Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I hold a position in Delfi at the time of publishing this article. To reiterate, this post and the presentation below are for informational and educational purposes only — not a recommendation to buy or sell shares.

A quick background

I've written about Indonesian chocolate producer Delfi (DELFI SP – US$384 million) many times.

In fact, Delfi was one of the first companies I covered back in 2021:

What drew me to Delfi is that it dominates its home market of Indonesia, where chocolate consumption is still low and has room to grow.

The company owns several brand names, including SilverQueen, Ceres, Delfi, Goya and Van Houten. The first three are almost seen as national brands within Indonesia, having been around for well over 50 years.

Delfi's best-selling chocolate bar is "SilverQueen". The most popular version is made with milk chocolate and cashew nuts. But there are several more recent variants, including fruits & nuts, matcha tea, dark chocolate and white chocolate.

Delfi's second-most popular product is called "Ceres" — a type of chocolate sprinkles used on bread. The practice of eating bread with chocolate sprinkles was borrowed from Holland since the days of the Dutch East India Company. And in Indonesia, Ceres is the most well-known of any chocolate sprinkles brand:

Since the 1980s, Delfi has also sold "Delfi" branded chocolate bars, featuring a skier going down a slope. The chocolate has a stronger, more European taste. These cost roughly the same as SilverQueen chocolate bars, at least on a price-per-gram basis:

Delfi also has a chocolate button product called "Cha Cha", which looks suspiciously similar to Mars Inc.'s M&Ms:

In Indonesia and Singapore, Delfi sells premium "Van Houten"-branded chocolate. Delfi acquired the Southeast Asian rights to the Van Houten brand in 2018. This chocolate sits at a higher price point than SilverQueen, though still much cheaper than European premium brands like Lindt:

In the Philippines, Delfi sells chocolate under the "Goya" and "Knick Knack" brand names. These brands were acquired from Nestlé back in 2006.

In addition, Delfi also acts as a Malaysian and Indonesian distributor for brands such as Kellogg's, Toblerone, Pringles, Guylian, etc. This is what it refers to as its "agency" business, which is low-margin but cash flow positive. Delfi's agency business accounts for 44% of revenues but — given the low margins — represents only a fraction of operating profits.

Back in 2021, I purchased all the Delfi chocolate products I could get my hands on, and compared the taste to competitor Mayora Indah's products:

Delfi used to have a 45% market share in Indonesia – an impressive number. However, according to Euromonitor data from 2024, its market share appears to have declined to 38%.

Competitor Mayora Indah now holds a 35% share through the chewy chocolate toffee product Beng Beng and the chocolate paste product Choki Choki. Both of these products are low-priced and popular with children.

I think Delfi's competitive advantage is having access to over 400,000 points of sale across Indonesia. Nationwide distribution is rare and a valuable asset. Indonesia has over 17,000 islands, the infrastructure is poor, and the temperatures are hot and humid. Cold chain logistics are needed to prevent chocolate from melting.

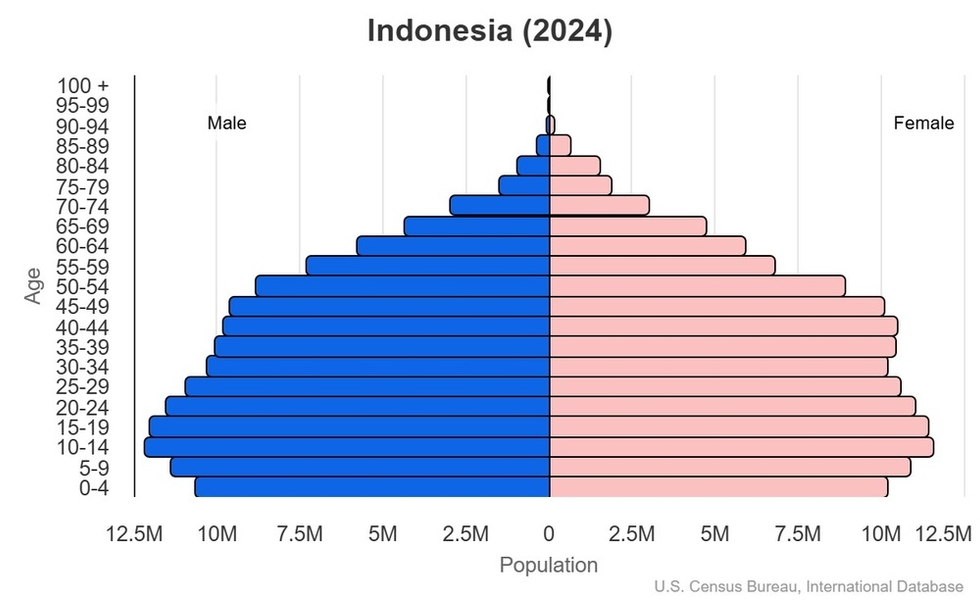

The per-capita chocolate consumption in Indonesia remains very low. Only about 20-25% of that in Singapore and Japan. And Indonesia's population is growing more than 1% per year, so there are underlying tailwinds that should boost growth over the long run. Delfi itself has guided for high single-digit growth:

Delfi and its predecessor, Petra Foods, have been with the Chuang family since the 1940s. Today, three brothers are running the day-to-day operations, including CEO John Chuang, who's based in Singapore.

Investor communication hasn't always been perfect, but Delfi has been good to minority shareholders. It's paid out 60% of earnings as dividends, on top of special dividends following the sale of its cocoa processing unit to Barry Callebaut in 2013.

When I first dug into the story, growth had slowed down significantly from the heydays of the early 2010s. And the share price had declined by over 80%.

Why? Well:

- One reason was the rapid weakening of the Indonesian Rupiah against the US Dollar. Delfi's costs were mostly in US Dollars, and it was unable to raise prices commensurately. Meanwhile, Delfi traded in Singapore Dollars and used the US Dollar as a reporting currency. So growth looked weak on a foreign currency basis.

- Another reason was that Delfi reduced its stock-keeping units from about 500 to less than 300. Management felt they had to go this route due to a shift towards modern trade. Minimarts and supermarkets tend to focus on fewer products but in greater quantities. And I think Delfi's historical distribution advantage might have diminished somewhat over the years.

But at the end of the day, Delfi's brands are well-known, and its market position is strong. And I still think that the long-term case for Indonesian chocolate consumption remains promising. It's only a question of whether Delfi will be able to compete with Mayora and the multinational chocolate companies that are now eyeing the Indonesian market as a source of future growth.

An update to my original post

Delfi's share price showed up after the depths of the pandemic between 2020 and 2022. But it's now come back again, more recently trading at SG$0.86 per share: