Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I hold a position in Delfi when publishing this article. Note that this is a disclosure and not a recommendation to buy or sell.

Summary

- Delfi is the leading chocolate producer in Indonesia, with an estimated market share of 45%. It owns brand names such as Delfi, SilverQueen, Ceres, and ChaCha and the rights to the Van Houten brand name in Southeast Asia.

- Indonesia is one of the fastest-growing chocolate markets in the world. Its growth is projected to remain high in the single digits for the foreseeable future.

- The company’s earnings rebounded strongly after Indonesia’s COVID-19 social distancing restrictions. But more recently, margins have compressed for reasons that are not completely clear. There’s talk of competition and a need for higher promotional spending.

- The big elephant in the room is the 2023 spike in cocoa prices. Delfi hedges 9-12 months forward, but higher prices may eventually hit the bottom line.

- On my numbers, Delfi trades at a 2026e P/E of 8.8x with a projected 6.3% dividend yield.

Table of contents:

1. Quick recap

2. Update since my first write-up

2.1. Delfi’s post-COVID recovery

2.2. New products

2.3. Alt-data update

2.4. Insider buying

2.5. New analyst coverage

3. What will change for Delfi?

3.1. Cocoa prices

3.2. Underlying chocolate demand

3.3. Capital expenditures

3.4. Ozempic

3.5. Succession planning

3.6. Potential buy-out?

4. Valuation multiples

5. Conclusion1. Quick recap

My initial report on Indonesian chocolate producer Delfi (DELFI SP - US$416 million) was published in April 2021. You can find the full report here:

My 2021 Q&A with Delfi’s investor relations team can be found here.

In my original report on Delfi, I noted the following:

- Delfi is Indonesia’s leading chocolate company, with an estimated market share of 45%. It owns several brand names, such as SilverQueen, Ceres, Delfi, Goya, and Van Houten (Southeast Asia and Oceania only). Delfi also distributes a variety of consumer products in Malaysia in what is known as its “agency” business for companies such as Toblerone, Kellogg’s, etc.

- The company sells its chocolates across Indonesia through a distribution system with access to 400,000 points of sale. Since Indonesia is a tropical country, the products are designed to withstand extreme heat and the lack of proper cold-chain logistics.

- There was room for growth. Indonesia’s chocolate consumption per capita is only 1/4 of Japan's and 1/15 of the United States. The population grew almost 1% per year, with an average age of 30.

- Delfi was and continues to be run by three brothers in the Chuang family, who have controlled Delfi for over half a century. They’ve paid generous dividends over the past few decades with a dividend payout ratio of 60%. It has a fortress balance sheet with a large net cash position.

- At the time of writing, Delfi’s share price had dropped significantly. One of the reasons was the significant depreciation in the Indonesian Rupiah from 2013 to 2015. Another reason was a reduced number of SKUs from 2015 onwards as the company adjusted to a world with modern grocery stores holding fewer product varieties. Delfi also opened a massive new factory in 2016, significantly increasing the cost base. Finally, Delfi was hurt by COVID-19 as certain mom-and-pop stores had to close down. Other buyers were cautious in buying inventory that might expire within 12 months.

- Delfi’s forward P/E multiple at the time was only 12x, about half of the level of its global peers. And CEO John Chuang had been buying shares in the company, suggesting faith in the business.

- In my initial report, I noted that industry acquisitions had typically taken place at P/E multiples of 20x to 30x. Delfi seemed to be open to a takeover. Given that John Chuang’s children were not involved in senior positions and he was in his mid-70s, a tie-up with a multinational could eventually make sense for Delfi.

2. Update since my first write-up

2.1. Delfi’s post-COVID recovery

Since my initial report on Delfi in April 2021, the share price rallied to a peak of SG$1.44 as the company recovered from COVID-19. More recently, the share price has dropped to around SG$0.90, which I think is related to the headwind of sharply rising cocoa prices.

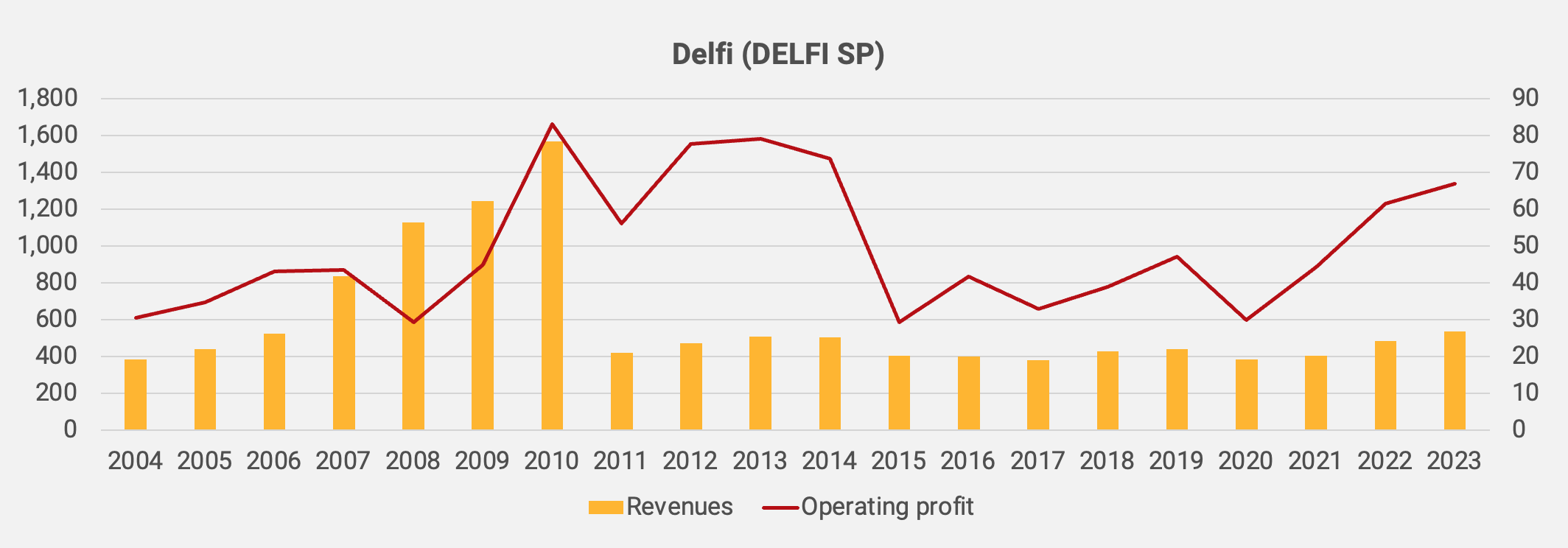

Delfi’s performance over the past few years has been excellent. Revenues are now 22% above the pre-COVID level, even in US Dollar terms, Delfi’s reporting currency. You can tell from the following chart that operating profit (red line) has also rebounded strongly since 2021. Delfi has been growing nicely.

If you’re wondering why revenues dropped in 2011, Delfi divested its cocoa ingredient business to Switzerland’s Barry Callebaut in that year. But adjusting for this revenue drop, Delfi has performed satisfactorily, especially since 2018.

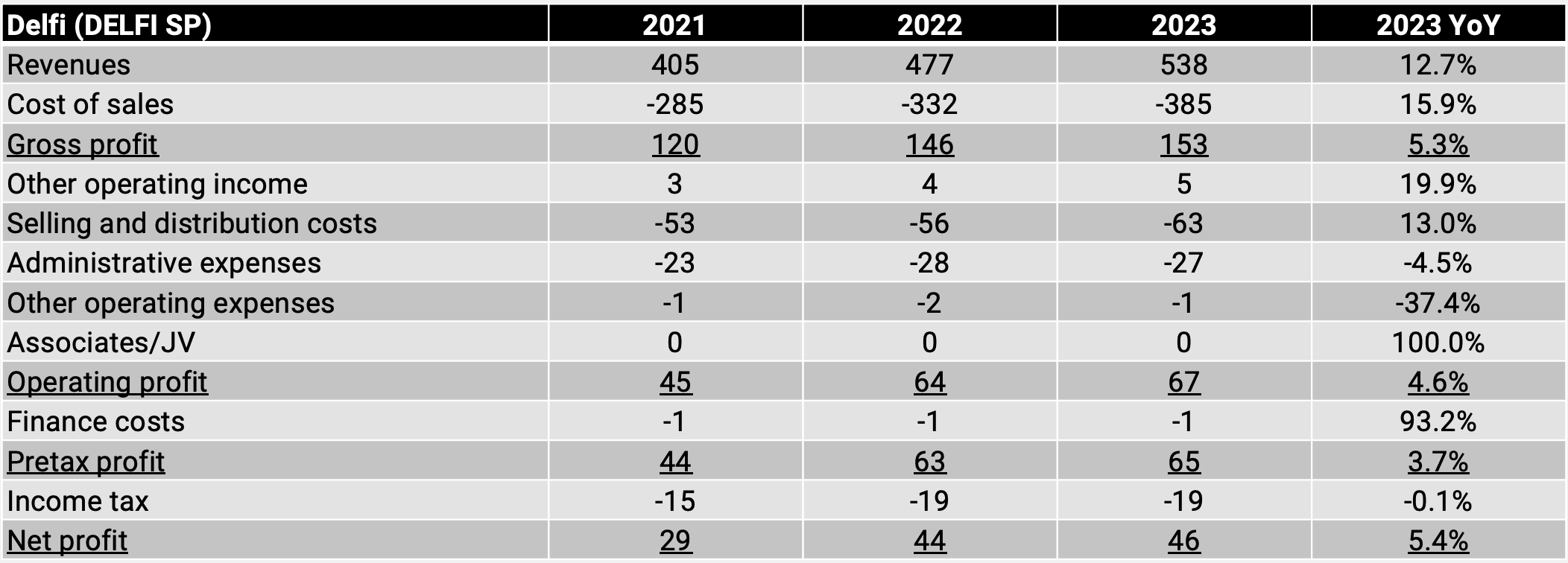

Here is Delfi’s income statement, showing how the business has grown over the past few years:

As you can tell, revenues have grown nicely, most recently at +12.7% year-on-year. Delfi’s strong revenue growth was mostly due to the opening of Indonesia’s economy after heavy social distancing restrictions during COVID-19. Delfi’s premium brands, including its Van Houten-branded chocolate bars, are doing well.

But the gross profit margin fell further, from 30.5% in 2022 to 28.5% in 2023:

The gross profit margin dropped in 2019 due to the adoption of a new accounting standard where trade promotions are now counted as part of net sales. If you adjust the margin for the shift in the account of trade promotions, the 2018 level would have been 29%.

Delfi explained the recent margin compression by stating that it had to spend more on marketing to address heightened competition and to push new product launches:

“These declines can be attributed to higher marketing expenses, partly to address heightened competition in Indonesia, and to fund more brand building initiatives.”

In 2018, Delfi acquired a regional license for the Van Houten brand for US$13 million, allowing it to market chocolates in certain key markets in Asia and Oceania with the Van Houten brand name. Van Houten is an old European chocolate brand now owned by the Barry Callebaut group in Switzerland. Delfi has been pushing this brand, as long as its other premium chocolate varieties, through its distribution channels, partly through greater trade promotions.

But also note that Delfi’s inventory balance almost doubled in 2022, with company-wide inventory days going from 83 to 126. Since cost of goods sold is calculated by deducting end-of-year inventory, it’s possible that an overvaluation of inventory in December 2022 caused Delfi’s gross profit margins to go up in 2022 and then down 2023.

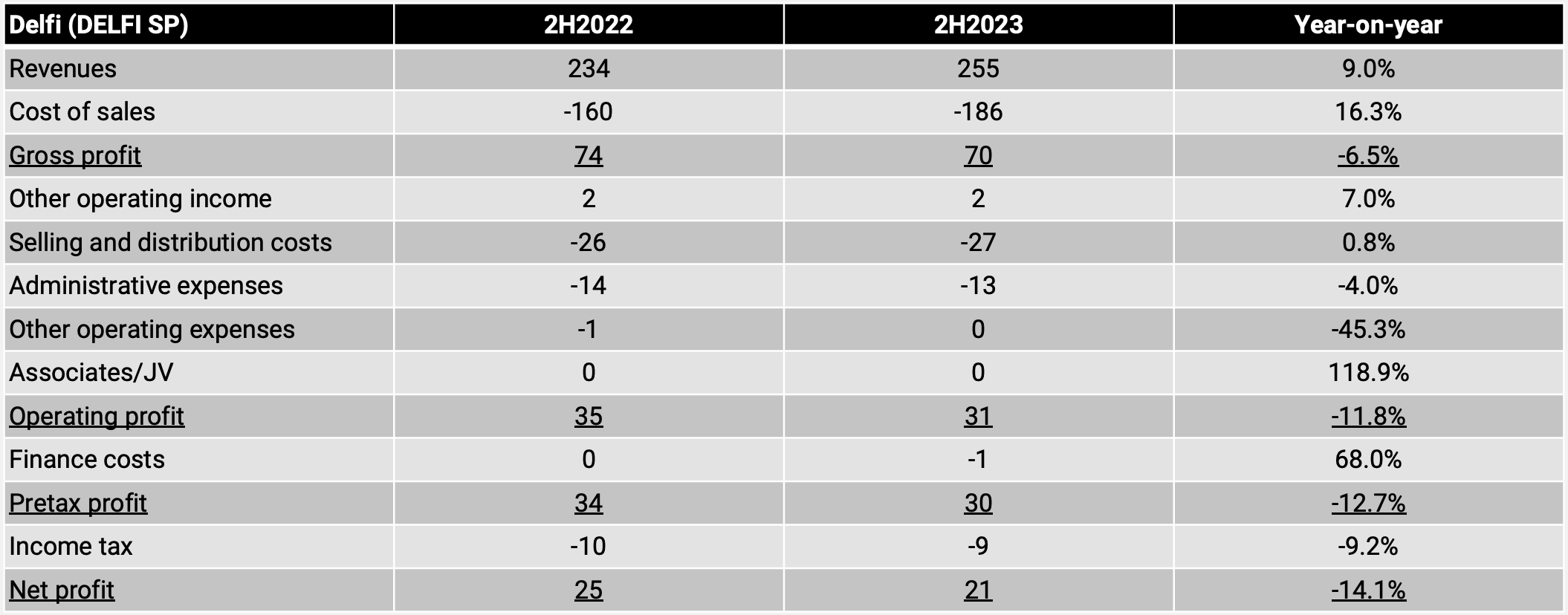

The 2023 results also mask incremental weakness in Delfi’s margins towards the end of the year. In the second half of 2022, revenue growth decelerated to just +9.0% year-on-year, while Delfi’s net profit dropped -14.1% year-on-year:

The gross profit margin weakened further to 27.3% in the second half of 2023, and again, this seems to be due to competition and investments in new brands.

The big elephant in the room is cocoa prices. They’ve gone up significantly since late 2022. Delfi is downplaying the issue but it’s clear to me that cocoa must become a challenge to the company at some point, if it hasn’t already.

2.2. New products

Delfi’s product innovation continues to impress me. They’re heading in the right direction, in my view.

For example, in 2021, Delfi launched the Van Houten Dark Milk variants with more cocoa and less sugar. While people in the region typically do not like dark chocolate, its popularity is growing. The new varieties include dark milk chocolate, dark milk almond, dark milk hazelnuts, 52% cocoa almonds and dark milk fruit & nut. I’ve tried these and will continue to buy them.

On the SilverQueen side, Delfi launched two new flavors in 2021: Very Berry and Matcha Green Tea. These are yoghurt chocolate products with cashew nuts inside. These two new flavors were also launched under the Goya brand name in the Philippines.

Goya also launched two other flavors: Black Cookie Crunch and Winter Chill:

For Delfi’s M&M style chocolate product ChaCha, Delfi launched several collaborations with Mickey Mouse, Frozen, Toy Story and Tsum Tsum to drive sales:

In 2022, Delfi created an entirely new brand called 7+, a cereal brand catering to consumers searching for healthier snacking options:

In 2023, Delfi’s JV with Orion launched the O’Rice snacking product and has expressed a positive view on it. These are rice crackers, which remind me of what Want Want is selling in China.

And finally, in late 2023, Delfi launched a vegan version of Van Houten chocolate with no dairy, eggs or honey. The flavors on offer include coconut almond, salted caramel and finally, almond & berries:

To be honest, I think that very few of these products will become successes. Delfi’s growth is primarily driven by SilverQueen, which has become a hit product. And the Van Houten brand certainly has potential. But in any case, it’s great to see that Delfi continues to innovate.

2.3. Alt-data update

The number of Google search queries for the key SilverQueen brand rose nicely throughout 2022 and 2023. The spike during Valentine’s Day in February 2024 was much lower than in prior years, and I’m not sure why.

There’s been talk about competitors spending more on advertising and promotion, but as far as I can tell Mayora Indah is mostly focused on wafers and cookies with Mayora Indah’s Beng Beng chocolate product not visibly taking market share.

2.3. Frequent personnel changes

In mid-2022, I noticed that Delfi advertised for a larger number of job positions at its Bandung factory than before, including project engineers and maintenance personnel. At the time, I speculated that a recovery in production volumes might be taking place.

There’s also been a shake-up in the board and among senior executives:

- In early 2022, Tan Chay Kee was promoted to become the new Chief Operating Officer for Delfi. He was previously the Group Financial Controller for Delfi’s predecessor, Petra Foods, from 2003 to 2009, then worked at other companies before coming back to Delfi in 2022.

- Delfi’s group head of engineering and projects, Michael Roberts Wynne, stepped down in 2022. He had led the COVID-19 task force in the prior few years. It seems like his resignation was due to personal reasons rather than any dispute with Delfi’s senior management team, as we wanted to move back to Europe after 20 years in Asia.

- In late 2022, Graham Nicholas Lee became an independent director. He’s an accountant with four decades of experience and is originally from Australia.

- In 2023, independent directors Mike Dean and Koh Poh Tiong resigned from the board without any immediate replacement. Later, in 2023, Lee Meng Tat was instead appointed as an independent director after having served as the head of non-alcoholic beverages at Fraser & Neave.

Some investors expressed concern about this high management turnover. But I think this reflects that the Chuang family runs Delfi, and they have high expectations of their staff. Since I believe in John Chuang, I’m not particularly worried about this turnover.

2.4. Insider buying

In January 2023, the controlling shareholder “Berlian” - owned by the Chuang brothers - had acquired an additional 2.4 million shares, increasing their position to 52.4%. At the time, the share price was hovering around the SG$0.80 level, suggesting a decent entry price. You can find the related SGX disclosure here.

2.5. New analyst coverage

In 2023, we saw several brokers initiating coverage of Delfi:

- In February 2023, Lim & Tan initiated coverage, commenting that the valuation multiple was “undemanding” and that it was generous in its dividend payouts. Further, it noted that Delfi had an extensive distribution network and a first-mover advantage in a market with significant growth potential.

- Also, in February 2023, UOB Kay Hian initiated coverage and valued the stock at a 17x P/E in line with its long-term average level. UOB noted Delfi’s high recent growth and generous dividends.

- In October 2023, RHB’s analyst Alfie Yeo initiated coverage, calling it a “strong Indonesian consumer play” and saying that it could eventually become a takeover target.

I don’t pay much attention to sell-side analysts, but I find it interesting that there’s been a pick-up in interest in the stock. The weak analyst coverage of Delfi has been a key differentiating factor between itself and Jakarta-listed competitor Mayora Indah. Perhaps the sell-side is finally starting to pay attention to the company.

3. What will change for Delfi?

3.1. Cocoa prices

The big elephant in the room for Delfi is the sudden spike in cocoa prices from late 2022 onwards, rising from US$2,400/ton to now over US$7,000. I sense speculative euphoria, with industry analysts now predicting prices going above US$10,000.