Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may from time to time have positions in the securities covered in the articles on this website. This is disclosure and not a recommendation to buy or sell.

Summary

- I pay attention to buybacks for several reasons: management might think the stock is undervalued, buybacks are a way to screen for future positive events, they signal decent corporate governance, and they also provide liquidity for those who want to exit.

- The pitfalls are if buybacks are never cancelled or just used to counteract the dilutive effect of share-based compensation.

- I screened for stocks in the Asia Pacific (ex-South Asia), with buybacks initiated in 2023 above a US$100 million market cap. That list gave me 346 stocks, including Tencent, Toyota, AIA and Sony.

- I discuss six stocks in that buyback list in greater detail, specifically COSCO Capital, Tian Lun Gas, Boustead Singapore, Star Mica and Playmates Holdings.

If you’re a long-time reader, you will know that I love buybacks:

- They can signal that management thinks the stock is undervalued.

- They often precede major events, such as the success of a new drug.

- Buybacks can also signal decent corporate governance. True crooks would never buy back shares - they’d prefer to funnel money out of the company via related party transactions instead.

- And buybacks also provide liquidity for those who want to exit their position.

The major pitfalls are buybacks used to counteract the negative effect of dilution from share-based compensation. In some cases, management teams also use buybacks to create liquidity for their own selling.

And finally, some management teams buy back shares without the intention of cancelling them. In such a scenario, their companies accumulate Treasury shares with no positive impact on the earnings per share. This is particularly common in South Korea and Japan.

My 2023 buyback screen

For a while, I included a buyback screen on every single “Monday morning links” newsletter. But I found that very few readers clicked on the links, suggesting they skipped that part of the email. So instead, I’ve shifted towards doing occasional buyback screens and picking out stocks that I think are worth highlighting.

Today’s buyback screen uses the following criteria:

- Minimum market cap of US$100 million

- Southeast Asia, East Asia and Australia/New Zealand

- Buyback announcement date after 1 January 2023

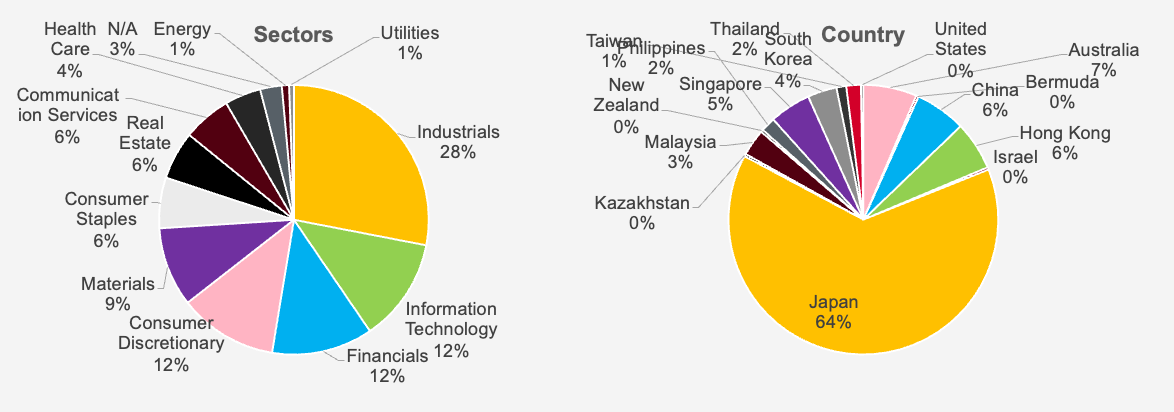

I found 346 stocks that satisfied these criteria. Oddly enough, almost two-thirds of the stocks are from Japan. And many of them are industrials.

Note that these are just announcements. Based on the data at hand, we don’t know whether the companies will follow through on their buyback announcements. For example, Alibaba has famously announced a number of multi-billion dollar buybacks, but the total share count continues to increase.

Here is the full list of the 346 companies, available for download. My preferred way of ranking them is by looking at how much the stocks are down compared to their 52-week highs.