Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Astra International when publishing this article. Note that this is a disclosure and not a recommendation to buy or sell.

In less than a year, Indonesia has transformed from one of the hottest stock markets in Asia into a relative pariah.

One company that’s suffered recently is the Indonesian automotive conglomerate Astra International. It has a 56% market share and is widely regarded as one of the best-managed companies in Indonesia. From this perspective, it’s surprising that the stock trades at just 6.1x P/E.

I’ve written about Astra’s parent, Jardine Cycle & Carriage, in the past. But this time, I want to revisit the story from the perspective of Astra to understand why the company has become out of favor. And to explore what might change over the next few years.

Table of contents:

1. Quick recap

2. Update since my first write-up

2.1. Financials

2.2. The post-2021 auto sales recovery

2.3. A boom and bust in heavy equipment sales

2.4. A series of acquisitions

3. What will change for Astra?

3.1. Cautious guidance

3.2. Interest rate declines

3.4. Electrification of vehicles

3.5. Indian and Chinese demand for coal is rising

4. Valuation multiples

5. Conclusion1. Quick recap

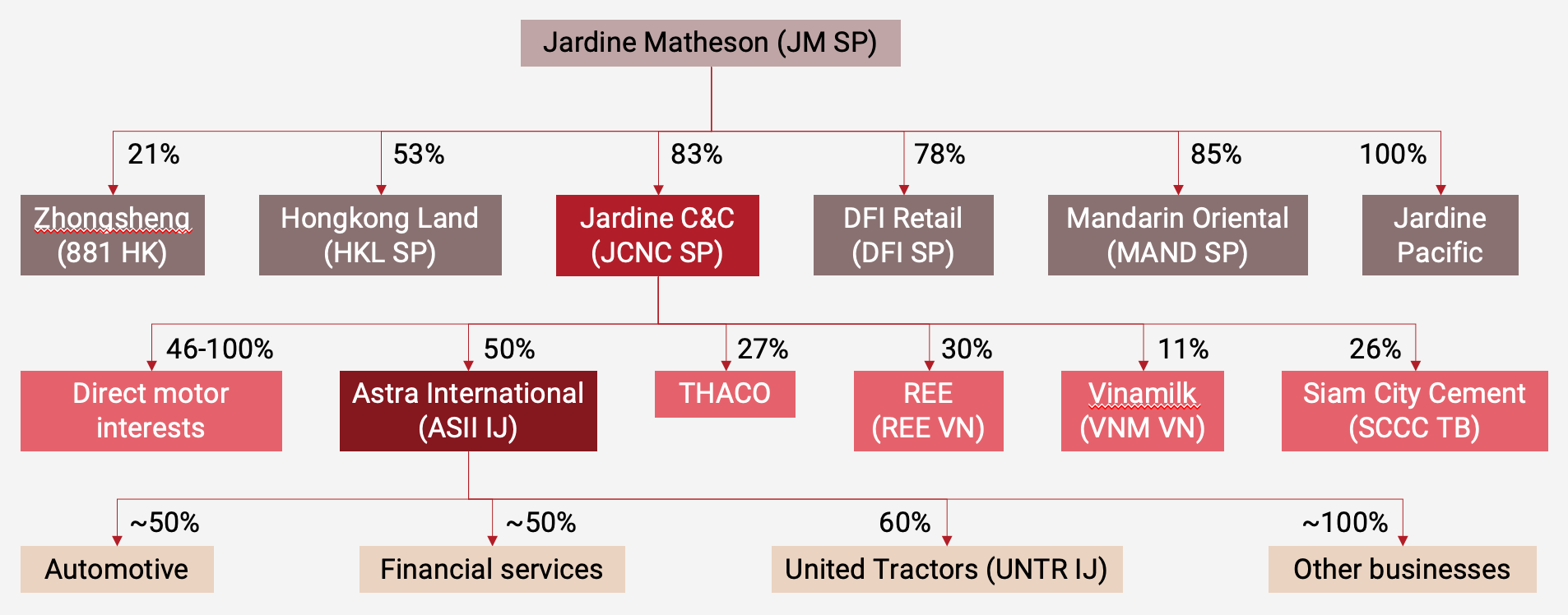

I wrote about Astra’s parent Jardine Cycle & Carriage (JCNC SP - US$8 billion) )(“Jardine C&C”) back in 2021. It’s listed in Singapore and owns several consumer-related businesses, the largest of which is Indonesian automaker Astra International (ASII IJ - US$13 billion).

Here’s my presentation on Jardine C&C from back then:

My key points were as follows:

- Jardine Cycle and Carriage, also known as “Jardine C&C”, is a holding company in the Jardine Matheson Group focused on consumer-related investments in Southeast Asia.

- Jardine C&C’s most important asset is a 50% stake in Indonesia’s largest automaker, Astra International. Other parts of Jardine C&C included an 11% stake in Vinamilk, a small stake in engineering firm Refrigeration Electrical Engineering, shares in Siam City Cement, and Vietnamese automaker THACO. However, Astra represented 73% of NAV and was, hence, the main focus of my presentation.

- So, who is Astra? It’s the local partner of Toyota and Daihatsu in Indonesia, engaged in both vehicle production and distribution. Thanks to strong execution, it now controls a 50%+ market share in the Indonesian auto market. This market dominance reminds me of Maruti Suzuki in India, which also assembles and distributes vehicles in a fast-growing emerging market and trades at a P/E ratio of 26x.

- As fund manager Michael McGaughy recounts here, Astra’s founding family has a great reputation in Jakarta business circles. Astra is known for treating its minority shareholders well.

- The long-term case for the Indonesian auto market was and remains compelling. The car ownership rate was just 60 vehicles per 1,000 individuals compared to over 200 in China and 600 in Europe. That low penetration has been driving single-digit volume growth for decades.

- Astra is also involved in the distribution of heavy equipment through its subsidiary, United Tractors. It primarily sells Komatsu-branded heavy equipment to Indonesian coal miners and operates coal mines, both on its own and for third parties.

- COVID-19 hit the auto market as consumers stayed at home. There was also a headwind to auto sales between 2015 and 2019. Coal prices had also been low throughout 2020 and 2021. But I thought there would eventually be an end to the pandemic and that the currency would stabilize. I predicted a return to country-wide auto sales volumes of over 1 million vehicles annually.

- My numbers at the time showed a sum-of-the-parts valuation of Jardine C&C +49% above the then-prevailing share price. With my projection of a recovery in Indonesia’s auto market, I predicted a P/E ratio for Jardine C&C of around 6-7x.

2. Update since my first write-up

Since my first presentation of Jardine C&C back in August 2021, the share price has risen about 30% from about SG$20/share to SG$26.

Jardine C&C’s Indonesian auto subsidiary Astra International has performed worse, especially considering that it’s denominated in Indonesian Rupiah - a currency that has dropped 12% against the Singapore Dollar over the past three years:

So, what’s the explanation for this decline? In my view, two separate factors: