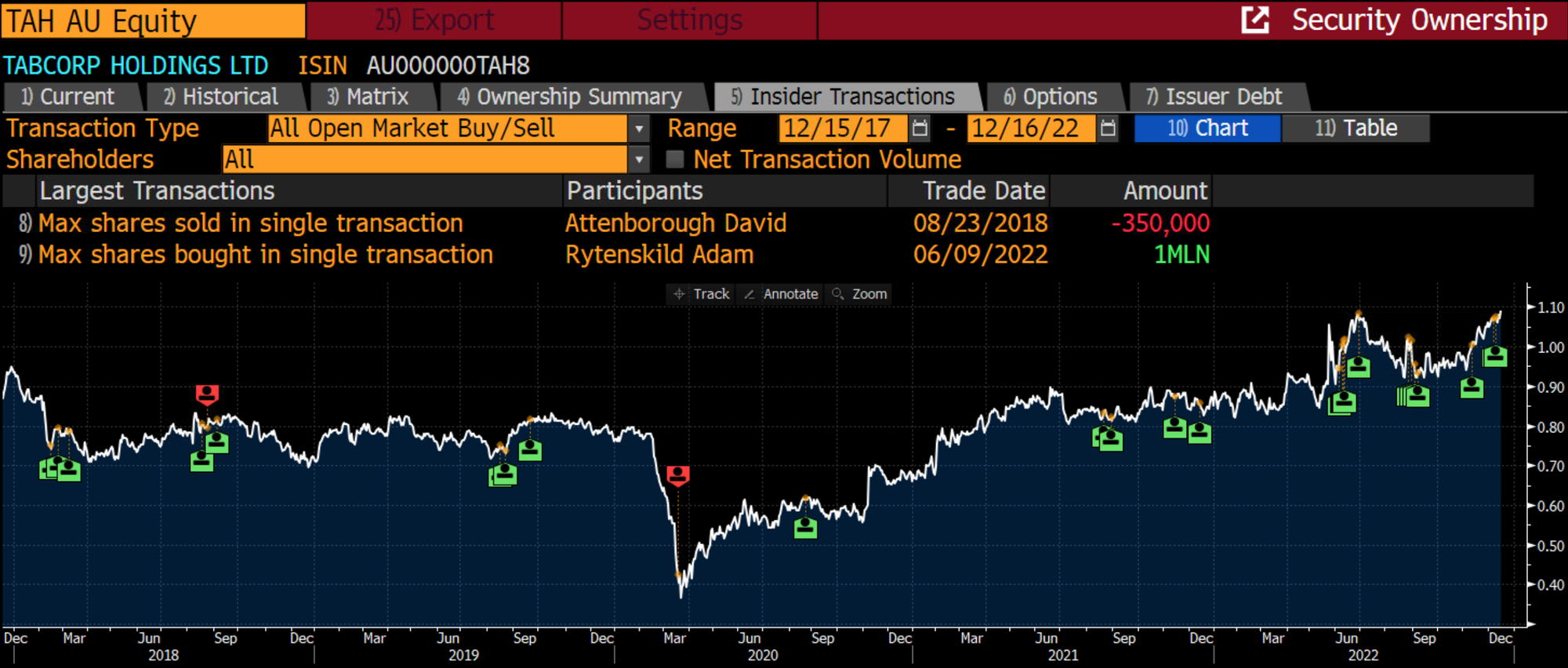

2. Tabcorp (TAH AU)

I wrote about Tabcorp (TAH AU - US$1.7 billion) in a deep-dive on 20 November 2022, available here. If you want to read the demerger presentation, it’s available here.

Tabcorp demerged from The Lottery Corporation (TLC AU - US$7.0 billion) in May 2022 and shifted practically all its debt to the lottery business. The Lottery Corporation is a great business but also trades at a very high multiple of 30x P/E.

The remaining Tabcorp entity - while hit by COVID-19 and online competition - has now become more attractive for potential suitors. It’s cheap on an EV/Sales basis at around 0.9x sales.

While Tabcorp never said so explicitly, it’s clear that the purpose of the demerger was to unlock the value hidden in the lotteries business. Such businesses tend to trade at much higher valuations than Tabcorp was trading at previously. And we indeed got a valuation uplift through the demerger.

Smart, value-focused funds like Airlie Funds Management have now shifted their attention to Tabcorp itself, which, thanks to the transfer of debt, has ended up trading at a low EV/Sales.

It’s hard to say where New Tabcorp’s margins will end up after COVID. While Australia’s COVID restrictions have eased, that’s not the only issue plaguing Tabcorp. But regulation is slowly moving in Tabcorp’s favour as well. Pre-COVID margins of 8-9% may not be impossible.

It’s also worth mentioning that Tabcorp had already received a bid of AU$4.0 billion from Apollo, way above the current market cap of AU$2.5 billion. There are regulatory hurdles, but they’re not insurmountable.

There’s been tons of insider buying in Tabcorp since the spin-off, including over a million shares by CEO Adam Rytenskild and almost a million shares by Chairman Bruce Akhurst. Those are positive signs, in my view.

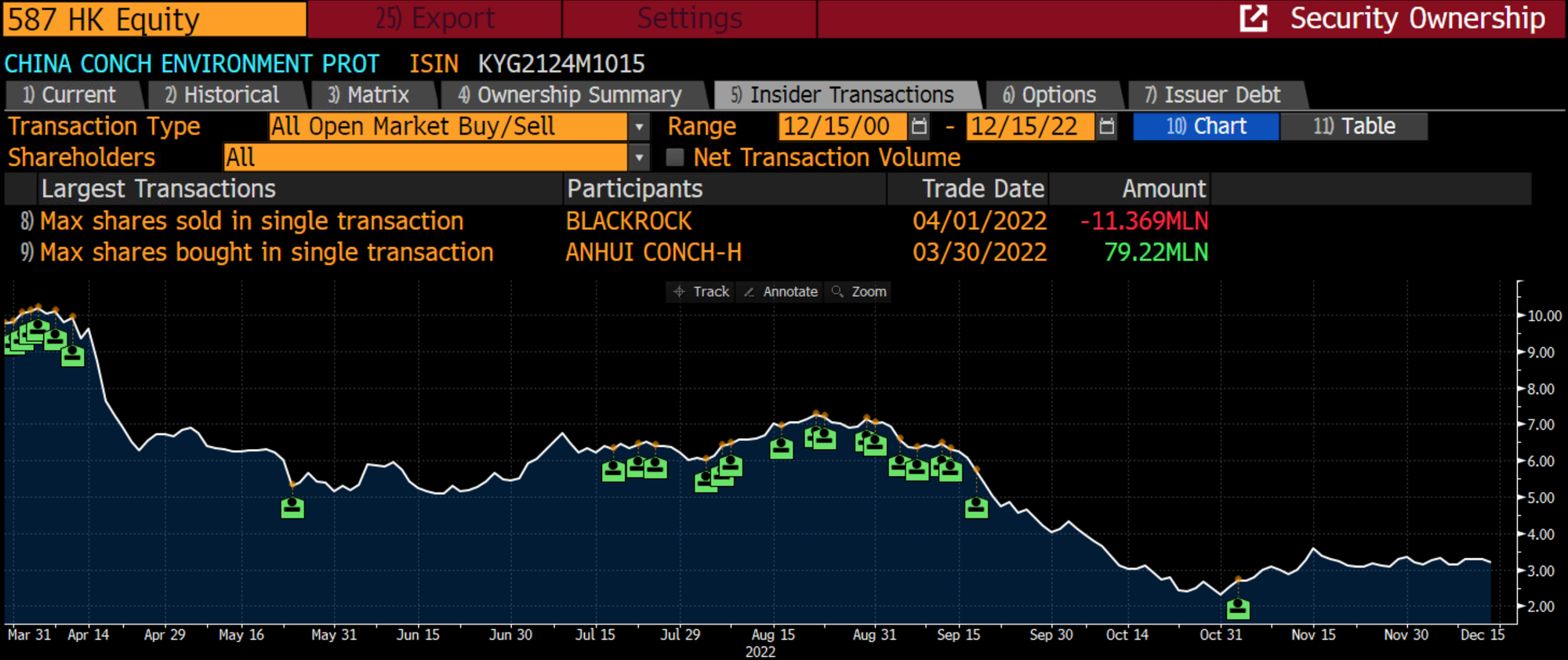

3. China Conch Environment Protection (587 HK)

China Conch Environment Protection (587 HK - US$752 million) was spun off from state-owned enterprise China Conch Ventures (586 HK - US$4.0 billion) in March 2022. Its Chinese-language website is available here. The ultimate parent of the group is cement company Anhui Conch (914 HK - US$22 billion). The company is engaged in industrial solids and hazardous waste treatment, with a large portion of revenues coming from other companies within the group.

China Conch Environment Protection’s March 2022 prospectus shows that the purpose of the spin-off is to use the listing to secure funding to support faster growth and expansion, improve corporate governance and enhance the brand value of the company. I wonder if the entity will be used to roll-up China’s waste management industry, perhaps by taking over private businesses. SOEs taking over private enterprises is a trend that has accelerated in China over the past few years.

The spin-off’s market cap of US$754 million remains much smaller than its former parent’s US$4 billion. So it’s plausible that some original shareholders sold their shares without regard for value post-distribution.

Today, China Conch Environment Protection stock trades at a forward-looking P/E of 5.1x. The company has a high debt load of about US$550 million or 5x EBIT, causing the EV/EBIT to be higher than the P/E at 7.7x.

While global waste management peers trade at much higher levels say 27x for America’s Waste Management or 36x for Australia’s Cleanaway, I’m not sure they are direct peers. China Conch Environment Protection has a return on equity of just 3.1%. And the delineation between China Conch Environment Protection and the group’s other listed entities is not obvious. But perhaps third-party revenue will grow over time.

In June, Anhui Conch proposed to acquire 16% of China Conch Environment Protection, presumably from Conch Ventures. Nothing has come out of it. Looking at the insider transactions, Conch Ventures keeps buying shares, as is Conch International Hong Kong. China Conch Environment also announced a 10% share buyback. In other words, insiders appear to see value in the stock.

4. LX Holdings (383800 KS)

LX Holdings (383800 KS - US$529 million) was formed by taking four non-electronics affiliates of LG Corp (003550 KS - US$9.6 billion) and listing them as a separate entity by distributing shares of them to LG shareholders.

Today, that entity operates the following subsidiaries:

- LX International (001120 KS - US$1.2 billion) (24.7%): A coal mining and oil palm plantation company with operations across Indonesia, China, Australia and other countries.

- LX Hausys (108670 KS - US$234 million) (33.5%): Building and interior design products

- LX Semicon (108320 KS - US$1.0 billion) (33.1%): OLED and LCD semiconductor products for displays

- LX MMA (Private) (50%): Chemicals producer focusing on methyl methacrylate

LX Holdings’ Chairman Koo Bon-Joon has sold most of his shares in LG Group, which has been left to his nephew Koo Kwang-Mo. The purpose of the spin-off was alleged to divide the family fortune among the descendants of the LG Group’s founder while avoiding serious tax consequences. Koo Kwang-Mo’s LG Group retains consumer electronics company LG Electronics, cosmetics company LG Household & Health, LG Life Sciences and telecom operator LG Uplus.

LX Holdings’ market cap of US$540 million is tiny compared to LG Group’s US$10 billion. So I imagine that there must have been significant forced selling, especially given that the price is down ~50% since the first day of trading.

LX Holding now trades at a P/B of 0.4x. The trailing twelve-month P/E ratio is 3.0x. If you take LX Holding’s cash and add the value of their stakes in listed companies plus the unlisted ones (LX MMA), I’m getting to a number close to the book value. For reference, LG Corp also trades at a low P/B of just 0.5x.

In September and October, there was a large insider buying by Koo Bon-Joon’s son Gu Hyung-Mo, who now acts as the new Vice President of LX Holding and owns 12% of the company. He must have seen value in the stock at around the KRW 8,000/share mark.

5. Jinmao Property Services (816 HK)

Jinmao Property Services (816 HK - US$488 million) is a spin-off from state-owned Chinese property developer China Jinmao Holdings (817 HK - US$3.2 billion). The ultimate parent of Jinmao is the Chinese state chemicals company Sinochem. That makes Jinmao Property Services an SOE. The spin-off took place in February 2022, together with an issue of new shares, with the prospectus available here.

The purpose of the spin-off and offering seems to have been to raise funding for acquisitions as well as for reinvesting in the business.

Property management companies provide basic services to already-built apartment complexes, including security, cleaning, repairs, receiving e-commerce packages, etc. They look like commodity services to me. But what’s great about them is that it’s challenging for residents to switch away from an apartment complex’s existing property manager. They’re usually stuck with whoever managed the property when they moved in. That means that property management companies’ cash flows tend to be sticky.

The major risk involved with these property management companies is usually that they funnel cash to related parties. We’ve seen that happen a few times, at least in privately-owned property management companies. There’s a risk that property developers use their property management companies to finance their property development arms.

Former parent and property developer China Jinmao Holdings is a much larger company than Jinmao Property Services, with a market cap 6x greater. On the other hand, many investors consider the asset-light business models of property management companies to be more attractive than those of property developers. So I’m not sure if the average investor chose to sell the shares they received in Jinmao Property Services.

Today, the stock’s forward-looking P/E is 6.7x, with a dividend yield of 4.0%. Yearly free cash flows are roughly US$60 million per year, compared to an enterprise value of US$313 million. That’s remarkable, given that the Chinese state controls the company and that cash flows therefore should be safe from expropriation. Jinmao has been spared from the crackdown that’s occurred among private property developers in China, and that gives me some comfort.

On the other hand, there’s been no insider buying in Jinmao Property Services since the spin-off.

6. Central China Management (9982 HK)

Central China Management (9982 HK - US$321 million) is the property management spin-off from Henan property developer Central China Real Estate (also known as “CCRE”) (832 HK - US$190 million). The company was spun off back in May 2021 and also raised capital in conjunction with the spin-off.

Central China Real Estate (CCRE) used to be a private developer, but the Chairman’s stake was taken over by the Henan Provincial Government in mid-2022. He still owns part of the convertible bond. But now that CCRE has become an SOE, you’d think that they’d honour their contracts and are at less at risk of bankruptcy.

The property management subsidiary’s market cap of US$317 million was small in relation to CCRE’s previous market cap (before the latest slump) of around US$2 billion. So forced selling might have been part of the picture, in my view.

Today, Central China Management’s stock trades at a P/E of 3.7x, with net cash approximately equal to the market cap, which means that the enterprise value is approximately zero.

There’s been massive insider buying since the spin-off by Chairman Wu Po Sum (also known as Hua Jianming) and board member Wu Wallis (also known as Li Hua). They must be seeing value in the shares.

7. Sierra Rutile (SRX AU)

Sierra Rutile (SRX AU - US$56 million) is an Australian mining company focused on mining for rutile in Sierra Leone, Africa. It’s the world’s largest natural rutile producer, with 541kt of rutile ore reserve and yearly rutile production of 144kt. The company was spun off from Iluka Resources (ILU AU - US$2.8 billion) in July 2022. You can find the demerger presentation here. Former parent Iluka focuses on the mining of zircon and ilmenite in Australia.

What is rutile? So, rutile is a mineral composed of titanium dioxide (TiO2), a pigment used in paints, plastics, paper, foods and other applications that require bright white colours. The titanium dioxide pigment is the single greatest use of titanium worldwide. Other applications for titanium dioxide include metals for aircraft frames and welding for steel fabrication of shipbuilding. Some of Sierra Rutile’s key customers include Chemours, Kronos, Tronox and Venator.

The purpose of the spin-off was to allow parent Iluka Resources to focus on its Australian operations and allow it to diversify into rare earths. Sierra Rutile, on the other hand, focuses on the Sembehun Project in Sierra Leone.

CEO of Sierra Rutile Theuns de Bruyn joined the company in 2019 as COO and CEO since January 2021. In other words, the management team was in place even before the demerger. He’s based in Sierra Leone.

Sierra Rutile is a US$55 million market cap company, much lower than Iluka Resources’ US$3.0 billion market cap. So, in this case, it’s highly likely that the spin-off was subject to forced selling pressure.

The company experienced weak operational performance during COVID-19 in 2020 and 2021. But production has since recovered. In early 2022, the company enjoyed sales proceeds of US$1,459/tonne of rutile against a cost per tonne of US$893, for a profit per tonne of US$566. With yearly rutile production of 144kt, the company earns gross profits of around US$82 million. EBITDA pre-COVID was about US$43 million.

Sierra Rutile has a net cash position of US$36 million with no debt in addition to an AU$63 million balance in the Sierra Rutile Rehabilitation Trust. Excluding the rehabilitation trust, that gives you an enterprise value of around US$20 million, about 0.5x EBITDA.

The problem is that the company is planning to spend US$284 million in capex for the phase 1 development of the Sembehun - the largest and highest-grade natural rutile deposits in the world. Phase 1 commissioning will take place in 2025. Such a greenfield project carries risk and requires mining expertise to assess. I don’t have such expertise.

But I still sense there is an opportunity here. Sierra Rutile has over 2,000 employees. With an enterprise value of just US$20 million, that gives you an EV/employee ratio of US$10k per head. I’ve never seen such a low ratio in my entire career. And while I’m not familiar with the rutile industry - or Sierra Leone, for that matter - owning the highest-quality ore body in the world has to increase the chances of success.

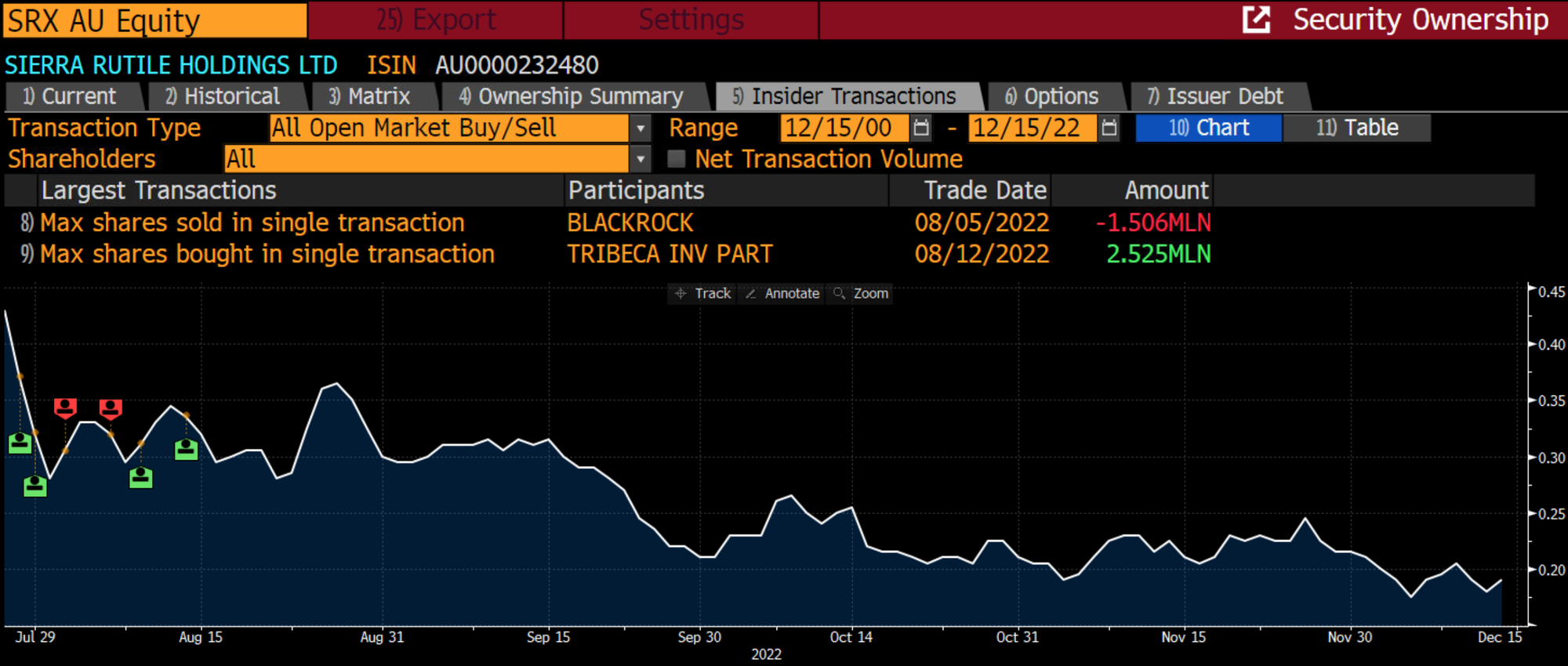

Blackrock has been selling its shares in Sierra Rutile, while finance director Martin Alciaturi bought 100,000 shares recently. Sydney-based wealth management firm Tribeca Investment Partners bought 5 million shares a few months ago, possibly on behalf of somebody else.

8. Juno Minerals (JNO AU)

And lastly, we have a nano-cap with a near-term catalyst. Juno Minerals (JNO AU - US$8.3 million) is an Australian iron ore miner spun off from manganese miner Jupiter Mines (JMS AU - US$283 million) back in May 2021. Juno raised new capital as well in conjunction with the spin-off at a price of AU$0.25/share. A June 2022 investor presentation is available here, and the prospectus here.

Former parent Jupiter Mines is a much larger operation with a market cap of US$283 million vs Juno Mineral’s current US$8 million. It’s therefore likely that we’ve seen significant selling pressure in the company’s initial year of trading.

CEO Greg Durack was previously CEO of much-larger Jupiter Mines and was responsible for two feasibility studies on its key Mount Mason resource. He is originally a chemist but spent 38 years in the mining industry. When the company was listed, 400,000 shares were issued to Greg Durack, and he’s also entitled to 2.4 million stock options. Note that Juno Mineral has 136 million shares outstanding. His salary is AU$250,000 per year - probably fair, in my view.

Juno Mineral owns an iron ore hematite deposit at Mount Mason, which it plans to bring into operation by mid-2023. All statutory approvals have been granted. It also owns a magnetite project called Mount Ida in the same region close to Kalgoorlie, which will be progressed once Mount Mason has started production.

The purpose of the spin-off was to raise funding for the Mount Mason iron ore project. That raises the question of whether they’ll raise more capital to fund the Mount Ida project later on. There are no indications that such a capital raise will take place yet.

Juno Mineral’s book value is currently AU$32 million, almost 3x the current market cap of AU$12 million. They have already spent AU$50 million on the Mount Mason project. In the investor presentation, management claims that the stock is valued significantly below its Australian magnetite peers, although I’m not sure how they measure this.

London-based hedge fund Tiger Hill Global run by Yilun Chen has been scooping up shares in Juno Minerals ever since the listing last year. He’s not an ACS subscriber, but I can pass along his contact details.

The stock is extremely illiquid, with only tens of thousands of shares bought and sold daily. So you’ll probably need to approach a broker to be able to buy a sizeable stake.

Conclusion

I think that spin-offs can lead to value dislocations. They’re rare in the Asia-Pacific region, but I’ll continue to monitor the area.

I will revisit SK Square once I get more comfortable with the DRAM cycle. Buying a DRAM proxy at 0.3x book seems like a way to get more juice out of a coming DRAM up-cycle if such an up-cycle ever materialises.

There’s a good chance that Tabcorp will ultimately get acquired or at least trade closer to its global gaming peers. I don’t love the business though, given the threat from online/mobile app gambling.

LX Holdings seems even cheaper than LG Corp, which I know some ACS subscribers are involved with. Both trade at low P/B. I’d like to find out which of the two companies has a better management team before committing any money myself.

China Conch Environment Protection seems like a story stock with weak corporate governance. The return on equity is low. Insider buying is encouraging, and the multiple isn’t particularly high.

The two Chinese property management companies Jinmao Property Services and Central China Management seem cheap. It wasn’t long ago that investors were in love with property management companies. Out of the two, Jinmao seems safer, given its connection to the state-owned enterprise Sinochem.

Sierra Rutile seems like a high-risk situation at a low valuation multiple. Upcoming capex seems high, even considering the company’s strong cash flows. I will try to get a second opinion from someone more experienced in the African mining sector.

Juno Minerals trades at a low P/B with a production catalyst just six months away. Liquidity is a key constraint here.